- Nine Energy Service’s top line is likely to increase moderately while its EBITDA margin can expand impressively in Q3

- Net pricing improvements and activity growth in the coiled tubing service line will push the margin higher

- Sticky pricing in the wireline market and supply restrictions in cementing will be its imminent challenges

- Negative shareholders’ equity puts its balance sheet strength to a stringent test

The Industry Outlook

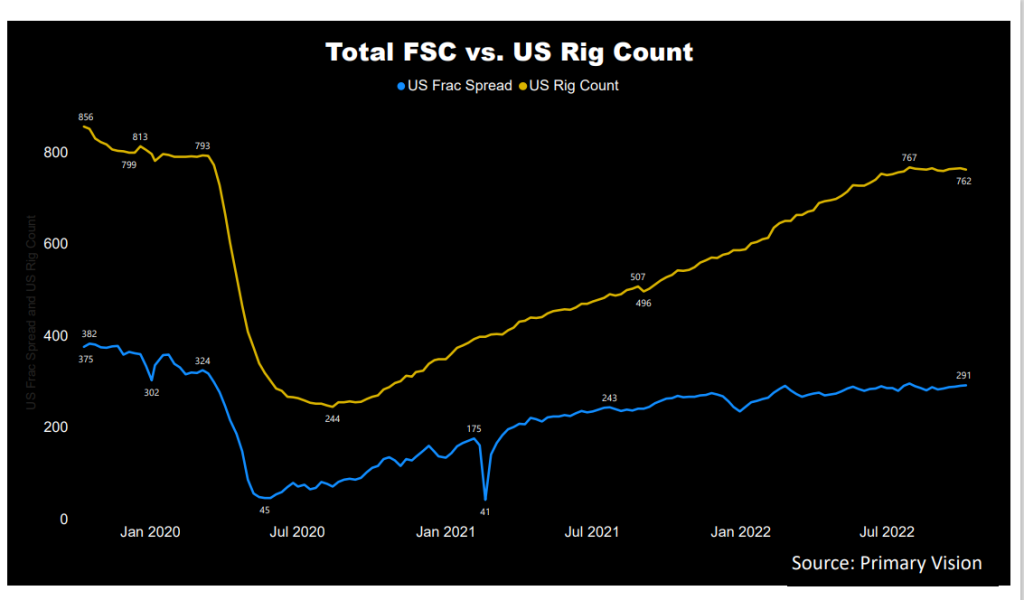

We discussed Nine Energy’s strategies and drivers in our previous article. In Q2, its management was cautiously optimistic about the US shale and short-cycle production growth, given the supply shortage in the backdrop of the Russia-Ukraine conflict and OPEC’s inability to ramp up crude oil production. At the same time, however, it concedes that the US energy producers will continue to exercise capital discipline in 2H 2022. The active frac spread count went up ~24% in 2022, according to Primary Vision’s estimates. The frac spread count has remained nearly unchanged since June-end, according to Primary Vision’s estimates.

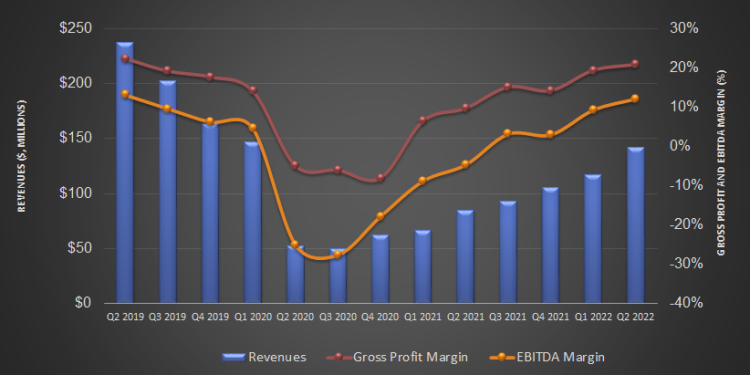

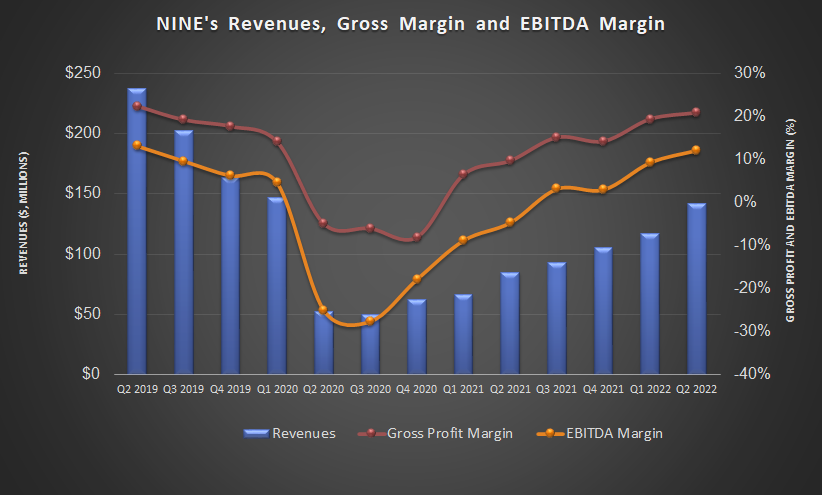

The oilfield services companies, too, will maintain capex restraint, which will not alleviate the already constricted supply of equipment in the market. Because there will be an equipment shortage while demand persists, pricing for equipment will get a boost. This will benefit NINE’s margin. On the other hand, growing production has put more pressure on labor demand. This, coupled with the supply chain disruption, led to wage and material inflation. Still, NINE’s adjusted EBITDA margin increased by 900 basis points over the past two quarters and may continue to inflate in 2023.

The Q3 Forecast

Based on the dissolvable plug market growth, in Q3, the company’s revenues can grow by 5.4% (at the guidance mid-point) compared to Q2. In the medium-term, the management expects the adjusted EBITDA margin to expand to 17%, which it achieved in 2017. The cash flows can also grow sequentially. The company’s geographic and service line diversity and labor-lite strategy will offset the cost hike, leading to the adjusted EBITDA growth in Q3.

The Pricing Strategy And Challenges

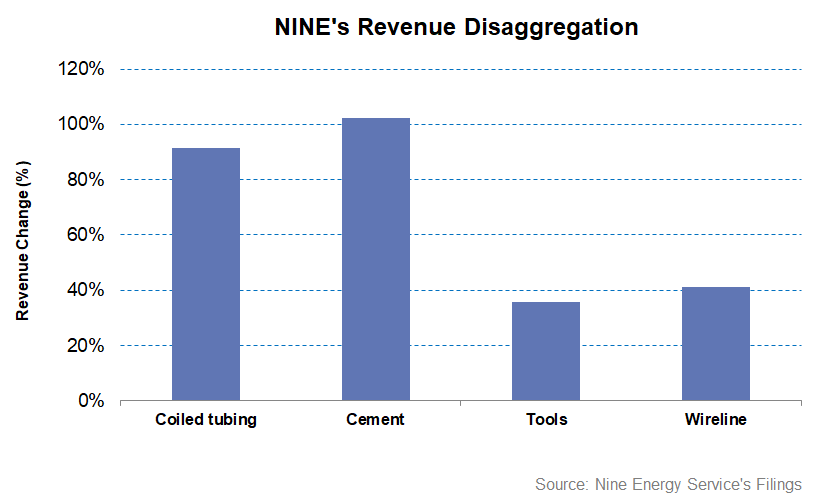

The company’s cementing and coiled tubing service lines saw activity and net pricing improvements, which drove strong incremental margins in these divisions in Q2. The shortage of qualified labor and equipment also accelerated the price hikes. Prices may continue to increase in 2023 to offset the cost increase.

The cementing market looks particularly challenged because supply is restricted due to maintenance work in the US and lower imports from Turkey. The situation, according to the management, can deteriorate. Although the company’s revenues from the cementing division increased by more than 50% in the past year until Q2, the supply constraint can lower the growth rate in the coming quarters.

The Dissolvable Plugs Growth Trajectory

Dissolvable plugs are taking a larger share of the overall plugs market in the US. However, the growth rate has been lower than the company’s initial anticipation. While in 2028, it had been estimated that the share of dissolvable plugs would triple to reach 50% of the overall plugs market in the US, it currently estimates that it would reach ~25% by 2023. The conversion of composite plug customers in the wellbore accounts for the highest rent.

Investors should note that the dissolvable plugs are environmentally friendly and lower emissions compared to the traditional drill-out services. Also, energy drillers’ ESG initiatives will encourage the adoption of dissolvable as operators look for cost-effective ways and reduce emissions.

What Were The Q2 Drivers?

In Q2 2022, the company’s total revenues increased by 22% compared to Q1. Division-wise, its cementing revenues also increased by 22% quarter over quarter in Q2. A favorable competitive landscape due to technical and capital barriers to entry increased pricing in Q2. On top of that, cementing jobs increased by 14%, while the average blended revenue per job increased by 7% in Q2. Pricing can strengthen further, and this division’s margin may improve in Q3.

In Coiled tubing, revenues increased by 28% in Q2 due to price traction and higher utilization. The recent coiled tubing operations in the Eagle Ford in NINE’s cementing facility have helped increase the topline and margin.

The revenue growth in the Wireline business was steady (23% up quarter-over-quarter) in Q2. Despite a market share gain in the Permian, the company’s outlook on Wireline remains conservative because it has been challenging to implement price hikes in this business due to the extensive competition in the market.

Cash Flows And Liquidity

As of June 30, 2022, NINE had $74.5 million in liquidity. Its shareholders’ equity, which has been negative owing to significant net losses over the past two years, went further into the negative territory. A negative shareholders’ equity and a considerable debt level can put it at financial risk or limit growth prospects.

In 1H 2022, NINE’s cash flow from operations (or CFO) was negative but improved compared to a year ago. Because its CFO is negative and capex will increase, free cash flow will remain under pressure in FY2022. FY2022’s capex can range between $20 million and $30 million, which would be 62% higher than the previous year.

Learn about NINE’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.