- Nabors’ US rig count can increase modestly in Q4, while it plans to deploy the entire high-spec rig fleet in 2023

- Its average contract duration in Saudi Arabia will increase after it renews contracts.

- The company’s digitization and automation services and ESG initiatives will become substantial in 2023

- If it can achieve its lofty free cash flow target in FY2023, it would do well to deleverage its balance sheet.

The Drilling Outlook

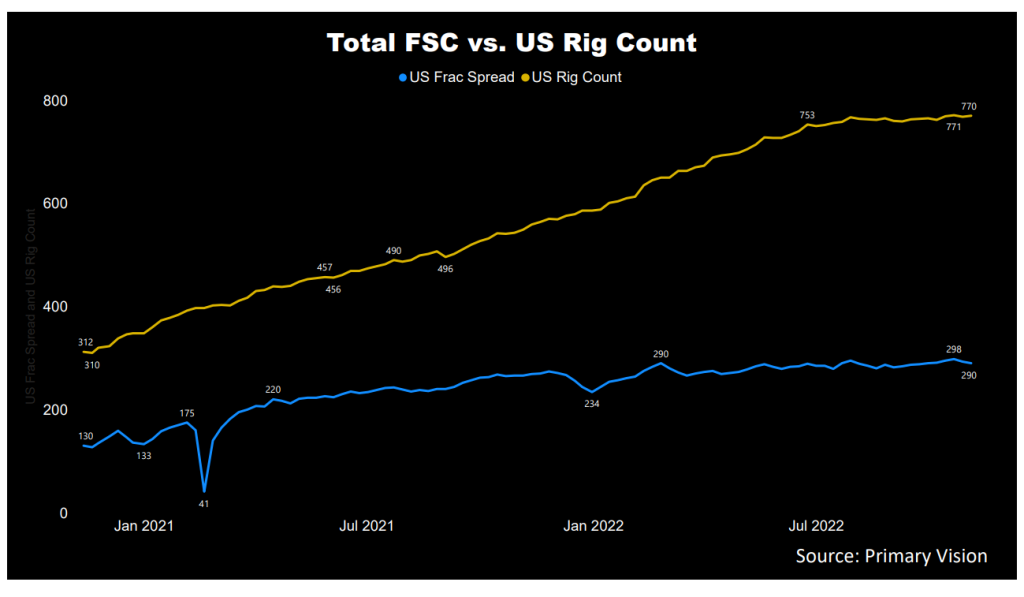

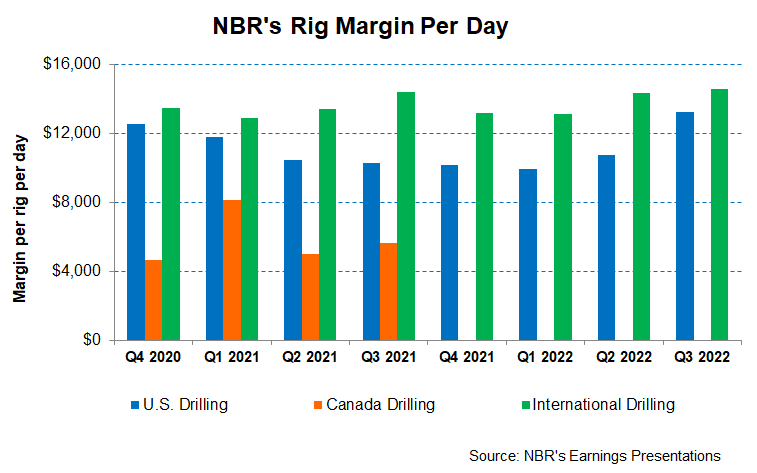

Nabors Industries (NBR) U.S. Drilling topline continued its positive momentum in Q3 2022 as the US onshore drilling rig count increased by 33% year-to-date. As estimated by Primary Vision, the frac spread count has underperformed the rig count’s growth. As utilization increased, NBR’s average daily margins in the US onshore increased by 23% in Q3. The average daily revenue in the US onshore increased by 14%. The daily rig margin in the international operations was much subdued (2% up).

The company’s strategy is to remain short on contract duration to capture the ongoing recovery in leading-edge pricing. It plans to stack as many contracts at the current rate as possible. It recently signed contracts with revenue per day of $40,000. So, in the US onshore, it focuses on the top-tier rigs. Learn more about NBR in our previous article here.

NBR expects to have its entire high-spec rig fleet deployed by 2023-end. It high-spec fleet size, however, will remain unchanged (at 111). The reason for not adding any new fleet but upgrading the 40 stacked M550 fleets is the cost advantage. It takes $13 million to $15 million to upgrade these fleets, which is nearly half the cost of a new build. The company has added many rigs in international operations following the price hike. So, the combination of price hikes and cost optimization should increase NBR’s drilling rig margin.

Q4 Outlook

In Q4, the management expects the US onshore margin to be $13,500 per day, or 2% higher compared to Q3. On top of that, it expects to add four to five rigs in Q4. In international operations, it plans to add one more new build and a legacy rig in Saudi Arabia. Following higher day rates in Latin America and the Middle East, the daily rig margin can increase by 2% in Q4 compared to Q3.

After the newbuild is deployed in Saudi Arabia in Q4, it may add more new builds from the initial awards in the SANAD joint venture. On top of that, SANAD recently agreed to renew 24 rigs on four-year contracts at current market rates. This means the average contract duration is Saudi Arabia is likely to increase, which is indicative of achieving a stable cash flow.

Automation And Clean Technology

In NBR’s digitization and automation services initiatives, it has introduced robotic modules to retrofit existing rigs and installed the first robotic module in the Permian. The new technology would fulfill the requirements of a safer work environment. During Q4, it saw 16% growth in SmartSLIDE and SmartNAV and an 11% rise in SmartDRILL.

In its ESG initiatives, NBR’s Canrig offers to draw works, tubular handling systems, casing running tools, and advanced robotics. It has recently developed the PowerTap module, which connects rigs directly to the grid. It plans to add seven units by 2022 and ten more units in the US onshore during 2023. It plans to differentiate its solution in battery storage by utilizing ultracapacitors instead of lithium. In addition, it is currently testing a hydrogen injection system, which reduces fuel consumption. These can also have uses in marine shipping and heavy trucking industries. These initiatives will likely start paying off in 2023.

Analyzing The Q3 Performance

Over the past few quarters, we have witnessed improved drilling activity, leading-edge day rates, and rig utilization. In Q3 2022, the company’s U.S. Drilling rig count increased by 4% on average compared to Q2 2022, while international rig count remained unchanged. As a result, quarter-over-quarter revenues from U.S. Drilling increased by 17%. We think the pricing will continue to inflate.

Capex And FCF

In 9M 2022, NBR’s cash flow from operations (or CFO) decreased by 8% compared to a year ago, despite the year-over-year revenue rise in the past year. Adverse changes in working capital following an increase in receivables and other deferred revenue arrangements and a fall in operating payables resulted in a cash flow decrease. In 9M 2022, the company’s capex increased sharply, resulting in free cash flow drying up in the past year. The company is targeting a $400 million FCF in FY2023, which would be significant jump compared to its expected FCF in FY2022.

NBR’s liquidity is $775 million (cash & investment and borrowing capacity). Its debt-to-equity (or leverage) is much higher (4.3x) than many of its peers (HP, PTEN, and PDS). A higher FCF will allow it to reduce net debt during 2023.

Learn about NBR’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.