The inflation story and “narrative” has been switching all over the place the last several years. It started with “inflation is transitory”, which is a view we never accepted and fought daily. The market slowly came to the same conclusion (and the Fed for that matter) and priced in a more aggressive inflationary backdrop. We believed that a massive inflationary surge would give way to stagflation, and finally end in a deflationary move for 12-24 months. We have now shifted firmly into the stagflation backdrop, which will be with us for most (if not all) of 2023. As the term “Disinflation” enters the discussion, it’s important to understand what each type means.

- Disinflation- a reduction in the rate of inflation. It addresses the slowing “rate of change” of prices.

- Inflation- a rise in prices.

- Deflation- a reduction of the general level of prices in an economy. To get “real” deflation, you need to see prices fall well below the inflationary trend- month over month and year over year. For example, in today’s market, you can have prices falling year over year BUT still have them increasing month over month. This is because the comps in 2021 are much harder given the pace of inflation last year while prices are STILL rising but just not at the same rate vs 2021.

- Stagflation- persistent high inflation combined with high unemployment and stagnant demand in a country’s economy.

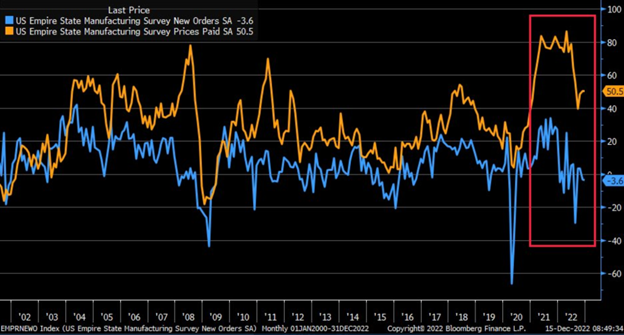

We are in a period of stagflation as prices keep moving higher as the underlying demand (globally) slows across the board. I think the below chart puts this in perspective beautifully as prices paid shift higher and still remain at some of the highest levels over the last several decades. This is all happening as new orders move into contraction, with more weakness coming based on other leading indicators.

This is where the term disinflation becomes important. We are seeing the rate of change of those prices changes slow BUT not reverse course. They are still elevated and will continue on a monthly basis as we head into the new year. We are going to cover this in more detail as we head into 2023, because this is going to shape a lot of commodity prices and underlying cost shifts. Stagflation is going to hit hard as we head into Q1 as we see economic growth shrinking while costs are still expanding just at a slower rate.

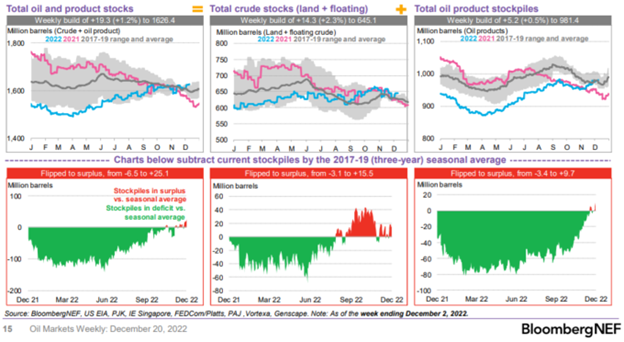

When we look at total oil and product stocks heading into 2023, we are in a comfortable position vs where we started. Globally speaking, we are back into a comfortable position- with more builds coming as the global economy slows further in Q1’23.

The physical market (already selling January and February) are seeing differentials weaken across the board. Nigeria cut its official selling prices for Qua Iboe and Forcados in January to one-year lows. The West African nation’s crude exports of 10 grades known so far are scheduled to increase by 18% m/m in February. China’s imports of crude from Angola in November were the lowest for the time of year since 2005. Even as China already hit the lowest import in November, we have ANOTHER slowdown as China imports slip further in December to 806k barrels a day from 854k in November. This is happening as China has already increased their imports back to more “normal” levels but ESPO and Urals continue to eat into imports from the Middle East and West Africa. Nigeria also cut OSPs for Qua Iboe and Forcados in January to one-year lows, and they are actually back in line with “historic norms.:” We expect even more pressure in Q1 as differentials weaken, and West Africa looks to compete more in the market to limit floating storage. This will accelera

Here is a quick summary of crack spreads, which will keep a lot of Middle Eastern grades on the sideline- even in Asia. Saudi crude looking very expensive. OSPs need to be cut significantly. Refinery Cracking margins from Platts ARA Arab Light: $4.98 Bonny Light: $15.59 MEH: $14.12 Singapore Arab light: $4.89 Espo: $24.42 Dubai: $9.04 Italy Arab Light: $5.79 CPC: $20.38 MEH:$9.37.

The U.S. still competes, and we have had a big step up from CPC and Libya now back above 1M barrels a day in December. CPC exports have moved to two-year highs, Libya went from 986k in Nov per day to 1.03M in Dec, and Norway brought on phase two of Johan Sverdrup- all of which will keep Europe supplied at this point.

The US is sending the equivalent of one cargo every day to Europe so far this month, the fastest rate since June 2018, and quadruple the November rate, according to data from Kpler.

- December flows so far total 310k b/d, up from 78k b/d in November and 27k b/d in December 2021: Kpler

- Europe also drew 880k b/d of diesel from Russia so far this month, most since February

- Strong flows reflect European efforts to stock up before EU ban on Russian fuel starting Feb. 5, said Viktor Katona, lead crude analyst at Kpler

- US Gulf Coast diesel is fetching deep discounts of around 20c/gallon to Nymex futures due to soft demand and rising inventories

- Gulf Coast refiners have been running harder than usual and rely on export markets to absorb a significant chunk of their production

We will see very stable exports of diesel from Gulf of Mexico, but Russia normally sends about 550k barrels a day into the Europe. The U.S. won’t be able to replace all of Russian flow, which will pull additional capacity from the Middle East and Asia to fill the void. We expect to see some of these support in the diesel markets on the very low sulfur and ultra-low sulfur side even as medium-high sulfur levels rise.

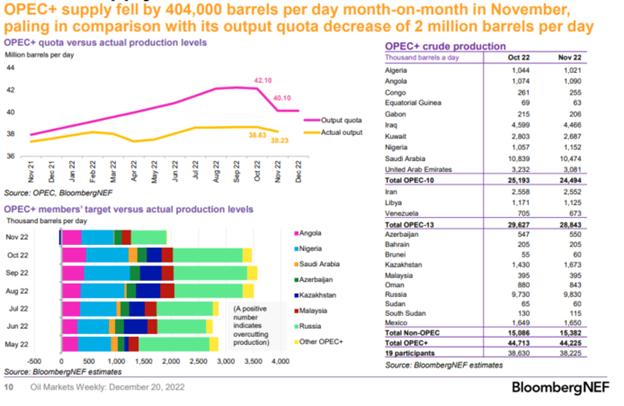

OPEC+ is still producing well below their “output quota” so even another proposed cut would have a limited impact on the physical market. We have seen further weakness in WAF and Europe, which will only intensify as the Middle East competes a bit more aggressively. We saw an unexpected bounce in ME floating storage, which is why we are confident another round of OSP cuts is going to happen. OPEC+ can try to “talk tough” about cuts, but realistically it won’t adjust the physical market. Instead, we will see bigger cuts to differentials, which will help refiners remain active and try to steady crude demand.

Hello Old Friend – Offshore Exploration Is Going to Bounce Back

Even as pressure mounts, there is still a broad shortage of “distillate heavy” crudes with a large part of it coming from the offshore market.

Everyone’s favorite sector is poised to come back bigly in 2023 and beyond, we believe. That’s right, oil drillers, subsea and seismic are coming back stronger and faster than a ‘90s boyband. There’s still time to get in with the brokers that will take you to site visits in Singapore, Korea, Brazil, Greece among other choice destinations, as well as building your portfolio. In fact, the oil price selloff may give you a much better entry point.

But why now? And why are the nearly demised offshore drillers and seismic going to come back when we have all that oil from shale and, of course, all that energy from solar panels and wind mills? If you’ve tuned into us long enough, then you know shale is near its peak and can’t contribute significantly to growth. As to solar and wind, well let’s just say they should rebrand to 5-hour energy and sell at gas stations (to be fair, they already sell solar at Costco near me). It’s not just shale, 5-hour, I mean renewable, energy and OPEC’s own inability to grow that spur our call on exploration. It’s the fact the industry all but cut their budgets to $0 since 2016, leaving us with a massive resource gap to fill.

There’s good reason behind that drive to exit exploration, punctuated by ConocoPhillips quitting deepwater altogether – cost. The drilling rig and seismic market were completely out of whack in the early 2010s. From Aramco’s $1 million drilling rig dayrate to stories of seismic companies bidding for jobs they wanted to lose at 40% mark-ups and winning! The whole industry was running through the same door at once and it showed on returns and capital destruction

This time is really exactly like every other time. We stop spending on oil, we suddenly realize that we don’t have enough and suddenly young men (and women) are launching themselves off the coast of Rio in search of riches.

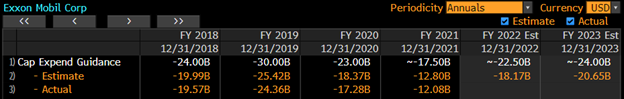

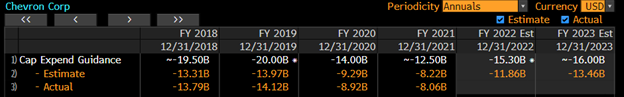

Exxon and Chevron announced increases to their capex budgets in 2023 vs. 2022, which itself was already significantly higher than 2021. Combined, the two majors are spending an additional $10 billion in 2023 vs. 2021 levels.

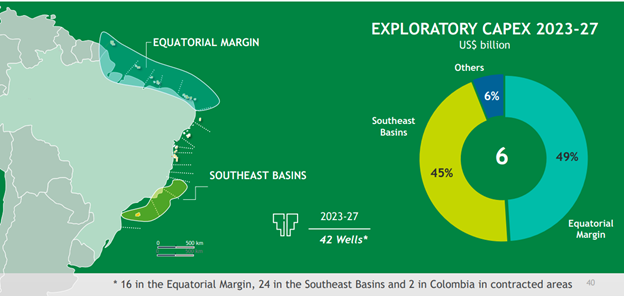

Petrobras plans to allocate $6 billion over the next five years to exploration alone. If its current plans are kept by the next administration, the Brazilian national oil company would drill 42 exploration wells, 16 of those in Brazil’s Equatorial Margin basins. At an average 120 days to drill an ultra-deep exploration well that would require at least two high-spec rigs for a five-year term. If we include Brazil’s Southeast basin, that’s a total of 5 UDW rigs just for Petobras’ exploration spending.

On the development front, Petrobras will drill over 300 wells. Those are faster to drill, but need more completion and subsea installation. Assuming a conservative 90 days for drilling, mobilization and demobilization of these rigs, Petrobras would need upwards of 15 UDW rigs for 300 wells drilled over the next five years. There are of course other operators in Brazil, from Equinor to TotalEnergies that will put in new production platforms in the pre-salt. Brazil alone may represent upwards of 25 UDW rigs for the next five year period.

If we are correct that shale and OPEC won’t be enough to offset global production declines, then there is bound to be another rush to offshore exploration. We simply have not found, in fact, have not looked for other regions to supply. And Russia’s geopolitics make it even harder to develop in oil-rich areas such as Kazakhstan or the Arctic. Guyana will be part of the solution, but far from enough.

The oil services sector, especially offshore, was decimated in the last cycle. Few public companies remain after severe rationalization of capacity, people and companies. That is part of the opportunity set in offshore. As was the case 15 years ago, there is not enough capacity, and that capacity is likely to warrant a premium as exploration ticks up.

Seismic, drilling and subsea services may all start to catch a bid. Shipyards, especially those capable of building high-spec and LNG tankers are also well positioned for the next order cycle, but will likely be hit by lower container and other transportation vessels.

Where to find those who are looking?

There are few areas of interest outside US shale, as that part of the industry garnered much of the non-national oil company investment over the past decade. There’s Brazil’s massive pre-salt, which is well understood, has running room and is as close to a sure-thing resource-wise as you’ll get in exploration. But of course, Lula’s next term is a major risk, seeing as he nearly bankrupted Petrobras and held progress in the region for 10 years in his first two terms.

Guyana is likely the third most visible growth region in global oil & gas, but there are few ways to play it. The country’s exploratory success is highly concentrated in the ExxonMobil and Hess partnership. But that will likely demand lots of rigs and FPSOs (some already on order) to continue development. It helps that Exxon’s MASSIVE new FPSO developments will likely need dozens of well connections, a boom for subsea and drilling rigs.

Outside of those, exploration is likely to resume, or rather accelerate, in the equatorial region of Latin America, boosted by the success in Guyana. Brazil and Suriname are the most likely candidates, with the later having some poor results to date, but still potential for surprises.

We also expect West Africa to make return to the rolls of drilling companies. High government takes have slowed down activity in Angola, Nigeria and Ghana, all of which have considerable resource upside. Namibia, where discoveries are yet to be developed, may also be a target for further exploration. The need for more LNG capacity may also trigger investments in Mozambique, although the country’s political and fiscal issues remain a barrier.

Names to follow

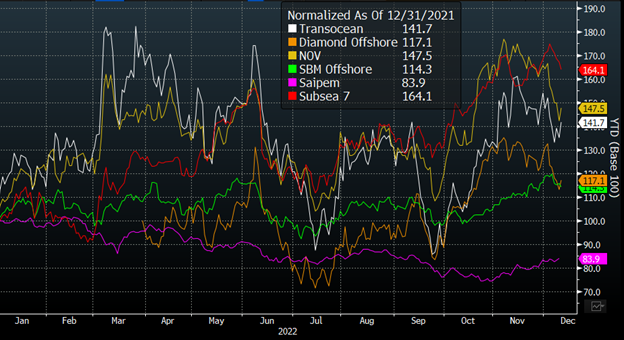

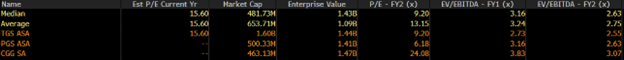

The list is fairly standard, all the companies that were decimated, but managed to survive the last cycle. There are age-old behemoths, like Transocean and Saipem (if you are OK taking Italian risk), Diamond Offshore. There are the subsea group, with Subsea 7 and NOV, SBM Offshore, etc. If you’re looking for more beta, the seismic group may be your choice, the real boom and bust subsector. PGS, CGG and TGS all trade near 3x 2023 Ebitda and are likely to see further growth as companies raise exploration budget. They may be the first and hardest bounce if exploration returns.

Drilling rigs may also be in for a re-rating, as most of the lower-spec, earlier vintage capacity has now been permanently scraped. It is a dicey group with lots of restructuring and legacy debt that has been chipped away over the past 6-7 years, but if exploration and offshore development are to recover, dayrates and backlogs will jump and with that earnings. The group trades at 6x 2023 EV/Ebitda with Transocean at the high-end at 8.5x. while Noble and Helmerich & Payne are below 5x.