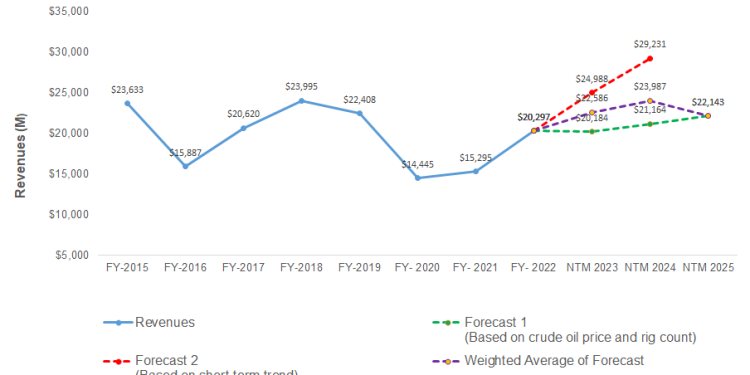

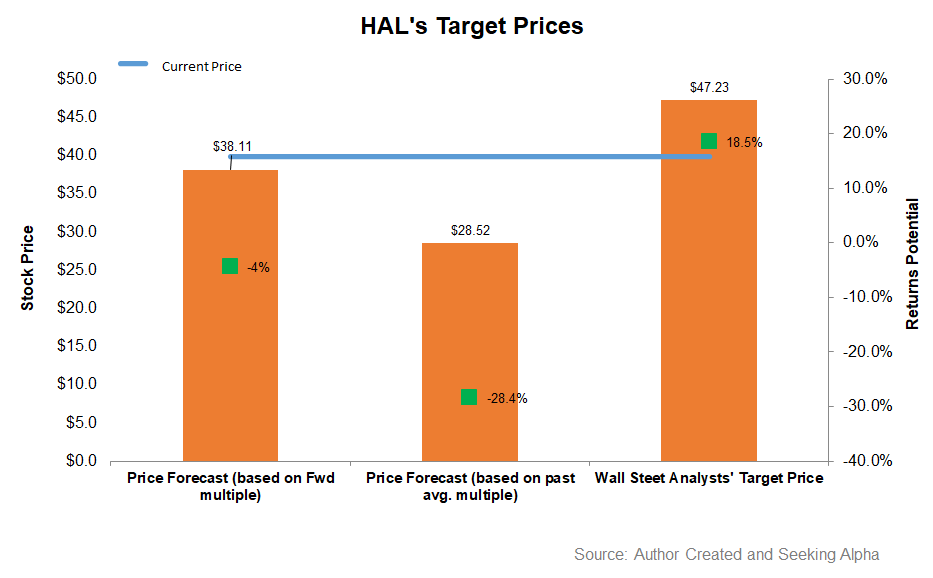

- Our revenue regression model suggests an increase in NTM 2023 and a deceleration in NTM 2024.

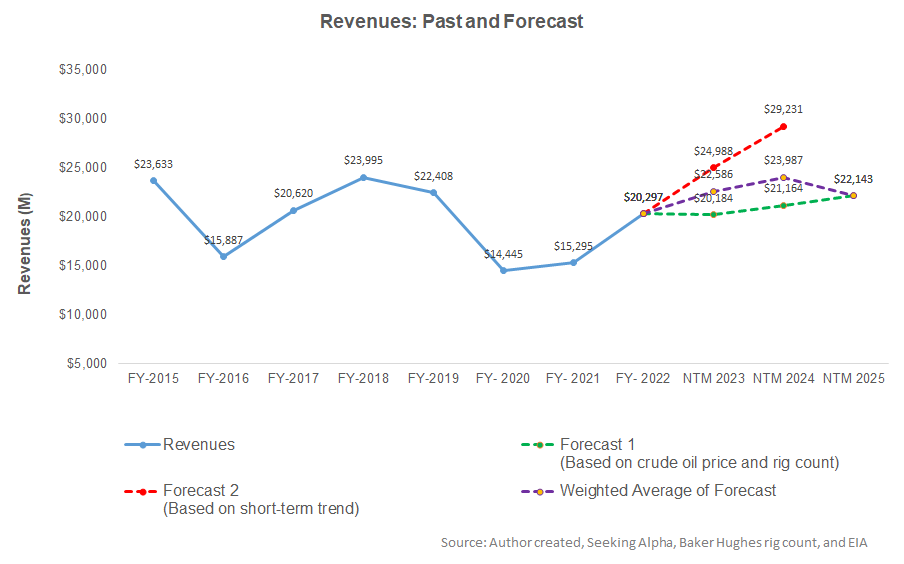

- EBITDA can decrease in NTM 2023 and the following year.

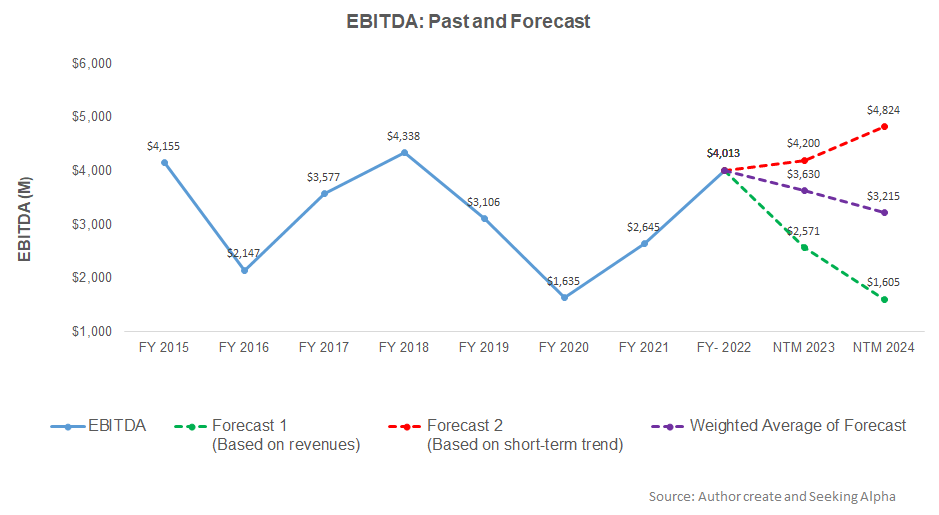

- The stock is slightly overvalued at the current level.

Part 1 of this article discussed Halliburton’s (HAL) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

For the short-term trend, we have also considered seasonality. Based on a regression equation among the crude oil price, global rig count, and HAL’s reported revenues for the past eight years and the previous eight quarters, revenues will increase by 11% in the next 12 months (or NTM 2023). However, the model suggests it may decelerate to 6% in NTM 2024 and decline by 7.7% in NTM 2025.

Based on the regression model using the average forecast revenues, the company’s EBITDA is expected to decrease by 10% in NTM 2023. The decline rate can come to 11% in NTM 2024.

Target Price And Relative Valuation

Returns potential using HAL’s forward EV/EBITDA multiple (11x) is higher (4% downside) than returns potential using the past average multiple (28% downside). The Wall Street analysts have considerably higher return expectations (18.5% upside).

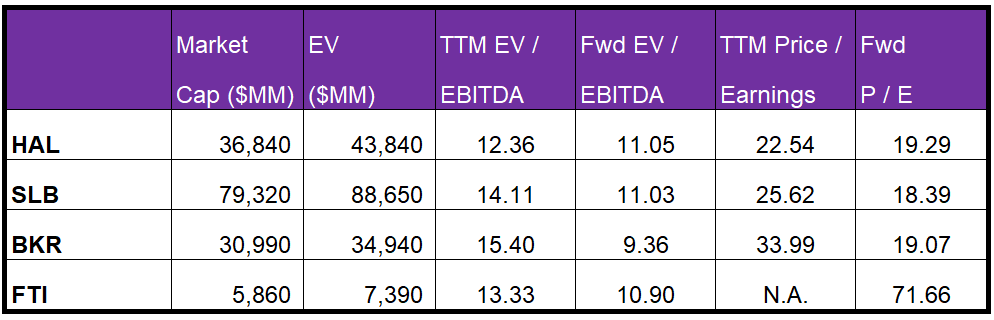

Halliburton’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because sell-side analysts expect HAL’s EBITDA to increase less sharply than its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple (12.4x) is marginally lower than its peers’ (SLB, BKR, and FTI) average of 14.3x. So, the stock is reasonably valued, with a negative bias, versus its peers at this level.

Analyst Rating

According to data provided by Seeking Alpha, 24 sell-side analysts rated HAL a “Buy” or “Strong Buy” in the past 90 days, while two of them rated it a “Hold.” None rated a “Sell.” The consensus target price is $47.2, which yields ~19% returns at the current price.

What’s The Take On HAL?

After Q4, Halliburton’s management identified the mid-term drivers and a few road bumps along the path. It expressed much optimism over the wellbore development activity and increased capex onshore and offshore in 2023 in the international market. The growth in North America will depend on higher customer spending and tight equipment supply, which will elevate oilfield services prices. For the medium-to-long term, HAL plans to offer a combination of Zeus e-fleets, an automated fracturing platform – Optiv, and a SmartFleet intelligent fracturing system.

The company has increased dividends and plans to improve shareholders’ returns considerably through dividends and buybacks. However, the management has become somewhat bearish on the operating profitability due to the year-end sales factor and the economic recession. On the other hand, cash flows improved in FY2022, which amplified the management’s confidence. The stock is marginally overvalued versus its peers at this level. Nonetheless, investors might want to continue to hold the stock for medium to long-term gains.