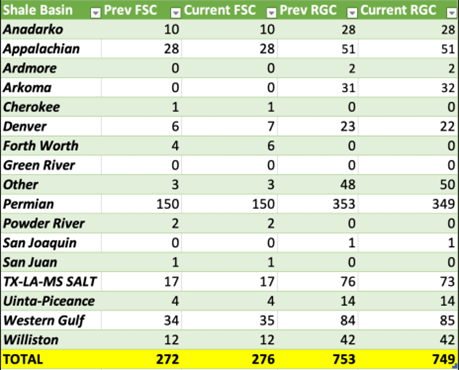

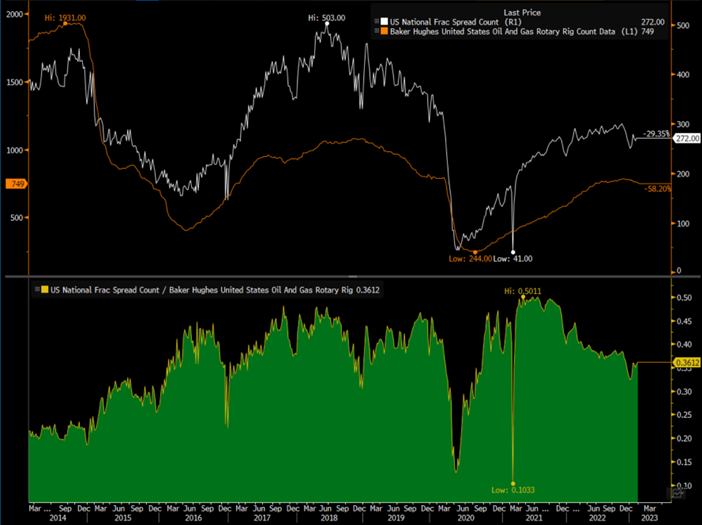

Completion activity maintained its steady pace of increases, which is very seasonally normal. Typically, rigs “outrun” completion crews in the winter months, and as spring approaches- rigs either flatline or decline while frac spread activity has a steady increase. A large part of the increase was driven by smaller basins as we see most areas holding steady.

We normally see an average ration of .4, but even if you update the numbers for today- we are at about .375. There is still more activity pivots that will happen over this time frame to get us into a steady rate as we head into Spring. March/April is a typical period to see some of these more meaningful pivots, which is why a large part of this pivot is seasonal.

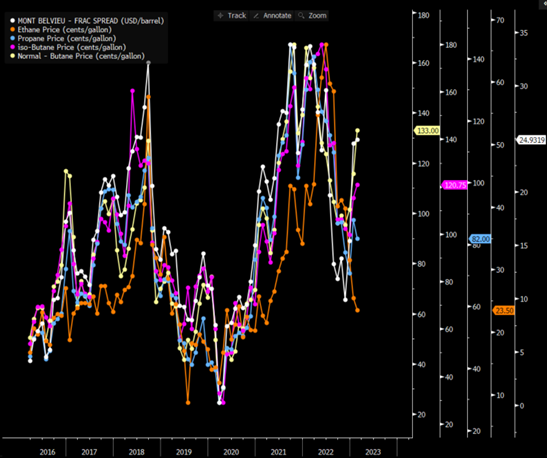

There has also been a steady increase in the NGL frac spread as exports remain very strong.

The spread was supported by a drop in natural gas prices, as some of the NGL components saw a bit of a bounce in pricing. We expect to see Propane hold around these levels as iso-butane finds some additional demand, and ethane at these levels will see some additional export demand. As China reopens, this will help pull additional ethane into the market helping to hold current pricing.

An article came out today that highlighted a growing rift between Saudi Arabia and the UAE. While the rift is true, the idea that the UAE plans to leave OPEC is a bit extreme. This was likely a “leak” to push an agenda that the UAE has within OPEC. They have used this tactic several times over the years to drive home their viewpoints on several key factors- including Yemen and production levels. Here are the cliff notes of what happened in Yemen:

- The UAE and KSA launched counter attacks on Houthi positions from the air while they utilized proxies on the ground.

- The Houthis proposed a “deal” that the UAE proxies were okay with to end the bloodshed in the region.

- The Saudi proxies rejected the proposal and the UAE/ KSA proxies got into an “altercation.”

- The UAE stopped support KSA in Yemen, but has stepped up some support- nominal at best

- UAE was getting “frustrated” with the OPEC+ agreement because they believed they were being shortchanged on production

- The UAE “Cheats” and produces/exports what they believe should be the “right” number based on their new baseline production

- UAE has invested billons to expand their production capacity and wanted their baseline moved up to reflect assets coming online.

- KSA throws them under the bus, but say nothing about Iraq/Russia/Nigeria cheating

- The UAE got very angry at how they were treated, which was going to pull forward some of their new trading vehicles

- UAE launched Murban futures that settle in physical without a destination clause, which flies in the face of how KSA and Kuwait trade their crude.

So to see the headline come across isn’t very surprising at all, but I would say it’s more posturing vs an actual push to leave the group. They have already benefited from Murban futures trading at premiums vs Middle Eastern blends. The UAE is bringing on 2-3M barrels a day of new production over the next few years, and they want their baseline to move higher. The money isn’t being spent to increase spare capacity, but rather expand sales into the market. In order to get the baseline moved earlier, the UAE held up the OPEC+ agreement for several weeks as negotiations kept happening in the background. The “leak” is just another way for them to press set the stage for negotiations.

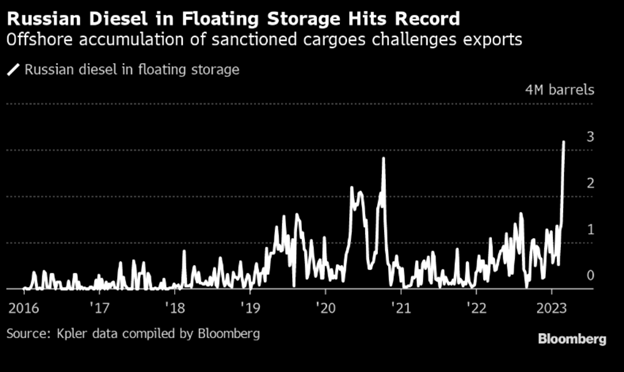

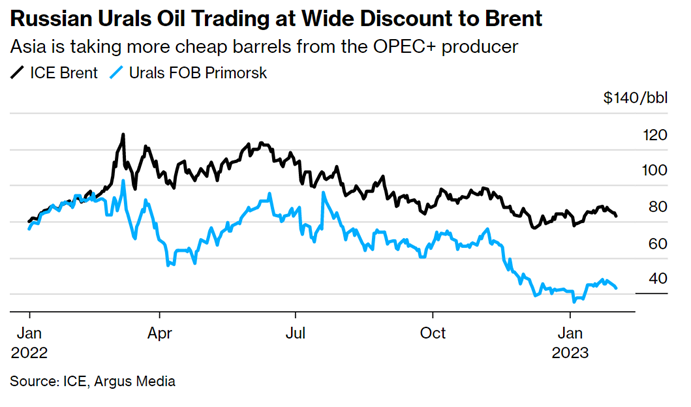

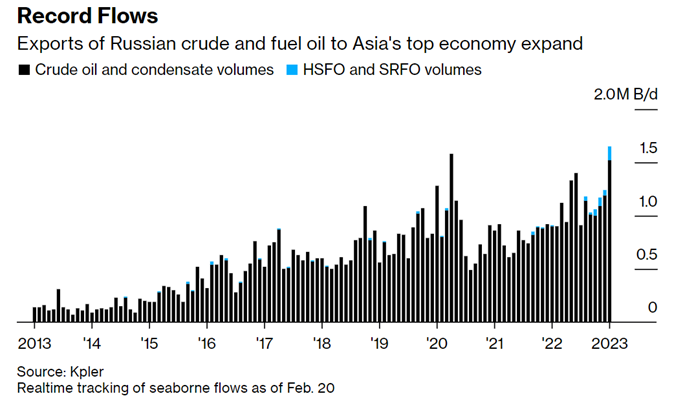

Russia is pushing more product into the water but is struggling to find enough buyers. “As much as 3.2 million barrels of Russian diesel-type fuel have been idling offshore for seven days or more, according to Kpler data compiled by Bloomberg. The surge in so-called floating storage comes as diesel exports from Russia’s Primorsk port hit the highest since at least 2016.” Meanwhile diesel stored in Russia’s fuel-pipeline network totaled 1.05m tons as of March 2, down 154k tons vs Feb. 14, the analytics firm said, citing data from the Energy Ministry’s CDU-TEK unit

- That indicates diesel exports are continuing even if the fuel is waiting a while on ships

- More monitoring is needed before an assessment can be made about whether Russia is struggling to find new buyers for its fuel

Trying to place Urals has become a bit more difficult with a lot of their current markets being “saturated” so Russia is looking to store crude in Turkey and Ghana. This has created some problems with Ghana where the tanker is still floating in the water waiting for “approval.” It will likely get approved, but Western sanctions is creating a broad concern for some of these smaller nations. Ghana for example is relying on the World Bank to help their balance sheet issues, so taking in Russian crude can easily create “problems” for receiving those funds. Russia will be able to find willing partners for crude storage- as long as they aren’t relying on Western funds.

Russia is trying to balance storage between products and crude, which is going to be difficult as they rely so much on exports. This will hinder “normal” operations causing further reductions in crude production and operations at refiners.

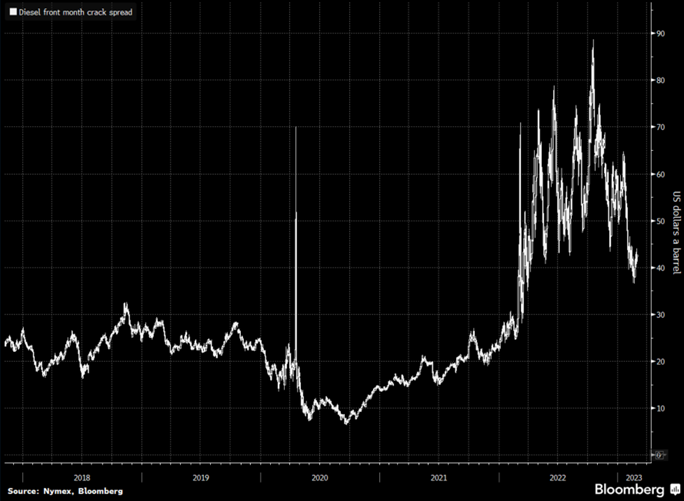

The market is going to struggle to absorb all of the Russian product as supply chains pivot to accommodate. Russian product has shifted into Asia as well as Latin America with Brazil taking in about 820k barrels of diesel. We expect to see these pivots accelerate over the next few months. As assets go into turn around, Russian crude will compete more aggressively keeping discounts broad against dated brent and result in storage increases. As refiners come back online, the key to watch will be builds across the middle distillate, heavy distillate, and residual fuel segments as Russia puts more product into the market. Gasoline and light distillates are still at record highs around the world, and we don’t see that changing in the near term. This puts all the pressure on the middle distillate crack to maintain operational margin.

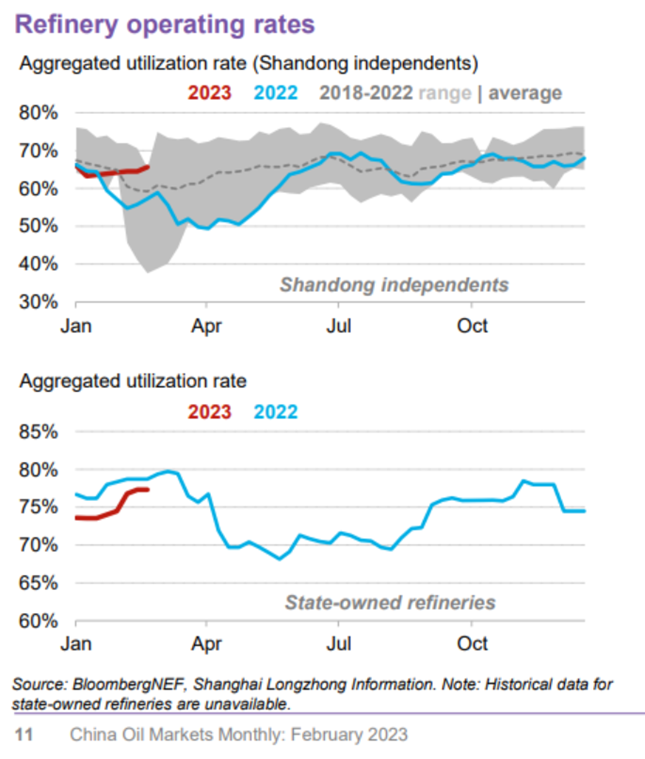

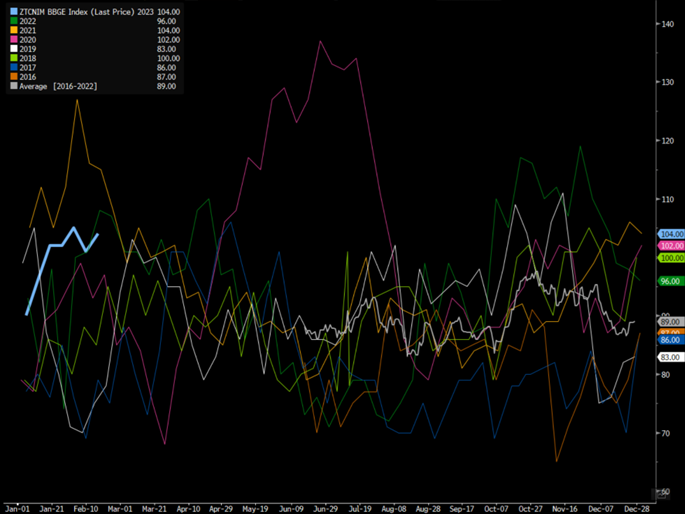

The crude markets remain range bound, and as we talked about last week- Brent reached the bottom of the range and was in a position for a bounce. There remains key resistance at around $86, which is mainly driven by macroeconomic factors. The geopolitical landscape and OPEC+ producing well below quota provides support as we approach $80-$81. The focal point remains Chinese activity, but we are seeing a mixed level of aggregate utilization rates. The activity footprint is weighted towards the Shandong refiners, which will remain the case during the next few weeks. We don’t see the same level of slowdown for state-owned refiners in April, which will make the y/y comps much better. Their activity will be supported by more local demand as well as export quotas that are still available. The elevated utilization rate during the spring months will show up in the international markets putting broader pressure on other Asian refiners.

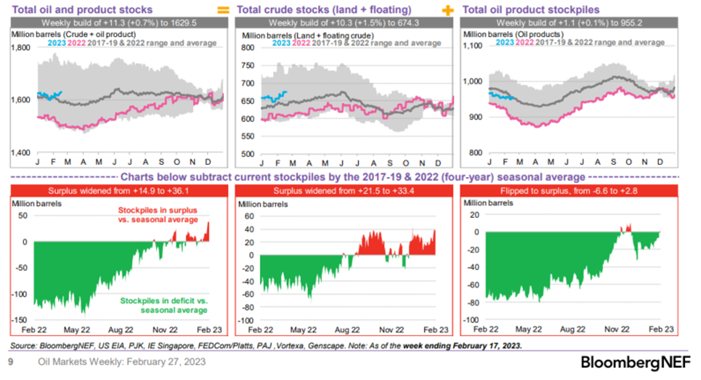

The build in product storage is the key piece to watch as gasoline builds continue and the “only” benefit to refiners- distillate- fades driven by an increase in storage. Crude and product totals are getting more “bearish” when we look at storage additions. Gasoline was already setting new records around the world in storage, so the biggest shift in the stockpiles remains on the middle distillate front.

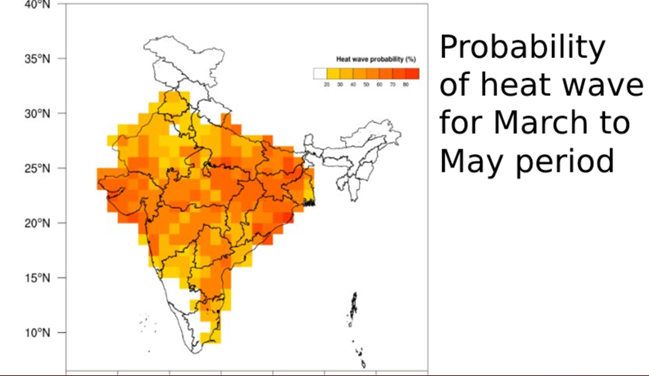

The diesel cracks have stabilized for the most part, but well below the highs and even the lows from 2022. It’s still above the average from 2018-2021, but as storage builds further and more Russian product comes to market- pressure is going to mount. The below chart looks at Asian gasoil cracks, but we see the same thing playing out in the U.S. The cracks have been stable at these levels, and an important piece to watch will be the heatwaves expected in India. There is a lot of concern around power availability in the region, and it could lead to some reduced run rates and product being kept onshore to ensure enough fuel for power generation.

The below chart is looking at the spreads in the U.S., and you can see a similar backdrop. Given the counter seasonal builds in the U.S. and warm close to the winter, we will see the cracks soften further to $30. Even at $30, its rich vs historics but won’t be enough to offset the softness in other areas of the crack.

Countries/companies that can import discounted Russia crude will be able to undercut the market. The other problem is the volume of Russian refined product exports that is hitting the market at an accelerating clip. Urals are trading at steeper discounts, which has brought renewed buying from India as well as China. But not only is China buying cheap crude- they are also buying “Cheaper” fuel oil since last year driven by shifts in Russian flows: “China’s private refiners have been buying more straight-run fuel oil since late-2022 due to attractive prices, said Mia Geng, an analyst at industry consultant FGE. Private refiners sometimes opt to refine fuel oil over crude in an effort to skirt government-issued quotas meant to limit crude imports, but the recent surge in purchases was more likely due to processors being able to reap sizable profits from processing, she said.”

An important piece to watch will be HSFO and SRFO flows from Russia that will find their way into the Asian markets at a rapidly expanding pace.

India imported about 51 million barrels of crude oil from Russia in February, 16 per cent higher than the 44 million barrels imported in January, according to data from Paris-based commodity market intelligence firm Kpler. In fact, India was the world’s biggest importer of Russian oil in February, exceeding China by 20 million barrels. Russia accounted for 39% of Indian crude supplies in February compared to 29% in January and just% prior to the war. This compares to Iraq’s 21%, Saudi Arabia’s 14%, UAE’s 7% and the US at 5%. We are seeing a drop across the board of Indian uptake from the ME, WAF, and the U.S. On a percentage basis, the U.S. and WAF have been the most impacted by Russian flows into Asia and India. “Iraq supplied 27 million barrels in February and Saudi Arabia shipped 18.5 million barrels, compared with 32 million barrels and 25 million barrels,, respectively, a year earlier. The UAE supplied 9 million barrels during the period, nearly half of the previous year’s volumes, while US shipments dropped by 58 per cent. “India will remain a long-run destination for Russian oil, even if the Ukraine war ends,’’ said Reid I’Anson, an analyst at Kpler. Europe will not buy any Russian fuel even after the war, forcing Moscow to market its crude and gas in Asia, said an analyst at the International Energy Agency.”

Russian flows continue to adjust flows with more impacts being felt again in West Africa. India picked up some of their buying once differentials weakened, but even the increase keeps it at very depressed levels.

WAF-ASIA TRACKER:

- 43 cargoes of crude are due to load for Asia this month, equating to 1.43m b/d: Bloomberg estimates compiled from a survey of traders, loading programs and vessel-tracking data

- Gains from a revised 1.4m b/d in January, which comprised 47 shipments

- Shipments to China are set to drop to 689k b/d, the lowest since July

- Shipments to India rebounded to 311k b/d from 216k b/d in January, which was the lowest tally since June 2020

- Crude flows from Angola to Asia declined to 580k b/d, the lowest since at least August 2011 when Bloomberg started monitoring flows

- Exports from Nigeria ticked higher to 278k b/d, highest since October, from 248k b/d previously

Some differentials strengthened the last week, but we are starting to see this slowdown a bit. Some spot offers have started to cut diffs again, and a large part of that is on the back of weak Chinese buying.

- Vitol offered 330k bbl of Angola’s Dalia on CFR Rotterdam basis for March 13-20 arrival at $1.05/bbl less than Dated Brent: person monitoring window

- Cargo to be discharged from Ardeche

- Declined from -$1/bbl on Feb. 23; the same lot for a similar arrival date was offered progressively lower in recent weeks, from +40c on Feb. 3

- A similar cargo — with volume of 375k bbl — was offered at +45c on Feb. 2, +55c on Feb. 1

There has been a perpetual view in the market that as China reopened there would be a sizeable drop in crude stockpiles, and the excess in the market would get absorbed quickly. Instead, we are watching China maintain their elevated purchases that was the “norm” in 2021 and 2022, but yet, there are still broad builds in crude storage.

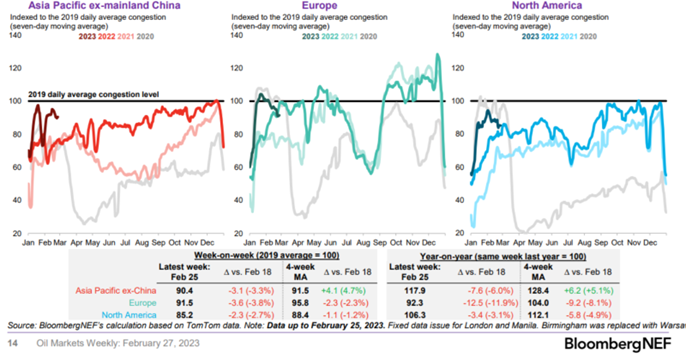

We believe this is driven by a “change” in the general flow of the crude supply chain. The “miles per ton” have risen, but broadly speaking, demand has weakened in Europe, U.S., and Asia (ex-China). So even as China pulls an “elevated” amount, other areas are pulling in less. This is why we remain concerned middle distillate storage (globally) and see more pressure on refinery margins across the board.

Outside of China, driving data remains a concern even as we should start to see a picot higher over the next few weeks. As inflation persists and economic data trends lower, summer driving season is setup to disappoint the market. Many investors still remain “hopeful” that summer demand and general travel will “save” the market from seeing some excessive builds. The current economic data trend and rising rates will put a big damper on consumer spending.

Weather impacts are going to be important for food and fuel shifts in the global market. After India’s hottest February on record, they may see more heat waves between March-May that could bring down crop yields for a second straight year. March is a critical month for winter-sown crops such as wheat. “The weather office expects an enhanced probability of heat waves in most parts of the country during the three months ending May 31, according to S.C. Bhan, a senior scientist at India’s meteorological department. An early onset of hot weather has already pushed electricity demand to near-record levels and led to the farm ministry setting up a panel to monitor the impact on the wheat crop, which is expected to reach a record this year. Last year, India suffered its hottest March in more than a century, scorching the grain harvest and forcing the government to curb exports.”

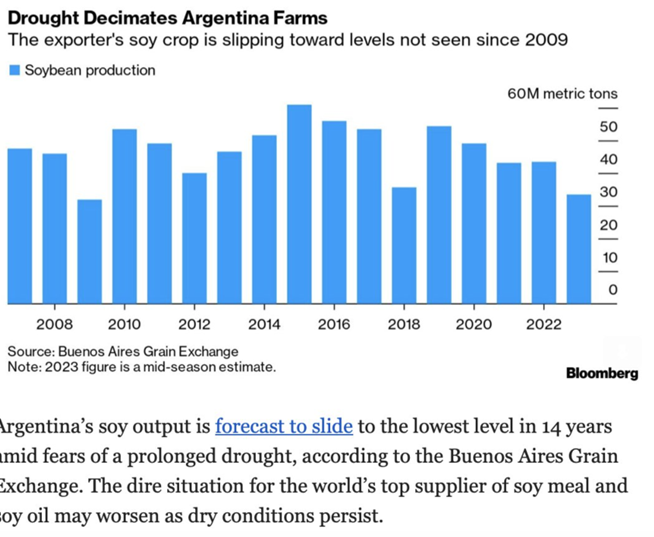

The issues aren’t only in India/Asia, but also hitting Latin America hard. Crop conditions worsened in Argentina again this past week: Soybeans are now 67% poor vs 60% in the prior week and 23% last year; Corn is 56% poor vs 51% prior week and 24% last year. Crops in good shape only came in at 2% for beans and 6% for corn.

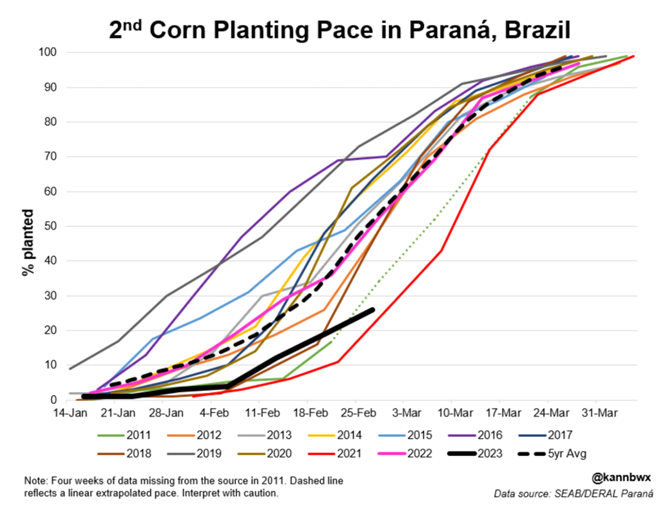

Brazil is currently struggling to get their planting done due to rain in the region. “Second corn is only 26% planted in Parana in Brazil‘s south, well below the 52% average. Only 2021’s pace was worse by the same date at 22%. Harvest of soybeans is 17% complete (same as in 2021) versus 37% average. Rainy weather has been delaying field work.”

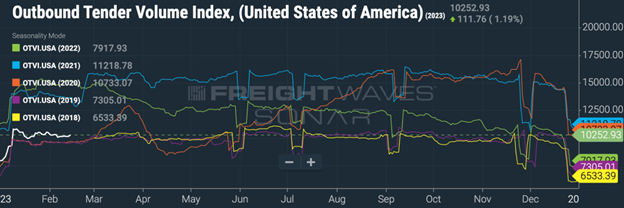

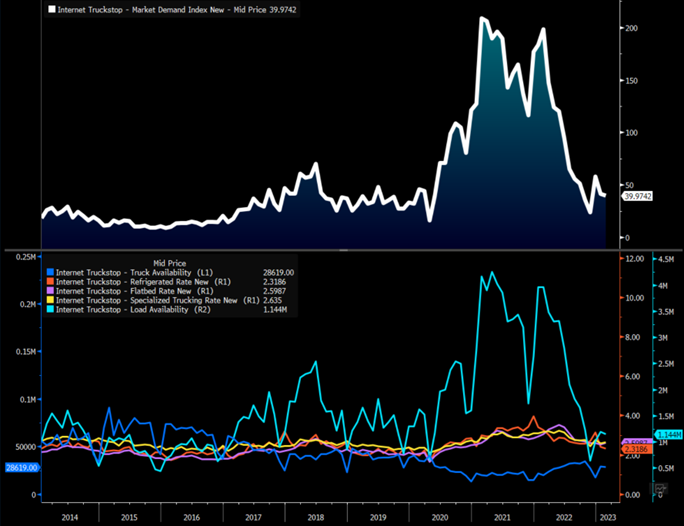

Rising rates and depressing economic data has also driven trucking and shipping data. We continue to see compressed margins on the trucking front after multiple additions over the last several years and now some reductions are accelerating. “At least that’s according to a recent FreightWaves Research survey. When asked to select statements that applied to them, 35.2% of self-identified owner-operators checked, “If the market does not rebound materially by the end of 2023, I will leave the industry.” Meanwhile, about 21% said they were having trouble finding loads to haul, suggesting woes weren’t primarily volume related — at least not yet. Fewer than 8% said they were considering signing on with a larger carrier.” The pressure is rising as underlying demand for trucking wanes and costs remain elevated across the supply chain. [1]

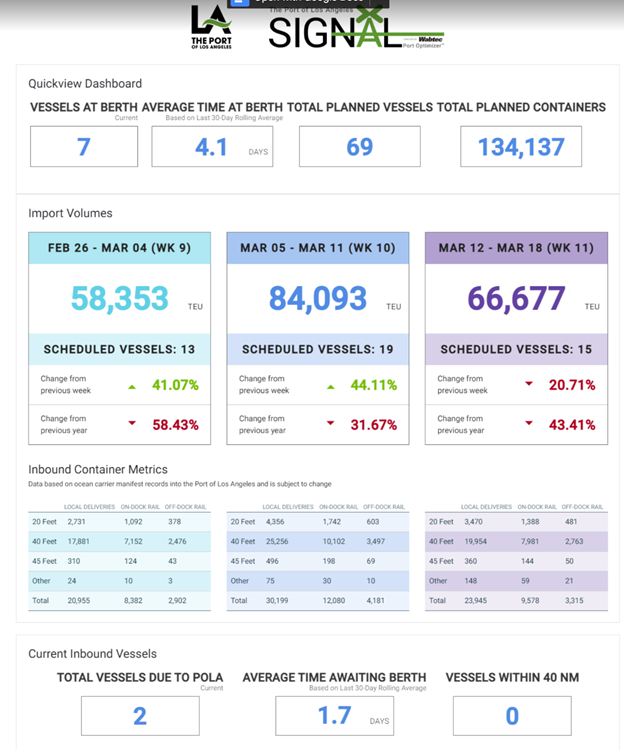

There is some stabilization in the market, but it’s well below the previous two years. The “inbound” tenders have moved below 2019 after holding up above throughout January. February has seen a much bigger drop over the month, which points to a slowdown across the board that is being highlighted in regional Fed data. It’s also confirmed with inbound ships coming into the West Coast.

The below shows the slowdown in underlying trucking demand:

The below shows the continued slowdown on inbound ships to the U.S.

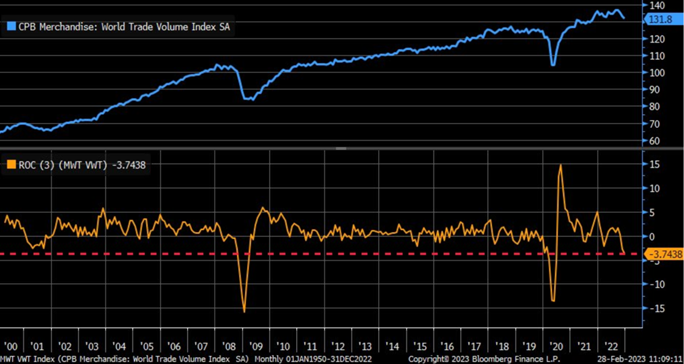

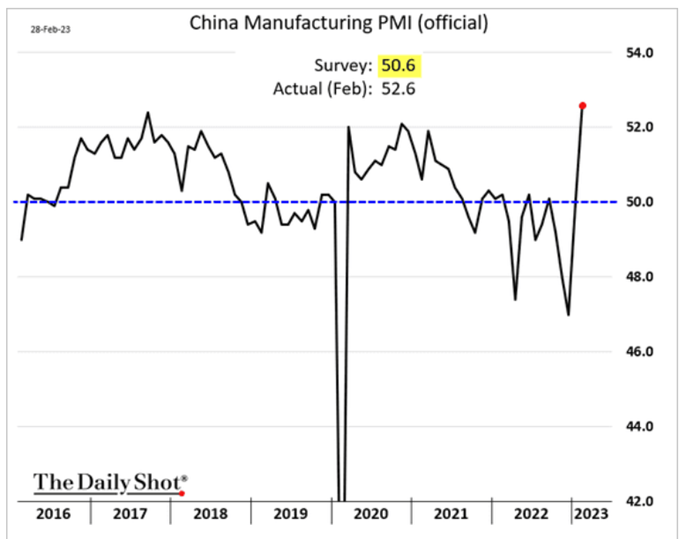

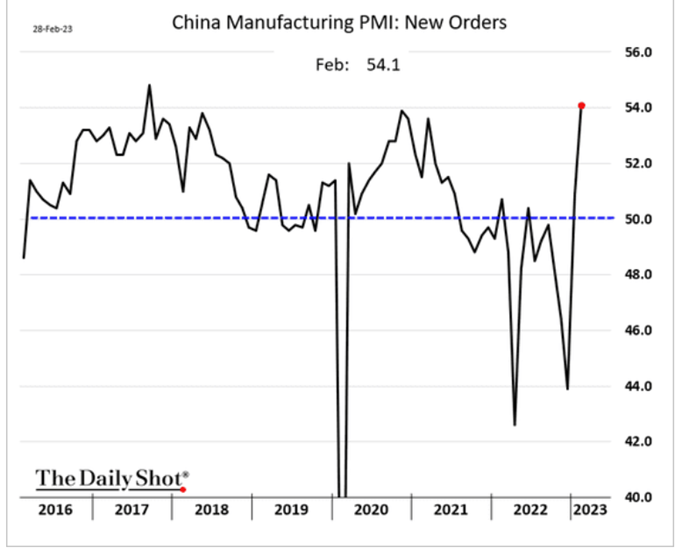

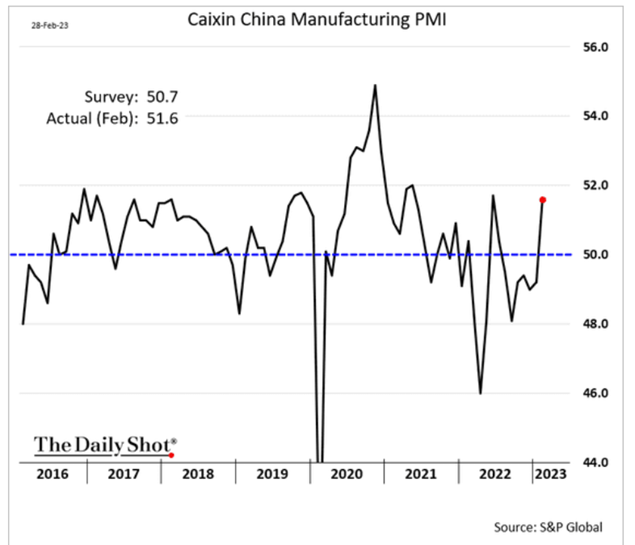

Some of the lagging data is confirming what we have seen over the last few months. We saw trade rolling over in December similar to what we have been highlighting for several months now, and we see the trend continuing as we progress through the quarter. Global trade volume contracted in December for third consecutive month, taking 3m change to -3.7% (worst since pandemic and before that, worst since GFC). We had continued pressure in Jan and Feb, but we did get some reprieve towards the end of Feb- so it will be important to see if we get any follow through. Our belief is that the increase was driven by the reopening of China, but it will be a shortlived increase as we don’t see much follow through once supply chains have “caught up” following the lockdown. Based on the recent data released from China, we have seen a “catch-up” so March data sets will be important to see if we are correct in our views.

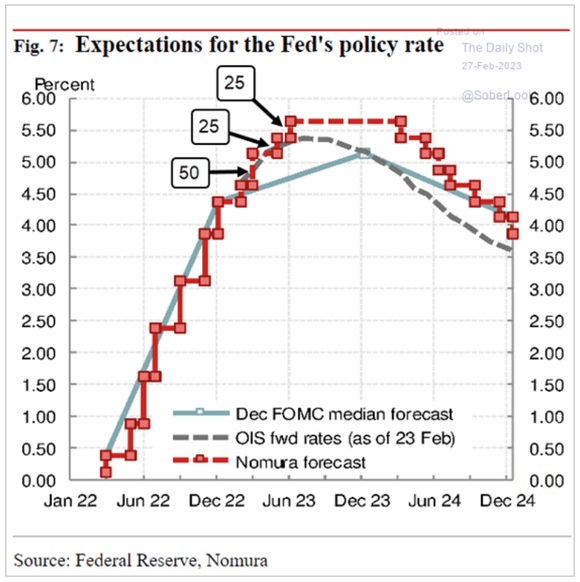

The broader market is showing economic pressure, which won’t be helped by expectations the Fed will now raise rates closer to 5.5%.

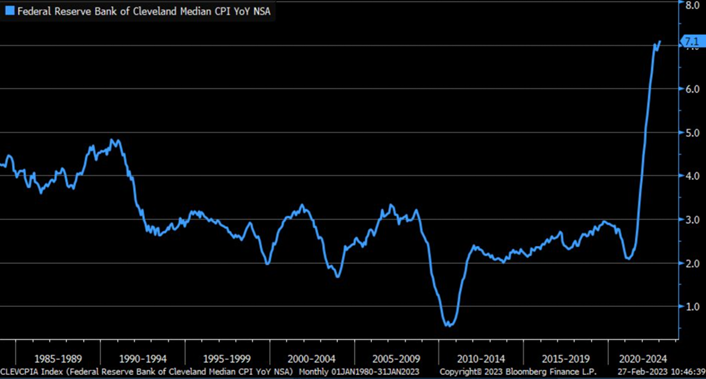

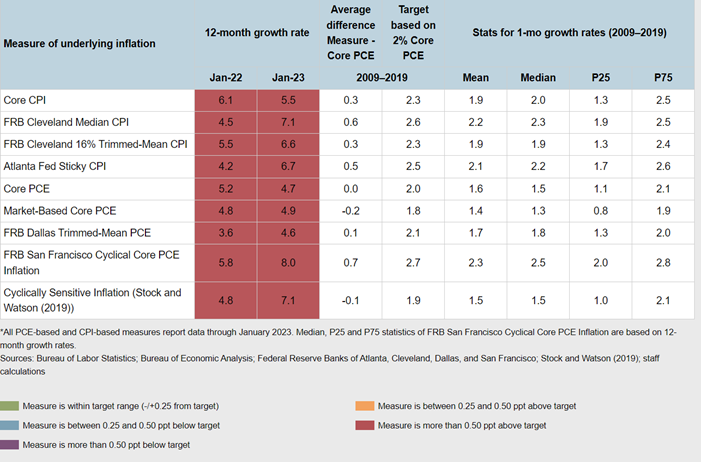

We initially expected to see rates at 5%-5.25%, but we have moved those estimates closer to 5.75% with a potential for 6% if inflation keeps coming in at these levels. I have spoken about the importance of evaluating the Median CPI and other metrics. We are seeing the Cleveland Median CPI shift to a new all time highs, which is exactly what we predicted. The underbelly of inflation isn’t going anywhere- instead we are sitting in a stagflationary backdrop with more pressure on rates around the world.

The below puts into perspective just how broad/widespread inflation is within the U.S., and this is by no means limited to the U.S.

Europe has seen another increase in most of their inflation metrics- especially in core. Inflationary pressures are rising around the world and the “breadth” of those increases remains well above normal. The food issues are not going to disappear anytime soon, which will keep a floor on how low inflation can go. These shifts will keep rates moving higher and maintain strength in the USD, and the drivers will also keep a ceiling on how high crude prices can rise.

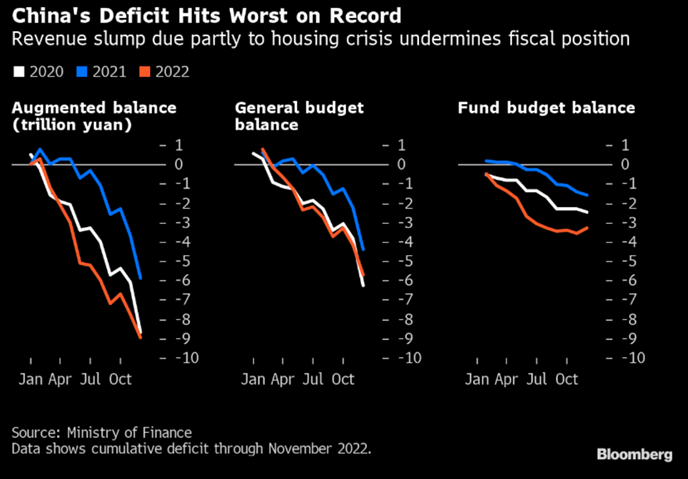

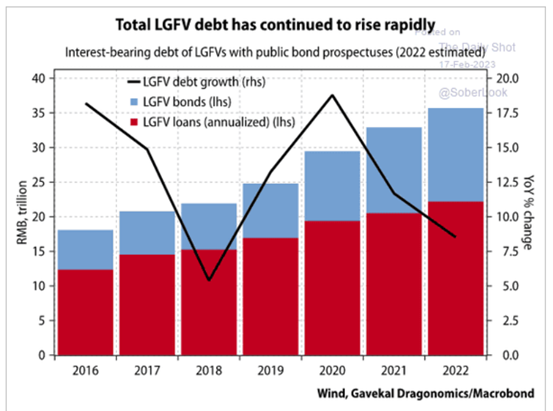

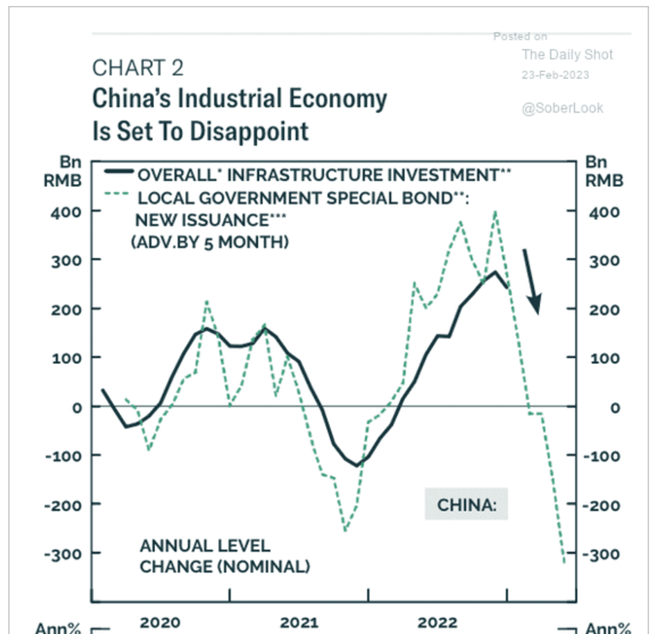

A key piece that the market also misses is the inability for the Chinese government to stimulate their economy. The debt overhang has grown over the years and reached a new pinnacle this past year.

The below helps drive home just how broad the issue has been and steep drops that will struggle to rise. Income drivers have been hit hard, and there is little reprieve on the housing/real estate market. “The outstanding local government debt exceeded 35 trillion yuan ($5 trillion) as of the end of last year, and that doesn’t include off-balance sheet borrowing via local government financing vehicles, which could be more than twice as big as official local liabilities, according to an analyst.”

As we’ve said, the PBoC isn’t in a hurry to support the market given the level of liquidity already in the market. “China’s central bank has told some banks to slow the pace of lending to contain risks after new bank loans jumped to a record in January, three bankers with knowledge of the matter said. The People’s Bank of China (PBOC) sent the informal instructions, or the so-called window guidance, earlier this month to some lenders that asked them to issue loans “under an appropriate growth rate”, the bankers said. The banks were told to control the scale of new loans in February to avoid issuing new loans at a too-rapid pace, the sources said. However, the loan growth was mainly underpinned by state-backed infrastructure projects, while actual business demand remained weak. “If banks are blindly pursuing the increase in the scale of loans, that may not be sustainable,” one of the bankers said.”

There is actually growing concern within the PBoC regarding spreads and underlying leverage ratios. I think the stimulus and growth the market is hoping for from China doesn’t exist.

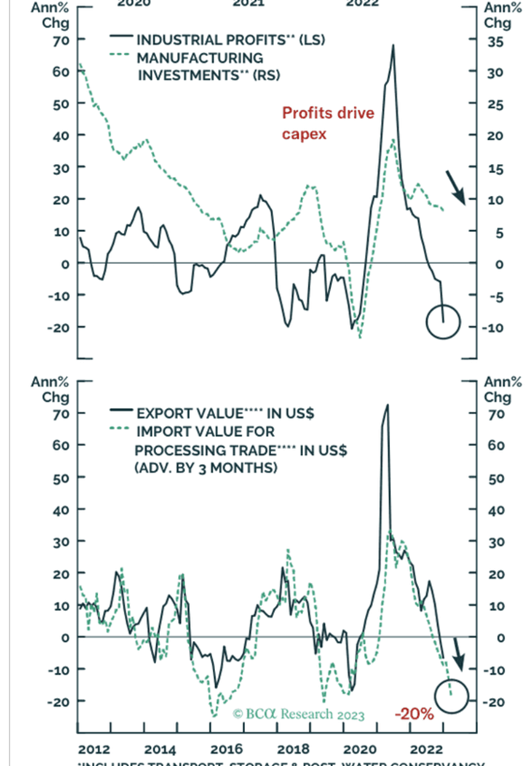

The PBoC concerns were validated in the most recent round of data released this week.

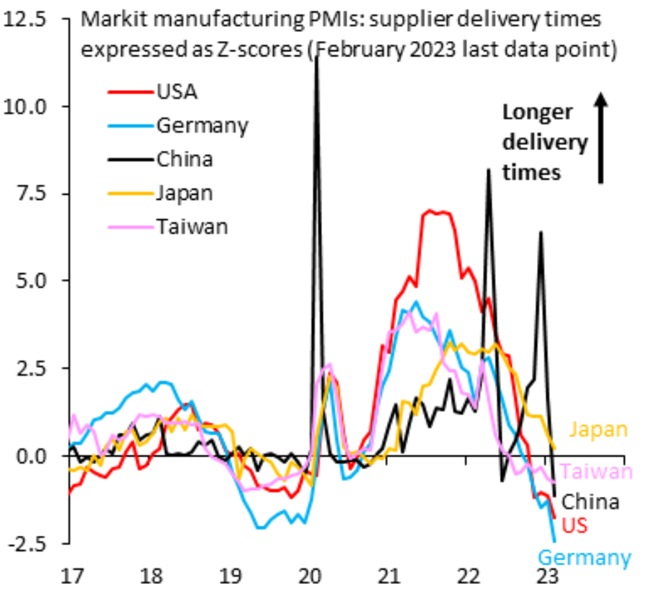

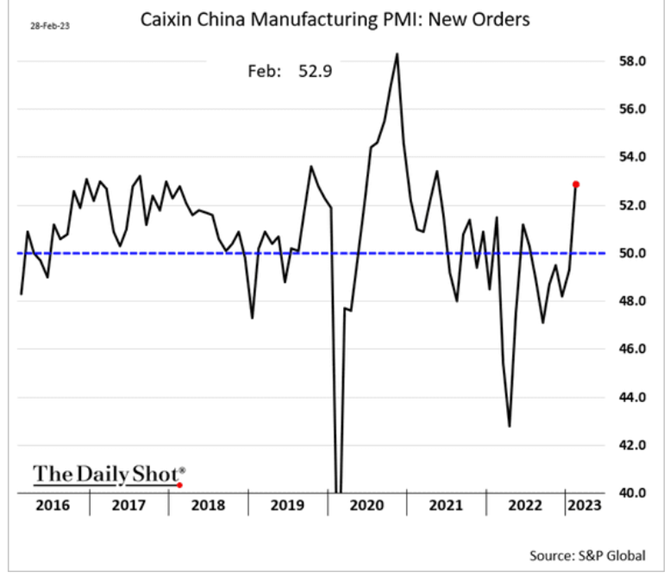

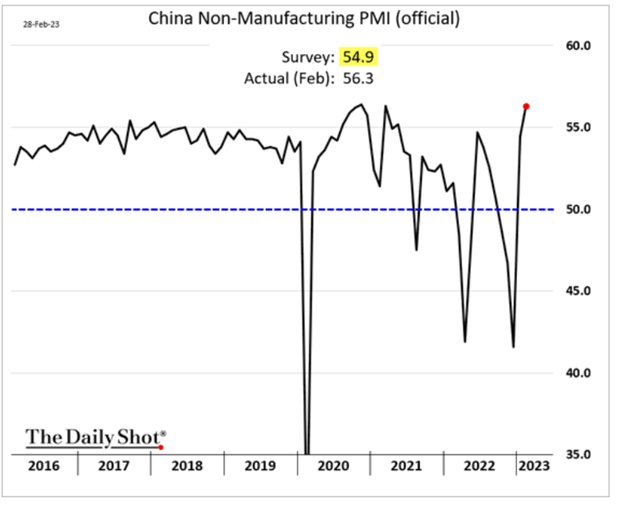

The data recovered well following some of the terrible numbers we saw during the extensive lockdown. We expected to see a bounce, but this move exceeded our views. There were some key reasons driving the large uplift in the data sets. These are diffusion indexes that can have outsized moves based on the survey, and given how people “felt” following a normalized business backdrop can make some views “outsized”. The below chart helps to put into context just how much of a shift people built into the models. We had a big shift in supplier delivery times, and a lot of “makeup” orders following several months of depressed ordering.

Even with the nice pick-up in activity, China is still markedly weaker on a year over year basis when you look at manufacturing in both Jan and Feb. The service side had a hard bounce higher as people moved about freely, and replenished a significant amount of products worked through during lockdown.

Even though we think the data is a bit “overstated,” they are still good economic data points, which is a cause for concern for the PBoC. If the speed and intensity of the recovery stays like this, it becomes an inflationary problem that could cause the PBoC to rethink their need to cut the RRR rate. We will likely see a lot of inaction over the next 2-3 months as they let the market settle and see if any support is needed. On the fiscal side, there are already plans for some sizeable stimulus, which could become a much bigger problem over the next few months.

Tax revenue has been declining for years so the ability for additional stimulus through tax cuts is near impossible without seeing more leverage at the government level (something they can’t tolerate).

Not for the tax man. After years of continuous tax and fee cuts for businesses, the government’s fiscal revenue is under severe strain:

- In 2022, government tax revenue only accounted for 13.8% of GDP – the lowest in a decade.

CAFS concluded that:

- “There is little policy space left to continue to reduce taxes and fees on a large scale.”

Get smart: With the zero-COVID policy shackles lifted this year, businesses operating in China should expect little to zero help with reducing their tax burden in the foreseeable future.

The below charts put into perspective some of the strain the local governments will be under over the next few years.

It’s also important to put into perspective the extent of the pressure on the Chinese economy in 2022, and this is what they government will actually admit too. Consumption is the biggest sticking point as we saw a sizeable drop on a per capita basis.

On Tuesday, the National Bureau of Statistics (NBS) released the Statistical Bulletin on Economic and Social Development for 2022.

This annual report is a treasure trove: It summarizes key econ data including GDP, industrial added value, trade, foreign investment, fiscal and finance, as well as sectors like education and health.

NBS Deputy Director Sheng Laiyun offered an official interpretation of the bulletin (NBS 1).

Sheng tried to accentuate the positive, just as ideology czar Cai Qi ordered in January when he told the propaganda system to boost confidence in the economy.

Sheng omitted disappointing data from his comments, including (NBS 2):

- GDP growth rate

- Added value of the primary, secondary, and tertiary sectors

- Consumption expenditure per capita

- Profit growth of major industrial and service firms

All those stats are pretty bad:

- GDP growth of 3% is the second-lowest recorded since 1976.

- Consumption per capita shrunk 0.2% y/y.

- Industrial profits fell 4% y/y.

Get smart: Free of zero-COVID policy shackles, econ prints this year will definitely improve.

But, but, but: Just how much things improve will largely depend on the government’s success in resuscitating the property market and restoring consumer confidence – which haven’t happened yet.

Li tried to highlight that consumption is his biggest reason for being optimistic, and they are going to help drive those number by combining Jan and Feb data in March. But, the question cycles back too- if consumption is so strong- why are provinces and local governments issuing vouchers for spending?

On Monday, China Securities Journal reported that numerous cities have rolled out voucher programs to encourage spending.

On Friday, the Beijing municipal government said it will issue vouchers to coincide with holidays and other peak consumption periods in 2023.

- Vouchers will range from RMB 100 to RMB 600, for purchasing items 10 times a voucher’s face value.

- This covers 55 categories of goods, ranging from laptops to home appliances.

Jinan, Shandong intends to issue eight rounds of vouchers this year.

- The first round will be distributed between February 24 and March 19, from RMB 200 to RMB 600, for purchases of home appliances.

Nanning, Guangxi is distributing RMB 30 million worth of vouchers until end March.

- These will focus on department stores, e-commerce platforms, restaurants, and cars worth more than RMB 80,000.

Cities in Guangdong, Hubei, and Henan provinces have also launched voucher programs.

Get smart: With households worried about the economic outlook, spending has not rebounded to the levels authorities want.

- We expect to see more moves like these until the recovery is truly on track.

Get smarter: These measures are a band-aid rather than an antidote to the structural issues depressing consumption.

- However, if this stimulus translates into a revival in consumer confidence, it could create positive momentum for consumption and business sentiment.

- We’ll be on the lookout for any data that signals such an effect.

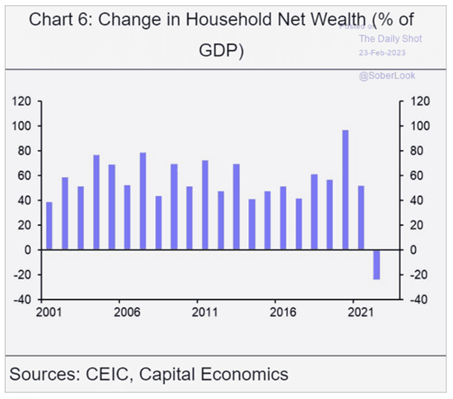

The additional fiscal stimulus on top of the momentum from the reopening could very well have an inflationary backdrop, which is already concerning the PBoC. The other issue comes down too- how are they going to pay for this? You already had these very governments struggling to fund themselves over the last few years while increasing Special Purpose Bonds with more and more coming do over the next several quarters/years.

Local governments saw revenue plummet in 2022 (Caixin):

- Total tax revenue – which accounts for just under 60% of total government income (central + local) – contracted 3.5% y/y.

- Land sales revenue – which accounts for over 35% of local government income – shrunk over 30% y/y for more than half of the surveyed regions.

To make up the shortfall, local governments engaged in a variety of one-off, revenue-raising measures.

First, they increased the sale of state assets, like housing and municipal facilities.

- Revenue from the disposal of government-subsidized housing rose 303% y/y.

Second, many areas intensified efforts to collect overdue debts and fines.

Third, they doubled down on one-off tax sources, like the farmland use tax. But moves like this are only a temporary fix. Why’s that?

- Developers are subject to a tax while they temporarily occupy farmland for construction projects.

- Once construction is complete, developers are entitled to a tax refund.

- By accumulating, and spending, the farmland use tax last year, governments were really accruing future liabilities.

What’s worse: Many regions face major debt maturation and repayment obligations this year.

Get smart: Fiscal revenues broadly match the performance of the economy.

- We’re expecting a solid improvement in local fiscal revenues in 2023.

Get smarter: That said, expenditures are also expected to rise due to high debt servicing costs and increased spending demands from the central government.

- We expect the rollout of a spate of measures to alleviate this growing fiscal pressure.

- These will likely include moves like expanding transfer payments and widening local government revenue raising avenues.

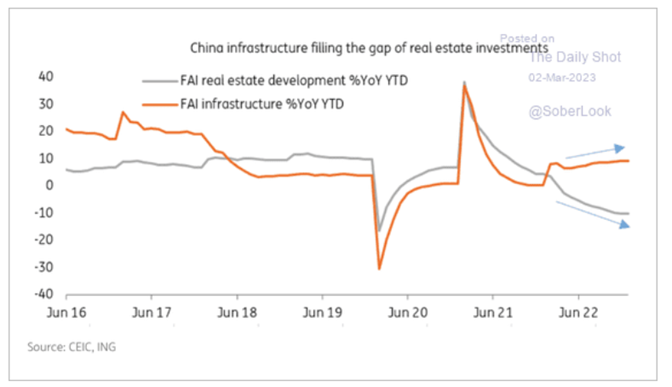

There is a very clear disconnect in China as consumption pressure remains with consumer confidence still weak and governments being directed to invest in infrastructure still. We already talked last week how the spreads on these bonds are moving wider, which will only get worse as less central banks look to buy their debt- even the government bonds.

There is still a belief that infrastructure has to drive growth to help offset real estate pressure, but how can stretched governments provide vouchers, roll debt, fund themselves, and invest in new infrastructure projects? The below puts into perspective just how wide the gap has gotten since the beginning of 2022- and it has only gotten wider into 2023.

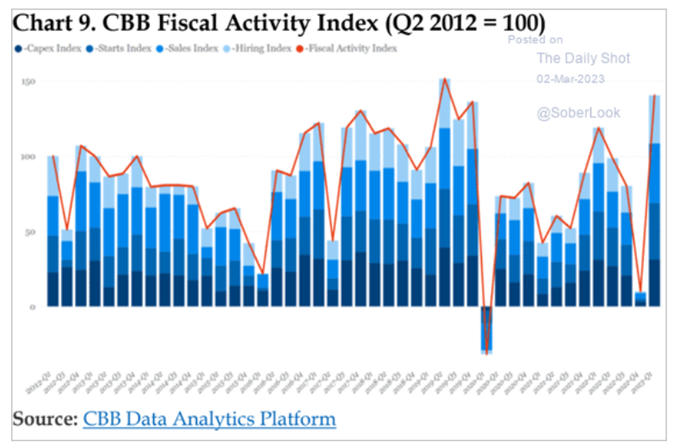

The below chart also helps to put into perspective the “make up” in fiscal activity that took place. Everything essentially came to a standstill in Q4, so there was a great “pop” in Q1- but we are already seeing some of it normalize.

Because of the reliance on infrastructure and Special Bond issuance to drive it, you can see the general trend is moving in the wrong direction to kick off the year. Many of these shifts will act as an anchor or at least headwinds to a broader recovery in the region.

Another “fun” twist is the push by Xi to have bankers “reign in their western ways.” Bankers in China are being told to rectify their mindsets, clean up their “hedonistic” lifestyles and stop copying Western ways. The directives, part of a 3,500-word commentary last week from the country’s top anti-graft watchdog, are just the latest sign that President Xi Jinping’s campaign to tighten the Communist Party’s grip on the financial system has a long way to go. As the National People’s Congress kicks off this weekend, Xi is poised to further entrench control by reviving a powerful committee to coordinate economic and financial policy and installing close allies to oversee it all. That comes on the heels of the sudden disappearance of one of China’s top investment bankers and follows the downfall of dozens of officials over the past 18 months in the most sweeping corruption crackdown on the financial sector ever. In its warning last week, China’s Central Commission for Discipline Inspection said bankers should abandon pretensions of being the “financial elite.” The change in household net wealth was still steeply negative even when you factor in the increase in household savings.

Until we get a more meaningful shift in real estate pricing, it will be difficult to get a sustainable pivot in consumer sentiment and spending. The pent-up demand created through the last 6 months of 2022 will help as well as the vouchers- but how sustainable is any of that over the long term?

The other issue will be the China and Russian relationship and what that means with the West and India.

On Wednesday, top Chinese diplomat Wang Yi met with Russian president Vladimir Putin in Moscow, on the eve of the first anniversary of Russia’s invasion of Ukraine.

ICYMI: On Tuesday, Putin gave a speech blasting the West and defending the necessity of his “special military operation.”

Wang had warm words for Putin (Xinhua):

- “China-Russia relations enjoy a solid political, economic and cultural foundation.”

- “[T]his is because a multipolar world and greater democracy in international relations, which China and Russia jointly support, are in line with the trend of the times and the aspirations of most countries.”

He also said China was:

- “[W]illing to work with Russia to…deepen political trust, strengthen strategic coordination, [and] expand practical cooperation.”

That’s not all: The Wall Street Journal cited insider sources claiming that Xi Jinping would use his upcoming visit to Russia to push for multiparty peace talks.

We should have more clarity soon: Xi will deliver a “peace speech” on Friday, according to Italy’s foreign minister.

Get smart: Beijing is on the horns of a dilemma.

- Russia is a crucial partner in China’s push for a multipolar world order.

- But China’s tacit support for Russia’s invasion has further tarnished its already poor image in the West.

- A political solution would be in Beijing’s best interests.

Get real: We doubt China can craft a mutually acceptable peace settlement.

Russia and India have historically been aligned- and joined forces against China over the years. The fact that Wang said China-Russia share a “Cultural Foundation” is factually and historically incorrect. There was a lot of fluff within this speech, but there will be enough to give the West more reasons to put sanctions on specific Chinese companies. India is trying to walk a line between the West and Russia- but the harder Russia pushes a tighter relationship with China- it will push India to further align with the West.

The next few months are going to see some very interesting geopolitical shifts with a large part of it being driven by food.

[1] https://www.freightwaves.com/news/for-some-owner-operators-this-is-the-end-of-the-road

Premium/Monthly