- Mammoth Energy has reactivated its fifth frac spread and plans to upgrade another frac spread to Tier 4 dual fuel.

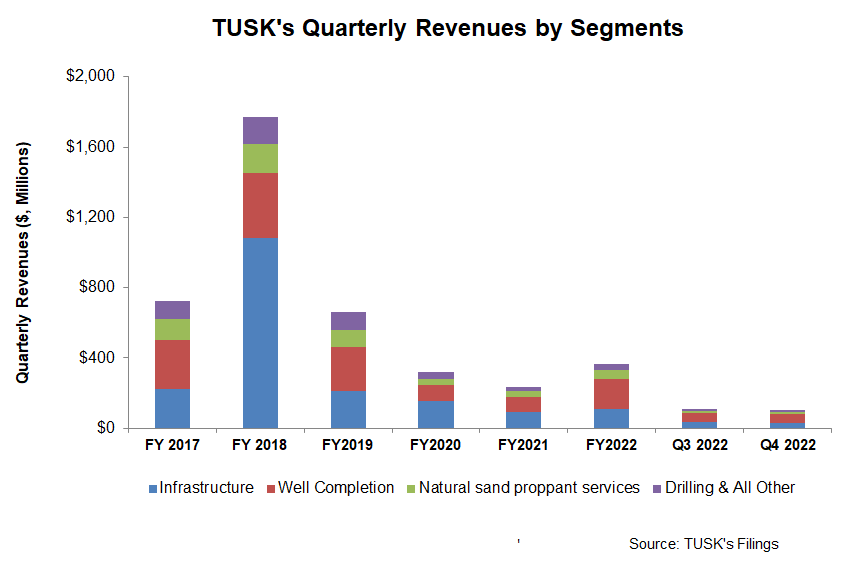

- The Infrastructure and Drilling & Other segments contracted in Q4 2022.

- After increasing significantly over the past year, the average sand price decreased marginally in Q4, but the sand sold volume continued to rise.

- Its cash flows turned positive in FY2022; capex fell short of projections due to supply chain constraints resulting in dual-fuel engine delivery delays.

Economic Environment And PREPA Update

Mammoth Energy Services (TUSK) Infrastructure segment accounted for 29% of its Q4 2022 revenues, down from 31% a quarter ago. However, the economic growth contracted in the first two quarters of 2022, technically entering into a recession, before registering a 3.2% growth in Q3, followed by a 2.7% growth in Q4. TUSK’s management believes the infrastructure business has a healthy bidding and pricing environment due to significant federal investment through the Infrastructure Investment and Jobs Act. In the long term, TUSK pins its hope on infrastructure as a key growth driver.

In this context, it is important to understand the PREPA (Puerto Rico Electric Power Authority)-related issues that have plagued the company’s finances for a few years. Among the risk factors, the PREPA-related matter drags on, as we discussed in our previous article. In January, PREPA’s bankruptcy case indicated that subject to approximately $21.5 million in offsets asserted by PREPA, roughly $99.2 million in FEMA funding would be available to PREPA. The company is still in pursuit of collecting the ~$379 million outstanding receivable from PREPA.

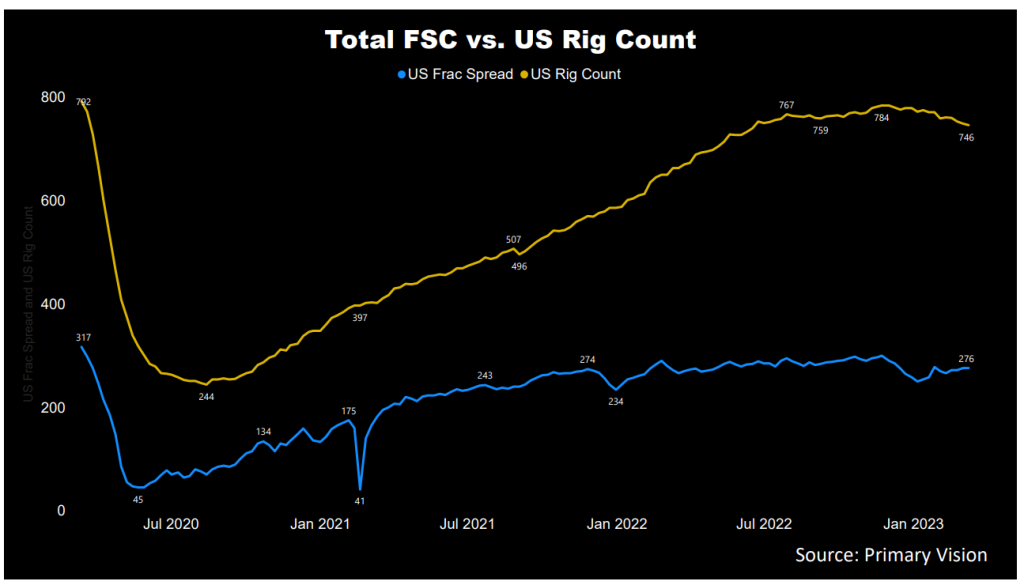

Oilfield Services: Industry And Outlook

In 2023, TUSK’s oilfield services business will likely see a qualitative improvement. First, we look at the industry drivers and how they have changed over the year. From January 2022 to January 2023, the drilled and completed well count was higher (35% and 29% up, respectively), while the drilled but uncompleted (or DUC) wells declined by 8%. According to Primary Vision’s estimates, the active frac spread count went up by 1% during this period. Mammoth Energy ended 2022 with four active frac spreads but added another by the start of 2023. It plans to upgrade another frac spread to Tier 4 dual fuel, and two frac spreads to Tier 2 dual fuel by 2H 2023.

The company’s sand business entered into two strategic sand supply agreements in November 2022. It had favorable pricing, improving the company’s profitability and ensuring stable cash flow in its natural sand proppant division. From Q3 to Q4, the average sand price decreased marginally, but the sand sold volume increased by 7% in this period. The sand price increased steeply (62%) year-over-year until Q4 2022. Despite the challenges of supply chain constraints, inflation, and higher labor costs, Mammoth’s management is confident that the macroeconomic trend will further support demand for its sand services.

Recent Drivers: Q4 2022

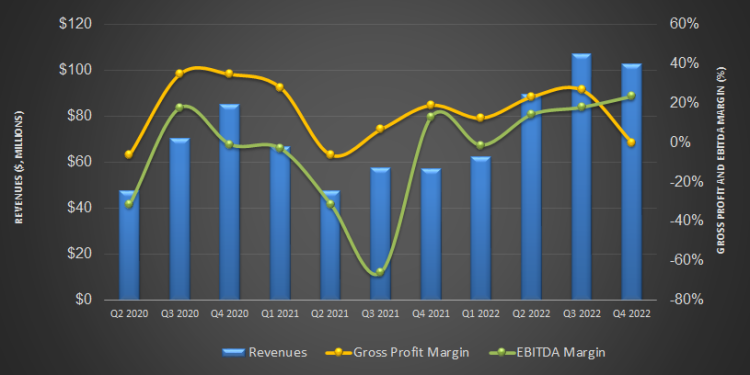

As the industry indicators weakened, TUSK’s frac fleet remained nearly unchanged at 3.4 in Q4 from 3.5 a quarter earlier. Its topline decreased by 4% sequentially due to the usual weather-related adversities and supply chain disruptions, although demand for its services in the market improved. Much of the slowdown occurred in the Infrastructure and Drilling & All Other segments. It added a fifth spread in January 2023, which can enhance the company’s Well Completion Services.

In Q4, the company recorded a net income of $4.7 million compared to a net loss of $13.2 million in Q3. Its Q4 adjusted EBITDA margin sequentially expanded by 560 basis points.

Low Leverage, Negative FCF, Capex To Rise

As of December 31, 2022, TUSK’s liquidity (excluding working capital but revolving credit facility available) was $37.5 million. Its cash flow from operations (or CFO) turned positive in FY2022 versus a negative CFO a year ago, led by higher year-over-year revenues.

As a result, free cash flow turned mildly positive in FY2022. The company’s leverage (debt-to-equity) is low (0.18x). The management overshot its FY2022 capex. Expecting $20 million to be spent, it ended up spending only $12.7 million due to supply chain constraints resulting in dual-fuel engine delivery delays. The management expects to move some of its projected capex fall in FY2023.

Learn about TUSK’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.