Contagion seems to be spreading. Fear has taken over, especially the banking industry which is the heart of global financial system therefore the chances of this turning into an ailment that can put the health of global economy at risk are high. As I explained in my last Monday Macro View, this isn’t about a particular

reason such as rising interest rates but that only highlighted what was already there. Now that a thread of mismanagement and intrigue has been exposed it is only a matter of time that we see such instances being mimicked across the industry – even outside of it as well. The recent domino that was shook by the wave of contagion is Deutsche Bank as the shares fell precipitously.

How does a contagion spreads?

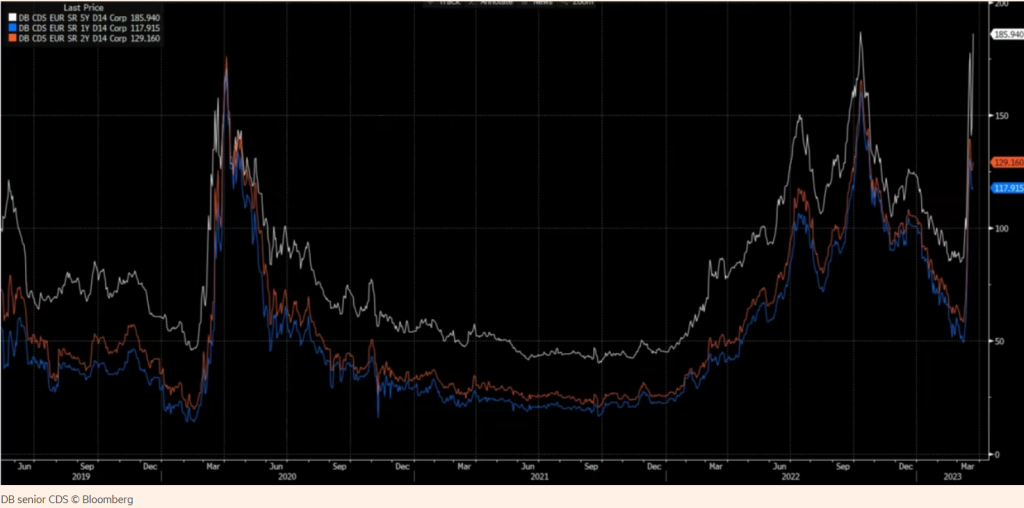

[Initial Crisis or Shock] -> [Increased Market Volatility] -> [Investor Panic] -> [Sell-Offs and Liquidity Crunch] -> [Defaults and Bankruptcies] -> [Wider Economic Impact] -> [Contagion Spreads to Other Markets]An interesting article in Financial Times provided some good insights regarding “What’s eating Deutsche Bank?“: Deutsche Bank, one of Europe’s largest lenders, has seen a sell-off of its stocks due to the “Friday Effect”, a phenomenon that sees it best to sell banks before the weekend in times of crisis. However, the cause for the sell-off appears to be the recent sub-CDS spreads blowout for European banks, which was a reaction to the weakness in AT1 debt instruments, according to analysts. While Deutsche Bank is exposed to US CRE, which is one of its more significant exposures, its CET1 ratio of 35% means that the exposure is manageable. Furthermore, only €13.1tn ($14tn) of its €42.5tn notional OTC derivatives book is not centrally cleared, indicating low counterparty credit risk. Deutsche Bank is profitable and is no more exposed to interest rate risk than the European banking average.

What is a CET1 ratio?

The CET1 ratio is a measure of a bank’s financial strength, and stands for “Common Equity Tier 1 ratio”. It is a key metric used by regulators to ensure that banks have sufficient capital to absorb potential losses.

The CET1 ratio is calculated as a percentage of a bank’s risk-weighted assets (RWAs) and is based on the bank’s Tier 1 capital, which consists of the bank’s common equity (i.e., shares) and retained earnings. In other words, the CET1 ratio measures the proportion of a bank’s capital that comes from its common equity.

If a bank has a higher CET1 ratio, it means that it has a larger amount of common equity as a proportion of its RWAs. This indicates that the bank is more financially stable and better able to absorb potential losses. A higher CET1 ratio also means that the bank is less reliant on debt and other forms of financing, which can be more expensive and increase the bank’s financial risk.

In general, a CET1 ratio of 7% or higher is considered to be a minimum threshold for a bank to be considered financially sound. However, the required CET1 ratio can vary depending on the specific regulatory framework in a given country or region, as well as the individual circumstances of the bank in question.

That means DB might not have structural issues but this is more of a psychological fallout. This is exactly what analysts at Citigroup tend to believe. They have expressed concern that the recent declines in major bank stocks such as Deutsche Bank may be due to psychological factors rather than actual business concerns. They view the market as irrational and note that a 2% decline in Deutsche Bank’s stock has coincided with a 10% increase in the cost of credit default swaps (CDS). The analysts suggest that the market may be reacting to negative headlines and broader concerns about the state of the banking industry, rather than specific issues at individual banks. They caution investors against overreacting to short-term fluctuations and recommend taking a long-term view of the market.

Nils Pratley in The Guardian has said the same thing.

- Deutsche Bank is in a better financial position than Credit Suisse.

- Deutsche Bank has undergone modernization and is profitable, while Credit Suisse lost billions in 2022 and its turnaround plan is unconvincing.

- Deutsche Bank has not experienced a flight of depositors, unlike Credit Suisse.

- Both banks’ share prices have fallen, and investors are concerned about the ongoing banking crisis and potential accidents.

So most of it looks like an extension of psychological fear and nothing substantial. However, that does not mean that this is insignificant or cannot cause damage. As Mark Carney said: “Narratives create the stories that explain the world around us, and that is a critical driver of economic outcomes”, this may as well be another driver or trigger to cause the much anticipated recession.

More on this in Monday Macro View and our ECON show. Until then, Happy Reading!