We discussed our initial thoughts about ProPetro Holding’s (PUMP) Q1 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

Frac’ing Update

In 2023, the company repriced and repositioned many of its active frac spreads. It also added the sixth Tier 4 DGB dual fuel spread in Q1 2023 and is expected to add the seventh in the coming months. In Q1, its effective frac fleet utilization of 15.5 fleets. By Q3, PUMP expects to deploy the first two electric fleets while it secures contracts for three e-fleets. At the same time, it has extended the life of key equipment components and reduced expenses and maintenance turn time. So, we can expect efficiency to improve in 2H 2022. According to the company’s management, its frac fleet remains “sold out.”

In Q2, the frac fleet utilization should remain between 15 to 16 fleets, while its wireline and cementing businesses should remain steady. The company has also implemented a fleet transition and replacement strategy, which involves retiring 140,000 hydraulic horsepower of Tier 2 conventional diesel frac equipment during 2023.

Acquisition benefit update

In November 2022, PUMP acquired Silvertip, which provides wireline perforating and pump-down services. Following the acquisition, the company announced its first two electric fleet orders and deployed the fifth Tier IV Dynamic Gas Blending or DGB fleet. The acquisition exceeded the operational synergies anticipated earlier, as we discussed in our previous article. According to the company’s estimates, Silvertip recorded robust revenues and profitability growth in Q1 and made further progress toward transitioning from diesel equipment to dual fuel and electric offerings.

Strategic Positioning

So, PUMP’s strategy essentially hinges upon the bifurcation of its pumps between legacy diesel engines and natural gas-driven efficient pumps. The bifurcation strategy would give it advantages over some of its peers in the Permian Basin. This is because the fracking industry is going through a phase of equipment attrition, supply chain constraints, and pricing and equipment discipline. As more frac equipment burns natural gas, it will keep pushing operating costs lower and returns higher. So, the fleet transition strategy is essential to PUMP’s core, although the pace of converting to electric and natural gas-burning equipment has slowed. In addition, the company also seeks accretive M&A opportunities to strengthen its position in the industry.

We need to remain cautious of the potential pitfalls in the near term. The uncertainty and volatility of natural gas prices and the impending recession in the US and some other major economies would require a more disciplined approach of the oilfield services industry to sustain through economic cycles. Nonetheless, the company’s management believes that “hydrocarbons remain in structural undersupply” and the cycle will remain “longer than normal.” By 2023, more than 67% of PUMP’s frac fleet will use natural gas-burnt next-generation equipment. So, the bifurcation strategy is expected to make the company more cost and price competitive in a volatile and uncertain environment.

Q1 Results And Drivers

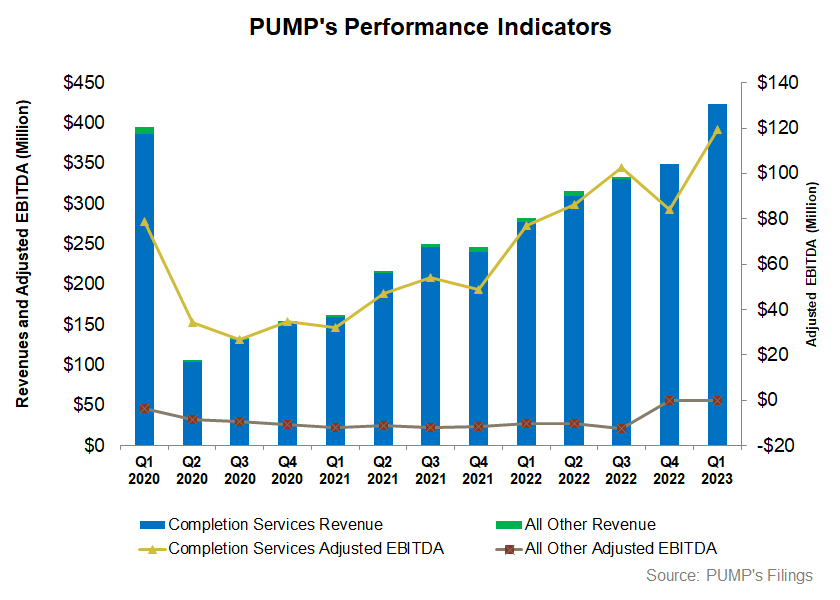

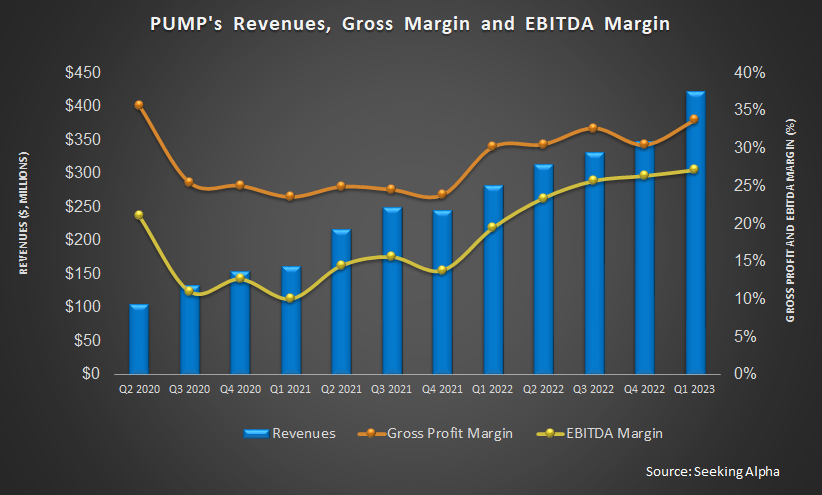

Quarter-over-quarter, PUMP’s revenues increased by 21.4% in Q1, while its adjusted EBITDA margin expanded by 400 basis points. Increased utilization, improved net pricing, and the frac fleet repositioning effort contributed to the growth. On top of that, executing a disciplined asset deployment strategy expanded the operating profit margin in Q1.

Cash Flows And Debt

PUMP’s cash flow from operations increased by 190% in Q1 2023 compared to a year ago. Despite such impressive gains, free cash flow stayed negative and deteriorated further in Q1 2023 due to a sharper rise in capex. It continues pursuing a more capital-light asset profile, which kept its capex guidance unchanged from the previous quarter. In FY2023, the company’s capex guidance is $250 million and $300 million, which would be 14% lower than FY2022 (at the guidance mid-point). In 2H 2023 the company expects to generate positive FCF in 2H 2023.

As of March 31, 2023, PUMP’s liquidity (cash & equivalents plus available capacity under the revolving credit facility) is $149 million. With enhanced profitability, liquidity, and lower capex, the company expects its financial condition to improve in 2H 2023.

Relative Valuation

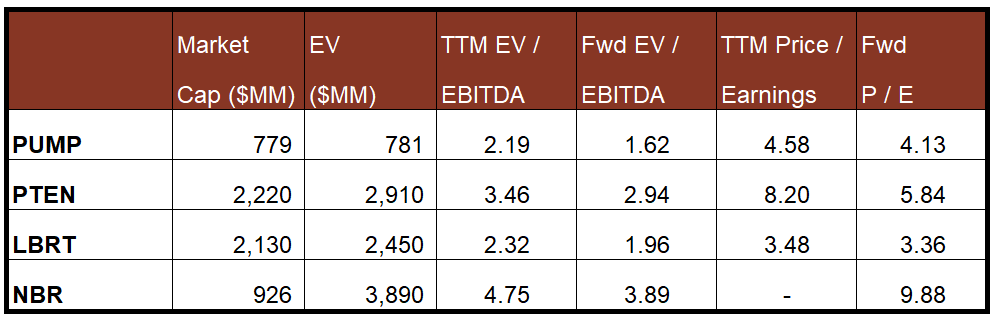

PUMP is currently trading at an EV-to-adjusted EBITDA multiple of 2.2x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 1.6x. The current multiple is below its five-year average EV/EBITDA of 5.1x.

PUMP’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is much steeper than peers because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (PTEN, LBRT, and NBR) average. So, the stock is undervalued versus its peers.

Final Commentary

PUMP has been fairly aggressive in capturing the fracking market. It added the sixth Tier 4 DGB dual fuel fleet in Q1 2023 and repriced and repositioned many of its active frac fleets. The primary strategy it adopted is to bifurcate its frac spread fleet between the legacy diesel fleets and natural gas & electric spreads. By Q3, it expects to deploy the first two electric fleets. The DGB frac spread transitioning strategy was accentuated by the Silvertip acquisition, which generated robust revenues and profitability growth in Q1. As more frac equipment burns natural gas, it will keep pushing operating costs lower and returns higher.

The stock is undervalued versus its peers. However, led by the natural gas price’s weakness, the fracking industry is going through equipment attrition, supply chain constraints, and pricing and capex restraints. Also, its free cash flow stayed negative and deteriorated further in Q1 2023. The company plans to address the issue through adopting a capital-light strategy, which would free up cash flows in 2023.