We discussed our initial thoughts about Nine Energy Service’s (NINE) Q1 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

Industry Outlook

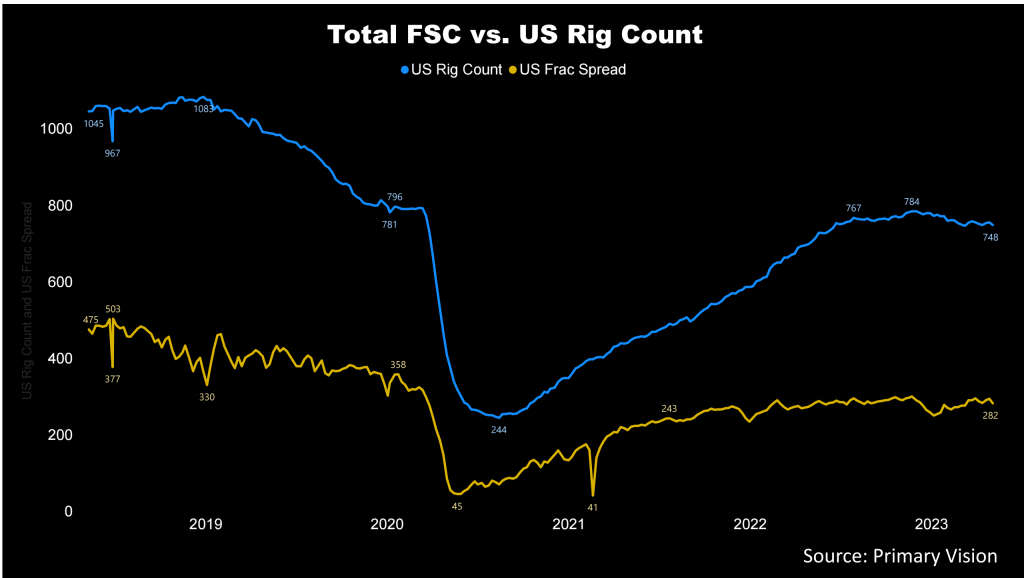

The US drilling and completion activity softened in the US in 2023, affecting oilfield services companies. According to the EIA, completion wells were down 3% quarter-over-quarter, while new wells drilled decreased by 1%. The US rig count, particularly the rig count in in Haynesville, was down in Q1 compared to Q4. The management expects rigs to decline in Haynesville in Q2. In comparison, the Northeast was flat.

Although short-term indicators are volatile and can change course quickly, we think they are more likely to keep NINE’s topline down in Q2. In the medium term, however, the company’s outlook is relatively optimistic because the energy supply side will be limited by OPEC’s and US oil producers’ commitment to capital discipline.

NINE’s Strategy And Outlook

NINE’s management is particularly optimistic about the cementing jobs. Nearly all US onshore wellbores require cementing, and the company holds technically advanced quarries (large, deep pit, from which stone or other materials are extracted). Despite the demand drawback, it plans to increase its share in horizontal lateral completions in gas basins. Read more about the company in our previous article here.

The company increased the sales of Dissolvable Stinger plugs by 23% in Q1, due mainly to higher international sales. It expects the sales of dissolvable plugs to grow in the long term. But, it will likely face near-term headwinds from the activity slowdown in Haynesville.

The company’s wireline product sales will likely decline in Q2 because of the weakness of natural gas pricing. Its wireline product sales are concentrated in the Northeast region. Coiled tubing, despite lower Haynesville activity, held up well in Q1. Nonetheless, it witnessed pricing pressure from customers across service lines in Q1.

To counter the pressure, NINE’s management formulated a two-pronged strategy: a capita light business that reduces capital allocation risk and geographic and commodity diversity. It also looks to add new technologies to improve its offerings.

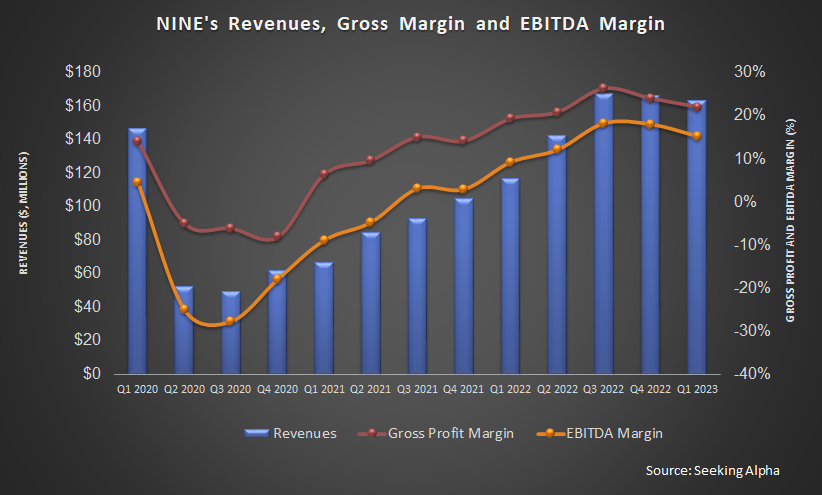

Based on the pricing and activity slowdown at the start of Q2, NINE’s management expects its Q2 revenues to decrease by 1% compared to Q1. It also anticipates its adjusted EBITDA and the adjusted EBITDA margin to decline marginally in Q2.

Q1 Drivers

In Q1, NINE’s cementing jobs decreased by 3% compared to Q4 2022, while the average blended revenue per job was down marginally, resulting in a 4% quarter-over-quarter revenue fall in this operation. Revenues from the wireline operation were relatively steady (2% down) in Q1.

Despite higher Coiled Tubing days, much lower stages completed and average blended day rate led to a revenue decline from Coiled Tubing in Q1. On the other hand, its revenues from Completion Tools increased by 7% in Q1. In aggregate, NINE’s revenues decreased by 2% quarter-over-quarter in Q1, while its adjusted EBITDA margin contracted by 270 basis points.

Cash Flows And Liquidity

NINE’s cash flow from operations decreased by 53% in Q1, while its free cash flow stayed negative. Due to negative shareholders’ equity and a reasonably high net debt ($311 million), the stock is financially risky. Its liquidity (cash and cash equivalents plus availability under the revolving credit facility) was $47.4 million as of March 31, 2023.

Relative Valuation

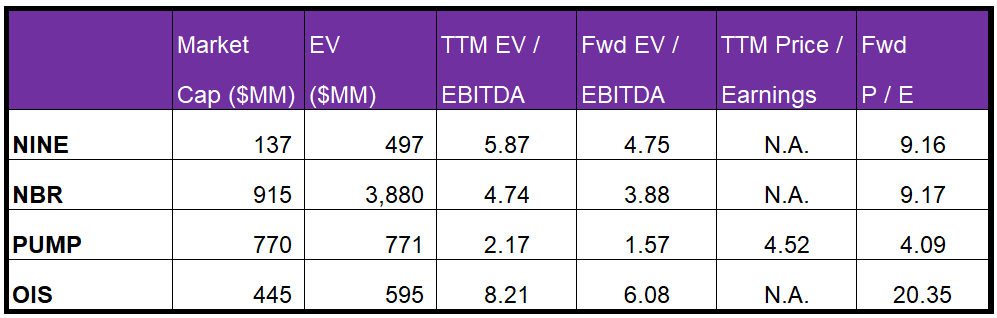

NINE is currently trading at an EV-to-adjusted EBITDA multiple of 5.9x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 4.8x.

NINE’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because its EBITDA is expected to increase less sharply than its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is higher than its peers’ (NBR, PUMP, and OIS) average. So, the stock is overvalued versus its peers.

Final Commentary

The softening of US drilling and completion activities will likely keep NINE’s topline down in Q2 due primarily to weaker activities in the Haynesville shale. However, in the medium term, the company’s outlook is more optimistic due to supply-side constraints. Dissolvable Stinger plug sales in the international markets increased. It also plans to increase its share of horizontal lateral completions in gas basins. As natural gas prices decreased, it witnessed pricing pressure from customers across service lines in Q1.

So, the company adopted a strategy of capita-light business, increasing geographic and commodity diversity and adding new technologies. The company’s cash flows and balance sheet are out of order. Its free cash flows, shareholders’ equity, and reasonably high net debt were negative. The stock is relatively overvalued versus its peers.