We had a bit of a slowdown in completion activity, which is normal for this period of time as we head into the 4th of July weekend/week. Next week will likely be another move lower as the holiday falls on a Tuesday. As we get into the 2nd week of July, there will be a quick recovery of activity as E&Ps start to make a push into year end. This will send Permian activity closer to 157-160 and a bit of a bounce in the smaller basins. The issues facing light/sweet crude will keep activity fairly range bound, as storage builds in PADD 3 and Cushing. The problem will be the divide between light sweet and medium/heavy sour. Exports and refined products will be important focal points for activity, especially as NGLs and condy prices come under pressure. Condensate (naphtha) pricing has gotten hit hard (more on that later), and it will hurt the economics as margins compress.

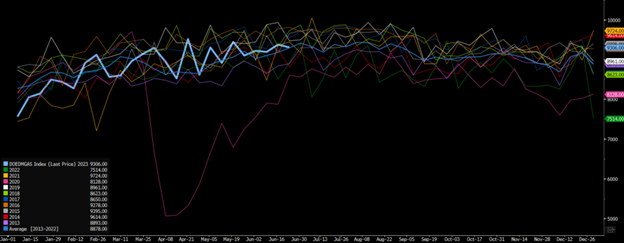

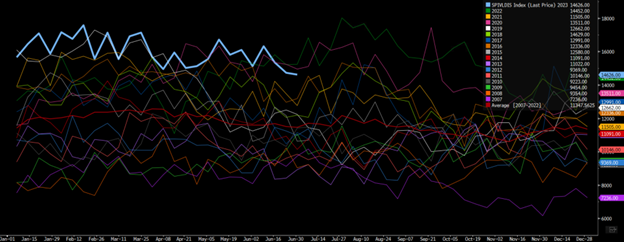

As the U.S. heads into the July 4th holiday, refined product demand is where many people will be focusing their attention. It’s important to put gasoline demand in seasonal perspective when looking at how the core of driving season is starting out. Our view from last week was that demand was going to flatline a bit, but will likely see a bit of a bump over the next to weeks to “refill” stations following the increase in -driving. We are coming right in at our estimate of about 9.3M-9.4M barrels a day of gasoline demand, which we don’t see breaking much above that 9.4M number on a rolling average. There could be a week or two when we spike higher, but it will fall back into our main threshold. This past week showed gasoline demand tracking right at the 10-year average, which is a bit skewed by 2020.

When we look at the average without 2020, the U.S. is now tracking below the nine-year average as demand remains a bit sluggish. The placement of July 4th doesn’t help (on a Tuesday), but we don’t see a big increase this summer from current levels.

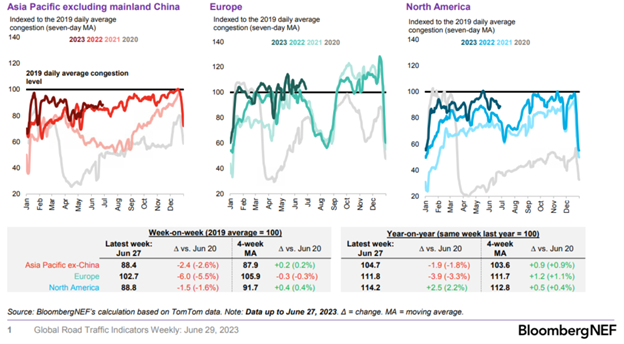

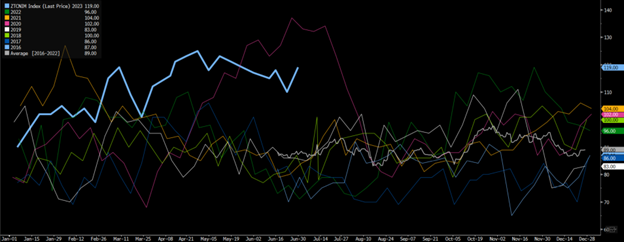

As we head into the next week or two, we will likely set the new 2023 high for gasoline demand- which is very normal for this time of year. You can see on the charts how we are still well off the “normal” pace we have seen pre-COVID. When we look more broadly and using a different data source, there continues to be a trend that is well below 2019. It’s consistent with our view that things will track about 8%-10% below normal in NAM and Asia Pacific. Europe has been a bit stronger, but we expect it to settle closer to the 2019 levels.

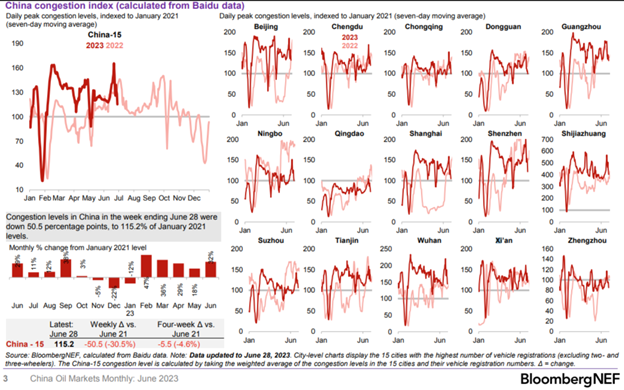

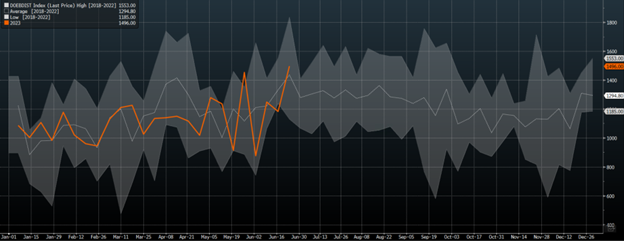

China had a nice spike for the dragon boat holiday, but it has quickly slowed back down in-line with our recent estimates. The Chinese data will remain above the Jan 2021 levels (the black line), as demand still out paces that slower period. We just don’t expect a massive bounce, but rather a trend similar to 2022 unless it reflects lockdowns as it did from Oct-Dec.

Gasoline demand won’t be the saving grace this summer, as the volumes balance out around the world. The U.S. is still the “most attractive” market to send product, which will keep our imports elevated. Europe is sitting on a record amount of gasoline, which will be the main flow into the U.S.

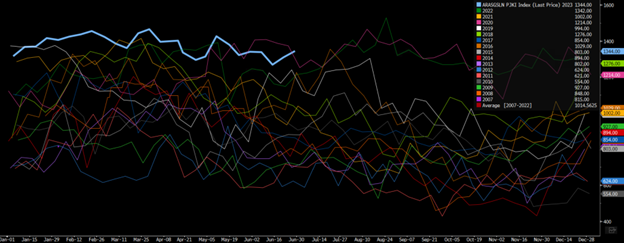

Singapore is sitting on a near record level of light distillate, which will get worse as China pushes more exports into the market. This will keep flows from the Middle East into Asia slow, instead- Middle East product flow will push into the Atlantic Basin.

As Russia and the ME push more product into the Atlantic, it will push down U.S. distillate exports pushing our storage higher along the Gulf of Mexico. The pressure will build throughout the summer as refiners run at summer utilization rates. This will put more distillate into storage as exports slow, and the economy comes under further pressure. The slow economy depletes demand for trucking, which will keep a lid on diesel demand within the U.S. This isn’t something limited to just the U.S., diesel is a key industrial product- especially in Asia. As manufacturing and industrial activity remains in contraction, it will limit underlying distillate demand.

It will take time for all of this to play out, which is why we think the pressure on crude prices increases in Aug/Sept. Crack spreads are still going to tell refiners to run at their usual 95%-96% utilization rate for the summer months. This will keep distillate storage building, but because we are starting from such a low point- we won’t see a big drop in the crack spread. Disty cracks will likely drift lower over the next few months to the 2023 lows, but the limitations on the East Coast (PADD 1) will keep activity steady. This will cause a bigger glut in gasoline as imports stay elevated, demand slows, and refiners are forced to create gasoline. When you make one barrel of diesel, you inherently make two barrels of gasoline that will have to either go in storage or the export market. Since the export market is massively saturated, it will sit in storage.

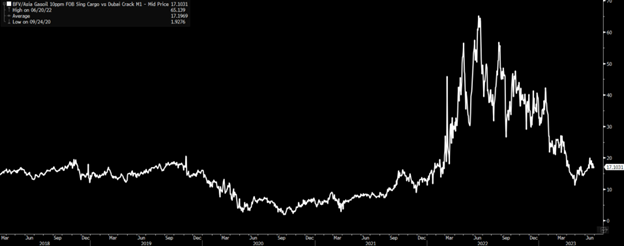

Distillate margins in Asia also remain steady, but have more risk (or faster risk) to the downside. The reason being the movement of Russian and Chinese product into a market that has ramping refining activity and an industrial/manufacturing that’s contracting.

We expect to see a move back to $13 over the next few weeks, but they are facing something similar when it comes to storage starting on the lower end. This will likely fill up a bit faster as exports hit hard and industrial slowdowns catch-up to storage.

All of these issues are going to keep a lid on underlying crude prices, which is getting more complicated given the variations across quality. We are going to look at heavy vs light and sweet vs sour. The light/sweet barrel is coming under pressure as gasoline stocks remain huge and naphtha prices fall. The light-sweet market is challenged while the heavy/medium market is tighter. The spread between naphtha and HSFO is doing very well, which just means that naphtha prices have fallen hard while HSFO has stayed strong. The petchem market has seen their margins plummet (again) resulting in more utilization reductions. This pushes more condy (naphtha) and NGLs into the market because there just isn’t a meaningful demand in the chemical stream. The cuts from Saudi has created a bigger imbalance- so light sweet horrible and Medium/heavy sour doing well because of cuts. Saudi is making this market unbalanced with their cuts, not actually balancing it. This helps put some of the economics into perspective:

HSFO has been having a huge run up. Currently with a -$3 handle in NWE. Low Sulphur trading negative to HSFO. Naphtha on the other hand is -$14. Sour crude has gone up in price but still better value than sweet for many refineries.

This has pushed the Brent vs Dubai spread upside down.

We will start to see some pressure on U.S. exports as we head into August as our light/sweet crude doesn’t have the same market it did a few months ago. The U.S. is still “favored” to Europe given our proximity, but it will be difficult for the U.S. to compete into the Asian markets. The rise in the sour spreads will also weigh on distillate cracks, but it will take a bit more time to see this play out- which is we are keeping our brent range here $73-$77. As we head into August/September, we are going to see more downside and “reset” closer to $68-$73. Depending on storage, the floor could be a bit lower, but it will be difficult to see a “bigger” collapse given the reduction of underlying supply in the market. There was a big spike in crude in floating storage, and the issue will be “the type of crude in storage.” Just because it’s in storage- it doesn’t mean its all equal. We are now at the 2023 highs for crude in storage, and as the imbalance of crude grows- we see this as drifting higher.

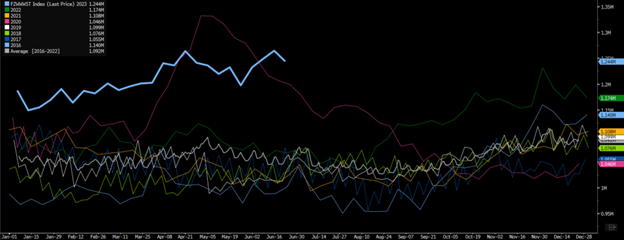

Some of the crude in transit has pivoted over into storage, which is helping to keep us elevated. This is why we think KSA will have to keep the “voluntary cuts” into August as well. We believe they will extend the cuts but not at 1M- instead- something like 500k into August. The below shows the total amount of crude on the water, and you can see there is still a TON out there that needs to be absorbed.

The below chart shows the increase in the Middle East, which is the one that is the most concerning for KSA. We are seeing more crude stuck in the ME as the OSPs hinder underlying flows. These will be my “famous last words” but based on the below chart- KSA needs to cut OSPs. I said that last time, and instead they absolutely gunned underlying prices. Now the Middle East is sitting on the most crude in 2023 and pushing to levels not seen since the end of the “price war.”

China is still taking advantage of Russian and Iranian discounts, which will leave ME and WAF cargoes sitting in the water. The longer China buys crude with a weak economic backdrop- the bigger their storage gets and the more they can “manage” underlying prices.

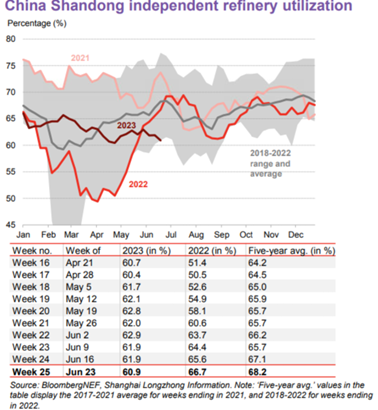

The storage of crude is made even worse based on the limited activity in Chinese refiners. I was expecting to see way more refining activity from China at this point, but instead we had ANOTHER reduction in activity. The elevated premium in HSFO should “technically” push them to increase run rates, but this could also help indicate how much refined product is actually in storage. We expect to see exports increase to help balance the storage situation within China, and as that balances, we will be able to see more activity from the refining space.

As China’s exports increase, we will see more flows moving West. It will help pull more product from the ME and into the Atlantic Basin, which will put pressure on U.S. exports.

The arb is still open from the U.S. to Europe, but we expect it to close as more volume flows from the ME.

Gasoline from Europe into PADD 1 is still wide open, and we don’t see that changing as pricing still favors imports.

The below chart shows the price of gasoline in the U.S., which is still elevated against historics. This will help pull in more imports, but also weigh on the local consumer and their ability to spend money. I know you can make an argument on “adjusting for inflation”, but I am looking more at the drop in real wages and the level of debt sitting at the consumer level.

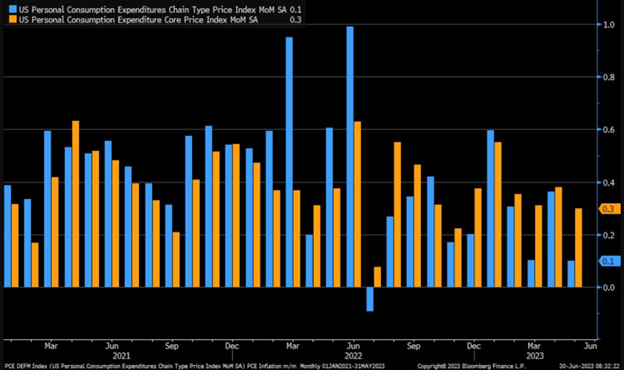

Core inflation continues to move at a very unhealthy rate that is hitting the consumer harder and harder. This will keep the Fed on pace to raise rates, and try to bring this under control. The month over month helps to show the pain as prices are relentless and driving the reduction in consumer activity. May PCE inflation +3.8% year/year vs. +3.8% est. & +4.3% in prior month; core PCE +4.6% vs. +4.7% est. & +4.7% prior and on m/m basis, May PCE #inflation +0.1%; core +0.3%.

Inventories keep trending higher as the “destocking” is FULLY complete and now this is showing the broad slowdown in activity. This is why we don’t see any saving grave coming from the shipping/trucking market. Instead, the trucking market is confirming what we have been saying for some time.

Over the next two weeks, I will go through more of the U.S. economic data points and highlight what we think is going to happen into the end of the year.