Frac’ing Outlook And Acquisition

In our recent article, we have already discussed RPC’s (RES) Q2 2023 financial performance. Here is an outline of its outlook. At the end of Q2 2023, RES’s management acknowledged the general downturn in the completion activity but appears optimistic about a resurgence in frac activity through a tighter calendar space in late 2023. Until now, however, fracturing activity pricing in the industry has gone through a significant concession, and RES has not been an exception. By 2024, the industry may see a recovery. Pricing may strengthen in 2024 as much as it did in early 2022 to mid-2022.

It expects heavy usage for the pressure pumps, which will require refurbishment by the end of the year. If there is a certain swing in favor of fracking activity, it may take delivery of a new fleet in 2024. The other factor that can impact growth is RES’s Spinnaker acquisition. The acquisition can integrate RES’s offering with cementing services in the Permian and Mid-Continent Basins. It can also improve its buying power as well as operating synergies.

Strategy And Cost Control Measures

One of the reasons RES was adversely affected in the completion activity depression is the higher share of its hydraulic fracturing work running on the spot rate, i.e., they are short-term. So, customers deferring planned activity resulted in lower utilization until June and may remain low in early Q3. RES’s diversified customer base can mitigate the short-term duration exposure of its fracturing business.

The company has also initiated a digital transformation. It will reduce the back-office’s maintenance, personnel, and equipment costs and provide extensive on-time data. As part of cost-cutting measures, RES took up a small-scale layoff. Nonetheless, it will remain sufficiently staffed to operate ten horizontal frac fleets.

The Q2 Drivers

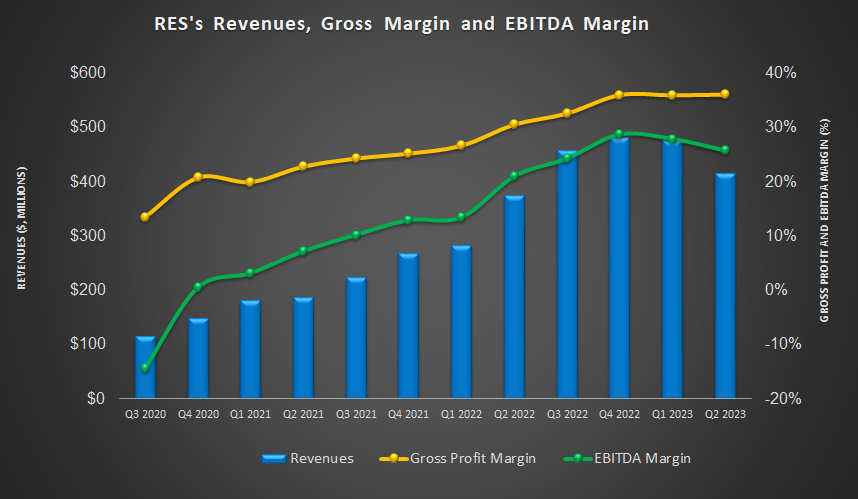

In Q2 2023, the company’s Technical Services segment revenues decreased by 14% compared to Q1 2023, while the operating income fell by 26%. The Support Services segment saw revenue growth (4.7% up) in Q2, and operating income increased by 19%. Overall, the company’s cost of revenues (as a percentage of revenues) remained steady despite weaker activity levels in the natural gas directive basins.

Cash Flows And Liquidity

As of June 30, 2023, RES had no debt and positive cash & cash equivalents balance ($180 million). To guard against any liquidity strain, the company can tap from its robust liquidity (revolving credit facility plus cash & equivalents) of $263 million. It has improved cash flow from operations significantly (by 3.1x) in 1H 2023 compared to a year ago, which turned its free cash flow positive versus a negative FCF in 1H 2022.

Recently, it has lowered its FY2023 capex plans to $200m-$25m from $250m-$300m set earlier. During Q2, its capex spend was due to putting in service a new Tier 4 dual fuel equipment and older equipment refurbishment. So, free cash flow can improve in 2H 2023.

Relative Valuation

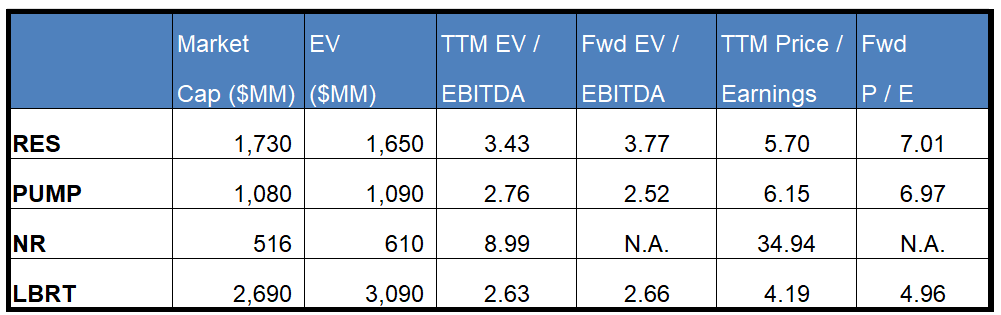

RES is currently trading at an EV/EBITDA multiple of 3.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.8x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 29.5x.

RES’s forward EV/EBITDA multiple expansion versus the current EV/EBITDA is steeper than its peers. This implies the company’s EBITDA is expected to decrease more sharply than the fall in EBITDA for its peers in the next four quarters. This typically results in a much lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (PUMP, NR, and LBRT) average. The stock appears to be reasonably valued versus its peers.

Final Commentary

A resurgence in frac activity and higher asset utilization in late 2023 can lead to a better performance for RES in 2H 2023 compared to the first half of the year. Pricing may strengthen in 2024, requiring the refurbishment of pressure pumps. RES may take delivery of a new fleet in 2024. Also, the company’s Spinnaker acquisition will integrate cementing services in the Permian and Mid-Continent Basins.

The US rig and frac spread count year-to-date remained relatively weak on the demand-supply balance. RES’s topline and margin deteriorated quite sharply in Q2. Customers deferring planned activity can result in lower utilization in early Q3. RES’s cash flows improved significantly in 1H 2023 compared to a year ago. It also lowered capex forecast to improve the bottom line. A robust balance sheet will allow it to remain relatively financial risk-free. The stock is reasonably valued versus its peers at this level.