It has been a very interesting week especially for oil markets. There seems to be an artificial supply shortage and that is driving the oil prices higher. Promises by OPEC+ to prolong their production cuts have also lifted up the bullish sentiment and this can be corroborated by looking at the total number of bearish vs bullish positions held by hedge funds and money managers. However, the story of the global economy and its recovery seems to give a different message. This article explores the recent developments in the global economy.

The Financial Stability Board recently warned us of extreme optimism regarding global economy in a note.

The global economy is currently described as “resilient,” but concerns are emerging regarding its ability to withstand significant shocks. Klaas Knot, Chair of the Financial Stability Board (FSB), has conveyed this message to G20 leaders scheduled to meet in New Delhi on September 9 and 10.

Knot’s warning comes as the global economic recovery shows signs of losing momentum, exacerbated by rising interest rates in major economies. This concern follows earlier vulnerabilities exposed by crises at Silicon Valley Bank (SVB) and Credit Suisse. Knot emphasizes the need for countries to recognize these vulnerabilities and monitor asset quality in sectors sensitive to interest rate increases, such as real estate.

Just a year ago, Europe was on the brink of a recession due to factors like the Ukraine war and an unexpected interest rate spike. While Germany experienced a downturn, it did not spread throughout the Eurozone. Nonetheless, Knot and international organizations are now observing signs of economic headwinds. Rising interest rates, coupled with slowing growth, could challenge borrowers in servicing their historically high levels of global debt and pose challenges for both banks and non-bank lenders.

Knot also reminds world leaders of earlier events, including the failure of a global systemically important bank and medium-sized bank failures earlier this year. While swift action prevented widespread contagion, ongoing financial market strains remain possible due to higher debt servicing costs permeating the economy.

Another significant concern is the sharp rise in interest rates within the Eurozone over the past year, drawing attention to the sources of global debt rather than just its volume. Knot and others highlight the increasing significance of non-bank finance and the associated shadow debt held by investment banks and technology platforms, exceeding $80 billion (€75 billion). Mismanagement of leverage in this sector can amplify stress and lead to systemic disruption, as witnessed in recent commodity and bond market strains.

Furthermore, Knot alerts G20 leaders to the risks associated with non-financial debt, particularly cryptocurrencies and stablecoins linked to major currencies like the dollar and euro. Incidents in the past year have highlighted vulnerabilities in the crypto-asset ecosystem, which could affect financial stability, monetary sovereignty, capital flows, and fiscal policy.

We need to pay heed to that.

Another article by The Barron’s Daily provides a very good overview of whether we should pop up the champagne (expect a soft landing).

The global economy appears to have escaped an immediate risk of recession, but its fragility persists, with potential threats on the horizon. Factors such as elevated debt levels, tighter financial conditions, and weaker growth prospects continue to loom, particularly for developing economies.

As of now, global debt stands at record highs, reaching around 2.5 times the world’s total economic output. By the end of 2022, the debt-to-Gross Domestic Product (GDP) ratio for developing economies (excluding China) reached 126%, surging by approximately 30 percentage points since 2010. This surge in debt coincides with rising interest rates, leading to budgetary constraints in many developing nations, where debt-service payments now often exceed allocations for essential services like health and education.

While global interest rates might be nearing their peak, significant reductions aren’t expected in the near term. In many advanced economies, headline inflation has moderated, but core inflation (excluding food and energy) remains stubbornly high.

Developing countries are grappling with considerably higher financing costs. In one-fifth of these economies, sovereign spreads—indicating the difference in yields on bonds issued by these economies relative to U.S. bonds—have exceeded ten percentage points, rendering borrowing prohibitively expensive. Consequently, sovereign debt defaults among developing countries have surged, with 15 defaults occurring in the past four years, compared to 19 in the previous two decades.

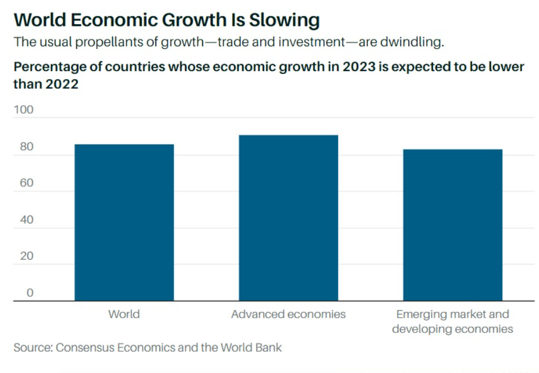

Recent consensus forecasts indicate that over 85% of countries will experience slower growth this year compared to the previous year. This widespread slowdown isn’t surprising. Among the three major engines of the global economy, only the U.S. is showing robust growth, while the euro area is stagnating, and China’s economy is faltering. Excluding China, developing economies are projected to experience a substantial growth deceleration, dropping from 4.1% last year to 2.9% this year.

These trends have troubling implications. By the end of the next year, nearly 30% of developing economies’ populations will remain poorer than they were before the Covid-19 pandemic. The usual drivers of growth—trade and investment—are on the decline. Global trade growth is expected to sharply slow this year, falling to less than 2% from 6% in 2022. Investment growth in developing economies for this year and the next is anticipated to average a modest 4.2%, significantly below the 7.1% average seen in the first two decades of this century.

Food insecurity is also on the rise, exacerbated by the impacts of climate change. At the close of 2022, approximately 2.4 billion people—nearly a third of the global population—faced year-round challenges in accessing sufficient safe and nutritious food.

Addressing these challenges will undoubtedly be challenging, but it remains feasible. Policymakers, both domestically and globally, must resist the temptation of quick fixes and instead focus on implementing long-term growth-enhancing policies. With fiscal resources depleted and inflation still a concern, large-scale economic stimulus packages are not advisable at this time.

Structural policies can play a crucial role in reducing overall uncertainty and restoring confidence. Key strategies should encompass increasing investment to meet development and climate goals, enhancing public-spending efficiency, prioritizing vital infrastructure projects, improving governance frameworks and business environments, and streamlining regulatory processes. Global cooperation will be indispensable for accelerating the transition to clean energy, addressing climate change, and providing debt relief to countries grappling with mounting debt distress.

Although a few economies have demonstrated resilience, the global economy still faces substantial threats. Policymakers must remain committed to addressing these challenges, including curbing inflation, implementing comprehensive policy reforms, and striving for sustainable long-term growth and prosperity.