Frac’ing Update

Our short article discussed our initial thoughts about ProPetro Holding’s (PUMP) Q2 2023 performance a few days ago. This article will dive deeper into the industry and its current outlook. In 2023, modernizing the frac spreads has become PUMP’s priority. After adding the sixth Tier 4 DGB dual fuel spread in Q1, it deployed the seventh Tier 4 DGB spread in Q2. The continued demand for such efficient equipment reflects their resilience during a volatile market. On top of that, in Q3 and Q4, the company will deploy its FORCE electric frac fleets.

In Q2, PUMP’s effective frac fleet utilization was 15.9. However, despite the systematic transition to modern equipment, it stacked a frac spread in Q2. It maintains a strategy of deploying assets where profitability is higher. Such a disciplined approach can reduce its frac fleet utilization in 2H 2023 and take the average utilization to 14-15 frac spreads in FY2023. Pursuing its strategy to retire pumping capacity, it retired an additional 30,000 hydraulic horsepower of Tier 2 conventional diesel frac equipment in Q2, taking the total retirement to 100,000 HHP in 2023.

Challenges And Asset Retirement

While PUMP maintains its capital-prudent approach, it bifurcates its strategy in the Permian, focusing on differentiation in the service quality, equipment, and customer portfolio. Such an approach insulated it from the rapid changes in the spot market while allowing it to gain from the Permian activity rises. The company has struck long-term lease agreements for its FORCE electric-powered frac fleets. Such agreements improve its operating cost because they require lower capital.

The transformation of the fleet into emissions-friendly assets should improve demand in the market. Over the past year and a half, PUMP has invested ~$1 billion in recapitalizing its fleet and adding new technologies. By 2023, the management believes it will have one of the most valued fleet structures in the industry.

Pricing And Outlook

Over the past year, underpricing or pricing concessions to keep asset utilization high adversely affected the fracturing market. During this period, the fracking industry went through equipment attrition, supply chain constraints, and a resulting equipment discipline. Low pricing caused PUMP to stack or sideline one frac spread. The company decided against running equipment at sub-economic levels.

Over the long run, PUMP’s management is bullish because it believes it is in an early stage of a sustained upcycle. Following the previous downturn, the frac market is more resilient and disciplined. However, in 2H 2023, its performance can deteriorate slightly compared to 1H 2023. It believes the US rig rough may have reached a trough and can increase soon.

Q2 Results And Drivers

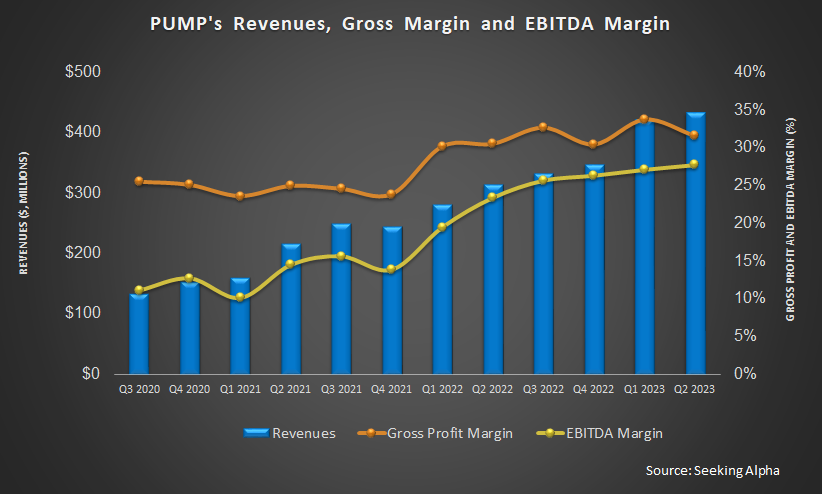

Quarter-over-quarter, PUMP’s revenues increased by 2.8% in Q2, while its adjusted EBITDA decreased by 5%. Adverse weather in Q2 and low pricing caused the company to idle one frac spread, which led to a revenue loss. Unabsorbed costs related to the weather-led delays caused the gross profit decline.

Cash Flows And Debt

PUMP’s cash flow from operations increased steeply in 1H 2023, but FCF stayed negative because of higher capex. In FY2023, the company reaffirmed its capex guidance at $250 million-$300 million, representing capex towards Tier 4 DGB and FORCE electric fleet deployments. In 2H 2023, the company expects to generate positive FCF in 2H 2023 owing to lower capex. As of June 30, 2023, PUMP’s liquidity (cash & equivalents plus available capacity under the revolving credit facility) is $170 million.

Relative Valuation

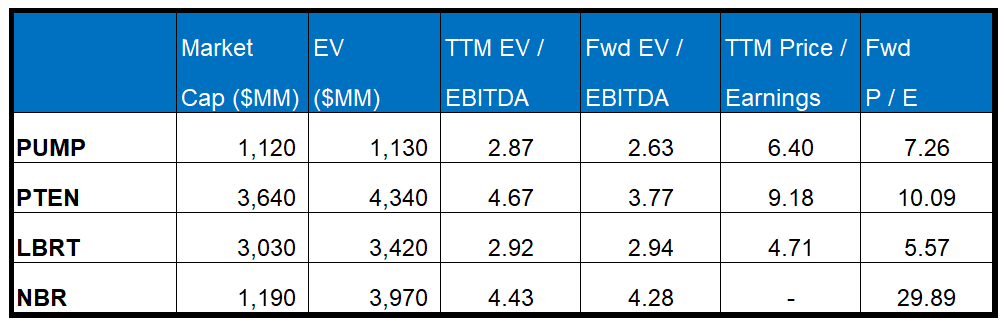

PUMP is currently trading at an EV/EBITDA multiple of 2.9x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 2.6x. The current multiple is below its five-year average EV/EBITDA of 5.0x.

PUMP’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is steeper than peers because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (PTEN, LBRT, and NBR) average. So, the stock is undervalued versus its peers.

Final Commentary

In Q2, PUMP deployed the seventh Tier 4 DGB spread. In Q3 and Q4, the company will deploy its FORCE electric frac fleets. In the middle of 2023, the company pursues a strategy of deploying assets with high profitability. As a result of such a disciplined approach, it can reduce its frac fleet utilization to 14-15 frac spreads in 2023 from ~16 in Q2. Investors note that many frac operators have resorted to pricing concessions to keep asset utilization high, adversely affecting the fracturing market. PUMP has also retired a total of 100,000 HHP in 2023.

In the Permian, the company has adopted a different strategy, focusing on differentiation in the service quality and equipment. This allowed it to readjust for the rapid changes in the spot market. Even though it looks to follow a capital-light asset strategy, it has a strong investment in Tier 4 DGB and FORCE electric fleet deployments lined up. So, its free cash flow stayed negative in 1H 2023. The stock is undervalued versus its peers.