Outlook And Strategy

Our short article discussed our initial thoughts about ProFrac Holding’s (ACDC) Q2 2023 performance a few weeks ago. This article will dive deeper into the industry and its current outlook. ProFrac’s management has a “constructive” view of the energy industry. In 2H 2023, it expects the mining assets to grow sales. It has made strong efforts to diversify the customer base in the Proppant segment. As the customer base expands and proppant production increases, costs are lowered. This is why the company’s vertical integration strategy of bundling fleets with internally produced sand, logistics, and chemicals works in its favor.

It plans to reactivate fleets in Q4 2023 and Q1 2024 as customers strengthen their 2024 capex. As activities improve in 2024, ACDC will prioritize returns over market share gains. Third-party sales have become a pivotal part of sales (70% in Q2). It seeks to increase diversification and improve stability through additional contracts. The non-productive time has bottomed out in May.

In Proppant, it plans to boost the utilization level to optimize profitability. It has a high cash conversion of proppant sales. The company believes it has the potential to increase EBITDA by 2x-3x compared to Q2. To save costs, the company slowed its capex, reduced spend on e-fleet, and lowered engine upgrades. It aims to capture longer-term dedicated work, reducing volatility in the business.

Pricing Strategy

Given the industry activity, ACDC’s management remains optimistic about its pricing strategy. Lower asset utilization was a concern in Q2. Many players have idled capacity, which helped pricing steady. Many small operators are bidding to spot work. The management believes 2H 2023 will be” stronger.” In the past six months, the number of fleets idled increased considerably. Nonetheless, operators’ activity should ramp up before 2024.

Q2 Growth Drivers

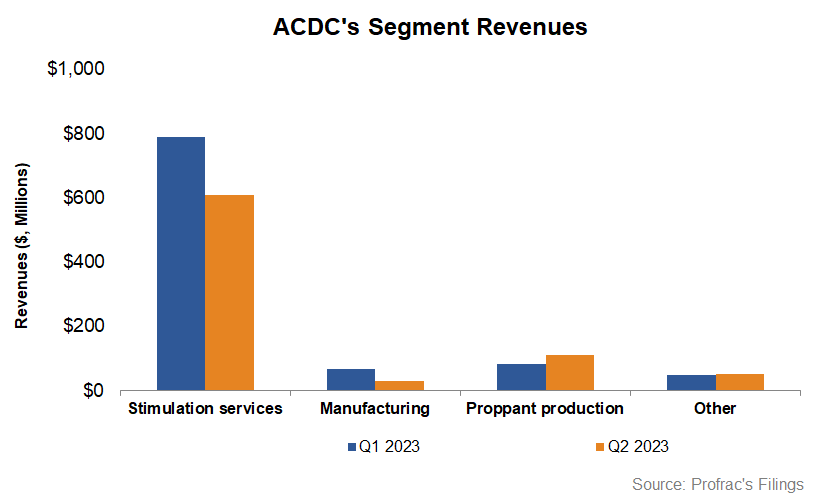

Quarter-over-quarter, ACDC’s Stimulation services and Manufacturing segment revenues decreased by 23% and 34%, respectively. Adjusted EBITDA also decreased considerably in these segments in Q2. On the other hand, its revenues from Proppant production increased by 34%. The company is one of the largest in-basin proppant producers in the US, following the acquisition of Performance Proppants in February. With the acquisition, it will have four mines totaling 10.4 million tons per year serving the core of Haynesville. Although it focuses on diversifying the customer base and signing contracts, the management believes the segment remains underappreciated and can potentially unlock further value in the future.

Cash Flows And Debt

ACDC’s cash flow from operations significantly increased in 1H 2023 (by 3.8x) compared to a year ago. Although capex increased, its FCF also turned positive. The cash flow improvement reflects higher revenues and better working capital management, especially the receivables and payables management. It will consume the inventory it built over the past year, which will help it reduce working capital further.

Since the beginning of 2023, the company’s long-term debt has increased considerably (38% up). The company funded the acquisition of Performance Proppants through higher borrowing. ACDC’s leverage (debt-to-equity) was 0.9x as of June 30, 2023. It had $163.5 million of liquidity as of that date.

Relative Valuation

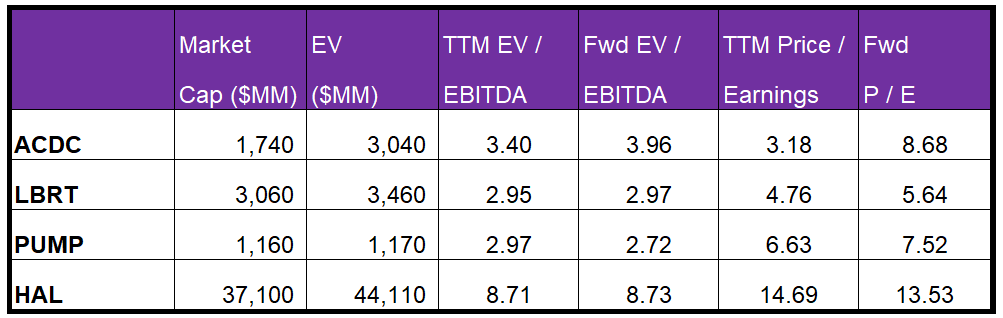

ACDC is currently trading at an EV/EBITDA multiple of 3.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is ~4.0x.

ACDC’s forward EV/EBITDA multiple expansion versus the current EV/EBITDA is steeper than its peers because its EBITDA is expected to decrease more steeply than its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (LBRT, PUMP, and HAL) average. So, the stock is reasonably valued versus its peers.

Final Commentary

Lower fleet count affected ACDC’s topline and operating income adversely in Q2. Its total costs and debt levels also increased following the Performance Proppants acquisition. Lower fracking asset utilization was a concern in Q2. However, the company appears to be shaping better for the rest of the year and aims to have a head start in 2024. It focuses on controlling costs. Its current strategy involves bundling fleets with internally produced sand, logistics, and chemicals.

The company has high hopes for the Proppant segment. Here, it plans to boost the utilization level to optimize profitability. It has a diversified customer base following the acquisition and signed many contracts. Its free cash flows have turned positive in 1H 2023, with further improvements in cash flows expected in 2H 2023. However, the company’s higher leverage is a concern. The stock is reasonably valued versus its peers.