Recently there has been some very interesting updates in terms of oil markets and global economy. The OPEC World Oil Outlook 2045 came out and it sits totally opposite in terms of its projection of peak oil demand to that of the IEA. IMF also released an update on its World Economic Outlook and sees more headwinds for the global economy moving forward. This update talks about the above reports in detail.

In a recent development that has sent ripples through the energy industry, the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) have found themselves on opposing sides of a debate concerning the future of oil demand.

OPEC’s Bullish Outlook

OPEC, in its 2023 World Oil Outlook, has projected a significant increase in global oil demand. The organization anticipates that by 2045, the world will require 116 million barrels per day (bpd), a substantial rise from the 99.6 million bpd recorded in 2022. This forecast is roughly 6 million bpd higher than their prediction from the previous year.

The driving forces behind this expected surge, according to OPEC, are the emerging economies of India, China, other Asian nations, Africa, and the Middle East. To meet this anticipated demand, the oil sector would need to invest a staggering $14 trillion, averaging around $610 billion annually. OPEC emphasizes the importance of these investments, stating they are crucial for both producers and consumers.

In the medium term, OPEC’s projections indicate a global oil demand of 110.2 million bpd by 2028, marking a 10.6 million bpd increase from 2022 levels.

OPEC Secretary General Haitham al-Ghais, in the report’s foreword, cautioned against halting investments in new oil projects. He warned that such a move could lead to “energy and economic chaos,” emphasizing the intricate complexities of the energy sector.

IEA’s Contrasting Stance

On the other hand, the IEA paints a different picture. Last month, the agency declared that we are witnessing the “beginning of the end” for fossil fuels. IEA Executive Director Fatih Birol, in an op-ed for the Financial Times, stated that the demand for coal, oil, and gas would peak before 2030, with a subsequent decline as climate policies come into effect.

The IEA’s stance is rooted in its World Energy Outlook, an influential report set to be released in October. Birol highlighted this forecast as a “historic turning point.” However, he also noted that the projected declines are insufficient to limit global warming to the critical threshold of 1.5 degrees Celsius above pre-industrial levels.

OPEC has been vocal in its criticism of the IEA’s predictions, labeling them as “extremely risky,” “impractical,” and “ideologically driven.” The organization has also urged the IEA to tread carefully when it comes to discouraging industry investments.

IMF’s WEO Update

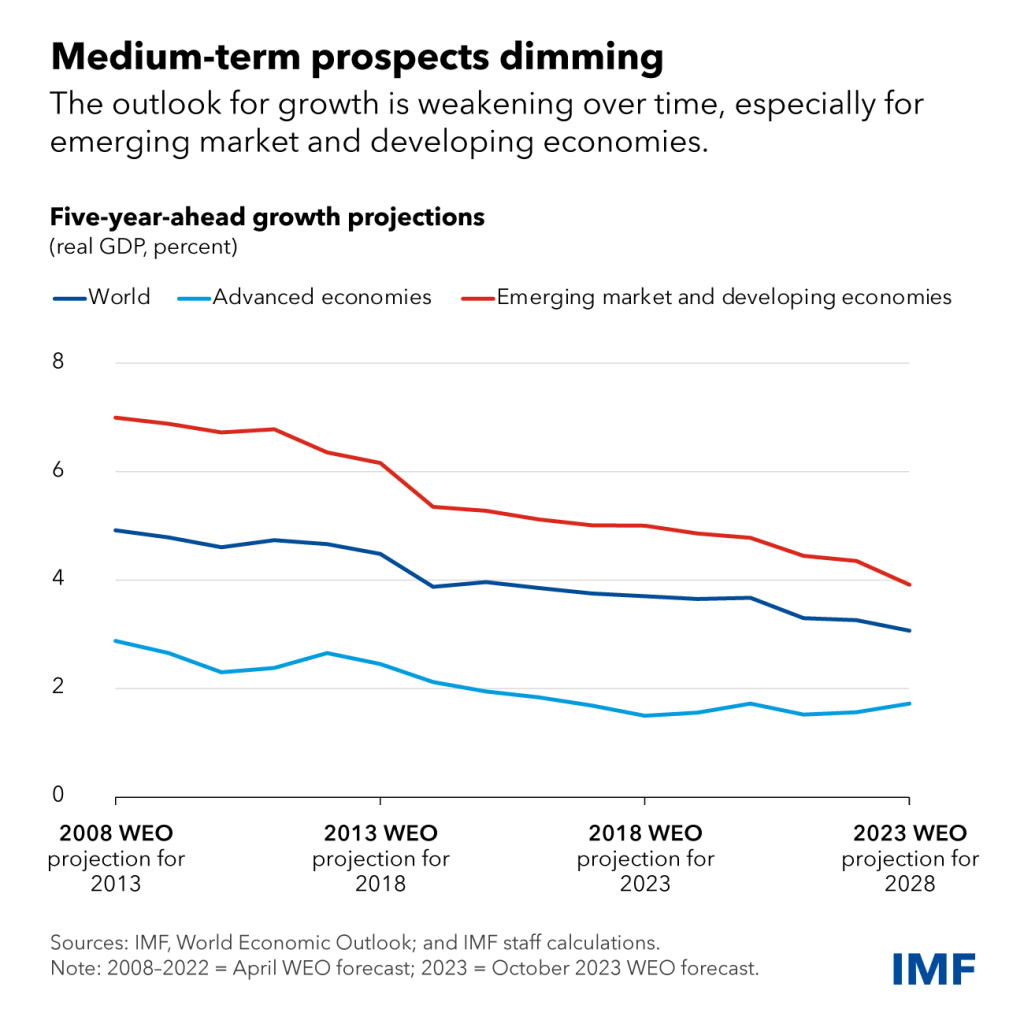

According to recent data, the global economic growth rate is anticipated to decelerate from 3.5% in 2022 to 3% in 2023, with a further dip to 2.9% in 2024. This projection for 2024 marks a 0.1 percentage point downgrade from July’s forecast, positioning the growth rate below historical averages.

Inflation, a key concern for policymakers worldwide, is on a declining trajectory. Headline inflation is projected to drop from 9.2% in 2022 to 5.9% in 2023, settling at 4.8% in 2024. Concurrently, core inflation, which excludes volatile components like food and energy, is expected to decline at a more gradual pace, reaching 4.5% by next year. The majority of countries are optimistic about returning to their inflation targets by 2025.

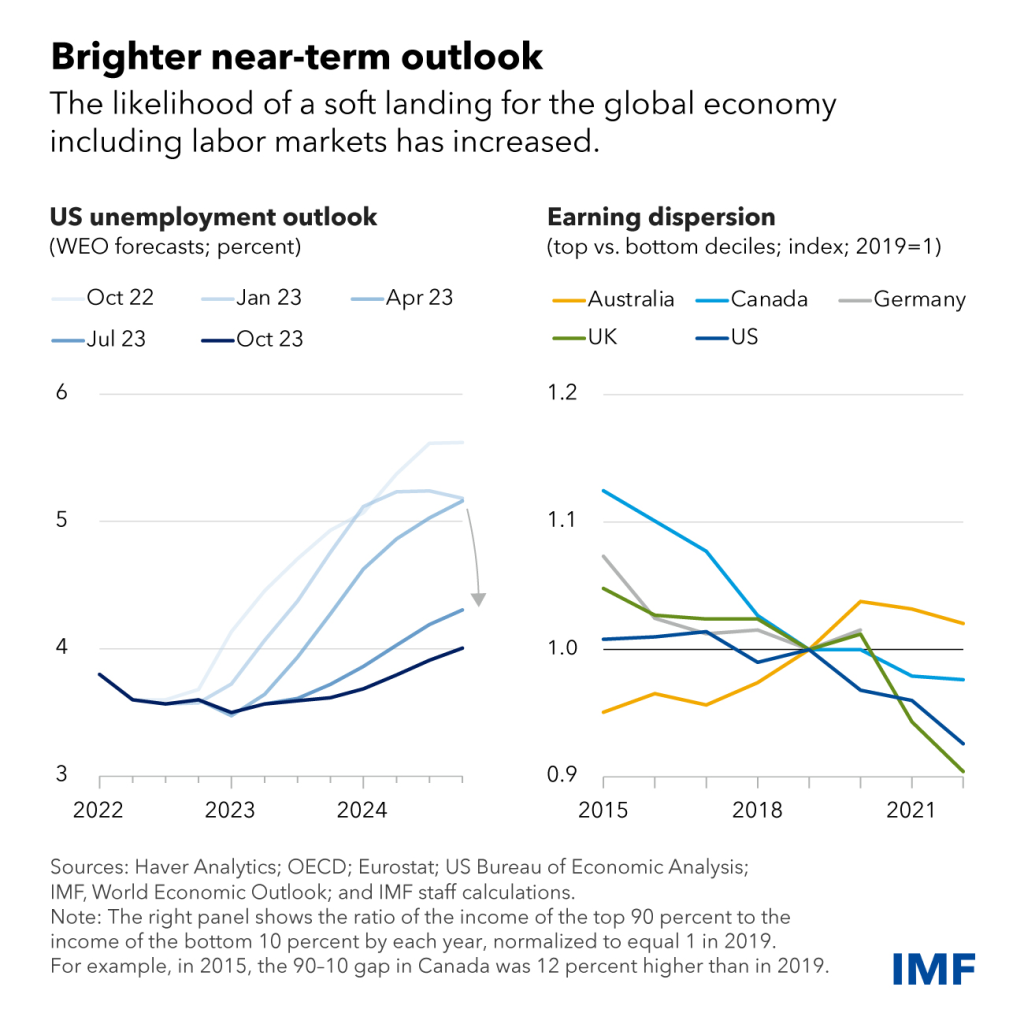

The U.S., in particular, is eyeing a soft landing, with unemployment forecasts suggesting a modest rise from 3.6% to 3.9% by 2025. However, not all regions share this optimism. Advanced economies are witnessing a sharper slowdown compared to their emerging market counterparts. While the U.S. remains buoyant with positive growth revisions, the Euro area faces downward adjustments. Emerging markets, on the whole, display resilience, with China being a notable exception due to its ongoing real estate crisis.

In conclusion, while the global economy continues its recovery march, the pace is akin to a limp rather than a sprint. Divergences are becoming more pronounced, and as the world navigates these economic intricacies, the need for strategic policy interventions becomes paramount.