The Economist Intelligence Unit (EIU) recently released their economic outlook for 2024 and it provides us a bigger picture analysis of the uncharted waters we will be stepping into.

Geopolitical Tensions and Economic Impact

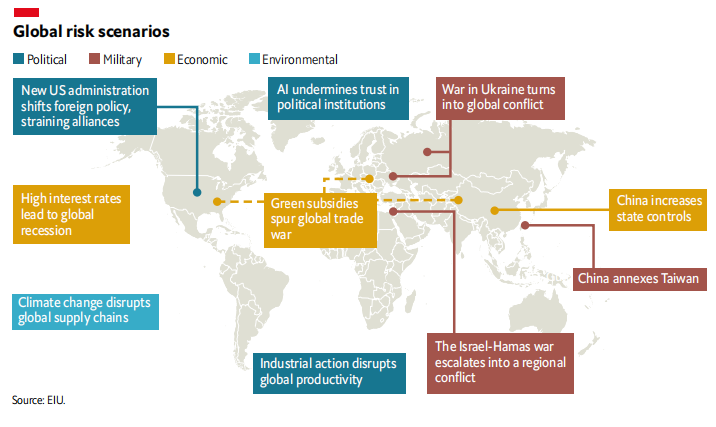

The current global economic landscape is significantly influenced by geopolitical events. The Israel-Hamas conflict, heightened US-China tensions, and the ongoing Ukraine crisis are reshaping economic alliances and supply chains. While the Middle East conflict is not expected to escalate, its effects on oil markets and global economies are profound.

Decelerating Global Growth

The world economy is projected to slow down, with growth rates dipping to 2.2% in 2024 from an estimated 2.3% in 2023. This slowdown is attributed to a decrease in US economic activity, somewhat balanced by stronger growth in Europe. China’s moderate stimulus measures are expected to support its economy. From 2025 to 2028, a rebound to an average growth rate of 2.7% per annum is anticipated, driven by technological advancements and investments in clean energy.

Inflation Trends and Supply Chain Dynamics

Developed economies are likely to experience a decrease in inflation, with rates falling to 2.4% in 2024 from an estimated 4.5% in 2023. This trend suggests that a wage-price spiral is unlikely. However, inflation risks remain, particularly if geopolitical tensions, such as an escalation in the Middle East, lead to increased hydrocarbon prices.

Emerging Markets Driving Global Growth

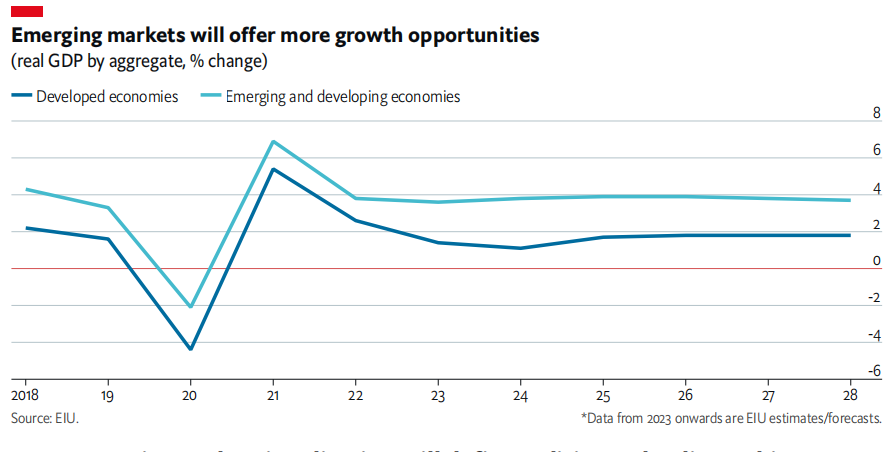

Emerging economies, despite China’s slowdown to under 4% growth by 2028, are poised to contribute significantly to global GDP growth, accounting for about 60% over the next five years. South and Southeast Asia are expected to play pivotal roles in this growth, with opportunities emerging in sectors linked to supply-chain reorganization and green technologies.

Public Debt and Bond Market Volatility

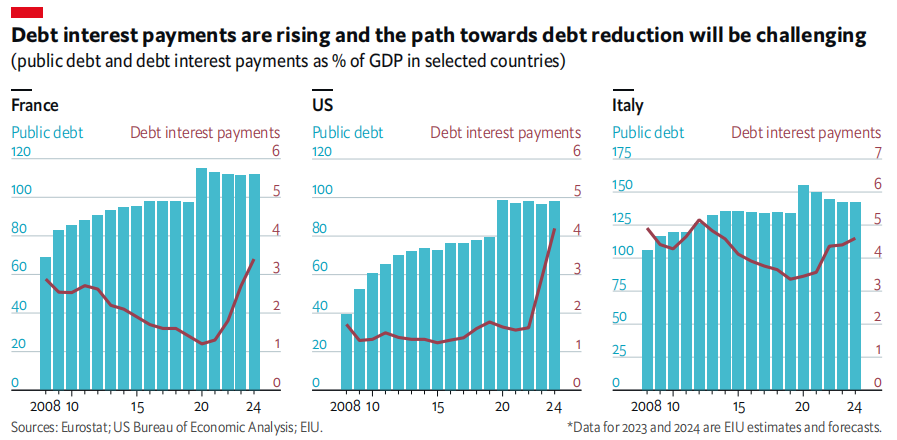

The global economic slowdown, coupled with tighter financial conditions, is raising concerns about public debt sustainability. Developed countries, with their substantial fiscal stimulus and high debt levels, face high borrowing costs and rising debt-to-GDP ratios. Developing countries, including Argentina, Ecuador, Maldives, Pakistan, and Sri Lanka, are at risk of sovereign defaults.

The Risk of a “Hard Landing”

The global economy faces a moderate risk of a “hard landing” due to the impact of recent rate increases. The transmission of these rate hikes could lead to a sharper contraction in credit demand from households and businesses, particularly in regions like the euro zone and the UK, where high inflation and stagnant growth intersect with a tight labor market.

The global economic outlook is shaped by a myriad of factors including geopolitical tensions, inflationary pressures, and varying growth trajectories across regions. The management of public debt, inflation, and the potential for a “hard landing” due to monetary policy adjustments are crucial challenges that will define the economic landscape in the coming years.