Industry And LNG Market Outlook

We have already discussed Halliburton’s (HAL) Q1 2023 financial performance in our recent article. Here is an outline of its strategies and outlook. After Q3, Baker Hughes’s (BKR) management was “confident in our 2023 outlook” due primarily to higher international drilling and completion capex and moderate capex growth in North America. However, it identified that geopolitical risks would remain a factor to keep a vigil. Following the strikes in Australia by LNG workers, the current environment has pushed up LNG prices. Globally, LNG demand is approaching 410 MTPA in 2023, or 2% up from the previous year. Effective utilization is expected to be over 90%. According to the company’s estimates, LNG demand can increase by 3% in 2024. In 2025 and 2026, supply and demand growth will be balanced, which should keep global LNG markets at relatively strong utilization levels.

LNG Order Bookings

Here is an outline of BKR’s order booking in the LNG market. In Q3, it received an order to provide additional liquefaction equipment and a power island for the LNG modules for both of VentureGlobal. Recently, it received an order from ADNOC Gas for two electric liquefaction systems in the United Arab Emirates. In 2023, it expects to book LNG orders totaling approximately 80 MTPA due to a strong project pipeline in the US and internationally. Similar growth in FIDs (final investment decisions) can add between 30 and 60 MTPA of LNG FIDs for BKR in both 2025 and 2026.

Offshore Order Bookings

In offshore, BKR received 21 subsea tree awards. This includes an equipment order from a sub-Saharan African operator consisting of 11 deep-water horizontal trees, up-tire manifolds, and subsea controls. In the North Sea, it booked two contracts from VAR’s Energy. One was a long-term contract for well-intervention and exploration logging services; the other was an order to deliver seven vertical tree systems.

Short And Long Term Strategies And Goals

BKR has short-term, medium-term, and long-term strategies. It looks to benefit from the macro tailwinds in the short time horizon (spanning through 2025). It has also undergone organizational simplification and expanded efficiencies through operational discipline and productivity optimization. The plans are primarily related to LNG demand growth due to higher upstream spending in the international and offshore markets. It plans to book almost $9 billion of LNG equipment orders across 2022 and 2023.

The global LNG installed base is estimated to grow by 70% by 2030. Because BKR has its equipment installed in many LNG projects, it has significant earnings and returns visibility through 2030. However, the short term is also mired with supply constraints and macroeconomic & political uncertainty.

Beyond 2030, BKR will broaden its revenue base by opening many new industrial and energy frontiers, including CCUS (carbon capture, usage, and storage), hydrogen, clean power, and geothermal. Its decarbonization solutions and emissions management will likely expand the industrial sector business. So, the management expects its new energy orders from its $600-$700 million target in 2023 to reach $6 billion-$7 billion in 2030.

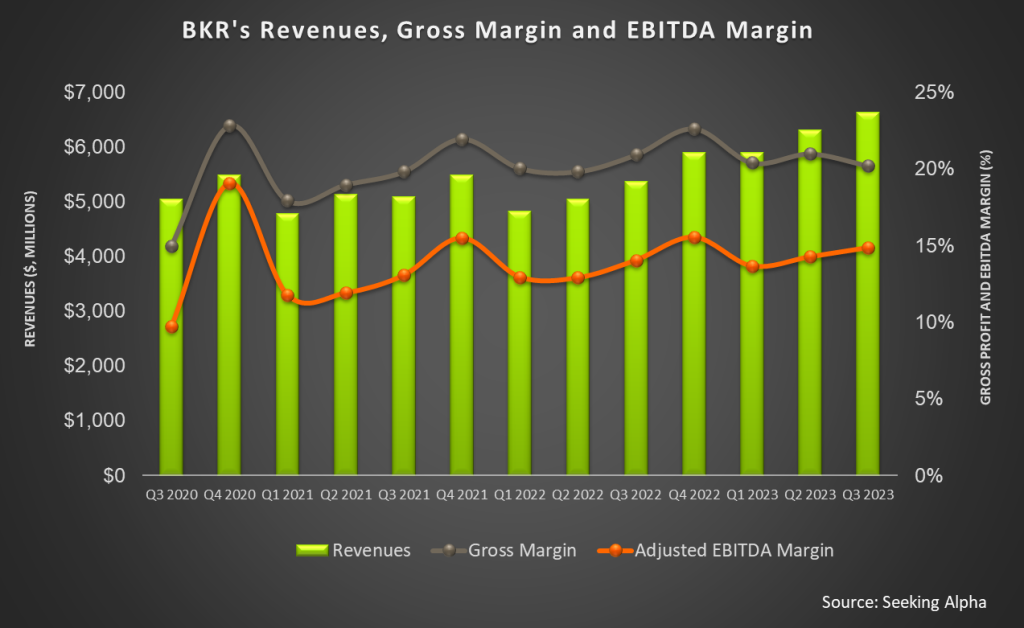

Given the drivers above, BKR expects EBITDA margins in the OFSE (Oilfield Services & Equipment) segment to reach 20% by 2025 and in the IET (Industrial & Energy Technology) segment by 2026. In the second phase, extending to 2027, the company expects growth to emanate from the new energy and industrial sectors as it leverages the Gas Tech services. However, this phase can decelerate upstream capex and natural gas growth. EBITDA margin, however, can exceed the targeted 20% in both operating segments.

Baker Hughes’s Q4 2023 Outlook

In the IET segment, the management expects growth due to an impressive performance in Gas Tech and industrial tech. It expects to generate $2.95 billion (at the guidance mid-point) in revenues in Q4, while EBITDA can be $705 million. This means its revenues and EBITDA can increase by 9.6% and 5%, respectively, in Q4. The pace of backlog conversion and supply chain issues can affect the operating income. In Q4, the company’s OFSE segment revenues will likely remain unchanged. However, EBITDA can inflate by 14% in this segment due to higher international projects, year-end product sales, SSPS backlog conversion, and cost-cut initiatives.

BKR expects aggregate Q4 revenue to be between $6.7 billion and $7.1 billion and EBITDA between $1.05 billion and $1.11 billion. So, it has effectively increased and narrowed its guidance ranges from the previous estimate. Read more about its Q3 results in our Baker Hughes In Q3: TAKE THREE article.

Cash Flows & Balance Sheet

BKR’s cash flow from operations more than doubled in 9M 2023 compared to a year ago, due primarily to higher revenues and substantial progress in the collection of equipment contracts. Its FCF also increased tremendously compared to a year ago.

Debt-to-equity (0.43x) remained nearly unchanged in Q3 from a quarter ago. It has recently increased its dividend marginally to $0.20. During Q3, the company repurchased $119 million of stock. Higher dividend payments and share repurchases reflect the management’s commitment to returning 60%-80% of free cash flow to investors.

Relative Valuation

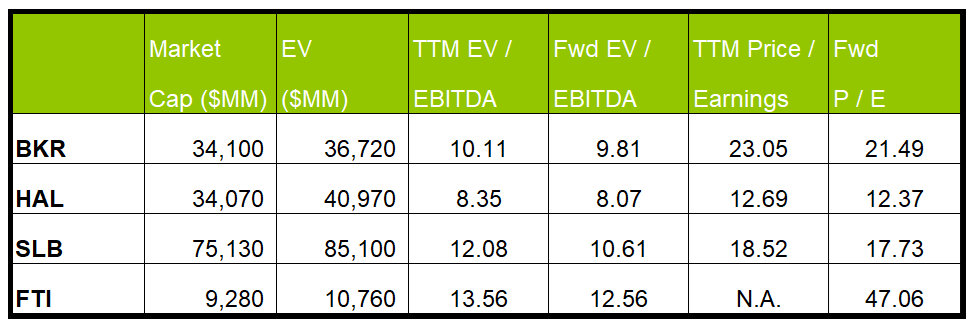

Baker Hughes is currently trading at an EV/EBITDA multiple of 10.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 9.8x. The current multiple is slightly lower than its past five-year average EV/EBITDA multiple of 10.7x.

BKR’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is marginally lower than its peers’ (HAL, SLB, and FTI) average. So, the stock is reasonably valued versus its peers.

Final Commentary

Despite geopolitical risks, BKR’s management has expressed “confidence” in its 2023 outlook for the energy sector due primarily to its strength in international and offshore markets. LNG prices also recovered in Q3 as the balanced growth in demand and supply in the global LNG markets kept utilization levels steady. The global LNG installed base is estimated to grow by 70% by 2030. The company expects LNG project FIDs to increase significantly by 2026, propelling BKR’s Gas Tech Equipment business. The company’s offshore equipment orders in Q3 also encourage a bullish outlook for the near-to-medium term.

Over the long term, it will aim to broaden its revenue base by opening many new industrial and energy frontiers, including CCUS and other clean energy initiatives. Over the next few years, it aims to exceed 20% EBITDA levels for each business segment when new energy and the Gas Tech business become its forerunner growth drivers. The company improved its cash flows dramatically in 9M 2023. This helped it increase shareholder returns through higher dividends and share repurchases. The stock appears to be reasonably valued versus its peers.