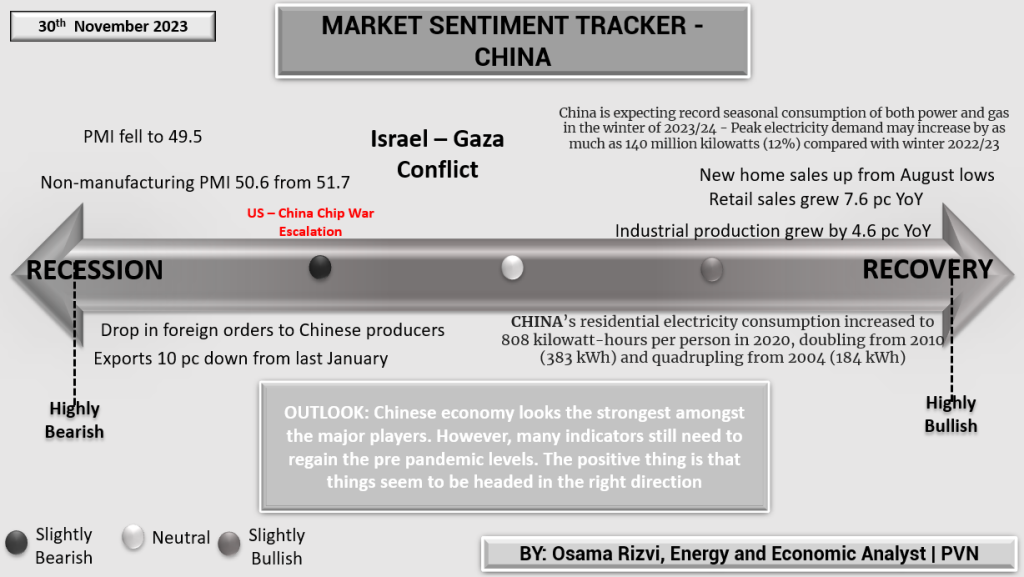

China’s economic pulse as captured in the Market Sentiment Tracker for the end of November 2023, reflects a complex interplay between domestic headwinds and growth:

- The manufacturing sector is under pressure, with the PMI just below the growth threshold at 49.5, and a notable decline in foreign orders and exports indicating global trade challenges, possibly amplified by US-China tensions in the tech sector.

- Yet, the economy exhibits resilience, with a bounce-back in new home sales and solid year-on-year growth in retail sales and industrial production.

- Residential electricity consumption data point to a significant rise over the past decade, hinting at increased domestic demand and urbanization.

- The outlook is cautiously optimistic, acknowledging China’s relative strength in the global arena, though a full return to pre-pandemic vibrancy remains a work in progress

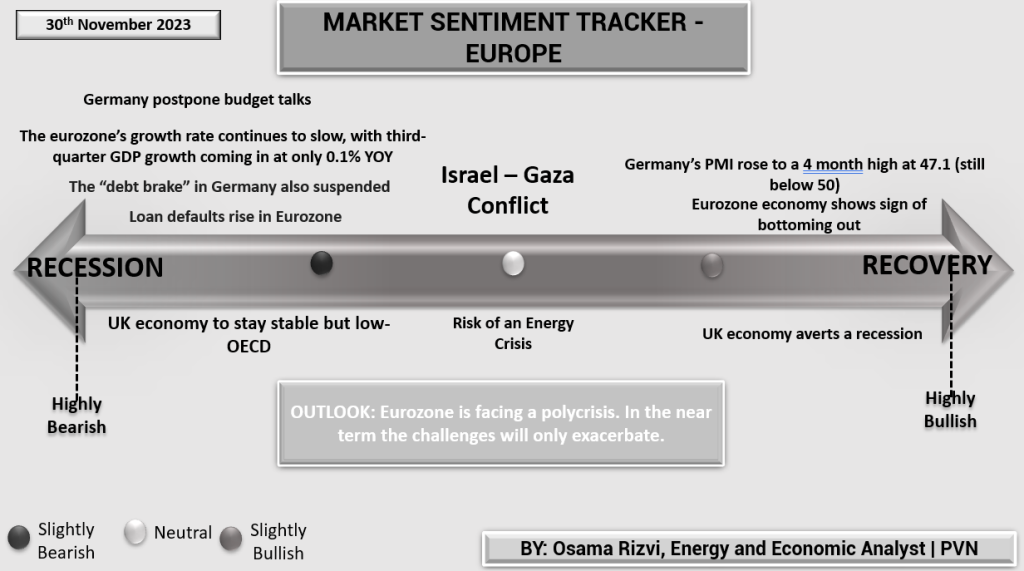

The Market Sentiment Tracker for Europe as of November 30th, 2023, sketches a picture of an economy grappling with numerous challenges yet showing faint signs of stabilization.

Recessionary Pressures:

- The postponement of budget talks in Germany, Europe’s largest economy, signals potential fiscal policy uncertainty.

- The Eurozone’s anemic GDP growth of only 0.1% year-over-year (YOY) in the third quarter indicates a significant slowdown in economic momentum.

- Suspension of Germany’s “debt brake” suggests fiscal measures are being loosened to potentially counteract economic stagnation, though it raises long-term sustainability concerns.

- Rising loan defaults in the Eurozone point to increasing financial stress among borrowers, a worrying sign for banks and the broader economy.

Stabilizing Factors:

- Despite the pervasive gloom, Germany’s PMI has risen to a four-month high of 47.1, suggesting a slight improvement in manufacturing, although it remains below the expansionary threshold of 50.

- The UK economy’s stability, albeit at a low level according to the OECD, provides some relief against the backdrop of European economic troubles.

- Signs that the Eurozone economy might be bottoming out hint at a possible end to the current downturn, albeit without clear indications of a swift rebound.

Outlook: The sentiment tracker concludes with a sobering outlook, suggesting that the Eurozone is facing a ‘polycrisis’ with expectations of exacerbating challenges in the near term. This implies that while there may be pockets of resilience, systemic risks — particularly from an energy crisis and fiscal instability — loom large, and could potentially derail the fragile signs of recovery. As an economic expert, this analysis would prompt a cautious approach to investment and policy formulation, advocating for measures that shore up economic resilience while preparing for a potentially turbulent period ahead.

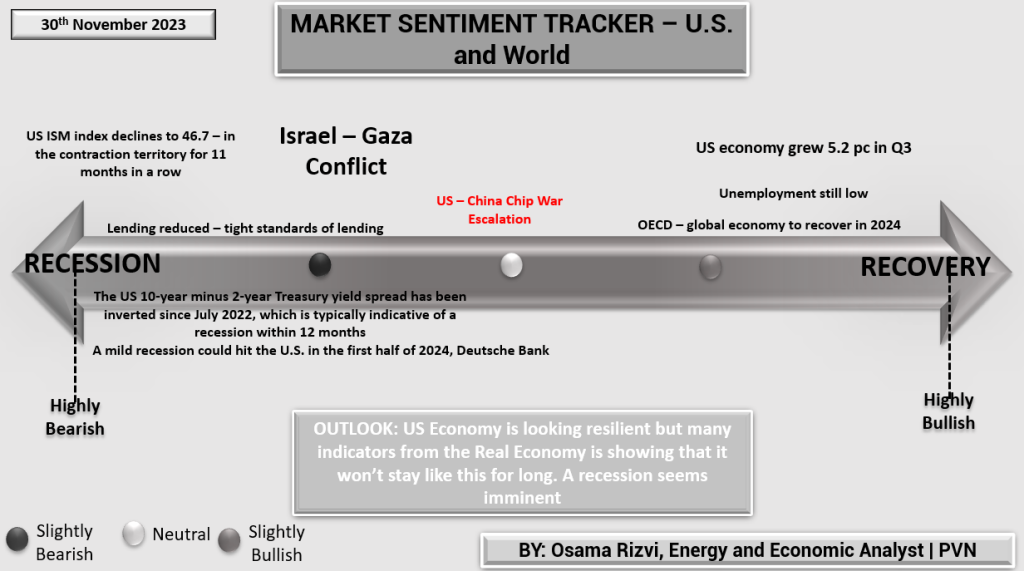

The Market Sentiment Tracker for the U.S. and World as of November 30th, 2023, offers a mixed perspective on the American economy, highlighting both robust growth and signals of potential downturn:

Recession Indicators:

- The U.S. ISM Index is below the neutral 50 mark for the 11th consecutive month, indicating persistent contraction in the manufacturing sector.

- Tightened lending standards may reflect growing caution among financial institutions, potentially leading to a credit crunch.

- The yield curve inversion, with the 10-year minus 2-year Treasury yield spread negative since July 2022, is traditionally a precursor to a recession, suggesting a possible downturn within the next year.

- Deutsche Bank forecasts a mild recession hitting the U.S. in the first half of 2024.

Growth Indicators:

- Despite these cautionary signals, the U.S. economy grew a solid 5.2% in Q3, and unemployment rates remain low, showcasing current economic resilience.

- The OECD predicts a global economic recovery by 2024, which could bolster U.S. economic prospects.

Outlook: The sentiment tracker underscores a resilient U.S. economy amidst challenging indicators. While growth is evident, the risk of an upcoming recession cannot be overlooked. Economic actors might consider preparing for a potential downturn while capitalizing on current strengths, as the tracker suggests a critical period ahead where the U.S. may face both domestic and global economic headwinds.