Industry Outlook

We discussed our initial thoughts about Nine Energy Service’s (NINE) Q2 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

The US drilling activity softened in the US in 2023, affecting oilfield services companies. The US rig count was down by 19% from January until the third week of November, resulting in pricing pressure for the oilfield services companies. Completion wells, on the other hand, stayed strong, recovering by 3% during this period. Much of the completions recovery took place in Appalachia and Niobrara.

NINE’s Strategy And Outlook

NINE faced challenges in August, but its management believes the sentiment shifted. Given the commodity price stability, The US rig count would bounce back in early 2024 as private operators resume activity. As the US onshore activity resumes, the spot market for drilling and completion will also improve. However, in Q4, it expects pricing and drilling activity to remain flat.

So, the company’s revenues can remain nearly unchanged in Q4 compared to Q3. Its adjusted EBITDA can improve slightly as the company continues to provide an asset-light business with advanced technology. It will increasingly focus on selling completion tools in the international markets. Read more about the company in our previous article here.

New Products

In the completion market, there is increasing demand for longer laterals because longer laterals help reduce costs and drive efficiencies. At the same time, this requires complex and risky technologies, especially with the drill out of plugs. Given the increased complexity, Nine’s dissolvable plugs are seeing demand rising. During Q3, the company announced its new Pincer hybrid frac plug. It comprises 47% less material than the Scorpion fully composite frac plug that was previously used.

The pincer plug offers lower drill-out times and significantly reduces bit wear. So, more plugs can be drilled on a single trip. The company utilized both composite and dissolvable materials to create this plug. The company will likely gain market share and move to a higher margin profile from switching to Pincer from Scorpion.

Q3 Drivers

Because rig count and new wells drilled drive the cementing business, the tig count fall adversely affected NINE’s cementing business in Q3. In the Permian, Eagle Ford, and Haynesville, rig counts have declined by nearly 100 since 2022, impacting the company’s topline and operating margin. In Q4, its cementing revenue may improve marginally.

Also, a significant reduction in international completion tools sales and lower US completion activity reduced NINE’s sales. The US completion well counts were down by ~10% in Q3 versus Q2. The wireline business also remained challenging. The company plans to grow its market share in the Permian Basin in the Northeast. Activity increases and sustained gas prices can cause its financial results to bounce back in Q4.

Cash Flows And Liquidity

NINE’s cash flow from operations increased massively, which led to its free cash flow turning significantly positive in 9M 2023. An increase in cash collections accounted for the rise in cash flow in 9M 2023. Due to negative shareholders’ equity and a reasonably high net debt ($307 million), the stock is financially risky. Its liquidity (cash and cash equivalents plus availability under the revolving credit facility) was $35 million as of September 30, 2023.

Relative Valuation

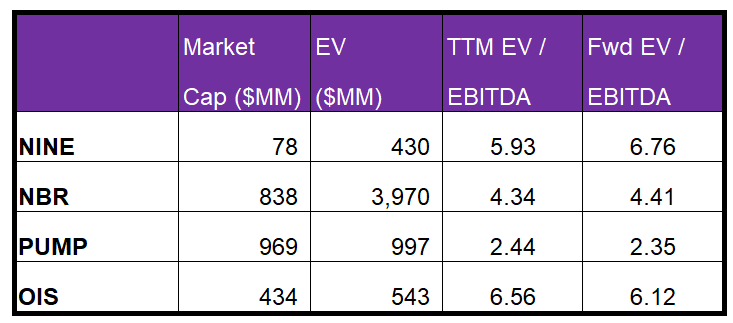

NINE is currently trading at an EV/EBITDA multiple of 5.9x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 6.7x.

NINE’s forward EV/EBITDA multiple compared to the current EV/EBITDA is expected to expand more steeply than its peers. This implies that its EBITDA is expected to decrease more sharply than its peers next year. This typically results in a much lower EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is higher than its peers’ (NBR, PUMP, and OIS) average. So, the stock is overvalued versus its peers.

Final Commentary

The drilling and completion activity appears to be bouncing back at the latter stage of 2023. The spot market for drilling and completion should also improve in 2024. However, the drilling and completion market is still not out of the woods. Therefore, drillers continue to go for longer laterals as they help reduce costs and drive efficiencies. In this environment, Nine’s dissolvable plugs are seeing demand rising. It has recently started replacing the Scorpion fully composite frac with Pincer hybrids. It will likely gain market share and move to a higher margin profile from the switch.

On the flip side, the rig count recovery sees a delay. Plus, the wireline business will remain challenging. Still, NINE’s cash flows improved significantly in 9M 2023. However, the stock is financially risky due to negative shareholders’ equity. The stock is relatively overvalued versus its peers.