In an era where operational efficiency is paramount, the U.S. oil industry has not only adapted but thrived, with a record high in denser crude oil production leading the charge. The Energy Information Administration (EIA) reports a notable increase in production in Texas, with substantial contributions from New Mexico and North Dakota. This surge is attributed to a constellation of factors including favorable sale prices, advancements in drilling technology, and enhanced pipeline access to refineries and consumer markets. Moreover, the recent rise in oil prices with windfall profits in 2022 had consolidated the industry’s fiscal matters.

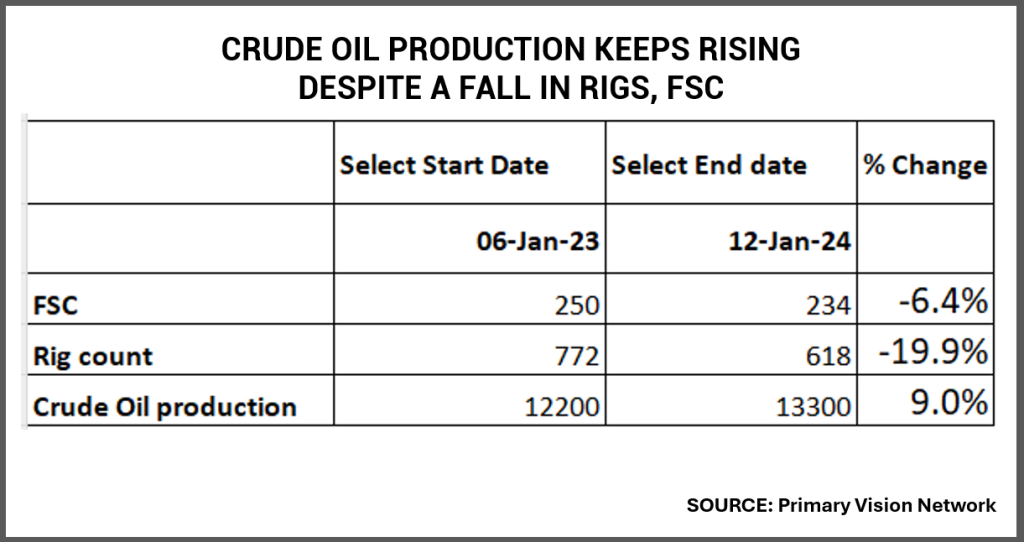

This context provides a richer tapestry against which the industry’s recent achievements can be appreciated. With frac spread counts (FSC) decreasing by 6.4% over the past year and rig counts down by 19.9%, a superficial analysis might predict a downturn. Instead, crude oil production has surged by 9.0%, revealing an industry that has mastered the art of doing more with less. This paradigm shift from drilling to completing wells suggests a maturing industry that is leveraging technology to extract more value from existing assets.

Moreover, the resilience of oil production amidst severe weather challenges, with millions of Americans facing wind chill warnings, is a testament to the industry’s robustness. Yet, the industry stands at a crossroads with the anticipated seasonal FSC rise. If this increase fails to materialize, it could signal a need to reassess the sustainability of current production methods.

In conclusion, the U.S. oil industry’s narrative is not one of decline but of strategic evolution. It’s a story of an industry that is not only weathering the storm but also using it to sail to new production heights. The coming weeks are crucial, as they will either confirm the industry’s ability to sustain its innovative momentum or highlight areas where it must pivot once again to maintain its growth trajectory.