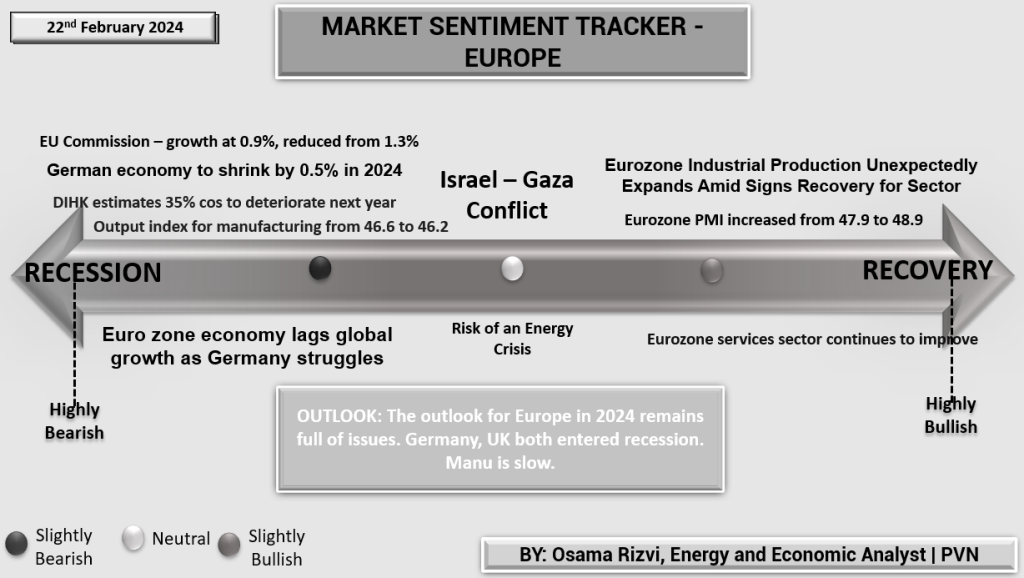

Market Sentiment Tracker – Europe (22nd February 2024)

Europe’s economic outlook appears somber, with the EU Commission revising growth forecasts downward to 0.9% amidst a potential 0.5% contraction in the German economy. The DIHK forecasts a tough year ahead, with 35% of companies expected to face worsening conditions. However, not all indicators are negative; Eurozone industrial production is showing unexpected signs of life, and the PMI inched up, which could hint at a nascent sector recovery. But the manufacturing output index’s slight dip and persistent energy risks underscore the fragility of this recovery.

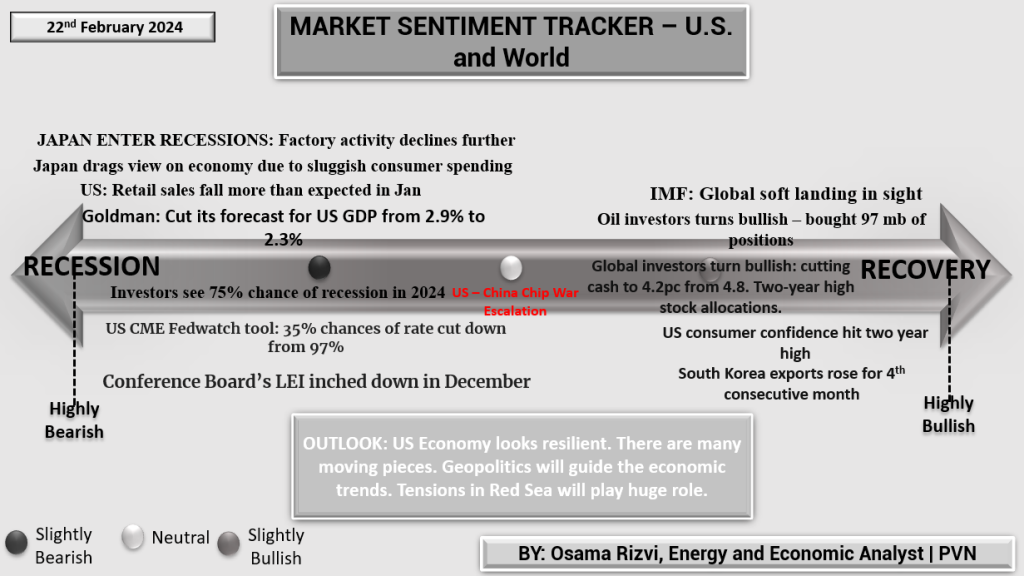

Market Sentiment Tracker – U.S. and World (22nd February 2024)

In the U.S., the market sentiment is mixed with caution and optimism. Retail sales dipped unexpectedly, causing a downward GDP revision from Goldman Sachs, reflecting consumer hesitancy. Yet, the global investor outlook is bullish, with cash allocations decreasing in favor of stocks. The CME Fedwatch tool indicates lower chances of a rate cut, suggesting confidence in monetary policy. Despite a minor decline in the Conference Board’s LEI, consumer confidence is strong, and there’s a general expectation of resilience in the U.S. economy against the backdrop of global geopolitical concerns.

These snapshots underscore the current state of global economic sentiment: a mix of cautious optimism and vigilance against potential downturns.