This weekly update discusses the potential risks encountered by the global economy. According to the latest Chief Economists Outlook, 97% of respondents believe geopolitics will contribute to global economic volatility in 2024, with 83% pointing to domestic politics as a source of volatility. In the U.S., cost inflation hit a 13-month high, with output prices rising in May. In China, the PMI fell to a three-year low of 49.5, indicating contraction. But we already have Canada cutting interest rates. Does this mean that the worst is behind us?

1. Monday Macro View: Potential Risks Remain – PREMIUM

The World Economic Forum (WEF) has highlighted that the global economy is expected to improve or remain stable this year, despite potential risks from geopolitical and domestic tensions. In the oil market, calm has returned following the massive disruptions caused by the coronavirus pandemic and geopolitical tensions. Production and consumption are growing at similar rates, inventories are near normal, and prices are close to average once adjusted for inflation. As of May 21, hedge funds held positions equivalent to 380 million barrels, down from 685 million barrels six weeks earlier. Read the article for further details!

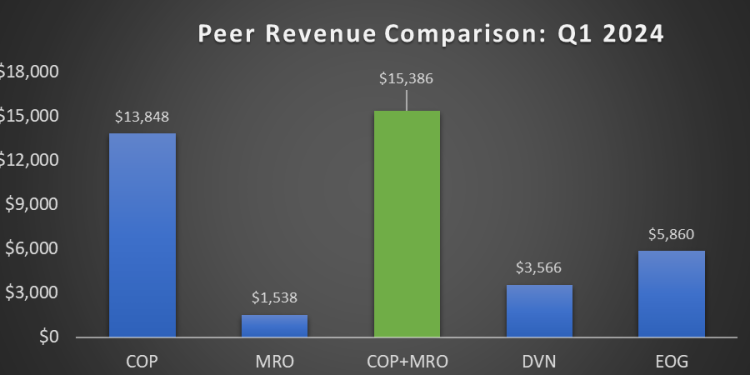

2. COP and MRO: A Well thought-out deal – PREMIUM

In May 29, ConocoPhillips (COP), one of the largest US energy producers, and Marathon Oil (MRO) announced a merger deal agreement. COP will acquire MRO for $22.5 billion of enterprise value. Both COP and MRO, being diversified energy producers, have plenty of common ground to share and optimize operations. MRO’s focus on select US basins will sharpen COP’s offerings, while COP’s international diversification can make MRO’s offerings global. What does this mean for the wider oil industry?

3. Primary Vision Insights – ENTERPRISE

The crude markets weakened further driven by the overhang of excess supply in the physical market. The overhang in the light, sweet market will result in more U.S. crude getting stuck on the coast. Crude continued to build driven by PADD 3. The biggest issue will remain on the economic side with consumers staying weak and/or weakening further around the world. Read more about global oil markets and economy in this must read by Mark Rossano!

4. Market Sentiment Tracker: Mixed signals in the US, China and EU grow – PREMIUM

Consumer sentiment plummeted in May, dropping from April’s already low levels, indicating significant consumer concerns. In China, the PMI fell to a three-year low of 49.5, indicating contraction. New export order subindex fell to 47.2 in May from 50.6 in April, highlighting weak external demand. In Europe, German inflation rose to 2.8% in May, up from 2.4%, while German business morale stagnated at 89.3. The HCOB Eurozone Services PMI Business Activity Index recorded a two-month low at 53.2 but still indicates expansion. Read the article to learn about the overall global economic dynamics.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co