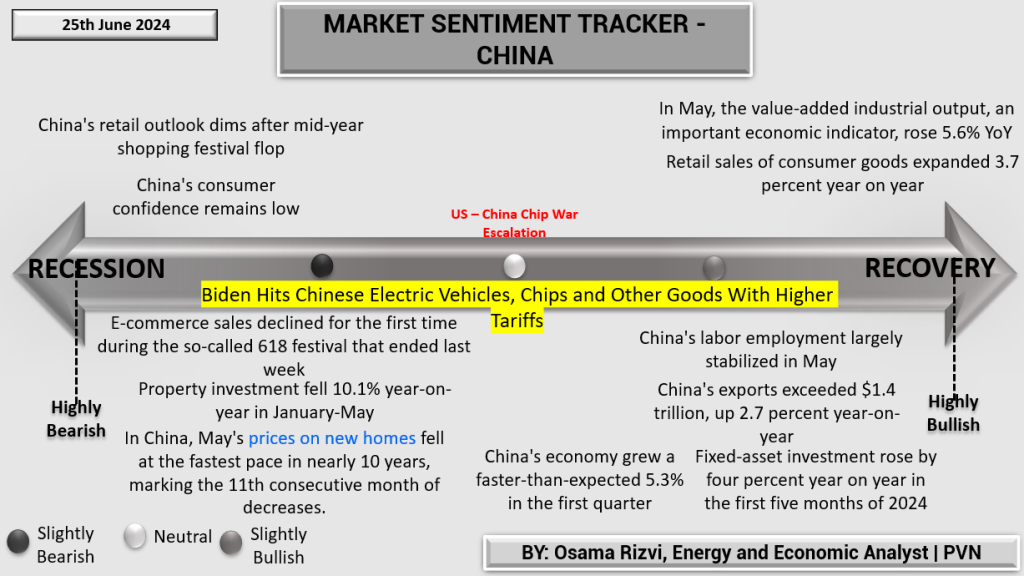

The Market Sentiment Tracker for June 25, 2024, presents a mixed picture for the U.S. and global economic landscape. In the U.S., the May PPI Services index showed a year-over-year increase of 2.5%, falling short of the expected 3.0% and a previous revision of 2.7%. This indicates that inflation pressures are still present but not as intense as anticipated. Consumer confidence is projected to dip to 100, reflecting continued uncertainty among American consumers. Retail spending in the first quarter of 2024 grew by only 1.3%, a significant decline from the 5% growth seen in the third quarter of 2023. U.S. retail sales in May showed only a modest rise, while the U.S. budget deficit is expected to reach $1.915 trillion in the 2024 fiscal period, surpassing 2023’s $1.695 trillion. Corporate bankruptcies have risen dramatically, with an 88% increase through April this year according to S&P Global data.

Globally, inflation is expected to moderate to 3.5% in 2024 and 2.9% in 2025, but the pace of decline remains slower than projected six months ago. U.S. Treasury yields remain roughly unchanged as the market awaits further inflation data, and wages continue to grow close to 4% annually, outpacing the rate of inflation. In Japan, core machinery orders fell in April for the first time in three months, indicating a slowdown in capital expenditure. U.S. natural gas prices climbed 4% due to forecasts for increased demand this week, reflecting tighter supply dynamics. The Chicago Fed National Activity Index rose to 0.18 in May from a revised minus 0.26 in April, signaling better production and moving out of negative territory. Despite these improvements, the economy faces mixed signals with ongoing concerns about inflation and consumer confidence.

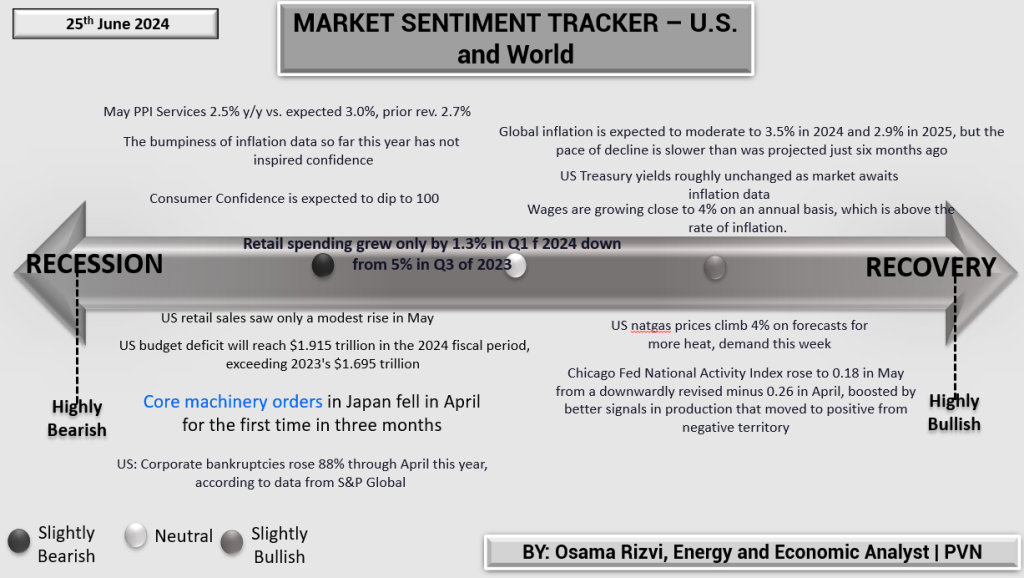

The Market Sentiment Tracker for China as of June 25, 2024, paints a picture of mixed economic signals. On the bearish side, China’s retail outlook has dimmed significantly following the mid-year shopping festival, known as the 618 festival, which saw e-commerce sales decline for the first time. This dip in consumer activity is accompanied by low consumer confidence, reflecting broader economic anxieties. Property investment also took a hit, falling 10.1% year-on-year from January to May, while new home prices in May experienced the fastest pace of decline in nearly a decade, marking the 11th consecutive month of decreases. However, there are also positive indicators. In May, value-added industrial output, a key economic metric, rose by 5.6% year-on-year, and retail sales of consumer goods expanded by 3.7% over the same period. China’s labor market showed signs of stabilization in May, suggesting some resilience in employment despite economic challenges.

On the international front, China’s exports exceeded $1.4 trillion, marking a 2.7% year-on-year increase. This growth underscores the country’s robust manufacturing and export capabilities. Furthermore, fixed-asset investment rose by 4% year-on-year in the first five months of 2024, highlighting continued investment in infrastructure and other critical sectors. Despite these positive trends, geopolitical tensions remain a significant concern. The escalation of the US-China chip war, with President Biden imposing higher tariffs on Chinese electric vehicles, chips, and other goods, adds an element of uncertainty to China’s economic outlook. Overall, while China faces considerable economic headwinds, particularly in consumer confidence and property investment, there are strong sectors that continue to drive growth, such as industrial output and exports.