Market Sentiment Tracker – U.S., China, and Europe (9th July 2024)

The latest Market Sentiment Tracker for the U.S., China, and Europe reveals a complex economic landscape marked by varying degrees of recessionary and recovery signals.

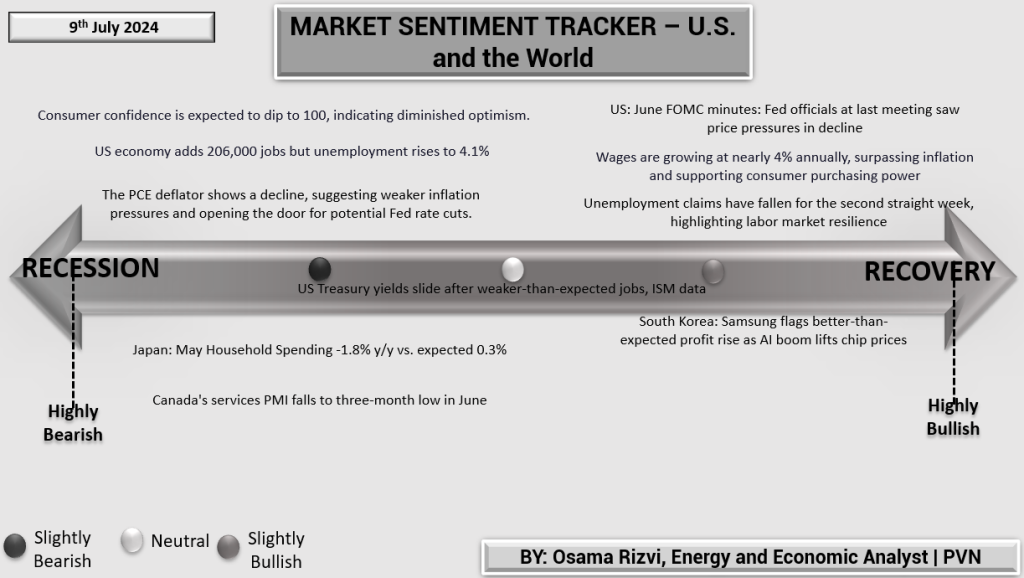

United States:

The U.S. economy presents a mixed picture. On the bearish side, consumer confidence is expected to dip to 100, indicating diminished optimism. The economy added 206,000 jobs, but the unemployment rate rose to 4.1%. The PCE deflator shows a decline, suggesting weaker inflation pressures and potential for Fed rate cuts. US Treasury yields slid after weaker-than-expected jobs and ISM data. On the bullish side, business investment continues to rise, with positive indicators in production. Wages are growing at nearly 4% annually, surpassing inflation and supporting consumer purchasing power. Unemployment claims have fallen for the second straight week, highlighting labor market resilience. Additionally, the June FOMC minutes revealed that Fed officials see price pressures in decline, further supporting economic recovery prospects.

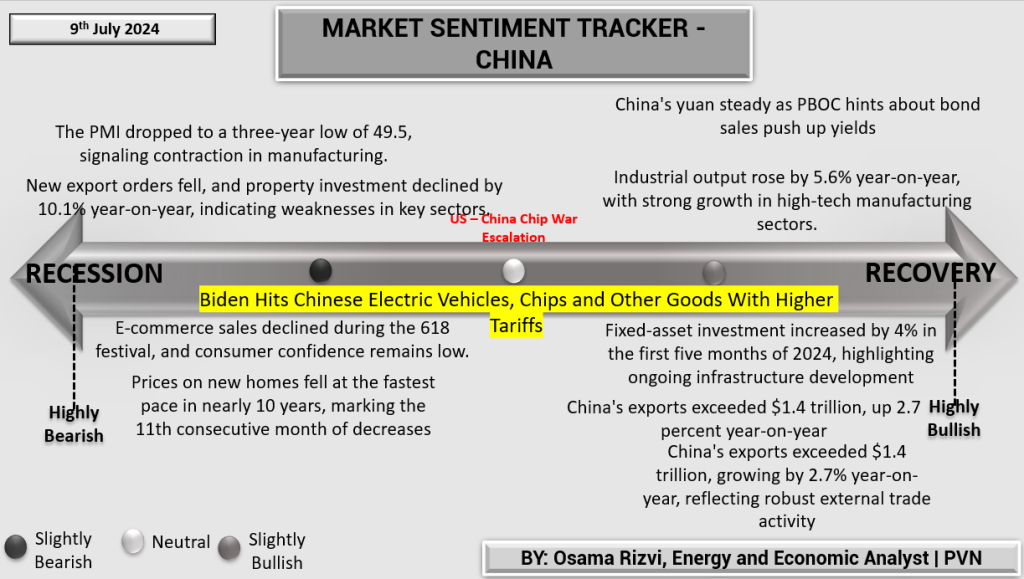

China:

China’s economic sentiment is weighed down by bearish factors, such as the PMI dropping to a three-year low of 49.5, signaling contraction in manufacturing. New export orders fell, and property investment declined by 10.1% year-on-year, indicating weaknesses in key sectors. E-commerce sales declined during the 618 festival, and consumer confidence remains low. Prices on new homes fell at the fastest pace in nearly 10 years, marking the 11th consecutive month of decreases. However, bullish factors include industrial output rising by 5.6% year-on-year, with strong growth in high-tech manufacturing sectors. Fixed-asset investment increased by 4% in the first five months of 2024, highlighting ongoing infrastructure development. China’s exports exceeded $1.4 trillion, growing by 2.7% year-on-year, reflecting robust external trade activity.

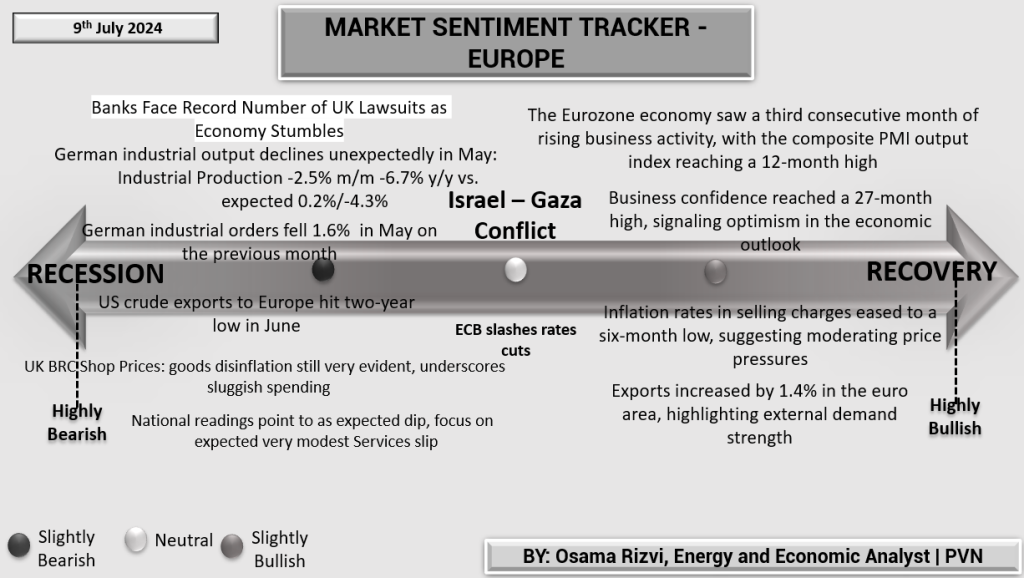

Europe:

Europe’s economic outlook presents both challenges and opportunities. On the bearish side, the UK faces a record number of lawsuits as the economy stumbles, and German industrial output declined unexpectedly in May by 2.5% month-on-month and 6.7% year-on-year. German industrial orders also fell by 1.6% in May. US crude exports to Europe hit a two-year low in June, and UK BRC shop prices indicate persistent goods disinflation. However, the Eurozone economy has seen its third consecutive month of rising business activity, with the composite PMI output index reaching a 12-month high. Business confidence reached a 27-month high, signaling optimism in the economic outlook. Inflation rates in selling charges have eased to a six-month low, and exports increased by 1.4% in the Euro area, highlighting external demand strength. The ECB’s decision to slash rates further supports the economic environment, albeit with caution amid mixed economic signals.

In summary, while the global economic landscape remains fraught with recessionary pressures, there are significant pockets of recovery and resilience, particularly in the U.S. labor market, China’s industrial output, and Europe’s business activity.