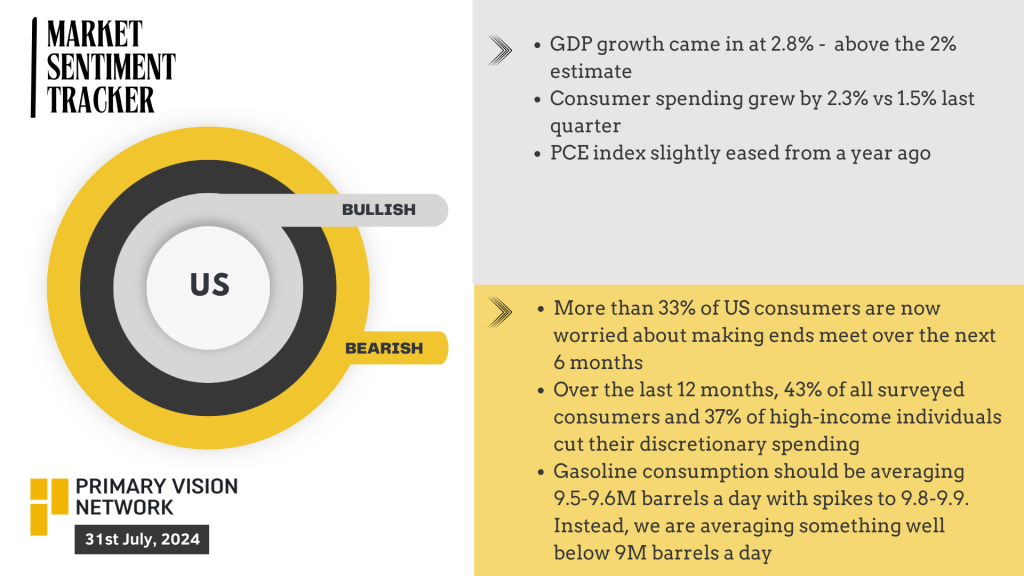

US Market Sentiment

The U.S. economic landscape shows a mix of growth and caution. GDP growth for the latest quarter exceeded expectations, coming in at 2.8%, above the 2% estimate. Consumer spending increased by 2.3%, compared to 1.5% in the previous quarter, signaling stronger economic activity. Additionally, the PCE index showed slight easing from a year ago, indicating moderated inflation pressures.

Despite these positive signs, consumer confidence remains a concern. Over 33% of U.S. consumers are worried about making ends meet over the next six months. In the past year, 43% of surveyed consumers, including 37% of high-income earners, have cut back on discretionary spending. Gasoline consumption is averaging below 9 million barrels per day, well below the expected 9.5-9.6 million barrels, highlighting persistent concerns about economic stability and future spending capacity.

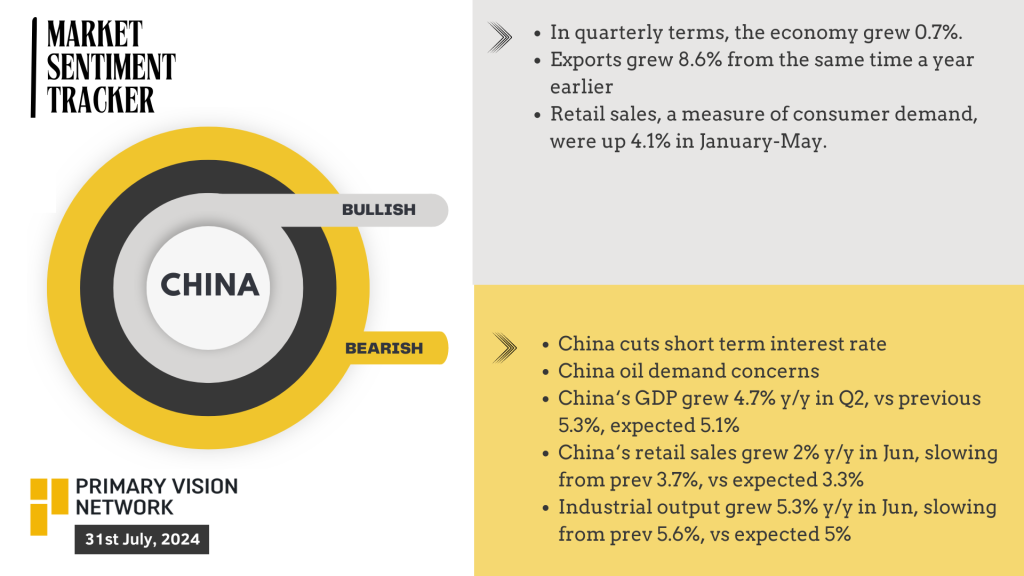

China Market Sentiment

China’s economic indicators reveal a mix of strengths and weaknesses. GDP growth slowed to 4.7% in Q2 from 5.3% in Q1, missing the expected 5.1%. Retail sales grew by 2% year-on-year in June, down from 3.7% previously and below the 3.3% forecast, indicating weaker consumer demand. However, industrial output grew by 5.3% year-on-year in June, slightly above the 5% expectation, though down from 5.6%.

China’s export sector remains robust, with exports growing 8.6% year-on-year. The country also cut short-term interest rates, aiming to stimulate the economy amid oil demand concerns. The yuan dropped to a near two-week low of 7.2750 per dollar following the rate cuts. Overall, while there are signs of economic deceleration, policy measures aim to sustain growth.

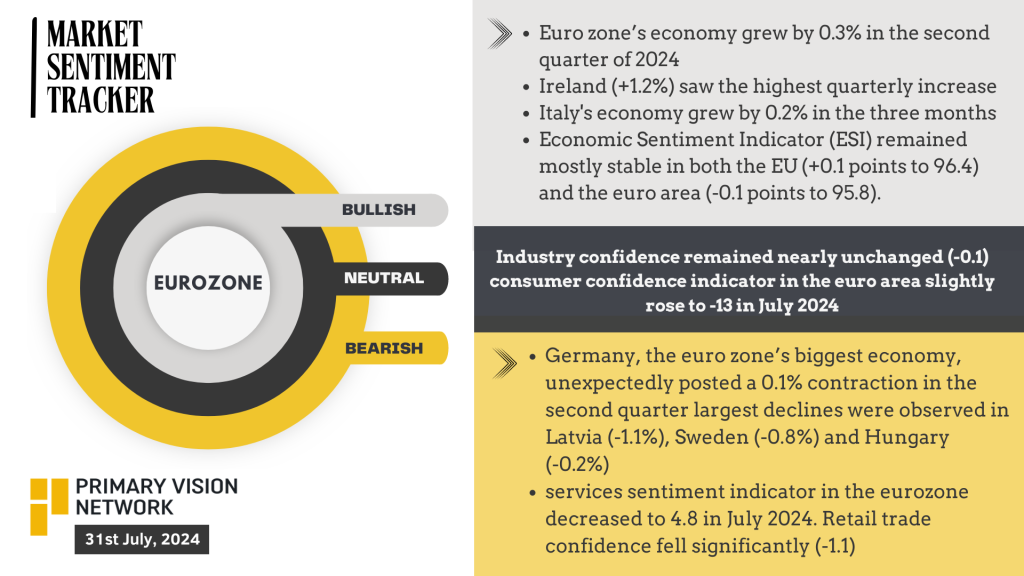

Eurozone Market Sentiment

The Eurozone economy shows mixed signals. On the positive side, it grew by 0.3% in the second quarter of 2024, with Ireland seeing the highest quarterly increase at +1.2%. Italy’s economy also grew by 0.2%. The Economic Sentiment Indicator (ESI) remained mostly stable, with the EU at +0.1 points to 96.4 and the euro area at -0.1 points to 95.8. Industry confidence was nearly unchanged, while consumer confidence slightly rose to -13.

However, Germany, the euro zone’s largest economy, unexpectedly posted a 0.1% contraction in the second quarter. This decline was most pronounced in Latvia, Sweden, and Hungary. Services sentiment in the eurozone decreased to 4.8 in July, with a significant drop in retail trade confidence. These factors highlight ongoing challenges in the eurozone’s economic recovery.