Stable Outlook But US Market Slips: In Q2 2024, STEP Energy Services (STEP) fracturing operating days kept increasing in Canada, but it fell in the USA compared to a year ago. Its dual-fuel horsepower increased by 65% in Q2 2024, although the total HP deployed remained unchanged. Nearly 71% of its total HHP is dual-fuel capable, up from 43% a year ago. The company activated two more coiled tubing spreads in the past year.

The company’s management considers that the “long-term outlook for oilfield services is very constructive.” The company expects proppant volume to increase in Canada in Q3, although pricing can remain under pressure. Coiled tubing utilization can improve in that region in Q3. In Q4, however, activity can decelerate due to operators’ capital discipline. The US fracturing market remains oversupplied. Read more about STEP in our recent article here.

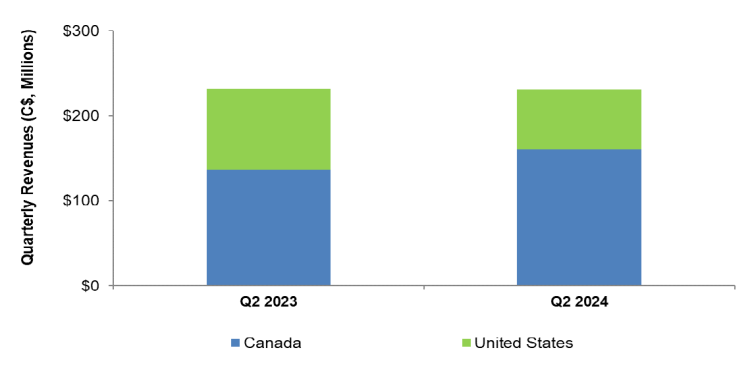

Operating Metrics Were Mixed In Q2: Year-over-year, STEP’s revenues increased by 18% in Canada but took a steep downturn (27% down) in the US in Q2 2024. However, its adjusted EBITDA margin contracted in both regions, more so in the US. Higher proppant volume and increased fracturing operations in Canada benefited its results, while fewer operating days and pricing pressure kept the US market performance under check in Q2.

Free Cash Flow Fell: STEP’s cash flow remained nearly unchanged (3% down) in 6M 2024 compared to a year ago. However, its capex increased sharply following the upgrade of fracturing fleets with the Tier 4 dual-fuel engine technology. As a result, its free cash flow decreased by 47% during this period. Its debt-to-equity improved to 0.19x as of June 30, 2024, from 0.24x at the beginning of the year. During Q2, it repurchased 0.88 million shares.

Thanks for reading the STEP Take Three, designed to give you three critical takeaways from STEP’s earnings report. Soon, we will present a second update on STEP earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.