Frac Fleets And Pressure Pumping Outlook

In our recent article, we have already discussed RPC’s (RES) Q2 2024 financial performance. Here is an outline of its outlook. RES’s management observes a shift in completion activity from natural gas-heavy basins to oil-centric basins. Many oilfield services and equipment providers prefer to offer large equipment. Although it may not add to the overall capacity in the long term, e-fracking capacity can increase in the short term. So, RES will see further competition in the market. So, it will redeploy assets at lower price points to drive utilization. It may continue to idle certain frac spreads and not serve the market that offers low returns.

RES will invest in Tier 4 DGB equipment due to customer preference for dual fuel frac spreads. RES believes that over time, it can acquire the necessary e-frac assets and capabilities. It also plans to invest in non-pressure pumping service lines such as coiled tubing, downhole tools, wireline, and cementing. The Spinnaker, acquired about a year ago, is a case in cementing operations. To know more about RES’s strategies in the frac and non-frac markets, read our article here.

Frac Spread Drivers

In frac assets, RES’s Tier 4 DGB frac spreads saw increased utilization with strong demand from semi-dedicated customers. In Q2, it deployed a new Tier 4 DGB spread. So, it currently has three DGB frac spreads deployed in the market. With a satisfactory gas substitution rate from these assets, it will continue to upgrade its frac spreads without adding to the count in the short term. However, as more and more frac spreads operate in the Permian, competition will likely heat up in that Basin.

Higher frac supply coupled with ongoing operating efficiency gains can lead to excessive capacity built in that region that exceeds demand. Increased competition can drive out less well-capitalized smaller players, leading to lower supply. Rig count can decline in the near term but stabilize, with a recovery in sight in 2025. In this environment, RES will control costs and maintain a disciplined operating and financial approach. It plans to diversify its service lines and invest in high-quality equipment.

The Q2 Drivers

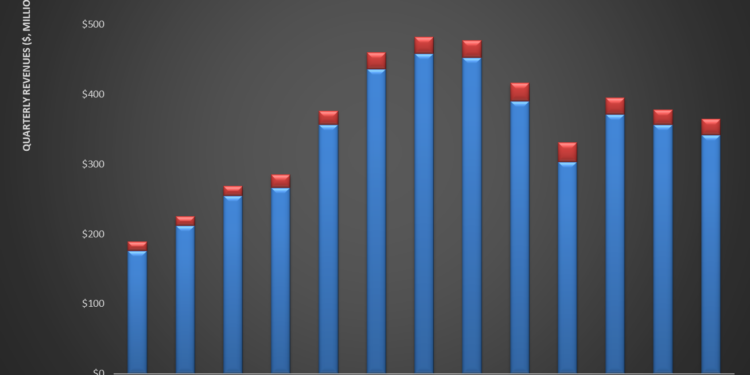

Quarter-over-quarter, RPC’s revenues decreased by 4% in Q2 due primarily to over-supply of oilfield equipment. On top of that, frac spreads moving from gassy basins into the Permian and efficiency gains by adding to pump hour capacity without a corresponding increase to pressure pumps kept RES under pressure in Q2. In coiled tubing, revenues grew by 18% following traction in specialized plug and abandonment work. The management believes its P&A work has created an opportunity to expand this business with large E&P operators in 2025. In Q2, sales in cementing and rental tools increased by 1% and 9%, respectively, while operating margins in these businesses expanded.

Its adjusted EBITDA margin expanded by 210 basis points, while net income increased by 18%. Despite the topline fall, pumping industry capacity and pricing indicated a steady completion activity environment. Year-over-year free cash flows deteriorated in 1H 2024 (22% down) because capex increased sharply. As of June 30, 2024, RES had no debt and a positive cash and cash equivalents balance ($262 million). Its expected FY2024 capex range remains unchanged at $200 million to $250 million.

Relative Valuation

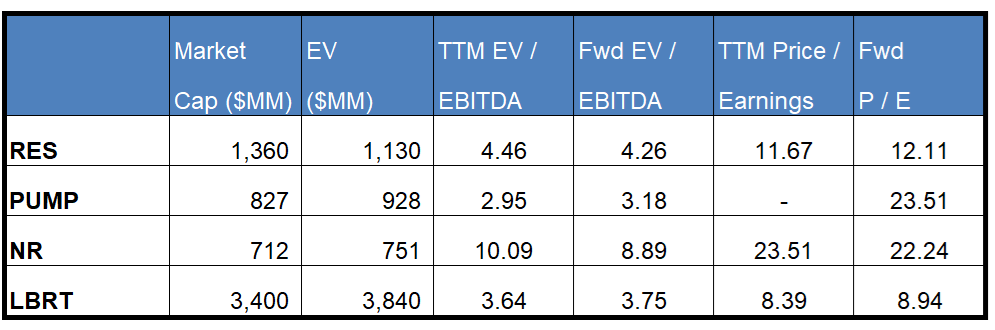

RES is currently trading at an EV/EBITDA multiple of 4.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 4.3x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 29x.

RES’s forward EV/EBITDA multiple is expected to contract more sharply versus its current EV/EBITDA than its peers. This implies that the company’s EBITDA is expected to increase more sharply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (PUMP, NR, and LBRT) average. So, the stock appears to be undervalued versus its peers.

Final Commentary

In Q2, RES deployed a new Tier 4 DGB spread. Given the frac pricing environment, assets will be redeployed at lower price points to drive utilization. However, it can idle certain frac spreads that need to offer sufficient returns. The company plans to upgrade its frac spreads without adding to the count in the short term. Supply will eventually adjust to demand after smaller players opt out. RES also plans to invest in non-pressure pumping service lines such as coiled tubing, downhole tools, wireline, and cementing.

RES’s management believes that P&A work has created an opportunity for the expansion of this business with a large E&P operator. However, with increased capex, free cash flows deteriorated in 1H 2024. Still, the presence of robust liquidity ($345 million) will ensure the risks are minimized. The stock appears to be undervalued compared to its peers.