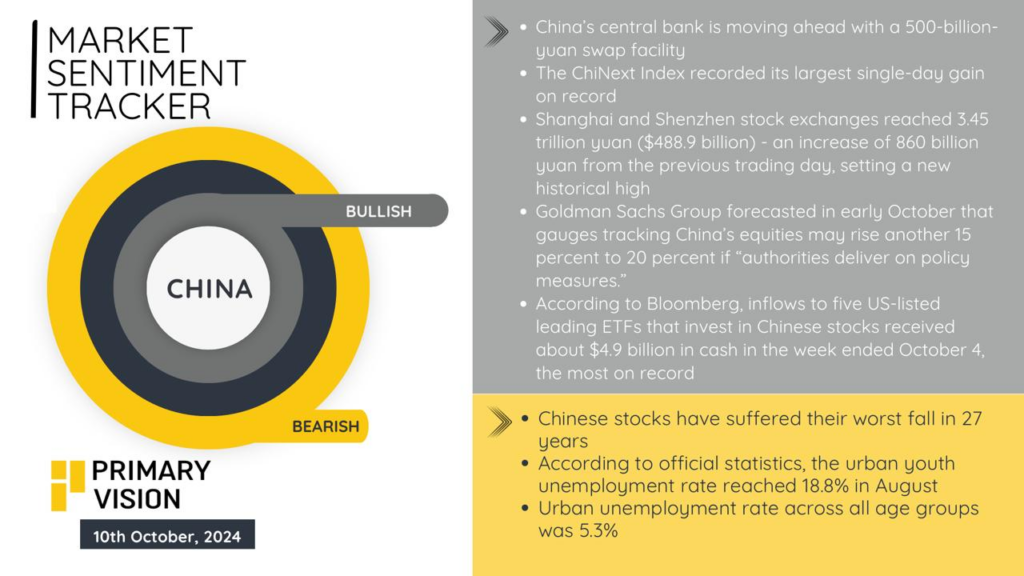

China’s central bank is moving forward with a 500-billion-yuan swap facility, boosting liquidity and bolstering market confidence. The ChiNext Index posted its largest single-day gain on record, and the combined market value of the Shanghai and Shenzhen stock exchanges surged by 3.45 trillion yuan ($488.9 billion).

This is a notable upswing, marking an increase of 860 billion yuan from the previous trading session. Goldman Sachs projects further gains of 15-20% in Chinese equities if policy measures are effectively implemented. Meanwhile, inflows to US-listed ETFs focused on Chinese stocks have reached $4.9 billion, the highest on record for the week ending October 4th.

On the bearish side, Chinese stocks have faced their worst slump in 27 years, and unemployment remains a challenge. Youth unemployment hit 18.8% in August, while the urban unemployment rate across all age groups stands at 5.3%, reflecting lingering structural issues within the economy.

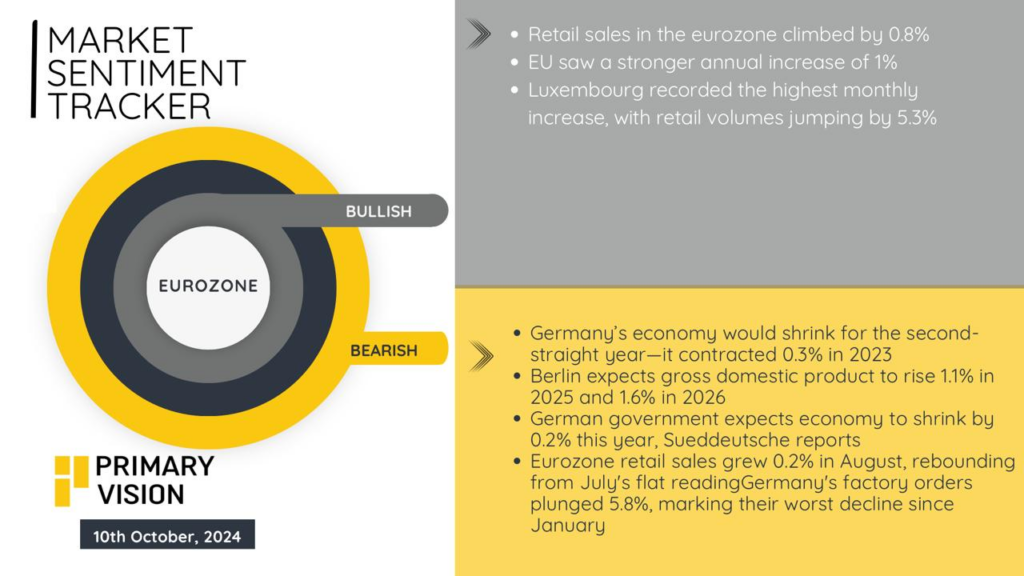

Germany’s economy faces another challenging year, with 2023 already showing a 0.3% contraction and further shrinkage of 0.2% expected by the German government. While Berlin forecasts GDP growth of 1.1% in 2025 and 1.6% in 2026, the current economic climate remains dire. Factory orders plunged 5.8% in August, marking the worst decline since January, signaling deeper industrial challenges ahead. On the brighter side, Eurozone retail sales showed modest recovery, climbing 0.2% in August after a flat reading in July, while the EU overall saw a stronger 1% annual retail increase. Luxembourg led the charge with a 5.3% monthly spike in retail volume, highlighting consumer resilience in some pockets of the bloc.

However, these modest retail gains might not be enough to offset the broader economic slowdown, as Germany’s manufacturing struggles and inflationary pressures continue to weigh down sentiment across the Eurozone. The region’s outlook remains mixed, with underlying weaknesses persisting.

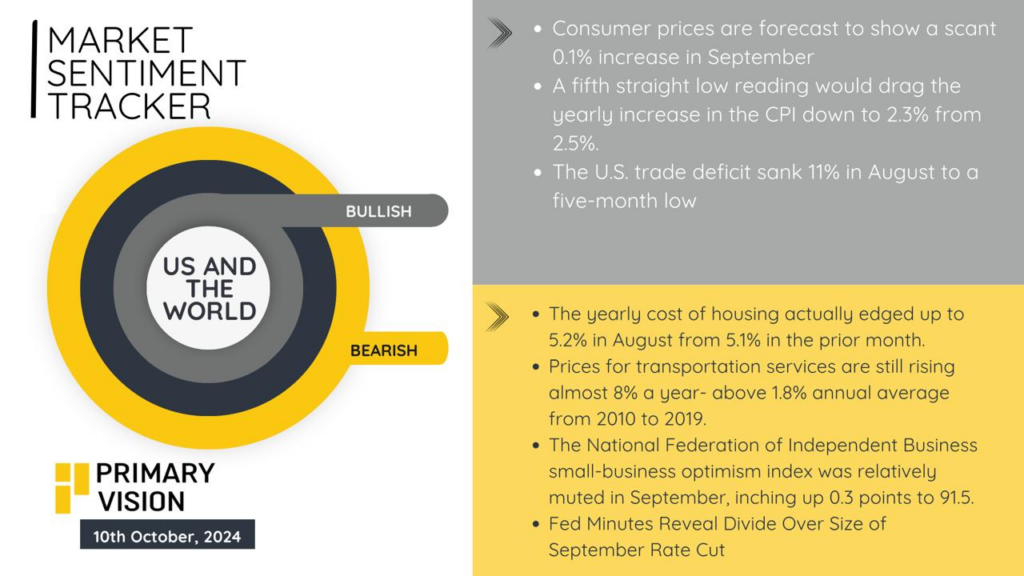

The U.S. inflationary pressures seem to be easing, with consumer prices forecasted to rise by just 0.1% in September, potentially lowering the CPI increase to 2.3% from 2.5%. This would mark the fifth consecutive low reading, signaling more moderate inflation. At the same time, the U.S. trade deficit saw a significant decline, dropping 11% in August to a five-month low. However, housing costs remain a concern, with annual increases edging up to 5.2% in August. Transportation service prices also continue to rise at nearly 8% annually, far above the pre-pandemic average of 1.8%. Small business optimism remains muted, with the index only rising 0.3 points to 91.5 in September, reflecting cautious sentiment. The Federal Reserve’s minutes highlight a divide over the September rate cut’s size, as the central bank grapples with balancing inflation concerns and economic growth in a challenging environment.