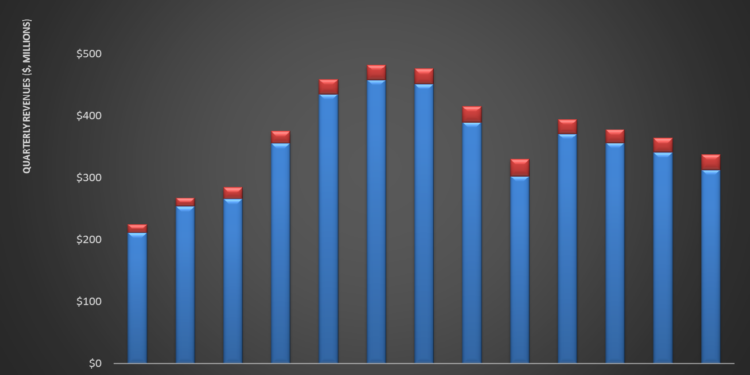

Revenues Decreased In Q3: Quarter-over-quarter, RPC’s (RES) revenues decreased by 7.4% in Q3 due to lower rig count triggered by lower crude oil prices. The company’s pressure pumping operations suffered significantly, dropping by “low double-digits.” This was because industry consolidation put pressure on the market, leading to spot market pumping customers contributing to whitespace. Older pressure pumping equipment utilization and demand were soft. The company’s Technical Services segment operating income decreased by 46% quarter-over-quarter while operating income in the Support Services segment improved by 21% from Q2 to Q3.

On the other hand, the company’s tier 4 dual fuel assets were highly utilized in Q3. RES took steps to control costs and preserve margin. The company will focus on coiled tubing and downhole tools. It may also seek to grow through M&As.

Net Income Decreased In Q3: Quarter-over-quarter, RES’s adjusted EBITDA margin contracted by 240 basis points after expanding in the previous quarter. Lower revenues in pressure pumping and the associated negative operating leverage and fixed cost absorption resulted in the EBITDA margin contraction in Q3. Also, the company’s net income decreased by 42% during Q3. Read more about the company in our previous article here.

Cash Flows Decreased: RES maintained a debt-free balance sheet as of September 30. This, along with a cash balance of $277 million and a $100 million revolving credit facility, allowed for maintaining a dividend payment of $0.04 per share. Free cash flows, year-over-year, deteriorated in 9M 2024 (50% down) because capex increased while cash flow from operations decreased.

Thanks for reading the RES Take Three, designed to give you three critical takeaways from RES’s earnings report. Soon, we will present a second update on RES earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-