China’s fiscal stimulus might seem to be doing its job. Beijing and Shanghai’s introduction of tax breaks aims to stabilize the struggling property market, with initial signs of confidence returning in major cities. The property sector’s fragility, however, continues to weigh on broader consumer sentiment, which remains hesitant despite stimulus measures. On the trade front, China’s aluminum exports have rebounded in 2024, bolstered by global demand, signaling some resilience in industrial sectors.

GDP growth reached 4.8% year-on-year for the first three quarters of 2024, a steady improvement though still underscored by underlying vulnerabilities. The US-China trade war casts a long shadow, with potential ramifications for export-oriented industries. While these numbers provide a sense of recovery, structural inefficiencies and cautious consumer behavior underline the need for sustained policy support to ensure durable growth. Economic sentiment, for now, treads a fine line between recovery and caution.

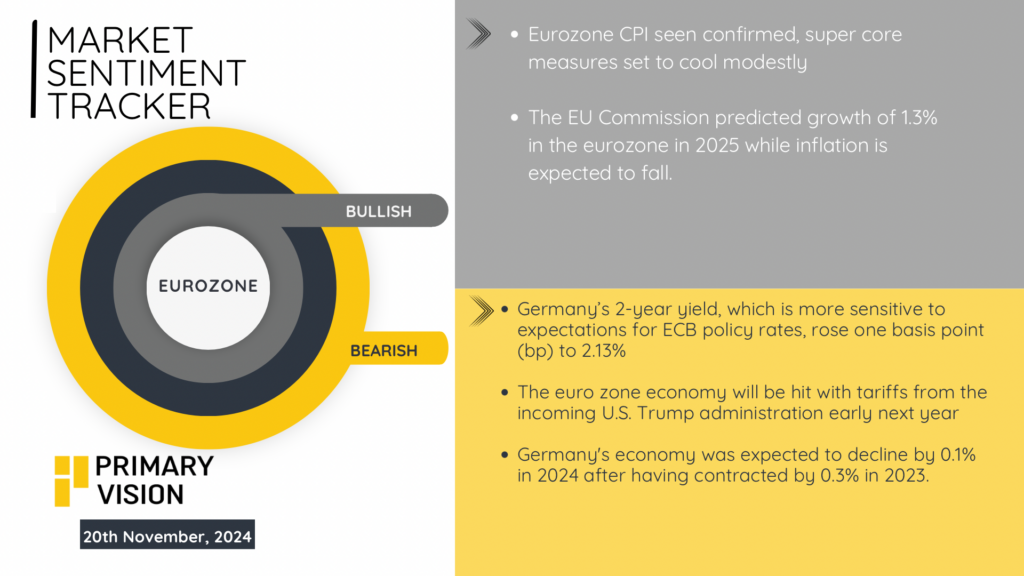

The Eurozone economy is undergoing a slow growth and tempered inflation period. Germany’s two-year yield edged up by one basis point to 2.13%, reflecting market recalibration on future ECB policy expectations. The European Commission projects the bloc’s GDP to grow at a muted pace of 1.3% in 2025, with inflation expected to ease further—signaling stability but also underwhelming dynamism.

Germany, still reeling from a 0.3% contraction in 2023, is forecasted to shrink marginally by 0.1% in 2024. The Eurozone now braces for potential trade headwinds, as tariffs from the incoming U.S. administration threaten export-heavy sectors early next year. While inflation trends suggest easing price pressures, weak growth prospects and geopolitical uncertainties continue to cloud the economic horizon. Structural reforms remain critical for turning cautious optimism into tangible recovery.

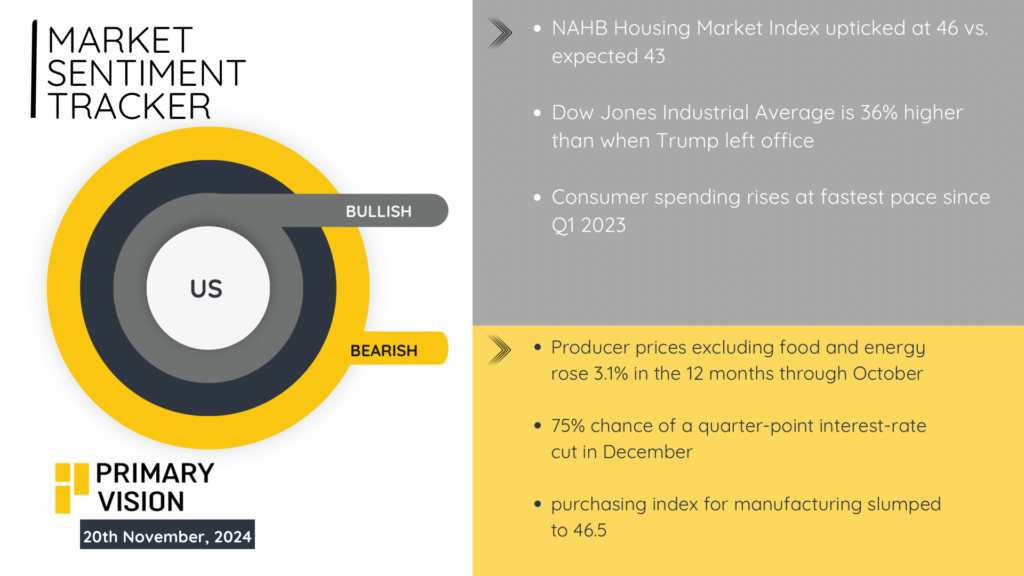

The U.S. economy is giving the most conflicting signals. Consumer spending surged at its fastest pace since Q1 2023, offering a bright spot amid broader uncertainties. The NAHB Housing Market Index rose to 46, above expectations of 43, signaling cautious optimism in the housing sector. Meanwhile, the Dow Jones Industrial Average stands an impressive 36% higher than when Trump left office, reflecting robust equity market performance.

However, underlying pressures persist. Producer prices, excluding food and energy, climbed 3.1% over the past year through October, sustaining inflationary concerns. The manufacturing sector continues to struggle, with the purchasing index dropping to 46.5, marking another month in contraction. Markets are pricing in a 75% likelihood of a December quarter-point rate cut, as policymakers aim to navigate a soft landing. The challenge remains balancing robust consumer activity against industrial weakness and inflation risks.