Frac Spread And Strategies

Our short article discussed our initial thoughts about ProFrac Holding’s (ACDC) Q3 2024 performance a couple of weeks ago. This article will dive deeper into the industry and its current outlook. As energy operators consolidated through the recent spate of M&As, the company’s model based on integrated solutions would give it an advantage. It has a leading position in the completions value chain, allowing it to add scale to the most active basins in the US. It sees incremental demand as it progresses through 2025.

The company repairs, services, and redeploys frac spreads as and when the market demand moves. The strategic moves involve commercial innovation. Recently, it tested its newest generation of electric pumps. The pumps will become available in its portfolio to deliver leading-edge performance while minimizing nonproductive time.

As we discussed in our recent articles on Liberty Energy and ProPetro, the industry witnessed equipment attrition. Lower equipment investment, increased hours per fleet and per component, and limited availability of capital characterize today’s frac industry. Higher equipment attrition may impact efficiencies. ACDC’s management believes this trend will accelerate in the future.

Opportunities And Challenges

In recent quarters, when the legacy Tier-II pumps and equipment are being retired, ACDC sees higher demand for its electric frac spreads and dynamic gas blending assets that utilize natural gas as the primary fuel source. Such technologies account for 75% of the company’s active frac spreads. The next-generation assets offer significant fuel savings, high reliability, and efficient operations. Following the recent grid constraints and failures in the US, its management also sees opportunities emerging in power generation capabilities. Increases in AI-driven computing power requirements have aided such industrial-scale electrification trends. On top of that, there is on-demand power generation at the wellhead. All these factors have contributed to the use of natural gas-power frac.

On the other hand, ACDC has identified ~400,000 HHP of legacy diesel-burning frac pumps that need to be retired. Subdued drilling and completion activity adversely affected its assets in Haynesville. Lower demand may continue to negatively impact this region in Q4. Also, the company’s proppant operations faced challenges due to a prolonged weakness in natural gas-related activity. In Q4, volumes and pricing in proppant can remain depressed.

In 2025, it expects operations in West Texas and South Texas to improve. So, it focuses on increasing efficiencies to enhance profitability during a potential recovery. The company plans to align its operating costs and capital investments with activity levels to manage costs.

A Q3 Financial Discussion

From Q2 to Q3, ACDC’s revenues from the Manufacturing and Other segments increased, while its revenues from Proppant Production decreased significantly. Revenues from Stimulation Services remained unchanged. Its free cash flow declined steeply in 9M 2024 over a year ago. Its projected growth capex for FY2024 is $100 million, which it plans to spend on frac fleet upgrades, investments in next-generation technologies, and sand mine improvements. ACDC’s leverage (debt-to-equity) deteriorated to 1.0x as of September 30, 2024, compared to 0.98x on June 30. It had $109 million of liquidity as of September 30.

Relative Valuation

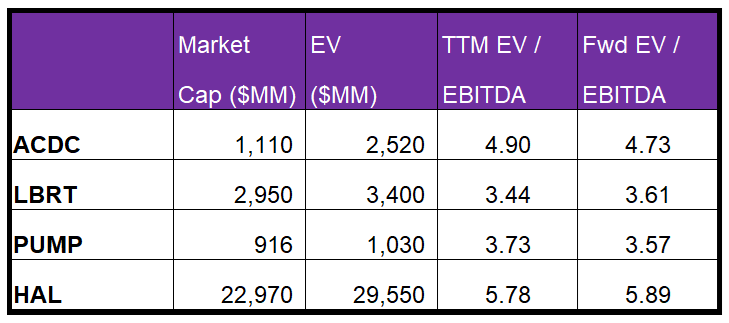

ACDC is currently trading at an EV/EBITDA multiple of 4.9x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 4.7x.

ACDC’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is higher than its peers’ (LBRT, PUMP, and HAL) average. So, the stock is reasonably valued compared to its peers.

Final Commentary

ACDC continues to retire Tier-II assets as and when demand for the company’s electric frac spreads and dynamic gas blending assets surge. It aims to achieve higher profitability through fuel savings, reliability, and efficiency by replacing legacy pumps with new assets. Its management also sees opportunities emerging in power generation capabilities, all contributing to the natural gas-powered frac uses in 2025. However, the prolonged weakness in natural gas-related activity can be sustained in Q4. So, ACDC can also reduce its operating costs and capital investments. The company’s integrated business model can leverage a low-cost structure.

ACDC’s free cash flow declined steeply in 9M 2024 over a year ago. Its debt-to-equity is also high. The stock is reasonably valued compared to its peers.

Premium/Monthly

————————————————————————————————————-