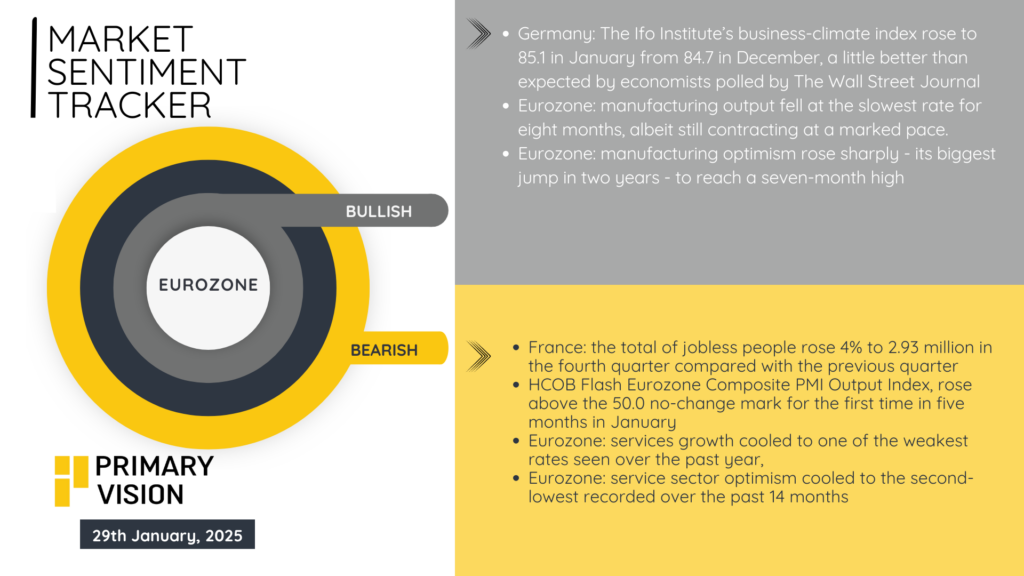

Eurozone

The Eurozone is trying to find its footing, but growth remains fragile. Germany’s business climate index saw a small uptick, signaling cautious optimism. Manufacturing output is still contracting, but at the slowest rate in eight months at least a step in the right direction. Optimism in the sector has hit a seven-month high, suggesting firms are hopeful for stabilization.

On the downside, France jobless rate jumped 4% in Q4, and service sector growth is cooling fast, hitting its second-lowest optimism reading in over a year. The Flash Composite PMI rose above 50 for the first time in five months, signaling slight expansion, but weak consumer demand and sluggish services growth weigh on the outlook. The Eurozone isn’t out of the woods yet, and while businesses may be seeing some light at the end of the tunnel, economic momentum is still patchy.

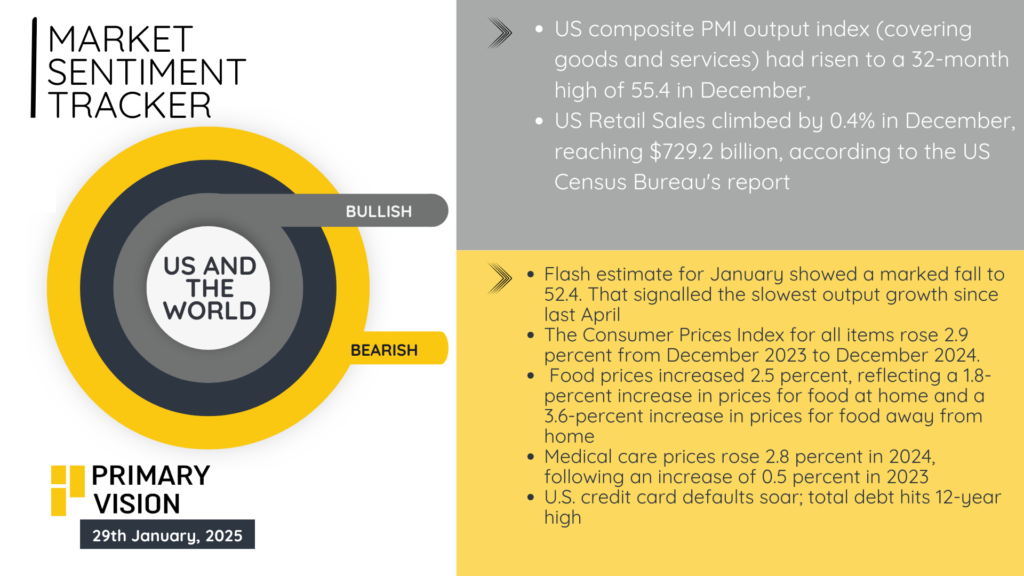

United States

The U.S. economy continues to send mixed signals. The composite PMI output index hit a 32-month high at 55.4 in December, and retail sales grew 0.4%, showing resilience in consumer spending. These are solid indicators of economic momentum, keeping recession fears at bay.

But January’s flash estimate of PMI saw a steep drop to 52.4, the slowest output growth since April. Inflation is still hanging around, with consumer prices rising 2.9% year-over-year, food prices up 2.5%, and medical care costs climbing 2.8%. On top of that, credit card defaults are soaring, with total household debt at a 12-year high. The U.S. economy remains sturdy, but rising debt levels and persistent inflation could complicate the Fed’s balancing act in the months ahead.

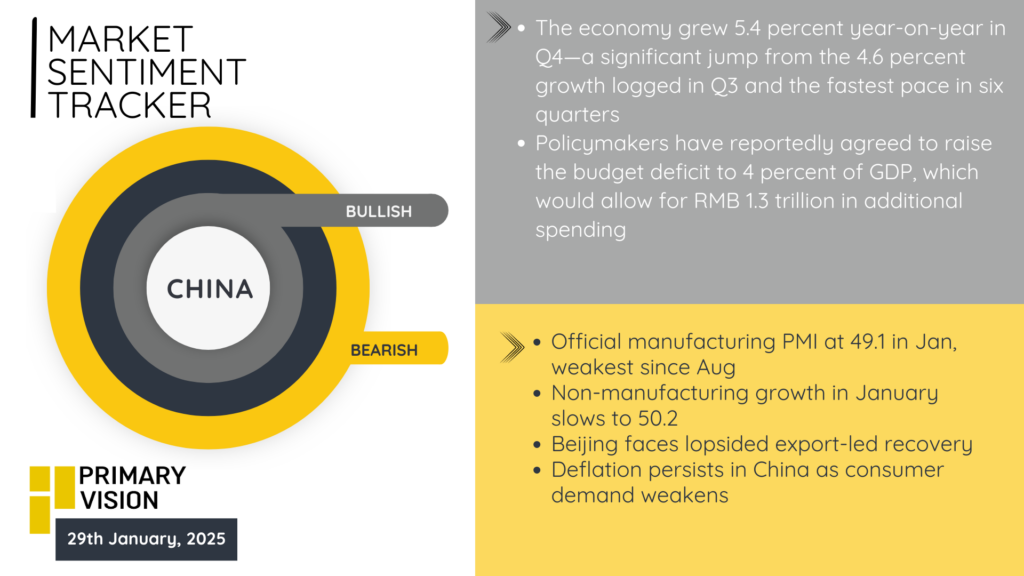

China

China’s economy closed out 2024 on a strong note, with Q4 GDP growth hitting 5.4%, its best pace in six quarters. Policymakers are doubling down on stimulus, agreeing to raise the budget deficit to 4% of GDP, injecting RMB 1.3 trillion in additional spending to sustain growth.

But challenges persist. The official manufacturing PMI slipped to 49.1 in January, its lowest since August, while non-manufacturing growth slowed to 50.2. The recovery remains heavily reliant on exports, leaving domestic demand weak. Deflationary pressures are still a concern, as consumer sentiment struggles to rebound. While stimulus efforts should provide some cushion, China’s long-term outlook hinges on whether it can shift away from an export-driven model toward a more sustainable, consumption-led recovery.