NOV’s topline and operating income experienced a slowdown in Q1, as industry activity levels declined and sales of aftermarket parts decreased. However, its cash flows improved in Q1. Share repurchases continued in Q1. Its outlook for Q2 performance is relatively bullish.

Q2 And FY2025 Outlook: During Q1, NOV (NOV) recorded $437 million in order booking, representing a 0.8x book-to-bill ratio, a steep fall from 1.2x a quarter earlier. The company expects “modest sequential revenue improvement” in Q2 compared to Q1. It also expects Q2 adjusted EBITDA to increase by 5% (at the guidance midpoint) compared to Q1.

In FY2025, the company’s management expects macroeconomic and geopolitical uncertainties to put pressure on energy activity in 2H 2025. Despite that, the expectations of a topline and margin improvement indicate NOV’s strong market positions, technological advancements, and its global diversification.

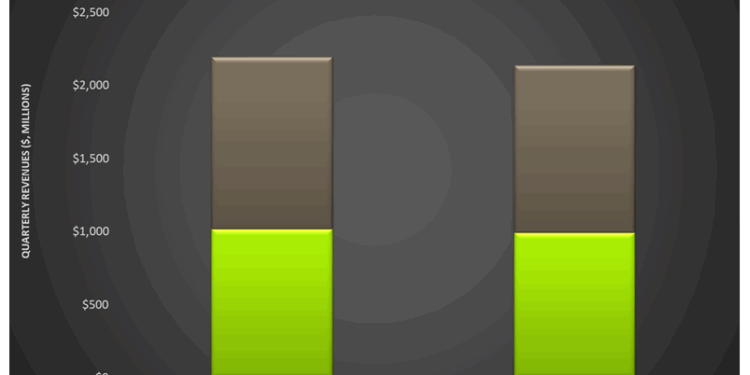

Revenue and Operating Income in Q1: In Q1 2025, both the Energy Equipment and Energy Products & Services segments experienced a year-over-year decline in revenue (2% and 3%, respectively). The Energy Equipment segment saw operating income rise (41% up) from Q1 2024 to Q1 2025. On the other hand, operating profit in the Energy Products and Services segment decreased by 31%.

Lower industry activity levels led to lower volumes and a deterioration in the sales mix in Q1, resulting in lower operating profit in Q1. Also, lower demand for aftermarket parts adversely affected Q1 results. However, Improved pricing and better conversion of backlog into revenues partially mitigated the adverse effects.

Cash Flows And Repurchases: NOV’s cash flow from operations turned positive in Q1 2025 compared to a year earlier. FCF, too, turned positive in Q1. Debt-to-equity (0.27x) has remained nearly unchanged from a year earlier. The company repurchased 5.4 million shares in Q1 and returned a total of $109 million in capital to shareholders in Q1.

Thanks for reading the NOV Take Three, designed to give you three critical takeaways from NOV’s earnings report. Soon, we will present a second update on NOV earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-