U.S. completion activity had its normal slowdown into the holiday season, and now with fresh CAPEX and supportive pricing we will see spreads bounce quickly back to 270 or so. Activity in the Permian barely dropped and outpaced many of the previous years, which helps highlight the underlying strength in that region. We are also starting to see more refrac interest in ’22 as companies look to evaluate wells from ’18 and ’19 for a possible uplift by doing either a workover, acid wash, or refract. This will help provide a bump in production in the near term, which will be mixed in with new fracs that will be completed across the U.S. The issue remains supply chains and labor shortages that will keep the available horsepower capped. We discuss the available horsepower by pumper and basin in our year end report- please reach out to learn more.

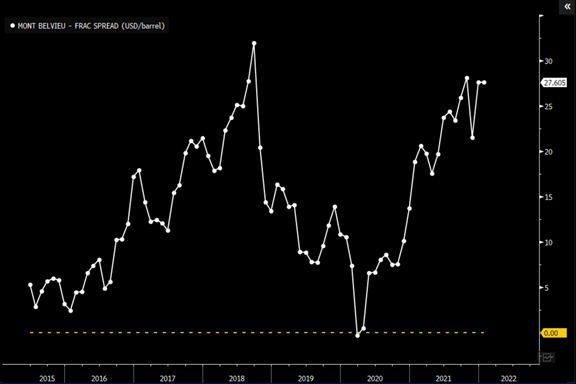

I expect to get to the 4-week rolling average quickly in the Permian, Anadarko, and Western Gulf. The dip in activity was fairly “shallow” when considering the previous years, which was driven by the strength in pricing and the fact we were starting from a lower level. The NGL basket is starting off the year strong and providing uplift for production in liquids heavy regions. We believe this persists through at least Q2 even as imports slow due to congestion at the Panama Canal and the price cut by Saudi Arabia. Local and international demand remains elevated, and will be supportive of propane and ethane in the below Mont Belvieu basket.

The biggest question becomes- how quickly can we get to 300 spreads. Labor and equipment shortages will delay a bigger move higher till about March, but if refracs pick up faster (we think closer to end of Q1 beginning of Q2) that will accelerate a move to 300. It will likely come towards the back end of February, but March is usually where we start to see a bigger increase in activity as the weather improves in some key areas. The strength in crude, NGLs, and natural gas will help us spring to 275 rapidly, but the move north of that will be limited in Q1. As we move into Q2-Q3, we can see move to about 325-330 spreads as the U.S. heads to about 12.3M barrels a day on an exit rate basis of production.

OPEC+ delivered exactly what we expected- another increase of 400k barrels a day, which we discussed as the likely direction last month. Even though there is room to expand, it doesn’t mean that countries will take advantage of the elevated production levels. West Africa is still struggling to sell at a normal pace, and China has now reduced crude import quotas putting additional pressure on Angola, Congo, and Russian grades. The cut in quotas was fairly broad, but the allocations favor the mega-refiners as China tries to push the smaller assets to shut down. They have been trying to make this pivot for several years, and now that the mega facilities are ready to come online the pressure will mount on the smaller and less efficient teapots. Every time the CCP wants to make room for new assets (especially State Owned) they increase scrutiny on adherence to arbitrary rules, and if they are shown to be out of compliance (and ALWAYS are) they are fined/ sanctioned or shut down. This all started last year so it isn’t shocking to see the pressure ramp in the new year. Total allocations are 11% lower than the same batch given a year ago and almost 40% of quota goes to three large, complex refineries. Beijing granted 109 million tons of allowances to 42 private refiners in the first batch for 2022, according to officials from companies that received notification of the allowances. China has also reduced the nation’s annual quota for oil-product exports by 10% to 20% this year, according to Energy Aspects Ltd., which previously expected the allowance to remain flat. With the reduction, the government may be seeking to push major Chinese refiners into prioritizing domestic supplies and squeezing out inefficient teapots. Even with the reduction, we are still seeing more gasoline cargoes get moved into the market and expect to see some additional distillate cargoes start getting marketed. Last year- China put a ban on gasoline/ diesel exports and slowly started to lift those restrictions as storage levels normalized. The current COVID outbreak in the country, and their zero-tolerance policy is resulting in broad shutdowns of some ports and smaller cities.

Even with the 400k barrel a day production increase, it is unlikely we see any type of increase from West Africa and possible Russia. Last month we explained how Russian grades- ESPO and Sokol- were trading at much lower premiums around $3.50 vs the $6.80-$7.30 it was trading previously. Spot differentials of Russia’s ESPO and Sokol as well as Qatar’s Al-Shaheen crude for February loading have slid by around $1 a barrel compared with last month, according to traders who asked not to be identified. Cargoes of ESPO were recently sold at the lowest level since August, while the premium of Abu Dhabi’s Murban crude has also slumped. This is a direct result of slowing Chinese purchases that have fallen even further after the cut in quotas. Angola was already struggling to clear cargoes, but now that is bleeding into the preferred cargoes of ESPO. Russia didn’t increase output last month even though they had the room to do so under the OPEC+ agreement, but the decision was driven more by the weakening differentials and less about the lack of spare capacity. If differentials are falling, why would you increase production?

Saudi Arabia cut their OSPs by a $1+ into Asia and $.30-$.50 into Europe while keeping other regions fairly flat. We expect other countries in the region to follow suit with additional reductions- especially as floating storage remains elevated in the area. We highlighted how Middle East floating storage was going to be a big tell on how the countries would react to pricing in February, and now we have a decline slightly above expectations of $1. The decline in pricing into Asia will help push more Middle East crude into the region and weigh further on sales from West Africa into Asia.

Middle East Arab Light Crude Saudi to Asia OSP Spread vs Average Oman/Dubai FOB

The talk is always around the OPEC+ production, but exports mean more when evaluating underlying demand. Ten of OPEC’s 13 members were permitted to add roughly 250,000 barrels a day last month under the terms of the group’s accord with the wider coalition, but their combined hike amounted to only 150,000. While Angola managed a modest recovery last month, its output is down almost three times the amount required by the agreement. Angola still has 12 cargoes to sell for February loading with the Congo sitting on about half of next months loadings. The pace of sales remains sluggish, and why would a country rush to increase production when differentials are falling and floating storage remains elevated?

The amount of crude on the water has increases based on sales that occurred through Nov/Dec and remains in motion. We have seen floating storage move back up as some of these cargoes reach their destination and get stuck on the coast due to the congestion at the ports. The increases in floating storage were driven by Asia and West Africa. The builds in Asia will slow down the purchases from West Africa exacerbating the issues for WAF, but it is made slightly worse by the OSP cuts from the Middle East because Asia will pick up those cargoes vs WAF. The floating storage market in WAF/ ME/ and Asia will be a huge driver of underlying differentials and demand. The COVID resurgence in China will slow demand that will be compounded by the Winter Olympics kicking off in a month. They typically slow industrial activity to clean up the air prior to a big event.

Global Crude on the Water

Global Crude Oil in Floating Storage

China isn’t going to be able to bail out the world (again) with stimulus as they manage liquidity and their own general slowdown. The property defaults are only rising with more bonds coming due over the coming few months. Shimao defaulted on something called a trust product — a high-yielding short-term instrument pitched to wealthy Chinese as safe and predictable. Property firms have $22b of these due this quarter, $90b this year.

Chinese developers are facing another waive of bonds coming due, and banks are being asked to boost property loans as default fears shift higher. Lending has been sluggish at best, and getting move expensive for the small and medium firms.

The banking system is struggling to meet loan quotas while keeping bad debt under control. “Chinese bank rushed to meet their annual state-imposed lending quotas last month by buying up low-risk financial instruments rather than issue loans.“ In fact this has been the heart of the problem in the Chinese economy for the past 10-15 years. The banking sector is responsible for boosting economic activity to meet high GDP growth targets but, in so doing, has had to run up enormous debts that cannot be repaid. This required the constant rolling over of hidden bad debts in order to work, which means it was always going to come to a head once the authorities tried to get bad debts under control. That seems to be what is happening now. At the end of the day Beijing can still only choose between getting debt under control and accepting much lower GDP growth rates, probably below 2-3%. What we have learned in the past year is how difficult it is to avoid this trade-off. In addition, it became more expensive for smaller firms to borrow, with the gap between the interest rates on loans for small and large companies surging to 2.73 percentage points, the highest level since the survey began in 2012, according to the report.

That’s despite a series of policies aimed at helping smaller companies, and the central bank guiding overall credit growth to pick up in November to counter a slowing economy dragged down by a property downturn and sporadic Covid-19 outbreaks. So far, the CCP and PBoC has said a lot of things about loans and supporting the local consumer- but policy is and remains lacking to actual push the agenda. I believe they have run out of running room to actually deliver on these promises.