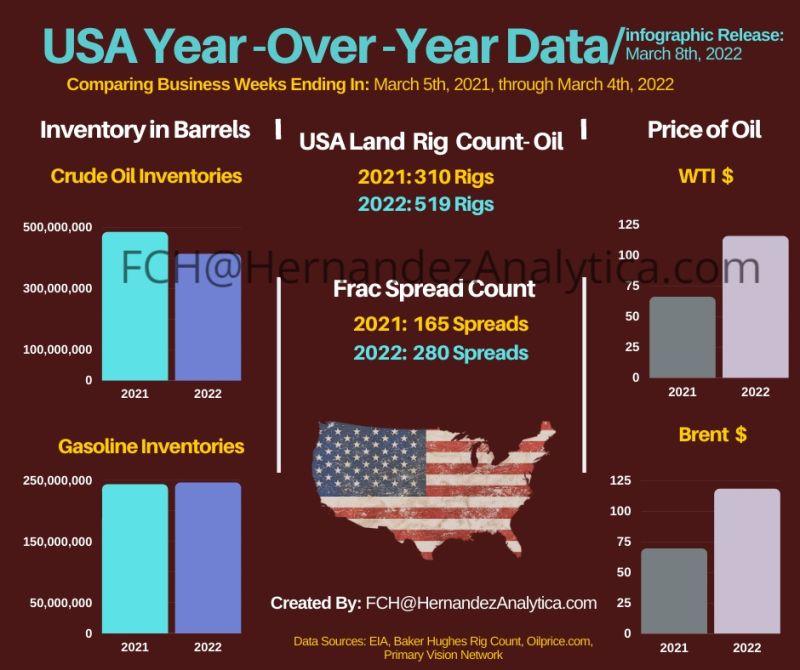

I have captured key industry data, as it relates to the previous business week. As such, the the oil rig count dropped by 3, after previously setting a new high for 2022. The count is equally up by 244 rigs compared to the lowest point seen in 2021.

• Also, the price for Brent and WTI crude has increased by over 47.00 USD over the course of a year.

The below information that further complements the #infographic:

(Oil Rig Count: Baker Hughes report)

• March 5th, 2021: 310

• March 4th, 2022: 519

(Primary Vision – Frac Spread Count)

• March 5th, 2021: 165

• March 4th, 2022: 280

(Oilprice site: #WTI price)

• March 5th, 2021: 66.09 USD

• March 4th, 2022: 115.68 USD

(OilPrice site: Brent Crude price)

• March 5th, 2021: 69.36 USD

• March 4th, 2022: 118.11 USD

(EIA Crude Oil Inventories: agency reports with a week delay)

• February 26th, 2021: 484,605,000 Barrels

• February 25th, 2022: 413,425,000 Barrels

(EIA Gasoline Inventories: agency reports with a week delay)

• February 26th, 2021: 243,472,000 Barrels

• February 25th, 2022: 246,011,000 Barrels