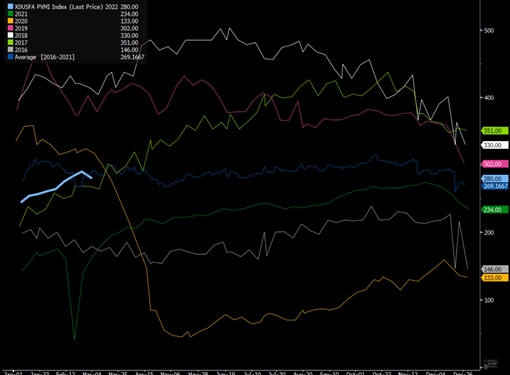

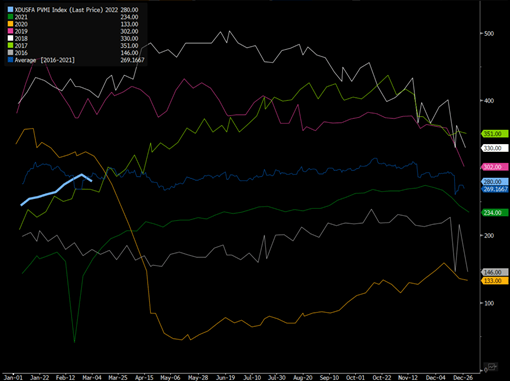

Completion activity dipped again this week by 8, but as we said previously- we expected to see some slow down. We normally see a seasonal drop this time of year, which lasts pretty much until the end of March. This also gives E&Ps time to build excess inventory heading into the core months of activity April-Sept. There was another big increase in rig activity bringing more horizontal back to live, which are pivotal for increasing the amount of available work. There will be fairly steady active at this level with more to come as we head into March in the Haynesville (that normally dips this time of year), Permian, and the Anadarko. Our NGL demand remains very robust heading into the international market with a large part still flowing into Asia- especially India.

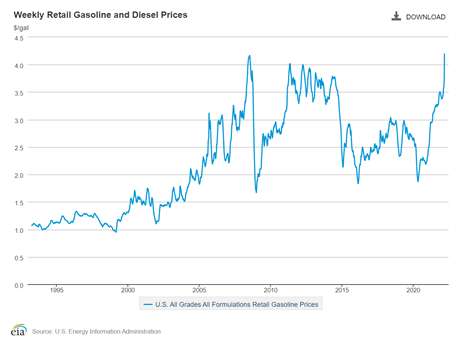

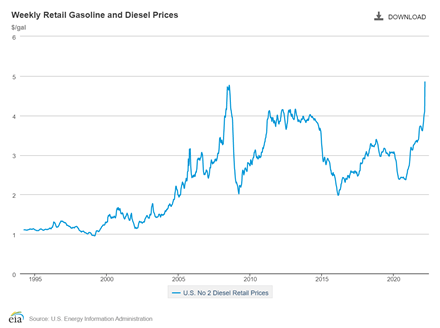

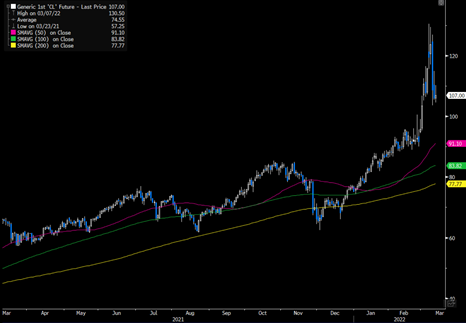

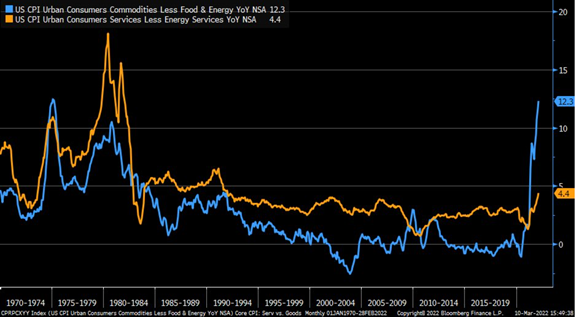

The inflation numbers that came out this week don’t cover a large part of the Russian invasion as this offensive kicked off on Feb 24th. Most of February crude sat between $90-$95 with an average much closer to $93 with gasoline around $3.50-$3.70 and diesel about $4-$4.10. Things went parabolic following the invasion- which will really be captured in the March data vs February.

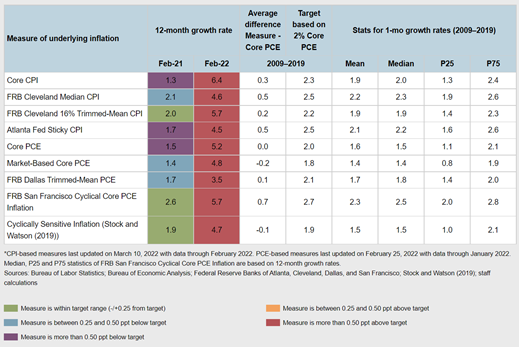

“Flexible” inflation will push higher and drag “sticky” inflation higher as we head towards a pivotal Fed meeting that will set the outlook for tightening. I don’t think Powell will be able to avoid raising rates, but I do believe it will be limited to only a .25% raise. I hold to my view from last year that the Fed will do 3 consecutive quarter point raises and start to tighten the balance sheet as much as possible. The speed of “selling” assets is where we could get some “Dovish” commentary where they decided to let things roll-off/ mature in the near term to avoid putting more pressure on bond prices.

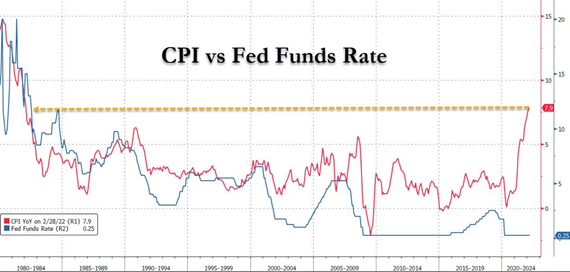

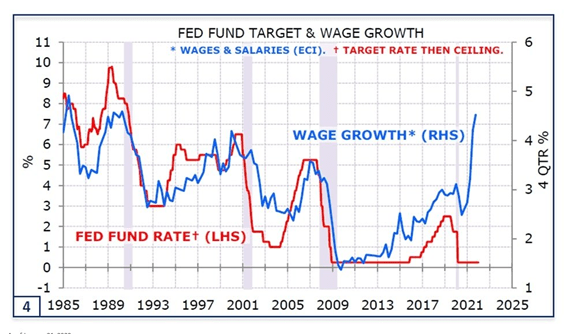

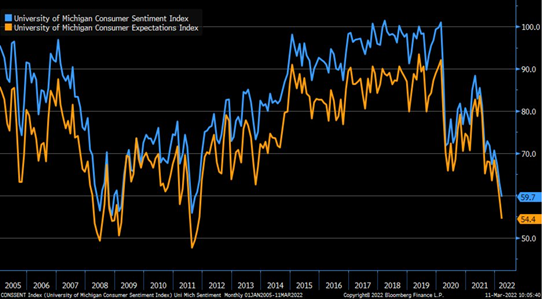

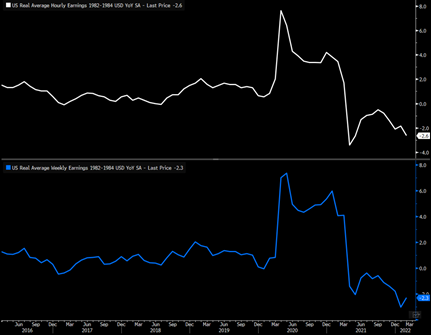

The Fed is already very far behind the inflation curve, and given the recent data: projections of prices and jobs/wages we will see a very consistent increase in rates. This will also put a bit more weight on the market but general volatility remains the name of the game. The consumer is coming under more pressure as wages fail to even remotely cover the rise in prices. Every metric is surging to new near term highs with sticky inflation the one that keeps grinding higher and will remain even if we find some sort of solution in Russia-Ukraine.

The Fed is very far behind the curve when we look at underlying wage growth/ inflation/ jobs. The last time CPI was at these levels the Fed Funds rate was 13%- it is IMPOSSIBLE for the Fed to hit those levels, but it gives more support for several rate hikes. The labor market is now well below the “natural” unemployment rate and now inflation is going into high gear (again) driven by commodity/ factory gate costs and wage prices.

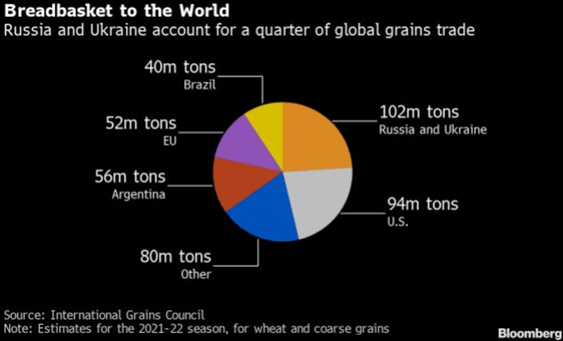

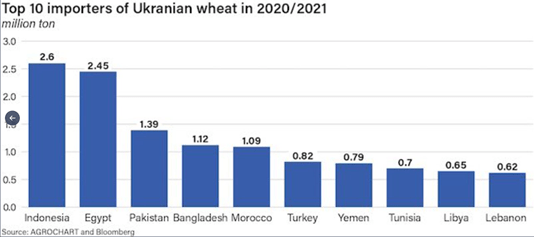

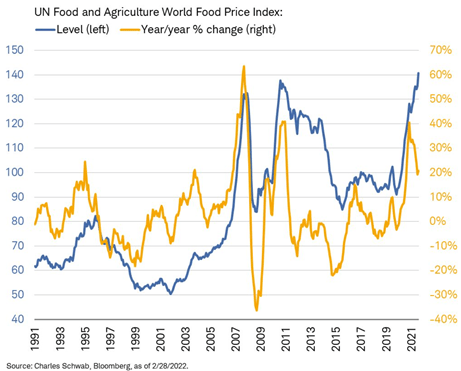

Food and housing remain a big issue around the world with the grains market getting worse by the day. Russia-Ukraine make up a huge part of the global market, and it is unlikely we will see normal movements out of the region- especially from Ukraine. We are expected Ukraine to be a “total loss” as Russia plays politics with their exports. “Russia introduces a temporary ban on grain exports to the Eurasian Economic Union countries of Armenia, Belarus, Kazakhstan and Kyrgyzstan until August 31, Tass reports, citing the economy ministry Sugar exports outside the Eurasian Economic Union also banned, Tass reports.” These are countries that haven’t condemned the actions, but also refused to commit personnel and equipment to the invasion. Putin made the request for their involvement and all the listed countries have refused to send any military support. In return- Putin is pulling some of their food availability. On the other hand, Azerbaijan signed a new agreement two days before the invasion, which is broadly viewed as support so by not cutting them off is a “reward.” The others denied Russia’s request for soldiers & equipment- while not condemning the actions- so it appears as a form of “punishment.” The below is just to reiterate how much Russia-Ukraine mean to the global grains market.

The shift in prices vs real wages in a big reason there was a steep drop in Consumer Sentiment and Expectations from the Univ of Michigan. UM sentiment dropped to the lowest level since 2011 with more pressure coming- because the full impacts from Ukraine-Russia are still trickling through the supply chain.

The below chart just puts the sheer rapid rate of change in CPI across core and broad inflation. Core commodities component of CPI #inflation (blue) continues to soar and is expanding at fastest rate since mid-1970s; rate for core services (orange) hasn’t caught up as quickly but continues to rise at fastest rate since 1990s.

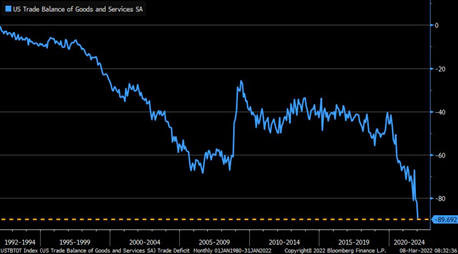

Inflation remains front and center as we face rising prices on a global scale. The U.S. remains a massive importer and is very exposed to the rising prices around the world. As factory gate prices keep rising, the U.S. consumer will be hit from multiple angles.

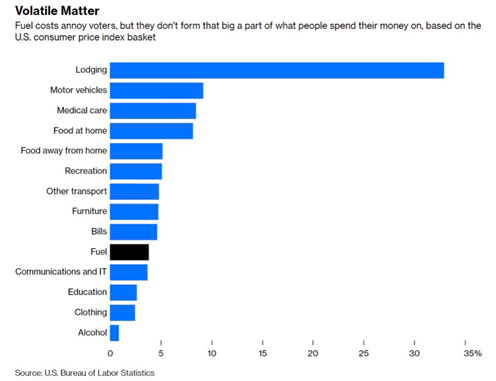

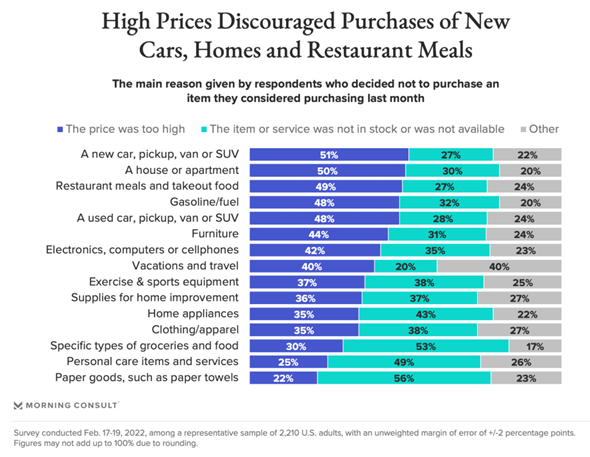

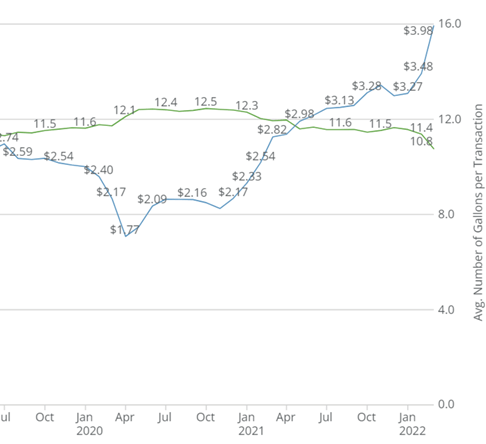

The local consumer is already getting hit on multiple levels of everyday life, but now prices have shifted even higher. We thought there was going to be a “pause” in the rate of change as price increased paused in January/February before continuing to climb in March-June. Instead, we had a parabolic move in crude/natural gas creating a knock-on effect into gasoline, diesel, and general logistic costs. The U.S. consumer spends more on other things, but each of those are also subject to fuel surcharges as diesel leads the charge. Gasoline is the most “real” connection a consumer has to crude, and it influences a lot of behaviors from spending to vacations. It is also a real gut check because the average person fills up their car at least once a week or every other week. The bigger issue is every one of the items on the bar chart below has gone up in price by a wide margin while wages have been unable to keep pace. Wages remain on an upward trajectory, but they haven’t closed the gap causing more people to reduce savings and spend more on daily life.

Even though fuel is on the lower end of what people spend money on, it influences how much people spend and view the overall market. Diesel is really the one that hits the hardest because it impacts every layer of the supply chain. Gasoline demand will come under pressure as prices remain elevated, and we haven’t even reached the point when refiners switch to summer blends. The cost of making summer gasoline is higher because of the RVP (Reid Vapor Pressure) ratio that has to be maintained- which is why there is an increase in prices by $.10-$.15. We could see a waiver on the RVP allowing for winter blend to be consumed- but I find it unlikely.

The high prices aren’t just impacting gasoline but other purchases both big and small. It isn’t surprising to see shifts in spending, but the below shows some of the broader issues going from availability to pricing. The availability of products still remains a problem, but when they are finally in stock- consumers are finding prices have spiked. This has changed people’s spending patterns by looking for more replacements.

Food prices have officially taken out the previous high from 2011 with more pressure coming as the planting in Ukraine is non-existent and Russia withholds exports. The rate of change has slowed, but it hasn’t stopped us from hitting new highs- with more to come. Diesel and fertilizer prices are still moving higher, which are all key input prices.

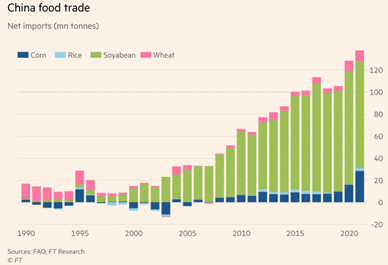

Grains is just the first in a long step of processes before it reaches you at the restaurant or is purchased at the grocery store. Each part of the supply chain has their own costs and margins to manage with a large part also being driven by labor shortfalls and logistical strain. The U.S. has the ability to feed itself, but the broad market is short and getting “Shorter” as many growing regions are seeing drought and yields falling. All the while- the global population is growing with Chinese demand surging to record levels. China is world’s largest agricultural importer … last year, it imported record 28 million metric tons of Ukrainian corn, more than double previous year’s 11 million; war now exacerbates risk for food inflation and disruption. This is another key reason we have seen China open its markets to Russian wheat and other grains to help offset the loss of LatAm and Ukraine.

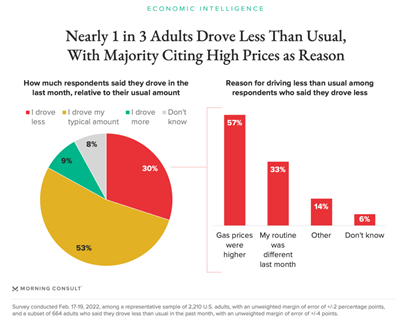

The below chart shows a shift in the amount people are purchasing at the pump as prices rise. Many times- people will fill up a set dollar amount that fits to their budgets. We don’t expect to see a huge drop-in near-term demand, but rather, a disappointing bounce in summer driving season. As food prices surge and general living costs while wages disappoint, it will cause people to rethink travel plans and look to stay local vs broader travel.

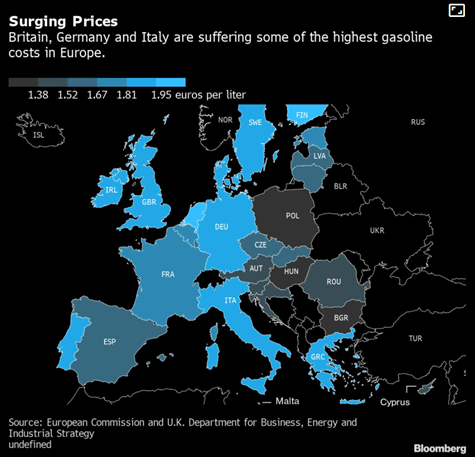

The pressure continues to mount as prices drive higher around the world and it will hit hardest at the emerging market level. Gasoline and diesel prices will remain elevated around the world, and will force Ems to adjust their subsidizes. This will be a much bigger shock to the demand profile as we stay in a rate rising cycle directly into a recession. It is also a big issue in Europe where prices remain excessive, and the local consumer was already struggling way before COVID ever burst onto the scene. They are taking the brunt of the pressure from the Russia-Ukraine war impacting broad spending patterns. We expect to see a fairly sharp curb in consumer active globally driven by fear, cost, and weak wages.

Even as the market expects to see shortages in the crude market- we continue to see softness out of WAF. Asia is currently purchasing cheap Russian cargoes which is leaving more WAF in the market. As Europe/US come out of turn around, we will see some additional purchases originating from the region:

Vitol reduced its offer price for Nigeria’s Okwuibome crude on the Platts window for the third time this week. Angola’s Sonangol offered to sell 1m bbl of Plutonio crude for late-April loading. IOC bought almost 3m bbl combined of Nigerian and Cameroon crude from Vitol and Shell via tender for May loading.

PLATTS:

- Vitol offered 500k bbl of Okwuibome for March 15-25 arrival to Augusta at $2.60/bbl more than Dated Brent; vessel is Montesperanza: trader monitoring window

- A cargo with similar arrival dates was offered at +$3/bblon March 10, +$3.60/bbl on March 8, +$4.20/bbl on March 7

Vitol reduced its offer price for Nigeria’s Okwuibome crude on the Platts window for the third time this week. Angola’s Sonangol offered to sell 1m bbl of Plutonio crude for late-April loading. IOC bought almost 3m bbl combined of Nigerian and Cameroon crude from Vitol and Shell via tender for May loading.

PLATTS:

- Vitol offered 500k bbl of Okwuibome for March 15-25 arrival to Augusta at $2.60/bbl more than Dated Brent; vessel is Montesperanza: trader monitoring window

- A cargo with similar arrival dates was offered at +$3/bblon March 10, +$3.60/bbl on March 8, +$4.20/bbl on March 7

Asia is going to keep playing hardball in order to drive down the price of Russian crude because many of them need ESPO and SOKOL for the diesel output.

Sokol oil from the Sakhalin-I project in Russia’s Far East was offered by ONGC Videsh for May-loading, with the latest price indications showing deep discountsfor the grade. The failure to attract bids follows a similar pattern to Russia’s Urals crude, which has struggled for buyers despite being incredibly cheap.

Sokol is a favorite crude of Asian buyers such as South Korea, China and Singapore, as well as Hawaii. The lack of interest could provide a sneak peak into what’s to come next week when another Far East Russian grade — known as ESPO — begins trading for the month. China’s independent refiners in the Shandong region are typically big consumers of the oil.