- Baker Hughes will benefit from the North American natural gas market’s stability and the Latin America and the Middle East markets’ recovery in 2022

- In recent times, it has veered towards clean energy-related business transformation

- However, commodity price inflation and supply chain issues can offset some of the profitability gains in the short term

- BKR has strong liquidity, while its free cash flows improved remarkably in the past year

Market Outlook

Baker Hughes’s (BKR) management sees myriad factors pulling the energy market in the opposite directions. While the demand side is improving fast post-COVID-19, the interest rate tightening in the US will keep the consumers under leash. On top of that, the energy operators’ capex budget is not loosening up fast. However, the Russia-Ukraine conflict can force the US and Middle East energy producers to accelerate the production growth plan, which will benefit oilfield service operators like Baker Hughes operating in these regions. The crude oil, natural gas, and LNG prices received a shot in the arm following recent geopolitical changes.

The LNG market is positioned to undergo a structural change in the coming days. BKR’s management expects to see a rise in the number of FIDs in the LNG market in 2022 and an extension of the contract terms. The European Union’s recent vows to reduce the reliance on Russia for natural gas can be interesting in this regard. In March, BKR received a contract to provide a liquefied natural gas (or LNG) system with 24 modularized compression trains. The contract is part of a 70 MTPA (million tonnes per annum) supply agreement with Venture Global LNG.

Strategy And Clean Energy Project Awards

Along with the traditional oilfield services and equipment business, BKR plans to expand into industrial energy technology. With this aim, it has recently created The Climate Technology Solutions Group (or CTS) and Industrial Asset Management Group (or IAM). CTS will offer a solution in carbon capturing, hydrogen, emissions management, and clean and integrated power solutions. The company’s resolve to penetrate these markets can be gauged from its recent acquisition of Electrochaea, a biomethanation company’s early stage.

In hydrogen, it invested in Ekona, developing turquoise hydrogen production technology. It received an award for gas turbines and compressors to support the Pluto LNG onshore processing facility expansion in December. In IAM, it will offer services in digital capabilities and software.

Natural Gas And LNG Market

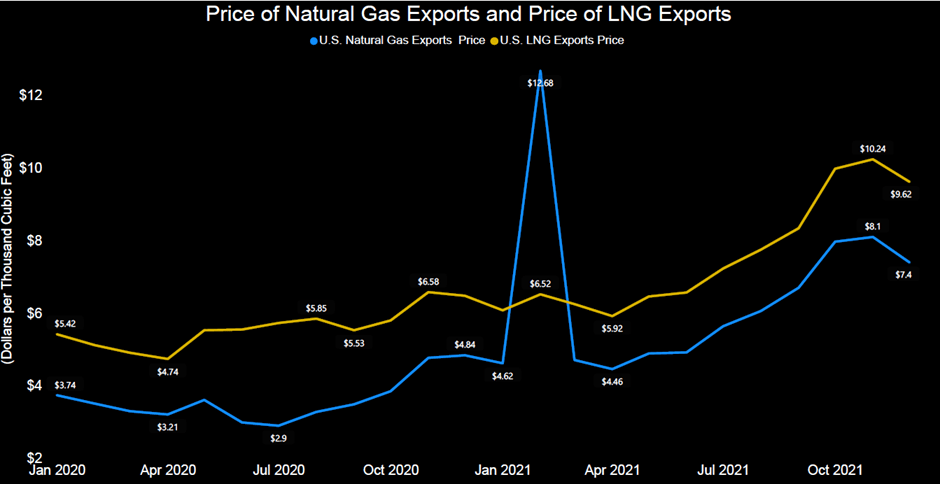

The natural gas export price increased by 53% in the past year until December 2021. The LNG export price, during the same period, increased by 48%. The EIA expects natural gas production to increase marginally (1.5% up) in 2022 compared to the current level and increase even more in 2023 (3.3% up compared to 2021). The natural gas spot prices can average $3.83/MMBtu in Q2 2022 and decline to $3.59/MMBtu, on average, in 2023. However, the geopolitical volatility arising from the Ukraine-Russia conflict has made it difficult to estimate the price with a fair degree of accuracy.

According to EIA’s recent analysis, the largest share of natural gas demand will emanate from the industrial sector as natural gas is increasingly used as a chemicals feedstock and heat-and-power consumption in the near to medium term. In the medium to long term, natural gas production will meet export demand, the majority of which will be LNG.

Oilfield Services: Outlook And Performance

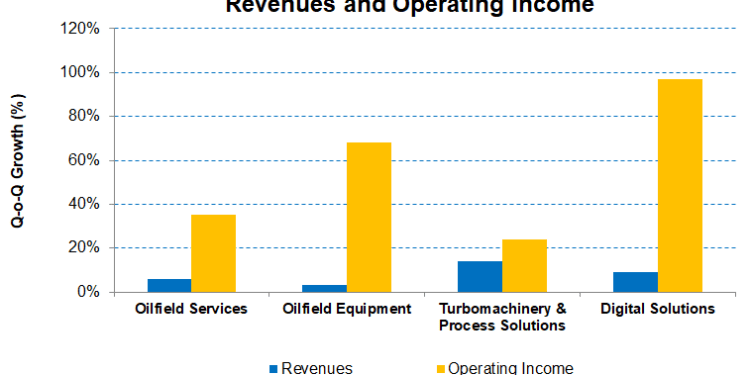

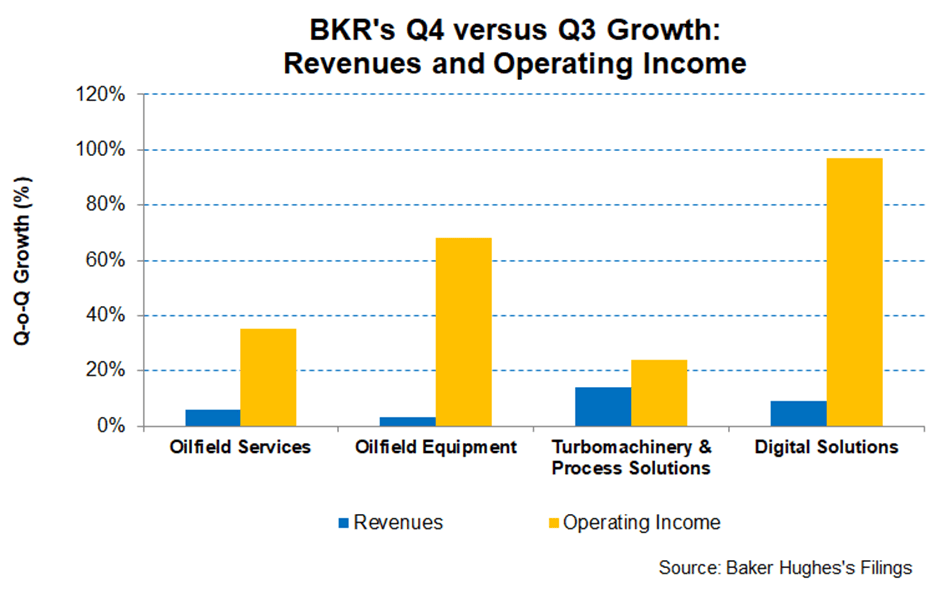

In Q4, revenues in this segment increased by 6% compared to a quarter ago, while the operating profit registered a 35% rise. In 2022, a strong recovery in the energy activities in Latin America and the Middle East will drive revenues. North American growth will be positive but not spectacular. The Middle East is likely to be at an early stage of a multi-year recovery, which is why it attracts capital to restore production in the short term and expansion in the long term.

In Q1 2022, however, revenue will face the typical seasonal slowdown, while operating margin can see a bit of pressure following supply chain disruptions and commodity price inflation. BKR expects revenues and margin in this segment to decline modestly compared to Q4 2021. In this context, investors might be interested in knowing the frac spread count changes – a key indicator for the oilfield services companies. According to Primary Vision’s forecast, the frac spread count (or FSC) reached 266 by the third week of March and has gone up by 14% since the start of 2022. In January, BKR’s frac spread count increased substantially compared to a year ago when it nearly stopped operating any spread. There can be, however, downward pressure in the short term with regard to utilization and frac pricing per stage.

The Oilfield Equipment (or OFE) Growth Drivers

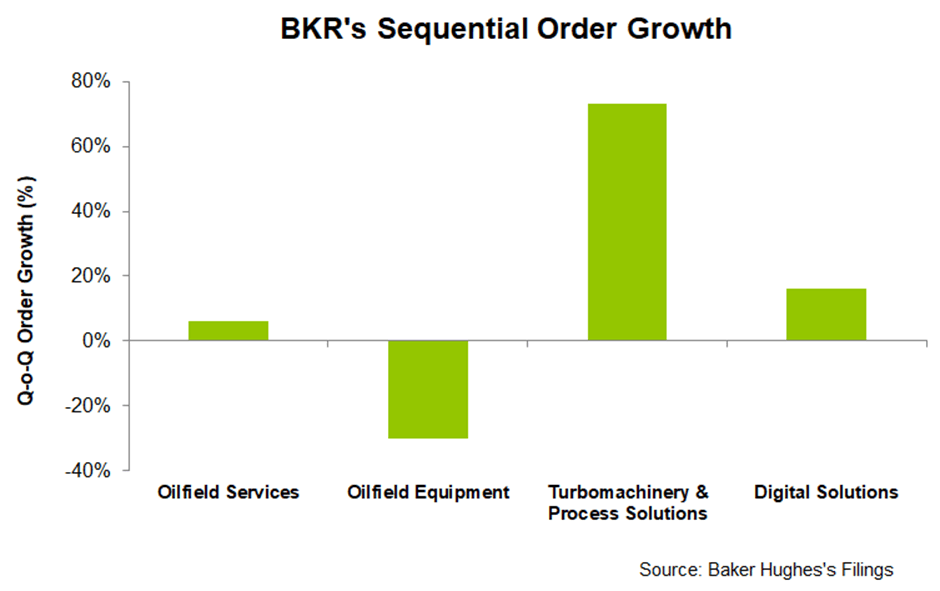

The segment revenue is headed for a revenue slowdown in Q1, with sales dropping by “double-digit,” as expected by BKR’s management. Operating income can also decline by “low single digits” in Q1 versus Q4. The subsea tree market, a key offshore energy indicator, is likely to increase in 2022, although it may fall short of the pre-pandemic level. As a result, the company’s international wellhead and subsea services businesses should get a boost in 2022. In Q4, it announced a 10-year contract for surface wellheads and tree systems in the UAE. There are also strong order prospects in the North Sea and Sub-Saharan Africa. However, investors might want to keep in mind the structural challenges from years of underinvestment in the offshore market and energy companies’ budget constraints.

In Q4, the segment revenues increased slightly (by 3%), although the operating income made significant progress (68% up) during the quarter. In Q4, backlog in the OFE segment decreased by 30% compared to Q3 and indicated topline deterioration in the coming quarters.

Analysis: The Turbomachinery & Process Solutions (or TPS) Segment

Sequentially, in Q4, the segment revenues increased by 14%, while the operating income shot up by 24% during this period. In Q1, the subsea drilling systems (or SDS) business can see revenues unchanged. However, opportunities in the LNG, offshore production, and new energy brighten the 2022 outlook. In 2021, it booked $7.7 billion of orders, including 22 MTPA of LNG orders. Over the next two to three years, the management sees order prospects worth 100 MTPA to 150 MTPA in LNG.

The non-LNG business booked an award for the NEOM carbon-free hydrogen project, which relates to an earlier announced Air Products award in Saudi Arabia. Based on the outlook, the operating income can increase marginally in Q1 compared to Q4.

The Digital Solutions Segment Outlook

In Q1, the company expects a higher backlog to generate higher revenue. Operating income margin, however, may decline marginally. In FY2022, the transportation and aviation end markets and energy markets will support a sales rise. However, supply chain challenges and chip shortages will affect its operating income adversely. Key opportunities lie in condition monitoring and Industrial Asset Management solutions markets.

Revenues in the Digital Solutions segment increased (9% up) due to industrial end markets growth while operating income nearly doubled from Q3 to Q4. Orders in this segment increased by 16%, sequentially.

Dividend

BKR’s annual dividend is $0.72 per share, amounting to a 1.91% forward dividend yield. Halliburton’s (HAL) forward dividend yield (1.28%) is lower than Baker Hughes’s.

Cash Flows And Debt

BKR’s cash flow from operations was $2.37 billion in FY2021, which was a sharp improvement compared to a year ago (82% up). Although year-over-year revenues remained flat, substantial growth in the working capital led to the surge in CFO. As a result, free cash flow (or FCF) increased steeply (255% up) in the past year. In 2022, the company expects free cash flow conversion from adjusted EBITDA to be ~50%.

Baker Hughes’ liquidity (cash plus revolving credit facility) amounted to ~$6.9 billion as of December 31, 2021. Its debt-to-equity (0.40x) is significantly lower than the peers’ average, suggesting the balance sheet strength. Of the $2 billion share repurchase plan announced in 2021, during Q4, it purchased shares worth $328 million at $25 each, on average. The current stock price is higher (~$37 per share). Since the balance sheet is strong and cash flows are rising, it can additionally invest in M&As and make other technology investments in the future.

Learn about BKR’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.