As we head into the weekend it is a good time to take stock of what is happening in the global markets. I have written about Sri Lanka, inflation, and other topics but in this article we will try to zoom out and take a bigger picture view and discuss some data points/economic indicators. Mark has spoke about these at length in our recent ECON show and I think it is a must watch along with the FSC show.

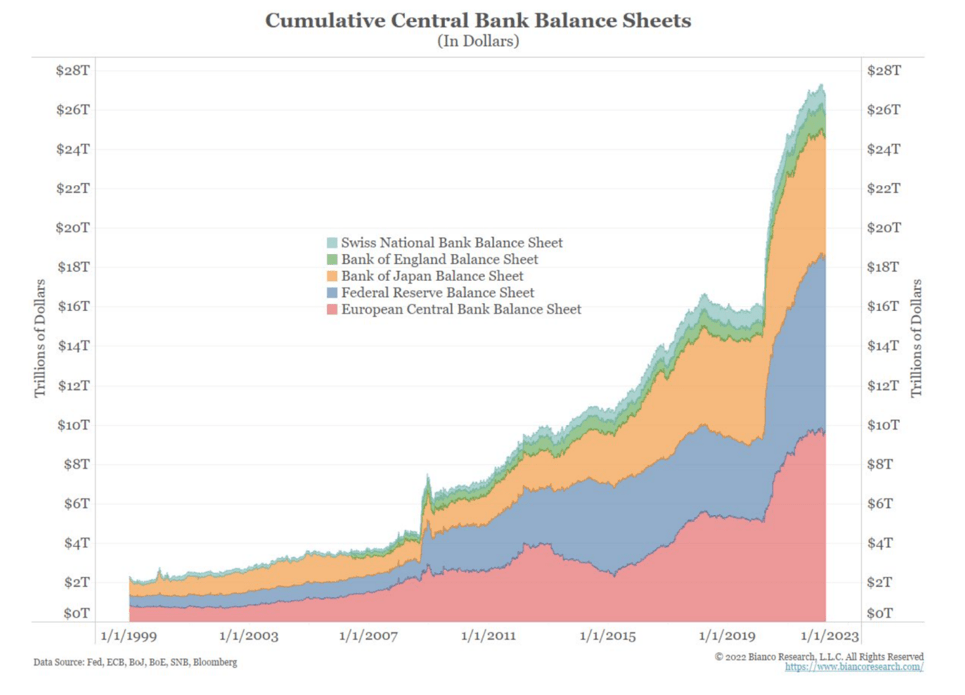

Let’s start off by looking at the balance sheets of 5 of the most important central banks across the world. The phenomenon is interesting as one can observe a huge spike after the pandemic. As Mark mentions that since the beginning of COVID, U.S. added $12 trillion to the balance sheets and the question is how much of it will be coming off as we see some tightening in the markets.

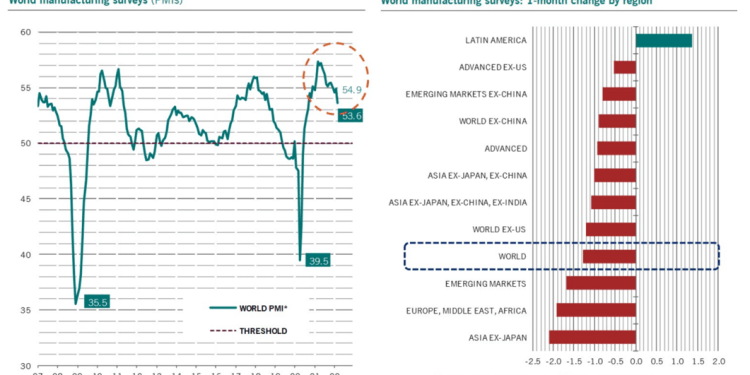

Global manufacturing PMI is also heading down, as the graph below shows. With a global recessionary monetary policy happening another important question is will this lead to recession? I personally believe yes, however, when no one knows!

There has been an uptick in global trade but we also have to remember that there was a huge supply chain disruption issue (read: back log). Speaking of disruptions, as COVID 19 has resurged in China, the supply chains will remain under pressure. This is a very interesting and insightful documentary by Wall Street Journal on this issue.

Let’s take a look at another leading indicator i.e. World Manufacturing PMI. Note that there is a dip of 1.25 points on MoM basis with other regions suhc as emerging markets and Africa down further. Here is where Mark really highlights the nuances that we don’t get at times. He says PMI isn’t negative (above 50 , we are still growing) so the calls for a massive global recession might be overblown or too early. But we are seeing more pressure and heading downwards. The question is when will we go negative? The pressure is on the downside – input prices are spiking – and the next stop might be near to 51. In 2019 it was steady, we were bearish as there were some decelerating moves. We are seeing something very similar to this slowdown but the difference is that in 2019 we only had pressures on the quatitative side whereas now we are seeing multiple issues all at once.

Speaking of multiple issues, let’s talk about inflation. We have spoken about this at length and multiple times that this is not a temporary issue but a structural, sticky, ‘here to stay’ one. This is evident by the rising food prices which has been made worse by Russia’s invasion of Ukraine – as both are extremely important players in the food sector. This has caused a domino effect with Sri Lanka imposing emergency after protests sparked and became uncontrollable. Similar conditions can be seen in Peru where rising food costs have forced people to come out on streets against the incumbent government. This phenomenon isn’t only confined to emerging markets, it is also happening in countries like the UK as well.

All in all, these are signs that things are headed towards a point where, as Adam Tooze mentions in his book Shutdown, different crisis (polycrisis) might converge into one megacrisis. Chances are it will be financial in nature.