- Most of the sell-side analysts recommend “Buy” for FTI

- The stock has a 34% return potential at the current price, according to sell-side analysts

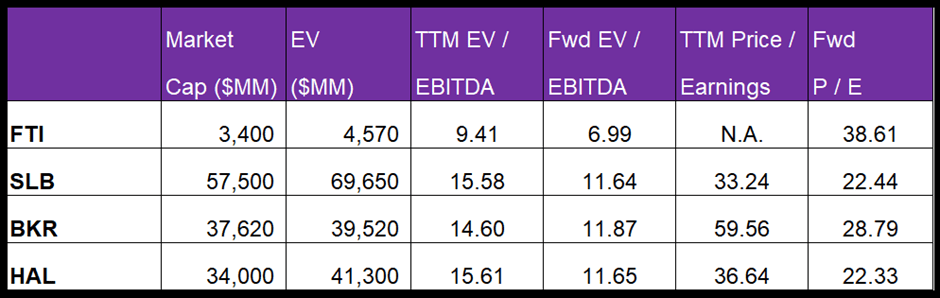

- The stock is relatively undervalued versus its peers

In Part 1 of this article, we discussed TechnipFMC’s outlook, performance, and financial condition. In this part, we will discuss more.

What Does The Relative Valuation Tell Us?

FTI’s forward EV-to-EBITDA multiple contraction versus the adjusted EV/EBITDA is steeper because its EBITDA is expected to rise more sharply than its peers in the next year. This should typically result in a higher EV/EBITDA multiple than peers. The company’s EV/EBITDA multiple (9.4x) is lower than its peers’ (SLB, BKR, and HAL) average of 15.3x. I think the stock is relatively udnervalued at this level compared to its peers.

Analyst Rating

According to data provided by Seeking Alpha, 16 analysts rated FTI a “buy” in April (including “Strong Buy”), while nine recommended a “hold.” None of the sell-side analysts rated it a “sell.” The consensus target price is $10.5, which yields ~34% returns at the current price.

What’s The Take On FTI?

In 2021, FTI invested significantly in Subsea 2.0 and iEPCI technologies and received an order boost through the adoption of iEPCI and the continued strength in LNG and downstream project sanctioning. By 2025, the company expects to see a multi-year subsea upcycle in subsea. In the short term, subsea tree orders will grow, mainly in the North Sea, Gulf of Mexico, and West Africa. The US LNG export price has also increased steeply over the past year as supply tightens amidst the geopolitical situation that deteriorates in Europe after the Russian invasion. Significant order growth in the subsea segment will lead to higher revenue and margin expansion in 2022.

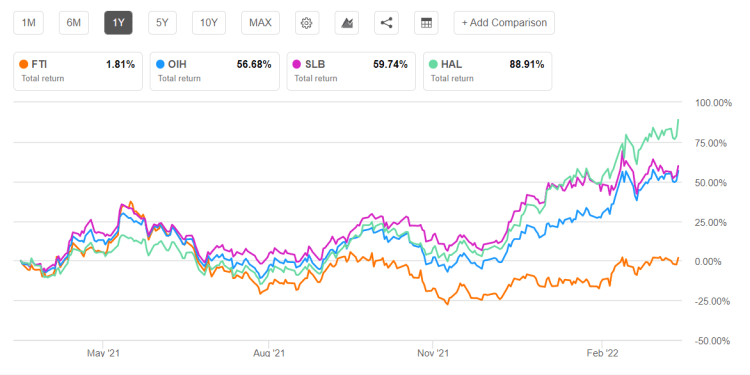

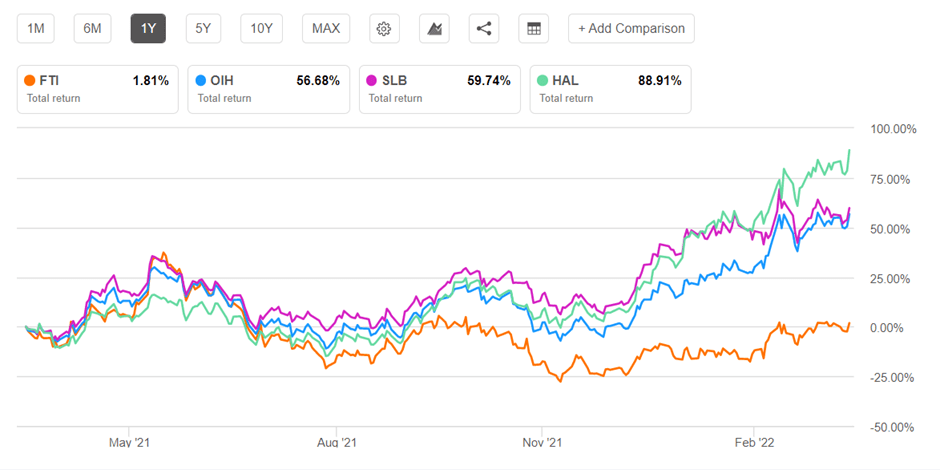

However, the company will face margin headwinds following its investment in new international manufacturing capacity, which led to increased expenses. So, the stock significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Over the long term, the company focuses to build a strong renewable energy portfolio through offshore renewables and green hydrogen. The company’s capex is set to go up, indicating that its FCF can decrease in FY2022. However, strong liquidity will cushion against any cash flow pressure. Over the medium term, I expect returns from the stock price to strengthen.