- Following the US rig count and crude oil price recovery, NBR’s US operations have shown considerable improvement in Q1

- Expect the pricing to inflate; much of the rig count gains, however, will confine to the US in 2022

- In the renewable energy sector, the company has revised up into carbon reduction target

- A leveraged balance sheet with negative free cash flows is a concern for the investors

The Drilling Outlook And Strategic Focus

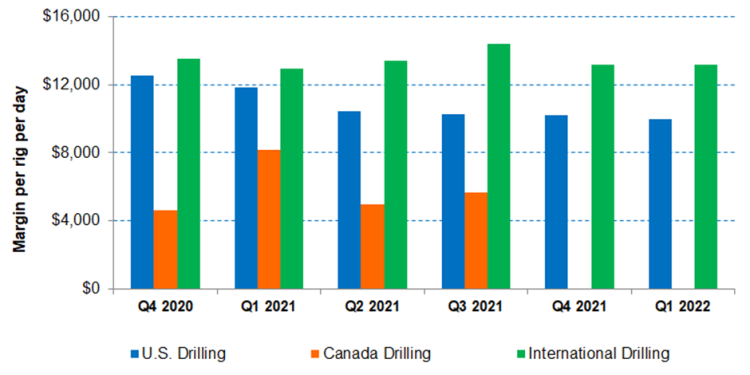

NBR’s U.S. Drilling topline recovered strongly in Q1 2022 after a sedate performance in 2021. One of the leading drivers for improved performance is the 49% rise in average drilling rigs in the US. Also, the market generated from NDS (Nabors Drilling Solutions – focuses on managed pressure drilling, casing running, and directional drilling automation) incrementally contributed a margin of $533 per day in Q2.

Automation, digitalization, and robotization are the company’s pillars for the topline and margin growth. Also, integrated casing and a smart suite across the rigs should help improve margin further. For example, NBR’s R801 automation modules will soon be applied to one of the company’s rigs in the Permian. Over time, the automation modules are likely to be deployed on most of the existing high-spec rig fleet. One of the critical growth areas in the US onshore is the revenue growth from the third-party rigs. The third-party customers accounted for more than 20% of NDS’s US onshore revenue.

International business’s share in Nabors came down to 47% in Q1 2022, after rising steadily in 2021. Saudi Arabia can see further addition before the end of 2021. The company has a joint venture (SANAD), which is expected to drive the company’s business in the Middle East. The first newbuild, which is ready to join the fleet, has been delayed from Q1 2022 to Q2. After that, the rest four of these newbuilds will join in each quarter. Estimate each of these new rigs will generate an annual EBITDA of approximately $10 million. The JV’s long-term plan is to build 50 units over ten years, translating into a massive addition to the margin.

Due to the pressures on the supply chain with the company’s internal manufacturing infrastructure, the lead time will stretch. So, the company increased its inventory level to avoid delivering the components and spare parts to its customers, which affected its Q1 2022 cash flows adversely.

Energy transition initiatives

In the carbon reduction initiatives, NBR has struck agreements to market multiple fuel additives, which would reduce fuel consumption. After reducing greenhouse gas by 10% in 2021, it aims to reduce it further by 7.5% in 2022. Extending the technologies used in these operations, the company is investing in several early-stage geothermal energy companies with strong growth potential. In March, it added to its clean energy portfolio with an investment in GA Drilling. The investment will complement NBR’s deep-drilling technologies for super-hot, ultra-deep rock reservoirs. I think these will bring additional revenue growth opportunities in the medium term.

Rig Count Outlook and Performance

Over the past few quarters, the drilling activity improved, leading-edge day rates increased, and industry utilization increased. In Q1 2022, the company’s U.S. Drilling rig count increased by 49% on average compared to Q1 2021. As a result, revenues from U.S. Drilling increased by 53% in the past year. We think the pricing will continue to inflate.

The management estimates the company’s rig count to increase by six to seven rigs in Q2. Much of the rig gains are expected to emanate in the US. In international operations, the rig count can see a more modest growth following the deployments of the first SANAD in Kingdom rig and another advanced 1200 Series rig. The rig additions may accelerate in Saudi and Latin America by the end of the year.

Capex And FCF

In Q1 2022, NBR’s cash flow from operations (or CFO) was decreased by 48% compared to a year ago, despite the year-over-year revenue rise in the past year. Adverse changes in the collection of receivables, other deferred revenue arrangements, and payments of operating payables resulted in a cash flow decrease. In Q1 2021, the company’s capex more than doubled compared to a year ago. Higher capex and the rise in CFO led to free cash flow turning negative in the past year. The company is targeting breakeven free cash flow in Q2 2022. Lower working capital buildup and the absence of material annual payments would allow the working capital to decline. The company plans to deliver ~$100 million of free cash flow in 2022.

Its debt-to-equity (or leverage) is much higher (3.8x) than many of its peers (HP, PTEN, and PDS). In Q1, the exercise of warrants reduced net debt exceeding $120 million and freed from near-term debt obligations. NBR’s liquidity is $744 million (cash & investment and borrowing capacity).

Learn about NBR’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.