- While RES does not plan to add to its hydraulic fracturing fleet in 1H 2022, it may add another in Q3

- Strategic changes in its pressure pumping service line following the sand supply issues can lead to lower costs and higher margin

- Its cash flows dropped significantly in Q1

- However, zero debt and a healthy liquidity base save from financial risks

The Strategy And Outlook

As the energy prices went through the roof in early 2022, energy customers increased their planned activities. The energy drivers intensified following Russia’s invasion of Ukraine. However, the situation brought significant volatility into the system as the demand side would be adversely affected as the global economy suffered from the war. Also, the management conceded that capex would remain partially restricted.

Nonetheless, RES’s management is convinced that it can plan with more uncertainty than before as the energy upcycle unfolds. The older pressure pumping equipment will continue to retire as new and modern frac fleets arrive. So, the company will focus on improving cash flows and plans to increase shareholder returns soon.

RES will continue to operate eight horizontal pressure pumping fleets in the near term in 2022, after adding three in 2021. Some of its pumps are Tier 4 dual-fuel fleet optimized for fuel burn, minimum emissions, and low maintenance costs. Currently, it is working on adding another fleet to the count, but the process is more likely to finish in Q3.

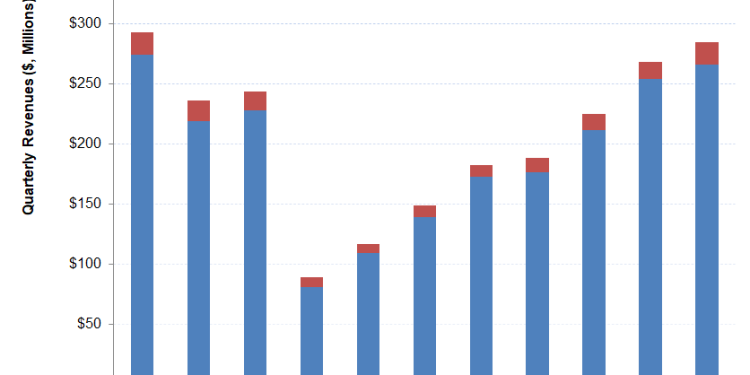

RES is impacted relatively less by the supply chain-related cost rise than other oilfield services companies. In Q1 2022, Pressure pumping remained the primary revenue generator (42%), followed by thru-tubing service line (28.5%) and coiled tubing (9.4%).

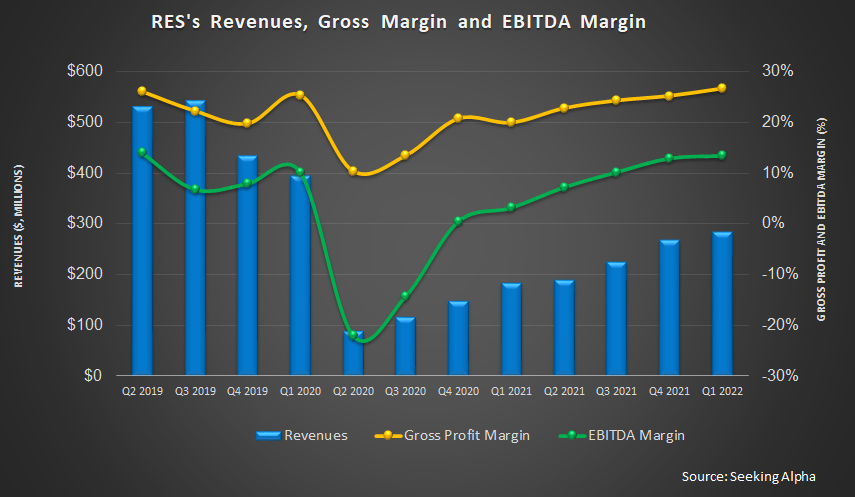

By early 2022, the pricing environment in the fracking and oilfield equipment industry improved, leading to a price hike that exceeds the cost increase following the disruption of supply chains. This was remarkable given the continued pressure from supply chain and personnel issues following COVID. In Q1 2022, its gross profit margin expanded by 140 basis points, while the EBITDA margin remained resilient (50basis points up) compared to Q4 2021.

Analyzing Industry Indicators

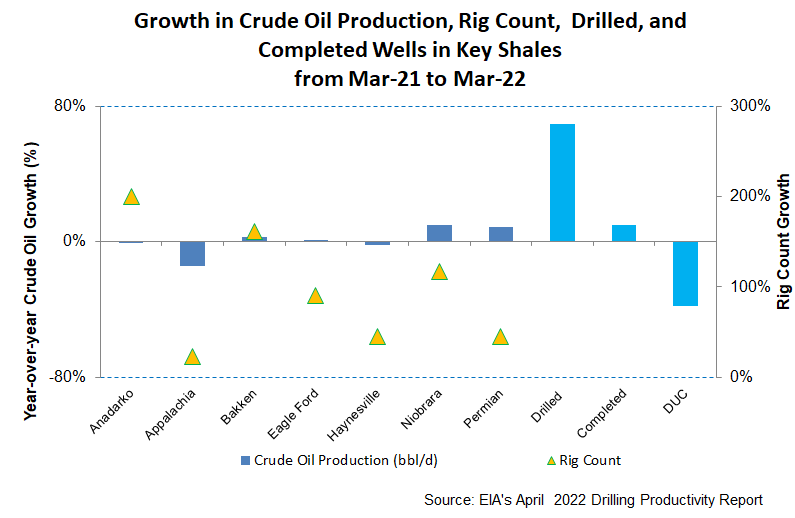

In the past year, until March 2022, the completed wells count growth (10% up) underperformed the drilled well count (70% up). But, the drilled but uncompleted wells declined (38% down). Niobrara (10% up) and Permian topped (9% up) among the shales that saw higher crude oil production in the past year. Crude oil production in Appalachia decreased the most (14% down).

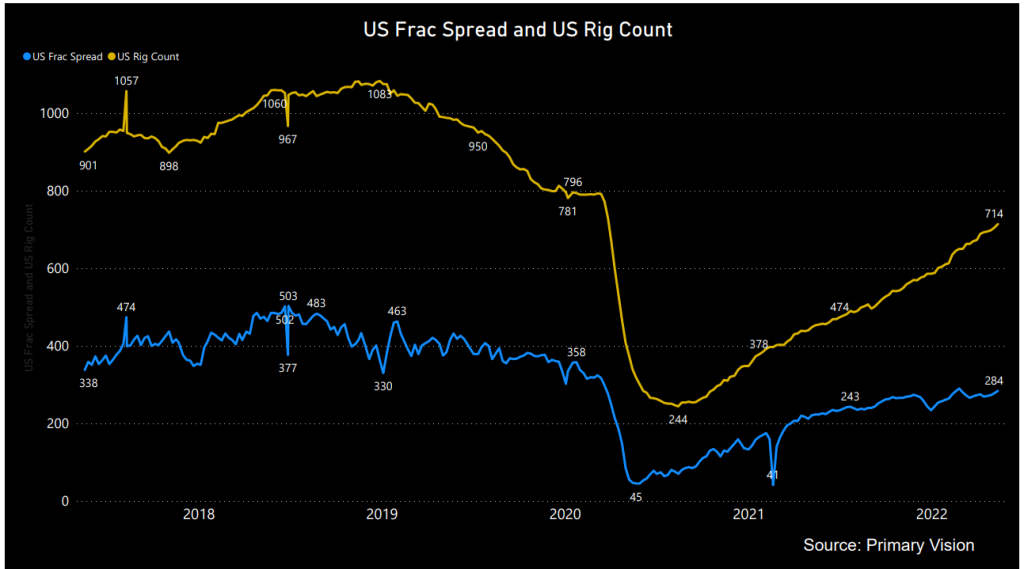

The average crude oil production in these shales went up by 1% in the past year, despite the crude oil price’s upward run. Since the beginning of Q1 (i.e., January), the US rig count pressed ahead (21% up). The US frac spread count went hand-in-hand, as estimated by Primary Vision. So, the short-term indicators are encouraging.

What Were The Q1 Drivers?

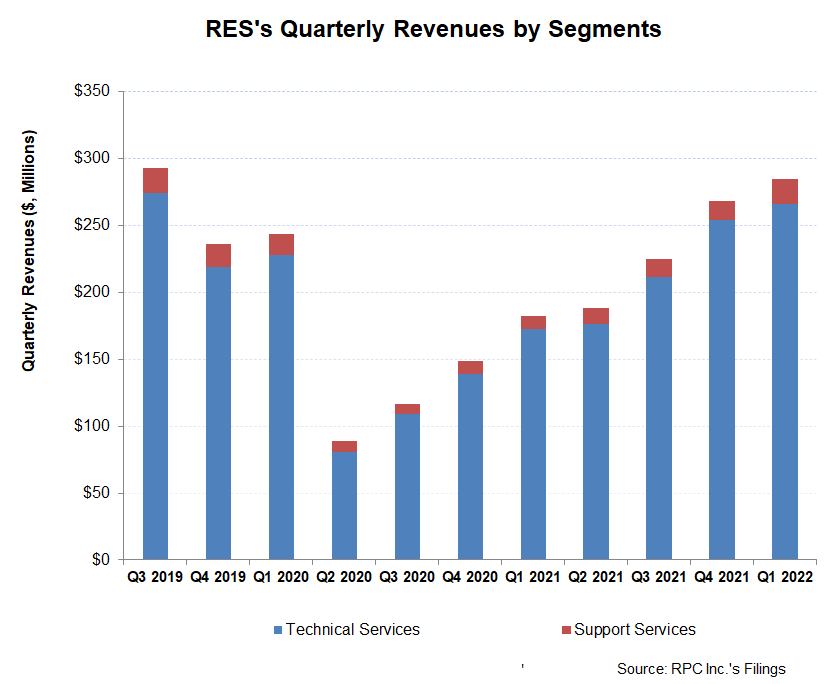

In Q1 2022, Technical Services revenues increased by 5% compared to Q4 2021. An improved job mix in the service lines and pricing hike led to sequential revenue growth. The segment’s operating income also went up (6% up) in Q1.

Overall, the company’s cost of revenues (as a percentage of revenues) increased. However, the Support Services segment saw a steeper revenue growth (32% up) in Q1, while the operating loss turned into a profit. The company made some strategic changes to its pressure pumping service line during the quarter because customer-provided sand supply issues impacted it in the previous quarter. So, the costs may decline in the coming quarters.

Capex Growth And Cash Flows

As of March 31, 2022, the company had no debt and positive cash & cash equivalents balance ($74 million). Despite much higher revenues in Q1 2022 than a year ago, cash flow from operations decreased (11% down) due to significantly higher accounts receivable, accrued insurance expense, and inventories.

The FY2022 capex forecast is $115 million, or 70% higher than FY2021. Capitalized maintenance for existing equipment and growth capex will account for the FY2022 capex budget. A rise in capex can reduce free cash flow. The company also has a $100 million revolving credit facility as of March 31, 2022.

Learn about RES’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.