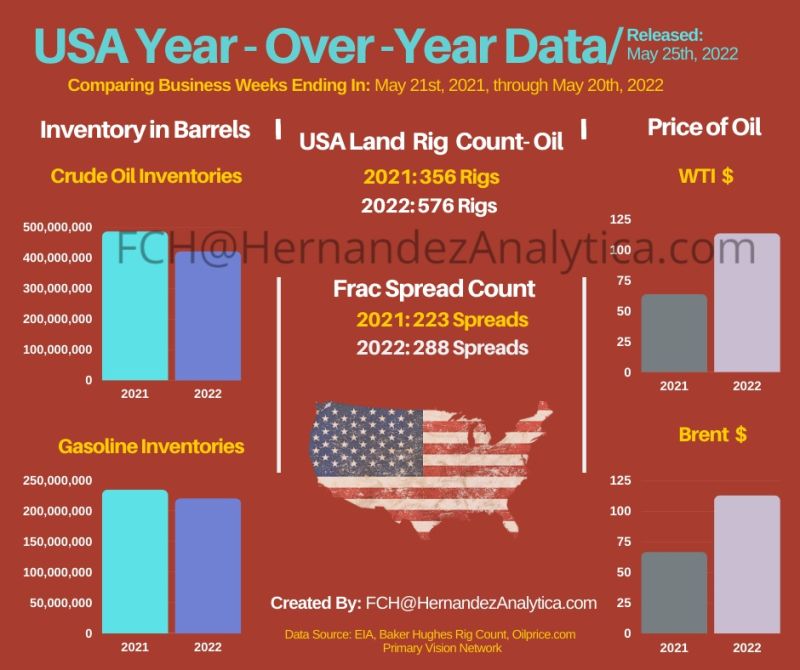

The oil rig count has increased by 13, and it is now the 9th consecutive week that a new high is set for 2022. Also, the price for Brent and WTI crude has increased by over 45.00 USD over the course of a year.

The below information that further complements the #infographic:

(Oil Rig Count: Baker Hughes report)

• May 21st, 2021: 356

• May 20th, 2022: 576

(Primary Vision Network – Frac Spread Count)

• May 21st, 2021: 223

• May 20th, 2022: 288

(Oilprice site: #WTI price:)

• May 21st, 2021: 63.58 USD

• May 20th, 2022: 113.23 USD

(OilPrice site: Brent Crude price)

• May 21st, 2021: 66.44 USD

• May 20th, 2022: 112.55 USD

(EIA Crude Oil Inventories: agency reports with a week delay)

• May 14th, 2021: 486,011,000 Barrels

• May 13th, 2022: 420,820,000 Barrels

(EIA Gasoline Inventories: agency reports with a week delay)

• May 14th, 2021: 234,226,000 Barrels

• May 13th, 2022: 220,189,000 Barrels