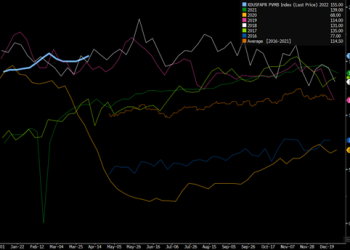

Market Trends

Emerging Markets, Inflation and Growth Estimates

Throughout this month, I have tried to specifically focus on emerging markets. Why? Firstly, these countries are the first victim...

Read moreDetailsPrimary Vision Insights – April 20th 2022

The U.S. completions market moved a bit higher again last week, and we expect to see another shift up over...

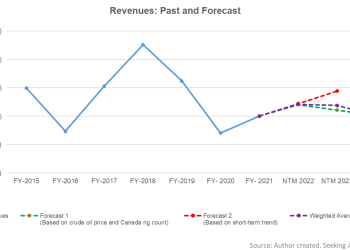

Read moreDetailsCalfrac Well Services Part 2: Estimates And Valuation

Revenue estimates suggest higher revenues in NTM 2022, but the topline can flatten or decrease afterward. EBITDA can increase significantly...

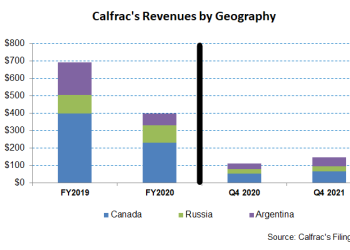

Read moreDetailsCalfrac Well Services Part 1: Cash Flow Concerns Versus Growing Activity

Calfrac's frac fleet count in the US stepped up in early 2022 but is unlikely to increase much from here....

Read moreDetailsMixed Signals in Oil Markets

Last time we talked about the cracks that are appearing in the global economy. One of the reasons for this...

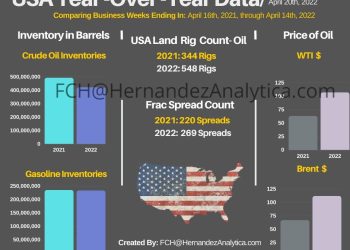

Read moreDetailsYear-Over-Year Oil Data (USA)

Key industry data is captured, as it relates to the previous business week.

Read moreDetailsPrimary Vision Insights – April 13th 2022

SUMMARY • US Completions Update • Physical Crude Market and Russian Flows • Saudi Arabia Pushes OSPs to Record •...

Read moreDetailsYear-Over-Year Oil Data (USA):

Key industry data is captured, as it relates to the previous business week.

Read moreDetailsTechnipFMC Part 2: Relative Valuation Analysis

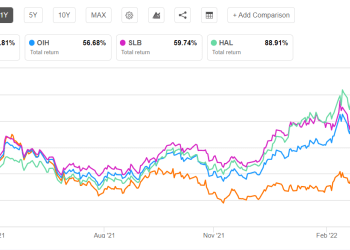

Most of the sell-side analysts recommend “Buy” for FTI. The stock has 34% return potential at the current price, according...

Read moreDetailsTechnipFMC Part 1: LNG Demand Growth And Renewable Transition Drive

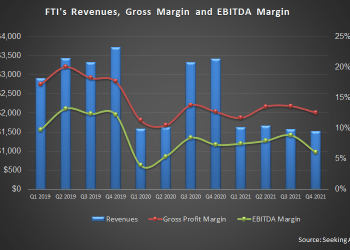

FTI's inbound order to strengthen further, indicating better revenue visibility in FY2022. A higher US LNG export and LNG price...

Read moreDetails