By Mark Rossano

The frac spread count has remained stable at about 265 spreads with the rolling 4-week average sitting at 266. We expect to see additional capacity coming into the market until mid-Nov getting us to about 275 spreads. The below shows the different between 2019 when we are looking across all the different basins. The biggest disconnect is in the Western Gulf and Williston, while the TX-LA-SALT has 7 more spreads active in the region vs 2019. The Haynesville we keep outperforming 2019 as natural gas and LNG demand remains robust and supportive of the region. We expect to see some additional activity move into the Western Gulf and the Williston as the Permian picks up an additional 1 or 2 over the next several weeks. Our U.S. crude exit rate was 11.5-11.7M barrels a day (put out in March), and we once we have the remaining GoM capacity coming online from Ida- we will be at about 11.65M barrels a day. There is still 150k-170k barrels sitting offline that Shell has said will be back online by the middle of November- about 6 weeks ahead of schedule. We expect rigs additions to have some strong additions over the next several weeks after two weeks of shifting assets. There will be a push to increase DUC inventory as we head into ’22 as drilling programs are being finalized. Due to the rampant cost inflation and labor shortages, negotiations between E&Ps and OFS companies have been ongoing for 2+ months to ensure there is enough capacity to kick off the first half of ’22. Based on our early projections, we expect the exit rate of ’22 to be about 12.3M barrels a day as work increase in the Permian, Western Gulf, Williston, and Anadarko. The NGL basket remains very supportive of activity as ethane/ethylene exports set records and LPG moves offshore at a record setting pace as well.

The demand for NGLs and LNG also remains robust with new contracts being signed with China as additional capacity is slated for ’22. We expect to see natural gas remain supportive of activity- especially in the Haynesville and “other” category. We will provide a bigger update on our LNG model this month going out over the next 10 years to give some color on where LNG flows will go and how the demand backdrop is shaping up.

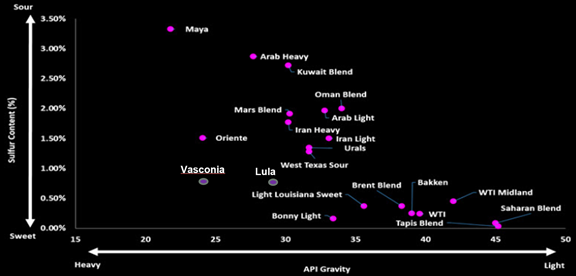

We have talked a lot about the importance of the physical market when we are looking out at demand over the next few months. I just want to go through our reasoning, and the importance of it for total demand in the global market. There are various grades that exist around the world, which yield different refined products. The “goldilocks” crude is medium-sweet because you don’t have to worry about removing sulfur, and it is heavy enough to produce a health slate of products.

The physical market is giving broad signals on the health of the physical market. As we have OPEC+ announcing their decision of maintaining course to increase 400k barrels a day, it is important to consider what is happening at the refining level. Global refiners are still struggling to make money as input costs keep rising and crack spreads remain under pressure. This is being driven by spiking input costs and sluggish demand on the backend for refined products. There has been no signal from refiners that they are looking to increase purchases as we have a large amount of crude- especially WAF- sitting in the water unsold.

Platts put together a broad backdrop in the form of the periodic table on different types of crude. Refiners will by a broad slate of products to reach the best price and the end stock they are looking to create. The refiner will also need specific processes in place and catalysts to run different slates of oil. The more complex refiners can take the heavy sour products because they have the coking capacity to remove sulfur in a cost-effective way. The less advanced asset will have de-sulfurization units that can be overwhelmed if too much sulfur enters the system. Medium-sweet and light-sweet are ideal for this backdrop, but they can also accept Urals (medium-sour), but within reason as sulfur needs to be removed. West Africa and Latin America is the largest producer of medium and heavy sweets that are typically the crude with the highest demand. Angola is always the first country to post their loading schedule, which is closely followed by Nigeria and Congo. West Africa (WAF) sets the pace for how much term buyers will pick up, and what spot prices will be across the world. Producers (Such as Saudi Arabia, Angola, UAE) sell some of their crude on term contracts, which just means there is an agreement between Saudi Aramco and CNOOC where CNOOC will have the ability to purchases up to say 4 cargoes every month. There are some key caveats in that agreement- KSA doesn’t have to take the full allotment (there is a floor and ceiling) and CNOOC doesn’t have to take the full allocation either. In tight markets, consumers will try to take the full slate as well as bid up cargoes that have been designated as spot. A producer can say- I am only giving you 60% of your allocation, and the rest is going to be put on spot price. You have the right of first refusal, but you will have to pay spot rates if you want to “reserve” these quantities. In the current physical crude market, producers are providing full allocations, and spot cargoes are struggling to clear. This shows that there is no fear on the refining side that they won’t be able to get crude.

Why aren’t refiners panicking? We must think about the timing of when crude is purchased and when it is turned into product. Here is an example: China decides to purchase an Angolan cargo for Nov 28th loading. Depending on the size of the vessel, it will take 2-3 days to fill it with the crude that has been purchased. So now- it sets sail for China on Nov 30th and takes between 35-55 days depending on the port destination. The crude will sit offshore for another 5-10 days offshore as it waits for a dock to open up. The physical cargo is now unloading around Jan 14th (taking 2-3 days) and will go into a temporary holding tank either at the port for about a week or so. This just means it will take another week between holding tank and pipeline to get to its next destination of a refiner holding tank for normally another 2-4 weeks. The oil enters the refiner around Feb 14th and after a day or two exits the other side as a refined product. Now as gasoline/diesel- it will sit in storage for another 2-4 weeks (maybe longer) as it waits to be moved into the market. So physical crude purchased in Nov won’t start moving to the market until at least March 14th. Just using gasoline for example: it will take another week moving through a pipeline or truck to get to the blender where it will sit in another tank waiting for the gasoline to be moved to the rack and eventually a truck. It will go from the truck to the gas station holding tank where it will eventually go into a gas tank for end market consumption.

The underlying price they pay is determined by the average of the 5 dated brent quotes immediately after the bill of laden (when boat finished loading) so the average for this boat would be the average of the 1-7th of December. (4 and 5th are weekend). You then add the differential you negotiate onto that average.

The sailing time of vessels is important to the refiner so they can time cargoes to stagger deliveries, but it also increases underlying cost for the crude as day rates, insurance, and other input costs increase the further away you go. U.S. crude trading at such a steep premium to Dubai (and other Middle East grades) as well as West Africa has limited the amount that is flowing into Asia given premiums and other input costs. The same can be said for flows coming out of Europe and North Sea towards Asia. We have seen a big slowdown in purchasing that is originating from Europe and the U.S. heading into Asian markets, instead- Asia has been steadily buying Middle Eastern grades with some sporadic West Africa cargoes.

The below chart provides a backdrop of what compliance has been for oil producing nations. The narrative spin on West Africa is that they can’t meet their production quotas, but as we have been saying for months- they are struggling to sell even reduced volumes. Why would they look to produce at their allotted quotas if they can’t sell the reduced ones? It costs money to pull crude out of wells and store it in onshore/offshore storage, so might as well use natures storage and leave it in the ground. The “overcompliance” will remain in place as the physical market remains a problem for West African grades. There was hope (mine included) that India, Japan, South Korea, and other ASEAN nations were going to start picking up more spot cargoes. India was the first to disappoint with a slow purchase, and now South Korea sold their term supply of Murban: “Korea National Oil Corp. sold term supply of Abu Dhabi’s Murban crude for 2022 at a premium of ~10c-13c/bbl to the grade’s OSP, said traders who asked not to be identified.

• Buyer was China oil

• KNOC will supply ~300-350k bbls of Murban grade per month for cargoes loading next year”

ASEAN nations have not shown up in any meaningful size even though there has been a directive to increase the storage of distillate ahead of the winter months. Many nations have been looking to ensure there is redundance heading into a questionable winter with huge price spikes on fuel sources.

The physical market is already selling crudes that will become crudes in Mar ’22 (more on that later), and there has been no impetus to increase purchases based on crack spreads or refined product storage. During the OPEC+ meeting, there was commentary around gas to oil switching, and the prevailing view is that it has reached 500k barrels a day and could top out at about 600k barrels a day. The interesting point of the commentary was that it has already happened, which would match up well with recent commentary from Asian nations. This is interesting because if it is already factored into the current physical market- the next wave of OPEC+ increases will need to be tracked closely to see how much is absorbed into India and other Asian nations. So far they have been slow to increase their physical purchases. Many of them provided directives to increase total available diesel/ fuel oil, with China going so far as to ban the export of gasoline and diesel. They have since allowed gasoline to be exported but have maintained restrictions on diesel exports until they meet “sufficient” levels. China’s refiners are set to halt the export of diesel for the rest of the year due to tight domestic supply, according to industry consultant JLC. Exports may potentially resume in the first quarter of 2022. Gasoline exports will continue, with refiners are expected to ship 770,000 tons of the motor fuel in November. “China has “effectively eased” its tight diesel market after top producers increased supply under government coordination, according to a report on Sunday from the nation’s state-run broadcaster CCTV.”

China went a step further and called on families and local governments to stock up on daily necessities as the country enforces stringent restrictions intended to curb a number of Covid outbreaks. The Chinese Ministry of Commerce issued the guidance in a statement on Monday. The Economic Daily, a Communist Party-backed newspaper, said that the directives were an effort by the government to prepare the public for Covid lockdowns in the prelude to winter.

It wouldn’t hurt to stock up on “a reasonable number of daily necessities” this winter.

That was the message from the Ministry of Commerce (MofCom), buried in a much longer routine notice issued late Monday about how it is managing weather-related vegetable price spikes.

By Tuesday morning, the call to stock up had gone viral across Chinese social media.

• Many read it as the sign of an impending crisis.

• Lines formed outside supermarkets around the country.

• Skittish investors bailed out of most stocks, which ended lower across the board on Tuesday.

• Within hours, efforts were underway to reassure a jittery public.

Party newspaper Economic Daily told readers that (Economic Daily):

• “The close attention of netizens is understandable, but it is completely unnecessary.”

• “[The suggestion to stock up] is related to epidemic control measures.”

• Zhu Xiaoliang, the head of MofCom’s markets and consumption department, was also deployed for a series of interviews with state media, to repeat that (People’s Daily):

• “The supply of daily necessities is sufficient, and fully guaranteed.”

• Get smart: MofCom was just doing its job – they send out notices like this one pretty regularly.

• There’s not a shortage of food or toilet paper on the horizon.

• But the overreaction demonstrates a serious shortage of consumer confidence.

• One worrying aspect: Some netizens speculated the call signaled an impending invasion of Taiwan.

According to the recent data sets, fuel oil storage remains at seasonally adjusted all time highs and gasoline/diesel storage has increased over 2M from 1-year lows. There has been a lot made out of this global satellite chart, but it confirms what we have been saying- we are back to pre-COVID levels. There isn’t anything surprising by these adjustments, and according to Kayrros- 40% of the decline was driven by India. This is a key fact, and we will need to be focused on what kind of physical cargoes is India buying at this point. They should be coming into the market in bigger size in order to address the big drop in storage- especially with diesel demand recovering to pre-pandemic levels. This will be the big tell on how accurate the data is and how much additional cargoes are needed for India.

India also cut taxes on diesel and gasoline: India’s excise duty on petrol has been reduced by 5 rupees (£0.049; $0.0671) per litre, and by 10 rupees on diesel. We have highlighted for months that India wouldn’t be able to cut taxes because of the historical government spending deficit. So it should be no surprise that the cut in taxes came after a big surprise in tax revenue collected providing the government the necessary wiggle room to cut some of the excise duty on petrol products. There could very well be more to come as the RBI is trying to mitigate the accelerating inflation within India.

The new OPEC+ target is listed below based on the 400k barrel increase for Dec. Nigeria is allowed to be at 1.66M barrels a day and Angola at 1.392- but so far their loading schedule remains well below those numbers.

The October vs Sept flows put into persepctive how low West African flows are while also highlighting the big increase out of the UAE. They are supposed to be producing 2.885M in Dec, but already in Oct they exported about 3.156M barrels a day. The amount of UAE crude available is helping to keep the spread wide between Brent and WTI, which has Asian buyers opting for ME grades. KSA also had a big step up in exports, but the below gives a clearer picture of the amount being exported and not just produced. We have said many times that exports mean more than production when we want to gauge the market, and that goes hand and hand with what is available in the physical realm.

The above flows should be compared against what was allowed to be produced under the OPEC+ agreement. West Africa has continued to underperform, but as we have stated time and time again- they are well below their quotas and still not able to clear even reduced levels of available crude.

Exports out of KSA was already at the highest levels since April 2020, and now with the next raise officially in the books- we will get another step up in capacity.

The new volumes from the Middle East will likely clear into Asia while West Africa tries to compete more aggressively. So far, we have seen some WAF crudes clearing into the Atlantic basin, but a huge amount still remains unsold in the region. “Eni sold a shipment of Angola’s Olombendo crude for November loading, traders familiar with the matter said. Final price, destination not immediately available The sale leaves around two cargoes of Angolan crude for November loading still awaiting buyers, the people said That’s down from four to five cargoes earlier this week.

• 15-18 cargoes of Angolan crude for December loading are still searching for buyers out of 37 planned

• That’s in line with typical pace since the monthly trading cycle is halfway complete, the people said

• Angola’s sales have been slower than usual for the November cycle, with about 4-5 shipments yet to find final buyers out of 34 scheduled

• Drops from 5-8 on Oct. 21

• Republic of the Congo’s Djeno crude is also selling slower than normal, with all seven of the grade’s December shipments looking for customers, the people said

• Two out of the six November-loading shipments of Djeno also yet to locate buyers, unchanged from Oct. 21

There has been a big step up in purchases coming from Russia- especially the far east with buying of ESPO and Sokol: Premiums for ESPO and Sokol rose last month to the highest in 21 months. ESPO traded at a premium of $5-$5.80/bbl to Dubai benchmark price around Oct. 20 and more than $6/bbl around Oct. 19. The price has remained fairly firm as Asia remains the biggest buyer of the crude grades. A bigger concern going forward is the flows of product in 2022 as China has kept Teapot import quotas flat year over year. This is bearish because new capacity is coming online in Q4’21 and next year, so the import quotas is going to be spread thin with the hope of squeezing out the smaller and less efficient refiners. “China is keeping the same import quota for private oil refiners next year, even after the sector faced government scrutiny for suspected violations of environmental and tax laws. The allowance remains at 243 million metric tons, according to a statement from the Ministry of Commerce. The first batch of that crude will be released before the end of this year.” This plays directly into the shift we have seen on policy: “China will ban the construction of refineries that have crude-distillate units with smaller capacity than 10 million tons a year, according to the China Petroleum and Chemical Industry Federation, which cited a 2021-2025 five-year carbon-reduction action plan released by the government.” The government is pushing for the bigger/ more efficient assets to get preferential treatment and to force the smaller entities to close. Even though the volume, a bulk guideline, is unchanged, that may indicate greater preference for the nation’s mega private newcomers in the likes of Shenghong Group and Rongsheng Petrochemical Co., which have more sophisticated petrochemical-focused refining units and are better able to help the nation meet its carbon-emissions targets.

Zhejiang Petroleum and Chemical Co. was given 12m tons of additional quota to import oil for the rest of this year, according to statement from Rongsheng Petrochemical Co. on the Shenzhen Stock Exchange.

• The additional allowance will be used for the Phase II project, which is designed with 20m tons/yr capacity

• Prior to this new allocation, ZPC had received a total of 20m tons/yr crude import quotas for 2021

The second CDU at Zhejiang Petrochemical’s phase 2 expansion of its Zhoushan plant will start operations at the end of this month, said Chen Hongbing, deputy general manager and director at Rongsheng, at S&P Global Platts’ Asian Refining Virtual Summit.

• The phase 2 expansion will be fully operational this year, giving the integrated refining complex a fuel yield of 29% and a petrochemical yield of 71%; refinery will run at a rate of more than 100% in 2021

The refinery response in China has been slow at the State-Owned level as many facilities are operating below seasonal norms.

Teapots have responded more aggressively sitting just below 2020 operating rates.

The Chinese economy hit another roadblock with an expanding COVID outbreak that is resulting in broad restrictions on travel. China cancelled almost 24,000 flights over the coming 11 weeks since this time last week as they look to tackle the outbreak. They have also cut train movements and limited cars across city lines without the necessary documentation of vaccination and negative COVID test. This has caused activity in China to slow further, and it will make Nov worse as Oct was ending weak. Liquidity has been getting pulled back out of the system, which was my expectations as a large part of the liquidity pushed into the market was for month end. The pressure on the underlying consumer remains problematic as companies have started increasing local prices following a slow down in exports and a continued move higher on input prices. Several large firms within China have increased prices ranging from 4%-17% as the pain has continued to grow and now reaching a 26 year high.

This is all happening as manufacturing and service performance weakened further. The pressure on the consumer is only mounting and resulting in much bigger issues across the economic complex.

The issues are also expanding to other areas of the economy- most importantly the local bond market. There has been a prevailing view that the Chinese government would be able to isolate this to only international bonds. It has now bled to the onshore market: “China’s property bond meltdown is spreading onshore, where the credit market is about 15x larger at $12 trillion. At least two local bonds halted trading today after significant declines.”

What we have known for a long time is finally coming to light: “Missed payments on off-balance sheet IOUs such as high-yield consumer products, secretive loans and private bond guarantees have rocked China’s credit market in recent weeks. Dollar bondholders are struggling to know their place in the repayment queue in the event of a default, forcing a dramatic repricing of risk that’s all but frozen the primary market for developers.” The biggest issue is the off-balance sheet debt that is now being pulled back onto the sheets, and showing just how bad the balance sheet for these companies remain. Kaisa Group Holdings Ltd. said on Thursday it failed to meet payments on wealth products, triggering a plunge in its bonds and shares. Fantasia Holdings Group Co. defaulted on a dollar bond last month only weeks after assuring it had sufficient working capital and no liquidity problems. Its failure to pay undermined the credibility of Chinese issuers just after Bloomberg reported China Evergrande Group was on the hook for an unknown bond issued by a separate entity. The limit on financing options only increases the risk to the underlying market as it has now come home to roost. All of the issues above have caused Kaisa Group, Kaisa Capital Investment, Kaisa Health Group, and Kaisa Prosperity have all had their trading suspended in Hong Kong.

Kaisa is important because it has a large quantity of dollar denominated debt- something similar to Evergrande. The spreading crisis into Kaisa helps to drive home that this is far from being contained and has much broader implications. Back in July- there was a view that things onshore would be able to survive even as offshore pressure rose. We now have another pressure point onshore that is going to drive the onshore stress level higher and keep pressure on the local consumer.

The pressure in Kaisa also comes on the back on the largest Chinese developer also hitting lows, and according to the “Three Red Lines”- they are one of the only ones that haven’t breached any of them.

The below gives a backdrop of who has crossed those red lines:

The amount of downgrades has accelerated, which will only increases as refinancing and new cash injections are much harder to come by.

Some developers are providing properties instead of overdue payments.

• China Evergrande said it handed over 57,462 homes across 184 projects in the mainland since July, but deliveries fell sharply last month

• Two suppliers, owed millions in payment, received flats from the developer instead of cash

The below helps to show the pressure in China vs US

President Xi is still maintaining his push to increase the technology industry within China- regardless of the near-term pain. They have been the largest buyer of semi-conductor equipment for the last 2 years, and that won’t be changing anytime soon even though the U.S. has restricted some sales.

China has remained a huge investor in the semiconductor industry, which won’t be changing anytime soon.

The grains and fertilizer market has gone parabolic as pressure mounts on globally available grains. Wheat tenders have been reissued globally as prices are not coming down as they hoped/expected.

Even as wheat prices soar, some of the world’s top buyers are piling in. Global trade of the staple grain will leap to a record this season, buoyed by an import frenzy in the Middle East, the United Nations said on Thursday. Iraq, Iran, Turkey and Afghanistan are all loading up after drought hit their harvests earlier this year, draining local supplies. Egypt is also replenishing stockpiles, the agency said. The gains highlight how the region is paying up to ensure food security, even as wheat prices soar to multiyear highs. That will put additional pressure on those economies, although rising oil revenues could cushion the blow for some nations.

The price of food is rising globally with the “cheapest” part of the day (breakfast) setting records.

Yields have been soft for several years now leaving countries with dwindling supplies, and now with energy putting pressure on fertilizers- next year costs are already pinned to the highs.

Next week- we will do a bigger write up on food and the geopolitical uncertainty that is creeping in because of it.