By Mark Rossano

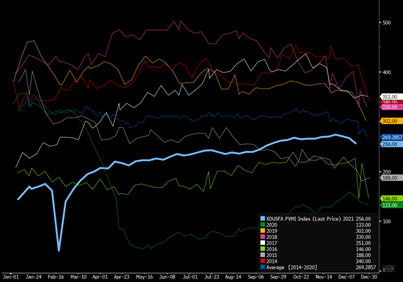

The completion market has seen a steady decline in activity, which will persist through the end of the year. We expect another 20 spreads to pause into year-end, and quickly get back to work by the 2nd/3rd week of January. This is seasonally normal, but the decline will be reduced against historics because we are starting from a lower number. It is important to note that the Permian is right back to levels we have seen over the last 5 years, and we expect to see activity remain firm in the region even as some seasonal slowdowns happen. The Permian activity will stay robust and top previous levels of completions as it is the biggest growth driver of U.S. production. On the natural gas front (Appalachian & TX-LA-SALT), we are moving closer to normal activity levels with the Haynesville now topping previous years. Completion activity will remain robust in the Haynesville as LNG cargoes remain strong and natural gas pricing supports the current level of spreads.

The natural gas physical market is supportive of activity- especially in the south where the realizations are much better. They are closer to the end market, don’t have the same bottlenecks, and cost of shipping gas is much cheaper. The pricing metrics in the region will keep activity above seasonal norms, and well above historics as companies are able to lock in strong pricing and underlying investment economics. We expect the Anadarko to remain fairly flat, but see a steady increase in activity by the end of Jan/Beginning of Feb as the NGL basket strengthens next near. Local demand remains elevated, but we have seen a slowdown in exports as the Panama Canal bottleneck has shifted some Asian demand into the Middle East. This will persist through Q1 as the Canal Authority gives LNG vessels and containerships preferential treatment. The supply chain issues will persist, but as we move into February/ March the need for LNG preferential treatment will diminish and open up more slots for LPG. The demand for chemicals and the underlying feedstock will remain robust and be supportive of the U.S. liquids complex- especially from Anadarko, Eagle Ford, and the Permian.

As we described last week, the issues will persist on labor and other input costs that will keep pricing elevated across the energy complex. But, as some of the supply chain issues “ease” there will be some money freed up to pivot to wages in an attempt to close the labor shortages. This will take time to convert as price increases are still occurring around the world- especially in key inputs to the OFS and E&P segments. We have seen some leading indicators showing a “pause” in some increases, but we don’t expect a deflationary cycle yet- instead one that gives way to stagflation.

The pace of the slowdown remains slow vs previous years, and we expect activity to outperform the other points in time. There will be the normal bounce in Jan/Feb, but the drop down won’t be as extensive. This puts us on a strong footing to get to about 300 spreads by the end of March, but the DUC inventory remains low- which is why the increase in rig activity is so important as we near the end of Q4 and spring load Q1. This will create the running room that will push activity steadily higher in Q1/Q2 of 2022. By way of this increase, we should hit an exit rate of about 12.3M barrels a day in Dec’22.

Next week we will provide a bit of a deeper dive on China and some of the key economic data points to close out the year.