By Mark Rossano (Originally published Mar 19th, 2021)

As the world starts to awaken from the COVID19 pandemic, we are quickly going to see the problems that existed prior to 2020 come roaring back with a vengeance. Historically, social unrest and uprisings have often followed widespread illness, and this does not bode well for a global economy that was already not in a good place in 2019. Those countries with the least economic support (Emerging Markets and Low-Income Countries) face the greatest likelihood of problems, as stimulus is harder to achieve on a monetary and fiscal level. The U.S. and other Developed Markets have the luxury of borrowing, and with the U.S. Dollar as the reserve currency of the world, we have gotten drunk on cheap liquidity (which we have discussed in previous articles). We have tried to stop the business cycle by stimulating the market with trillions of dollars globally, which has just made the underlying issues of social mobility and inequality exponentially worse.

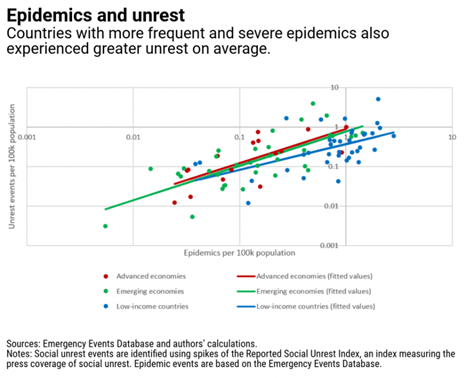

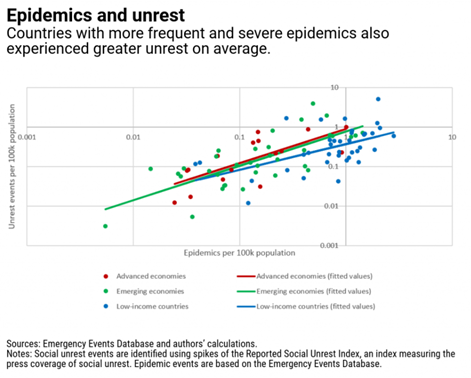

I want to look at Emerging Markets and Developing Nations because we know problems arise after epidemics, but what about a global pandemic? We haven’t had something on this scale since the early 1900s, and while there have been localized issues with illnesses such as SARs, MERs, and Ebola, the U.S. and Europe have been mostly spared—allowing for relatively stable trade, even as disruptions hit different corners of the world. Being the largest importer globally, the U.S. never stopped buying through those epidemics, but now we are facing a different economy on the other side. One with compressed wages, elevated unemployment, and rising inflation that will impact buying power. We will also see a change in consumer behavior as flexible work schedules are introduced and e-commerce purchases shift buying patterns. This will impact trade and consumption for an extended period and limit the recovery in Emerging Markets. Citizens are currently facing a lack of subsidies, job prospects, inflation, and food shortages that just throw jet fuel on the forest fire that was the economy prior to COVID. The below charts put some of this into perspective. It isn’t surprising to see that population density matters since there are less goods and money to spread around. Another key factor in assessing risk is Time. We may be returning to some normalcy, but as people go longer without food, work, or other basic needs, anger increases and the chance of unrest goes up exponentially. There is always a lag in the “anger” or expression of frustration as people are unlikely to protest/riot at the peak of a pandemic (or in this case, COVID19). Typically, poor nations are exposed to more disease and epidemic spreads, which keeps their economic development running in place and exhausting government support quickly. We are now facing a rise in food shortages and cost, and when people can’t feed their families, desperate actions and measures are taken.

The world has been facing a rise in inequality and social mobility long before COVID19 ever entered the lexicon. This is where the “Developed Nations” come into play, as wage compression has been a key factor in creating inequality. Look at the recent expansion in U.S household net worth in Q4’20: up $6.9T, but equity holdings increased by $4.9T, with real estate adding $1.5T through price appreciation, home improvement, and cheaper rates/refinancing. So $6.4T was created by holding a portfolio of assets, leaving the expansion for everyone else at $500B . . . how much was stimulus to the poor again? The top 10%–20% have the benefit of investing across inflating assets, but if you don’t have spare cash to put into a house or stock portfolio, you are left with whatever job you can get and stimulus the government throws your way. The U.S. at least has the benefit of trillions in fiscal and monetary stimulus, but since we have been stimulating the economy since 2008, inflation has been waiting in the wings.

When looking at the “Pandemic and Social Unrest Chart” you’ll see that as a country moves farther along the dotted line, the pressure mounts on the local citizens that are trying to improve their social standing. While global poverty saw a steady decline, food insecurity has become a broader problem as the population grew and grains yields remain stagnate. Wage compression has impacted social mobility across all economies: Developed and Emerging. The reduction in salary and benefits comes from the elevated level of unemployment and the duration that people have been out of work. The longer someone is unemployed, the less money they will accept to re-enter the workforce—especially if they are changing careers. Job openings are back above pre-COVID levels in the U.S., but yet companies are reporting that jobs are hard to fill because it either makes more sense for candidates to collect unemployment benefits + stimulus, or they have the “wrong” skillset. The below chart puts a value on the amount of money lost—the “red bar” highlights hours lost, with the lower-middle income and low-income brackets getting absolutely destroyed. Global debt is at historic highs. Countries are issuing debt at massive rates to provide stimulus for the economy, but the interest expense is now rising as yields push higher. The cost of this debt has risen since the below chart was created; yield curves price in more risk and inflation has risen on a global level. Debt requires a buyer . . . and who is the buyer of last resort? Or rather, when does that paper have to stop because demand is filled? If it is a central bank buying, when is inflation seen to be out of control and needing to be reined in? So the blue bar estimates what fiscal stimulus it would take to close that gap as of Q3’20—but how much money is available to bridge the gap? Is there a job on the other side, or will the individual have to change careers? Working hours have been lost around the world with little chance of a near term (or even long-term recovery). Companies were already bloated in 2019 (hello zombie companies!) and technology CAPEX has increased, resulting in further wage reductions. Automation has replaced or streamlined work processes, limiting total earning potential. This inherently impacts the middle- to low-income earners the most, as some (if not all) of their job function is replaced, outsourced, or done by less people working longer hours.

If a company hires someone with a limited skillset, they will offset the loss of efficiency from on-the-job training by reducing total compensation. This reduction in salary is being stressed further as inflation hits wallets and the costs of everyday life drive higher. The below chart also shows that more employees who want full-time work are only getting part-time opportunities due to the limitations in the current job market.

This pain is spread across the world, but it’s clear that those in the middle of the pack or lower seem to be getting left behind. It takes time to get discouraged and disenfranchised because nothing happens overnight, but the stress placed on the global economy by COVID19 has exacerbated the problem. Companies have found an “easy” way to cut personnel and an excuse to not hire them back, or if they come back, they are at depressed wages. Now with inflation kicking into high gear—and more importantly, food prices tightening—the stakes are really going to rise in the geopolitical theater.

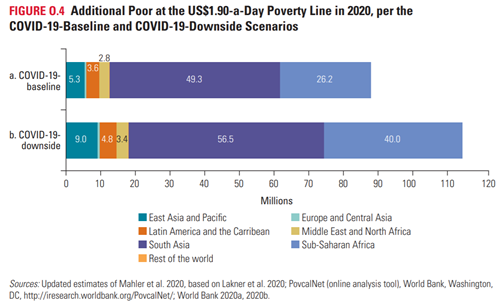

The number of global poor has increased the most in “medium-intensity” conflict locations. So if you have a group of people that were already at the front end of mounting unrest, what does a global pandemic do for you? How much support can these countries provide if they were already facing struggles at home? The “size” of those deemed as poor is erasing 10 years’ worth of progress. This will take years to adjust back to previous levels given prolonged issues in global trade and underlying pricing that will increase the cost of living. Regions already facing a problem will be driven into overdrive.

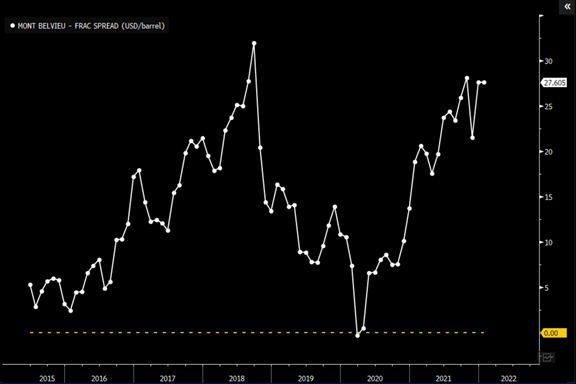

Basic needs are the crux of survival, and economic expansion can’t begin until people not only have enough to live, but excess that can be stored or sold to allow for growth. For example, if you are worried about your next meal, will you focus on growing a garden / foraging for food, or sitting at a library to study to become a doctor, engineer, writer, or another skilled job? Food insecurity has become a big problem around the world, with Africa and Asia seeing a steady rise in basic needs not being met. The below chart is from 2019, so when we factor in prices that are now back to 2014 highs, the pain is just getting worse. 2014 was when global food insecurity really started, and now that prices have pushed back to decade highs—alongside a global pandemic impacting salaries and subsidies—the pain is just beginning. It is important to note that even without COVID19, the world was already facing several “Biblical”-sized locust swarms, droughts, floods, swine and avian flu, army worm infestations, among other disruptions that were causing yield drops. COVID19 was the cherry on top that has made a bad situation much worse—limiting the movement of migrant workers, delaying plantings, harvests, and bottlenecks at ports. We have seen an increase in acres planted, but weather hasn’t been cooperative, delaying key planting across places like Latin America. These adjustments take seasons, and with China absorbing massive amounts of grains in the market and dealing with a new round of swine flu driving up prices, poor countries will be left paying up for goods to feed their people. Nationalism will also become a bigger issue as countries withhold exports, managing volumes and pricing, to make sure their citizens have enough to eat. We saw evidence of this at the outset of the pandemic, and restrictions still remain in place with export quotas and rising tariffs.

UN Food And Agriculture World Food Price Index

The global rise in grain prices has resulted in huge spikes of food inflation, with the below charts highlighting just two examples in Nigeria and India:

India Inflation Breakdown

The rise in inflation and inherent costs—alongside falling wages—has only intensified the extremes of poverty, with more people being added to the “$1.90 a Day Poverty Line” continuously throughout COVID19. The longer people reside below these levels, the more anger builds up against their situation, and blame gets passed around. We have already seen food riots and general uprisings in Africa (most recently Nigeria), the Middle East (Iran), and Asia (Myanmar), and we aren’t even fully out of the pandemic. Pain, despair, and anger has been bubbling beneath the surface for years, and now the match has been lit.

Globally, the number of poor is broken out into several categories based on the “depth” measured by USD payments per day—with the lowest being $1.90 and highest just below $6. The World Bank has seen the global poverty figures declining steadily over the last several years. Since 2019, the trajectory started to shift and COVID19 sent us on a completely different path higher due to lack of earnings potential. Now, with the U.S. 10-Year Treasury Bill shifting higher, the cost of borrowing has risen, limiting the underlying stimulus a government can provide through subsidies and economic incentives. We are already seeing fuel costs rise globally with little ability for governments to protect or limit the rise. This will only exacerbate underlying issues across food availability and basic needs. Sadly, the below chart illustrating global poverty is not painting the full picture. Their criteria for classifying “poor” does not include levels seen in Developed Countries—who are having their own issues with food security and populations falling well below the poverty line designated by the country. The U.S. is no exception to the pressure, as weekly jobless claims throughout the pandemic have outpaced the worst day of the financial crisis (665k jobless claims in March 2009). We have the benefit of borrowing, but as the U.S. taps the debt market at a greater rate and inflation fears rise, so do our interest rates. As our rates go up (10-year is typically the global “risk free” benchmark), countries are finding it harder (and more expensive) to access the markets. This is why I believe we will see those “Number of Poor” values continue to shift higher and reach the “downside” case—especially in Africa and Asia. In the United States and Europe, the extremes of destitution are vastly different, but that is not to say that people aren’t reaching the same levels of despair and “hopelessness” as other people in poverty around the world.

The hope is to continue to pull people out of poverty by 2022, but the baseline shift (measured by the light and dark blue lines) demonstrates the lasting effects of COVID19 on the global economy. Once we factor in the prosperity shift, we have to look at food security, age of the workforce, and underlying opportunities for advancement. The Middle East and Africa have a young workforce and some of the highest unemployment numbers for the key working ages of 16–35. This is when Generational Dynamics come into play as the next generation looks to enrich themselves and build a life/family. When that isn’t achieved, with little chance of change, this group is more likely to take to the streets to drive some form of change. We have seen protests across Asia, Africa, and the Middle East, with more to follow as pressure remains across the system. Europe is facing another wave of COVID19 cases alongside Latin America (Brazil), and with continued hurdles with the vaccine rollout, the pressure on economic activity will be prolonged. The longer the Developed Markets remain capped, the worse off Emerging Markets will fair, as major economies are the main buyers of raw materials and semi-finished goods. The limitations on demand prohibit the movement of capital into poorer nations and stress the balance sheet as foreign reserves dwindle. This leads to increased inflation fears, limiting the ability for the central bank to cut rates and the government to borrow.

Here is just one example, below: Nigeria is facing food riots and increased political pressure as a third of the 69.7M workers either haven’t worked or have fallen to below 20 hours a week since the pandemic started, while 15.9M have worked less than 40 hours a week. If you want something more for your family and are willing to work for it . . . how can you achieve that with limited opportunity and part-time work?

At the Developed Market level, millions of workers have been furloughed and are being paid to do nothing. Germany, France, U.K., and Italy are paying workers’ salaries until the economy normalizes so employers can avoid large-scale layoffs. They are looking to avoid the “social cost”—or unrest—that would result from that upheaval, but Emerging Markets don’t have that luxury. “Italy has been doing that for decades, turning what was supposed to be a short-term program to save jobs into a permanent fixture. Now, an especially weak economy and a glacial rollout of vaccines in the EU mean millions of workers will remain furloughed well into 2021.” The rise in COVID19 cases and pause in vaccine rollout will just increase the need for stimulus and underlying support. “Indeed, pandemics can set off a vicious cycle of economic despair, inequality, and social unrest. Using econometric analysis, we show that past major pandemics led to a significant increase in social unrest in the medium term, by reducing growth and increasing inequality. Higher social unrest, in turn, is associated with lower growth, which worsens inequality, forming a vicious cycle.” These characteristics are a problem given the low growth we have experienced over the last several years.

Wars don’t typically happen during robust economic growth, but rather when there is an event that creates prolonged impacts to basic needs. If I can get a job, afford shelter, and feed my family, why would I go fight a war? But would you feel differently if you were watching your children starve? The below chart is just one metric of evaluating growth, and we saw slowdowns creeping into key markets well ahead of COVID19. The International Monetary Fund “take[s] a closer look into this issue in a new IMF staff working paper by analyzing the effect of past major pandemics in 133 countries over 2001–18: SARS in 2003, H1N1 in 2009, MERS in 2012, Ebola in 2014, and Zika in 2016.” These were smaller pandemics. Now what happens after COVID19—a worldwide pandemic that sent the global market into its first contraction in over 20 years?

Emerging Market PMI (Purchase Manager Index)- source: Bloomberg and IHSMarkit

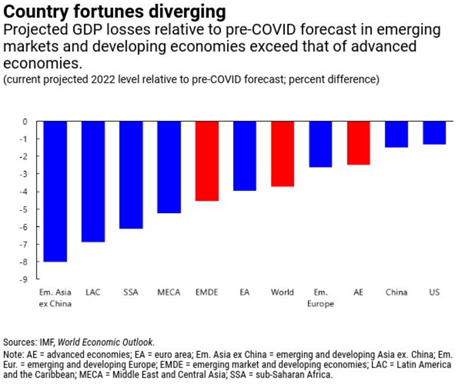

Living standards are dropping around the world with the extremes in Asia, Latin America, and Sub-Saharan Africa: all areas that were seeing an increase in uprisings before COVID19. A shift lower in GDP is just going to exacerbate an already terrible situation.

Developed Markets won’t be spared, either. The U.S. has already been experiencing riots in the face of an uncertain future. Living standards and general mobility in the U.S. has been falling, likely leading to more political strife. The gravity of it all has been somewhat kept in check by lockdowns and a hope for “better days.” But as COVID19 passes and people feel the sting of inflation and unemployment, the pressure will mount on governments, and calls for change will rise. The U.S. is addressing the rise in military pressure by looking to expand in Asia—accelerating our deployment of forward assets as depicted in the chart below. The U.K. is looking to expand their presence in Asia as well, especially after China’s violation of the Hong Kong treaty. India and China are already at standoffs in two strategic points of the Himalayas, with tensions rising. The U.S. is trying to win allies and influence to help manage China’s expansion in the region.

The “Spring Thaw” is approaching just as COVID19 cases are falling and vaccine rollouts are accelerating. We are living on the tip of a knife. Tensions are at the highest levels since the Cold War. We face a very bifurcated recovery, with the lowest three quintiles being left behind. The poor are getting poorer, and the middle class is being pushed closer to the poverty line as quality of life around the world is diminished. It just takes one incident (on purpose or by accident) to set off a chain of events that can’t be contained. This is why securing supply lines, solid allies, and trade partners will be pivotal for success on the other side of COVID. The problems we face were not caused by the pandemic, but rather magnified by underlying economic issues and growing food problems. This is a familiar trope: when the world becomes too tilted in one direction (as we have seen with the divide between rich and poor, with no growth or prosperity to promote social mobility), we face a rising chance of conflict. We have a long uphill battle ahead—one filled with difficult decisions and countless hurdles—but by relying on allies and supporting the business cycle, there can be light at the end of the tunnel.