- Halliburton sees growth opportunities from increased investment in the Middle East, Russia, and Latin America, especially in specialty chemicals and artificial lift

- Shorter cycle production growth and increased spending on wellbore will drive the topline in the medium term

- Its deleveraging in early 2022 and free cash flow sturdiness may favor investors’ sentiment

- HAL raised dividend in Q1 2022, which exhibits the management’s confidence in its financial strength

The Medium-Term vs. Short Term Outlook

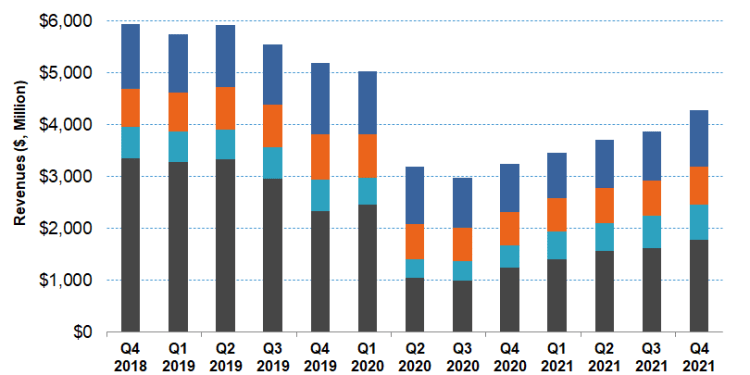

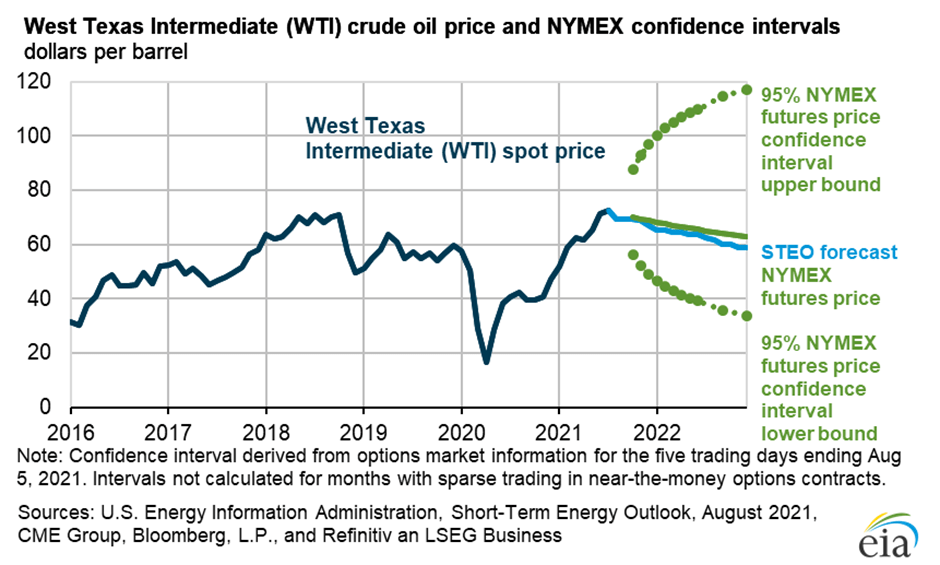

Let us discuss Halliburton’s medium-term operating and financial targets. The primary drivers for the growth are drilling outpacing completions as the energy operators build up well inventory for 2022. At the start of 2022, HAL’s management reiterated that several years of underinvestment in new production and the structural weakness in wellbore investment would benefit its strategic objectives. Earlier in 2021, it estimated that simultaneous growth in international and North American markets could lead to a CAGR of mid-teen over the next couple of years. The operating margin, by 2023, can expand by 400 basis points.

In the international market, upstream operators’ capex can increase by “mid-teens” in 2022. Much of the investment will flow in the Middle East, Russia, and Latin America, while opportunities in Africa and Europe will be limited. HAL will reap the benefit because the higher service intensity in the shorter cycle production and increased spending directly focused on the wellbore can lead to increased sales of its short-cycle products. So, the company will strategically reallocate assets to improve utilization and returns, particularly in the geographies where returns are high. The company has identified growth opportunities in specialty chemicals and artificial lift in these markets.

Following the improved commodity price environment, pricing traction and contract renewals in the integrated projects will drive the company to 2022. The company estimates that the completions market is nearing 90% utilization in North America. Plus, pricing for the fracturing fleets is getting strong traction in the low-emissions equipment and Tier 4 diesel fleets. In Q1 2022, it expects to see 30% increments in the hydraulic fracturing business, while the pricing recovery will occur throughout the year. The drilling and the non-frac businesses like cementing, fluids, drill bits, and artificial lift business will benefit from the ongoing changes. However, high trucking, labor, sand, and other input costs will adversely affect North American performance.

Explaining The Strategies

In recent times, HAL’s strategy for North America has been revised. Accounting for nearly 42% of its Q4 revenues, the company plans to maximize operating margin, translating into cash flow maximization in this region. So, it has been lowering operating costs by changing the equipment maintenance process and providing engineering support, which serves well when the market recovery accelerates. Also, it has been promoting the SmartFleet intelligent fracturing solution to focus on the wellbore. In several multi-pad completion programs, the solution improves cluster uniformity and manages offset frac hits.

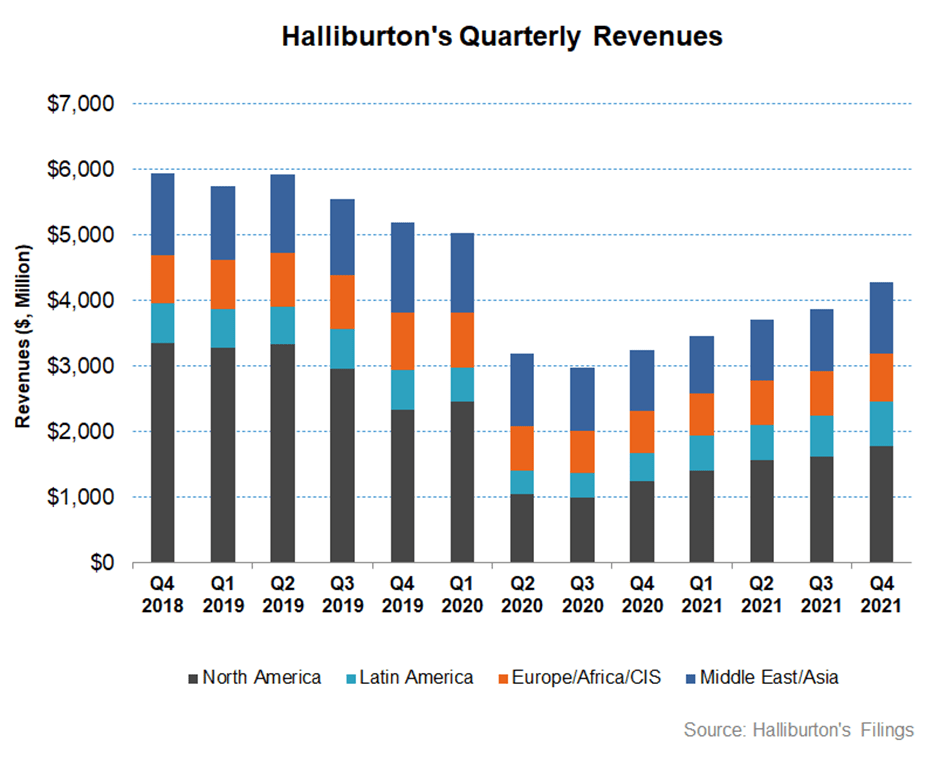

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 290 by the end of February and has gone up by 24% since the start of 2022. Halliburton’s FSC, which dropped significantly during mid-2021, has now doubled compared to a year ago. However, it can face downward pressure in the short term as utilization and frac pricing per stage shot up rapidly. Due to supply chain disruption, the delays can also affect proppant deliveries and operators’ pull back.

HAL In The Digital Space

Halliburton remains a top OFS company not merely because of its size but also based on technical differentiation. Digital integration of its offerings contributes to higher margins and internal efficiencies and also helps the company expand its revenue base. The iStar intelligent formation evaluation platform and the iCruise system for harsh drilling environments are recent innovations. Halliburton’s drilling jobs run on a cloud-based system, driven mainly through iEnergy public cloud. In drilling operations, ~60% of its iCruise drilling system runs are fully automated, which enabled a 70% reduction in headcount per rig.

What Do The Industry Indicators Suggest?

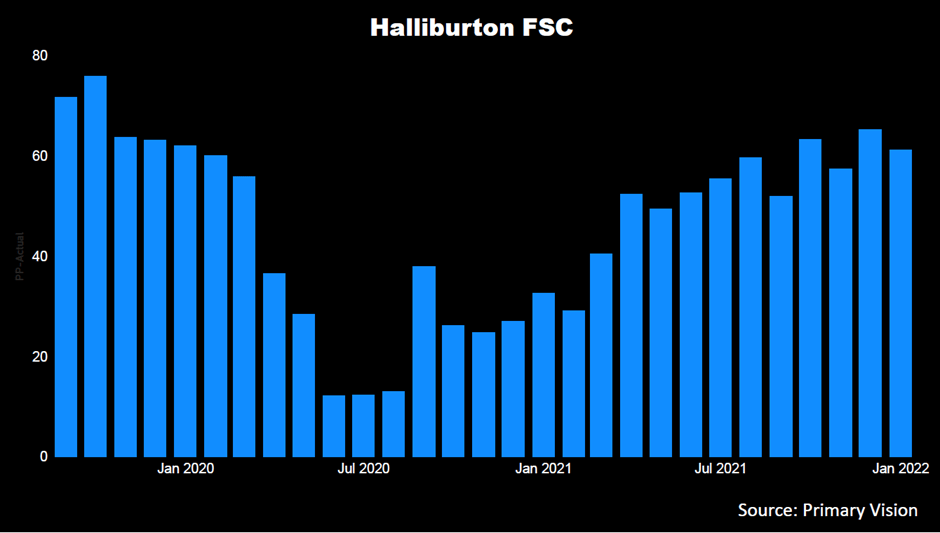

According to the EIA’s Short Term Energy Outlook, the Brent crude oil price can increase marginally in Q1 compared to the current level due to geopolitical tension and inflation. Still, it may come down considerably (~14% lower) by Q4 assuming the current situation improves and the central banks step in to control the inflationary pressure. According to the EIA’s Drilling Productivity Report, the US shale oil production is due for a steeper growth (2.1% rise, on average) by March.

The completed wells and drilled wells went up by 23% and 69%, respectively, in the past year. Drilled but uncompleted (or DUC) wells have declined by 40% during this period. The existing backlog of DUCs will continue to deplete in 2022 as the frac fleets return to work.

Analysing Performance

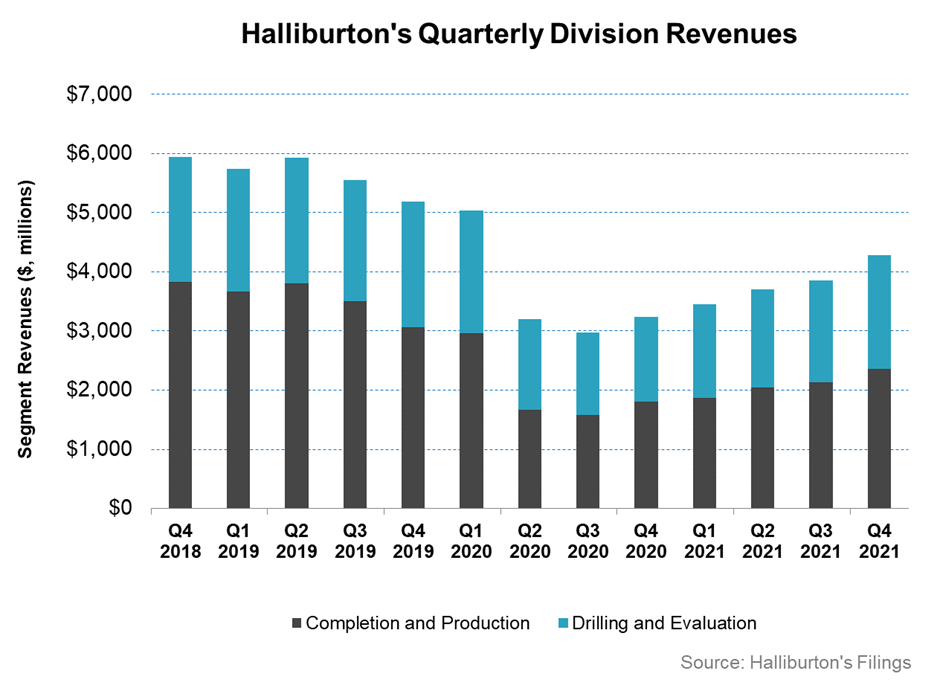

In Q4 2021, Halliburton’s Completion and Production division revenue increased by 10% compared to Q3 due to higher completion tool sales. Also, there was increased demand for pressure pumping services in North American land and the Middle East/Asia region. However, the division topline saw reduced stimulation activity in some geographies. Also, artificial lift activity in North America onshore decreased during the quarter.

Quarter-over-quarter, HAL’s Drilling and Evaluation division revenue growth was 11% in Q4. The operating income growth was more impressive here (45% up). Higher drilling-related services benefited the division results in all regions. Also, increased wireline activity and software sales affected some international markets during the quarter. There were, however, some headwinds from lower drilling-related activity in Russia and decreased project management activity in Mexico.

Dividend And Dividend Yield

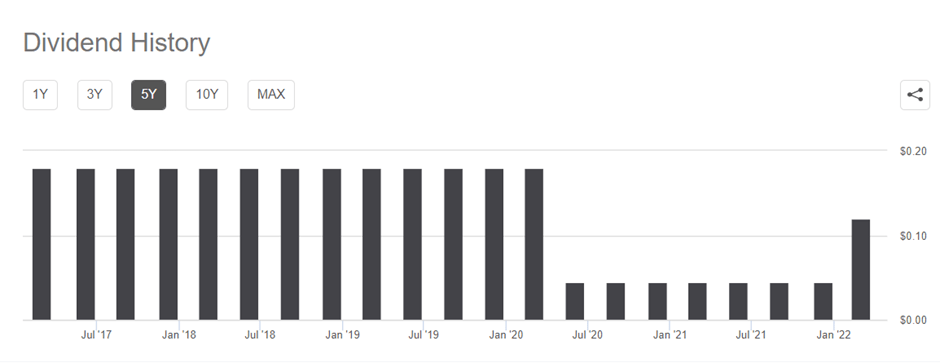

Halliburton will pay an annual dividend of $0.48 per share at the current rate after increasing its dividend by 140% from the previous quarter. It translates to a 1.52% forward dividend yield. In comparison, Schlumberger (SLB) pays a yearly dividend of $0.50, which equals a forward dividend yield of 1.26%.

Free Cash Flow To steady In FY2021

HAL’s free cash flow (or FCF) decreased marginally in FY2021 compared to a year ago. Revenue and working capital did not change much in the past year, leading to a resilient FCF. The management looks to keep capex at 5% to 6% of revenue in FY2022. However, with revenues set to increase in FY2022, it means the overall capex may reach $1 billion in FY2022, or a 25% increase compared to FY2021.

HAL’s debt-to-equity is 1.36x, which is higher than Schlumberger’s (SLB) (0.93x), but lower than TecnipFMC’s (FTI) (0.64x), and Baker Hughes’s (BKR) (0.40x). It plans to accelerate the deleveraging process by retiring $0.6 billion in debt in February. So, Halliburton’s debt-to-equity is likely to fall sharply to 0.82x in Q1. However, with increased cash flows, the falling leverage will reflect the balance sheet strength in 2022.

Learn about HAL’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.