- Revenue estimates are higher in the next year and stable afterward

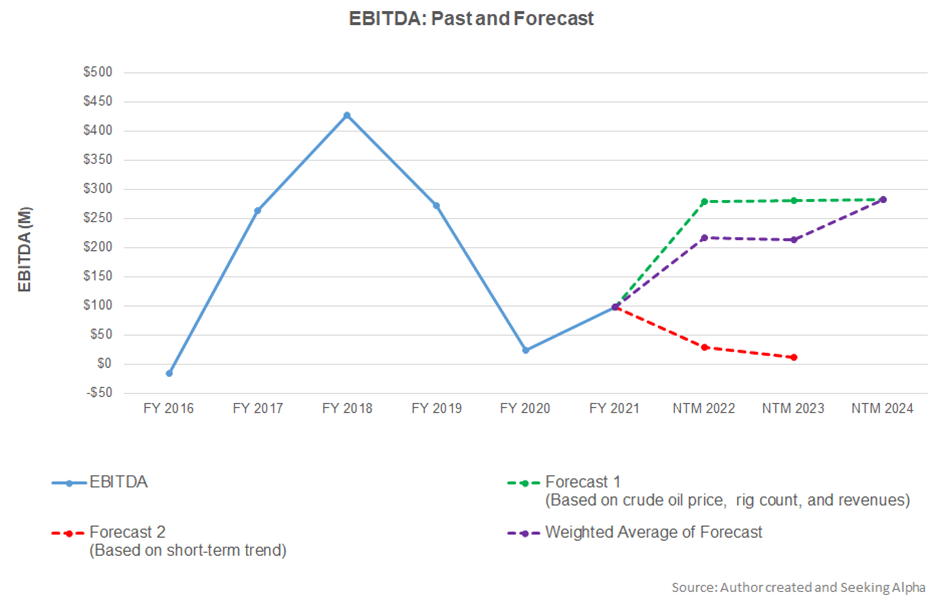

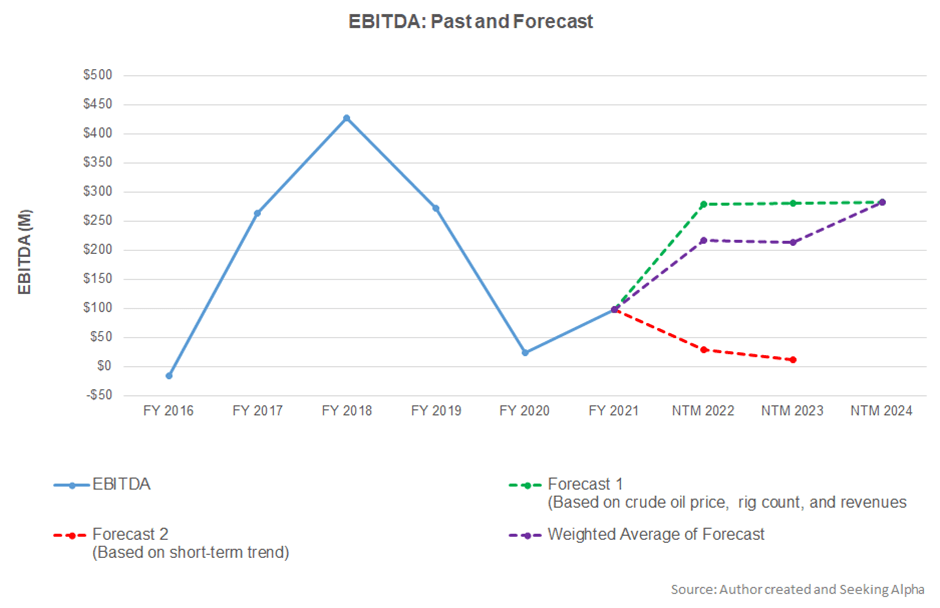

- EBITDA can increase sharply in NTM 2022 but will decelerate after that

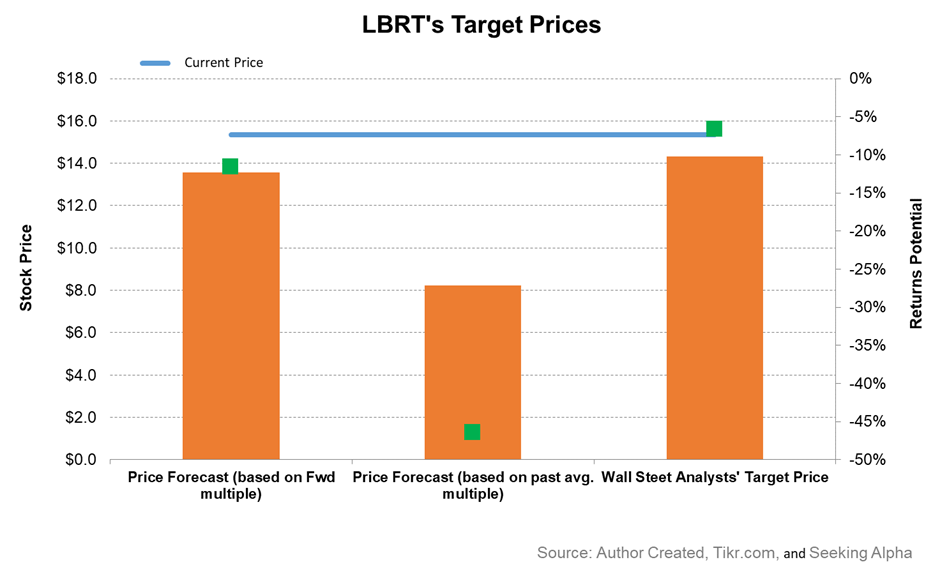

- The stock is mildly overvalued at the current level

In Part 1 of this article, we discussed Liberty’s outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation among the crude oil price, rig count, and LBRT’s reported revenues, revenues can increase sharply in the next 12 months (NTM 2022). The growth rate will stabilize in the following two years.

Based on the same regression variables, the company’s EBITDA can increase sharply in NTM 2022. In NTM 2023, the model suggests that the EBITDA growth rate will decelerate but may pick up again in the following year.

Relative Valuation And Target Price

Here is an analysis of LBRT’s relative valuation using its forward EV/Revenue multiple. The returns potential (12% downside) using the forward EV/Revenue multiple (0.85x) is lower than sell-side analysts’ expected returns (7% downside) from the stock but higher than the returns potential using the past average multiple (0.88x) (46% downside).

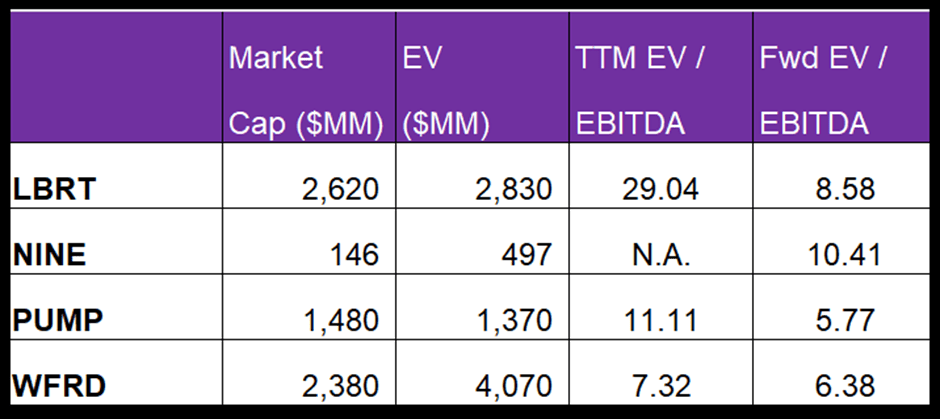

LBRT’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is steeper than peers because its EBITDA would rise more than its peers in the next four quarters. So, its EV/EBITDA is higher than its peers’ average. Still, I think the stock is slightly overvalued (with an EV/EBITDA of 29x) versus its peers and has a negative bias at this price level.

What’s The Take On LBRT?

Liberty is not reclining purely on the energy activity recovery but instead making proactive pushes to maximize the gains. As the demand for frac equipment increased, it expanded its revenue base by adding Schlumberger’s fracking business in the US and Canada. It strengthened the technology side of the business through the PropX acquisition and made significant improvements in route optimization. Also, in conformity with the recent drive for ESG compliance, it focuses on using Tier IV DGB and the digiFrac fleets. It plans to have at least two complete digiFrac fleets operational in 2022. On top of that, the company expects to benefit from higher net service pricing and frac pricing in the subsequent quarters in 2022.

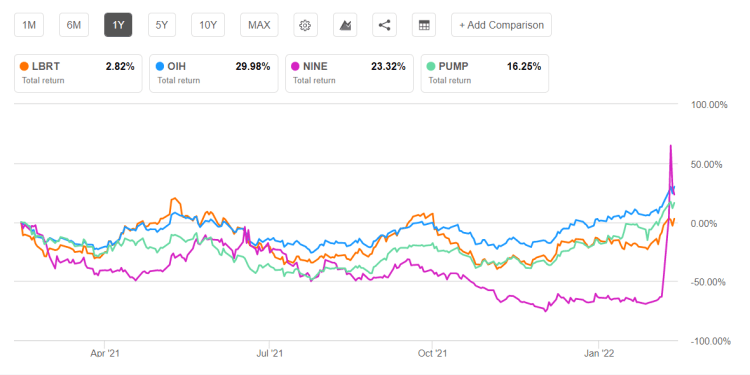

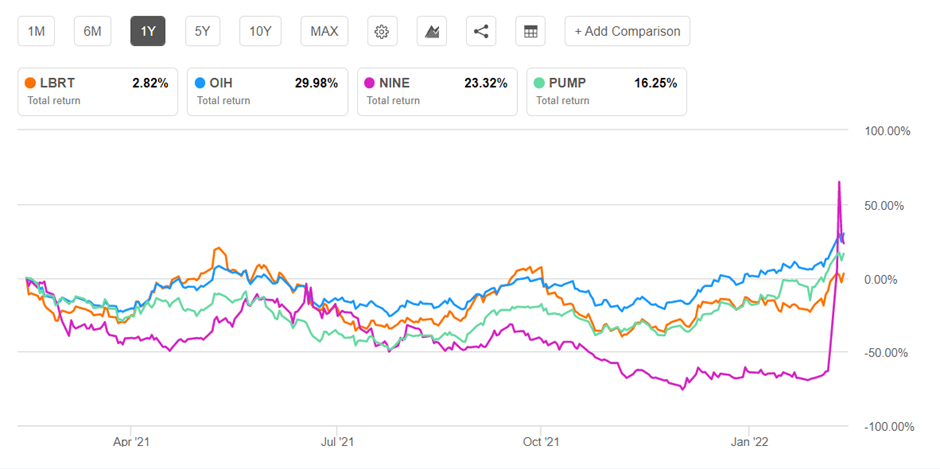

However, the OneStim fleet’s maintenance systems are different from the legacy set, which led to significant inefficiencies in recent times. We expect the cost level to fall in the coming months, leading to an EBITDA margin expansion in Q1. Also, its continuing investment in digiFrac pad generation systems and Tier IV DGB upgrades will lead to a significantly higher capex. This can lower free cash flow in 2022. So, LBRT’s stock price underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

Relative to its peers, the stock appears overvalued after the recent stock price run-up. I think investors might want to invest when the stock climbs down for higher returns in the medium-to-long term. Nonetheless, its low leverage (debt-to-equity) warrants against any possible pressure on cash flows.