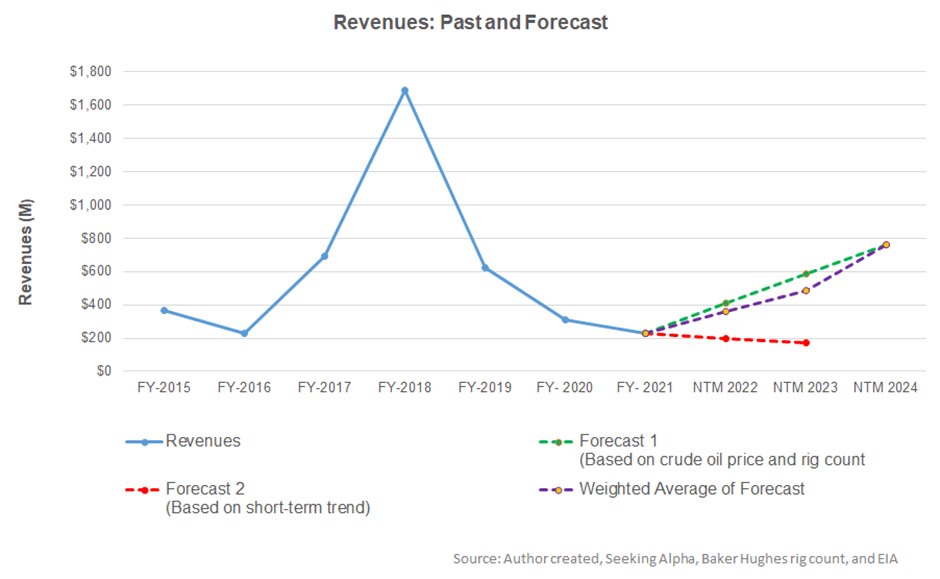

- Revenue estimates suggest an increasing trend in the next couple of years

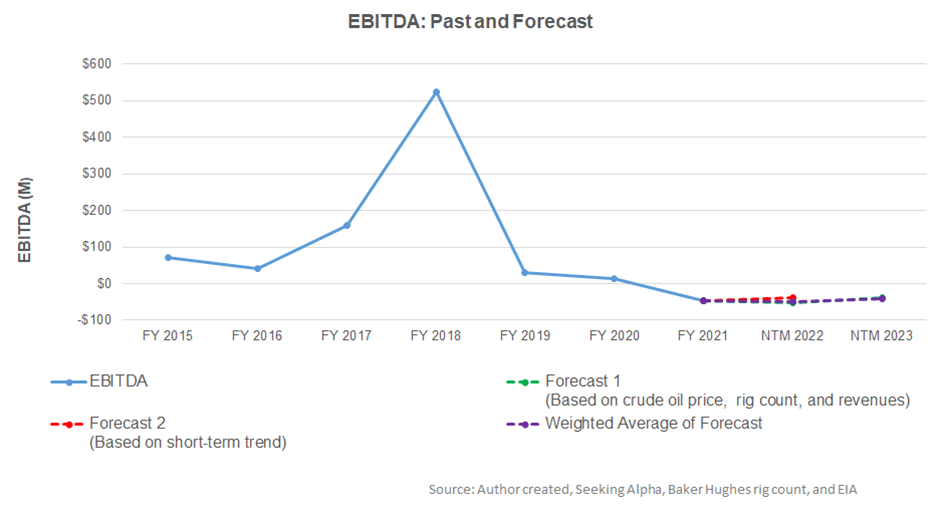

- EBITDA can stay in the red in the next two years

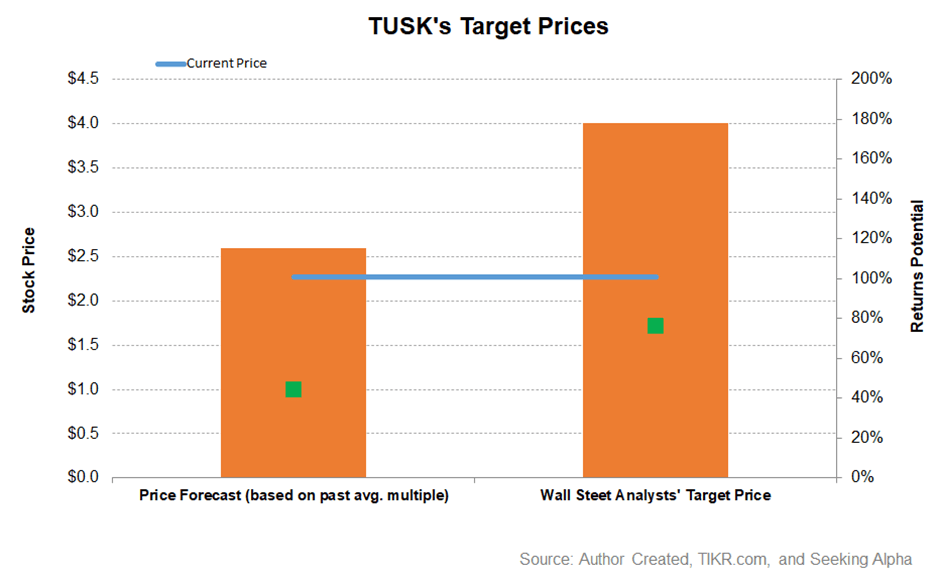

- The model suggests an upside to the returns potential

In Part 1 of this article, we discussed Mammoth Energy’s (TUSK) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and rig count) and TUSK’s reported revenues for the past seven years and the previous four-quarters, I expect its revenues to increase handsomely in the next 12 months (or NTM) in 2022. The growth rate can get sharper in the following year.

Target Price And Relative Valuation

Returns potential using the past average EV/Revenue multiple (0.93x) is lower (44% upside) than the sell-side analysts’ expected returns (76% upside) from the stock.

TUSK currently receives a “Hold” rating, according to Seeking Alpha’s Quant Rating. While the rating is high on the valuation criterion, the ratings are poor on profitability and momentum.

What’s The Take On TUSK?

TUSK is looking to maintain a healthy balance between an oilfield services-centric business model an integrated infrastructure business model. The economic tailwinds are in favor of an infrastructure business boom. It will also benefit from the tremendous growth opportunities by implementing fiber-related service agreements. The continued recovery of the energy sector will keep the oilfield services business busy in 2022. The company’s average fleet utilization and incremental frac fleet addition in a case in point.

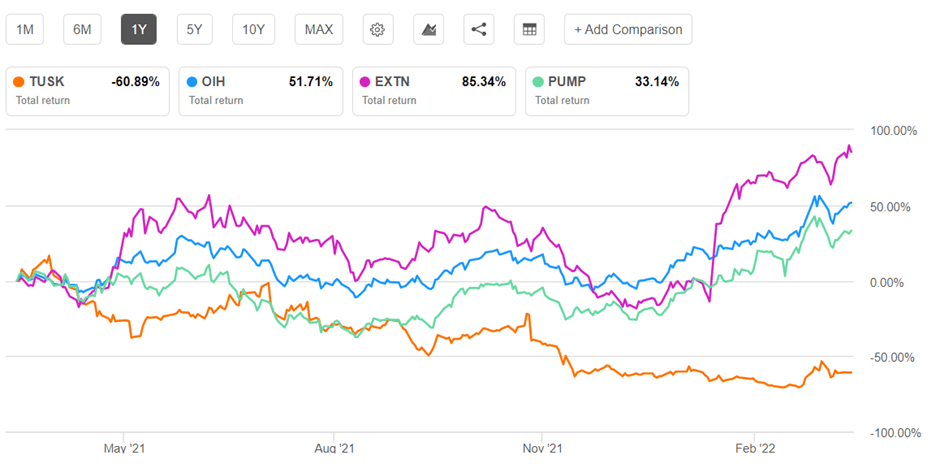

TUSK has a manageable debt level. However, the PREPA-related matter drags on, bogging down a significant part of its accounts receivable. On top of that, with negative cash flows, the company’s financial risks can worry investors. So, the stock significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. I think investors can hold with the prospect of higher returns in the medium to long term.