- The infrastructure business disappointed in Q4, but the economy provides sufficient tailwinds to the business in the medium term

- Mammoth Energy’s oilfield equipment business has also improved with an increased frac fleet and a much higher sand proppant pricing

- However, uncertainty over the account receivable from PREPA can continue to haunt its prospect

- Cash flows deteriorated in FY2021, but TUSK’s low leverage has an advantage over its peers

A Balance In Business Strategy

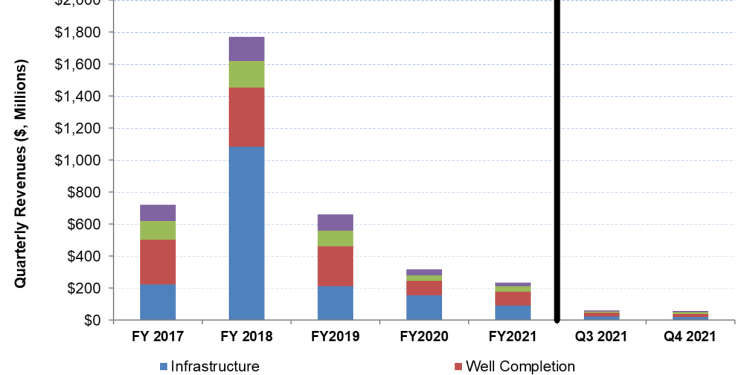

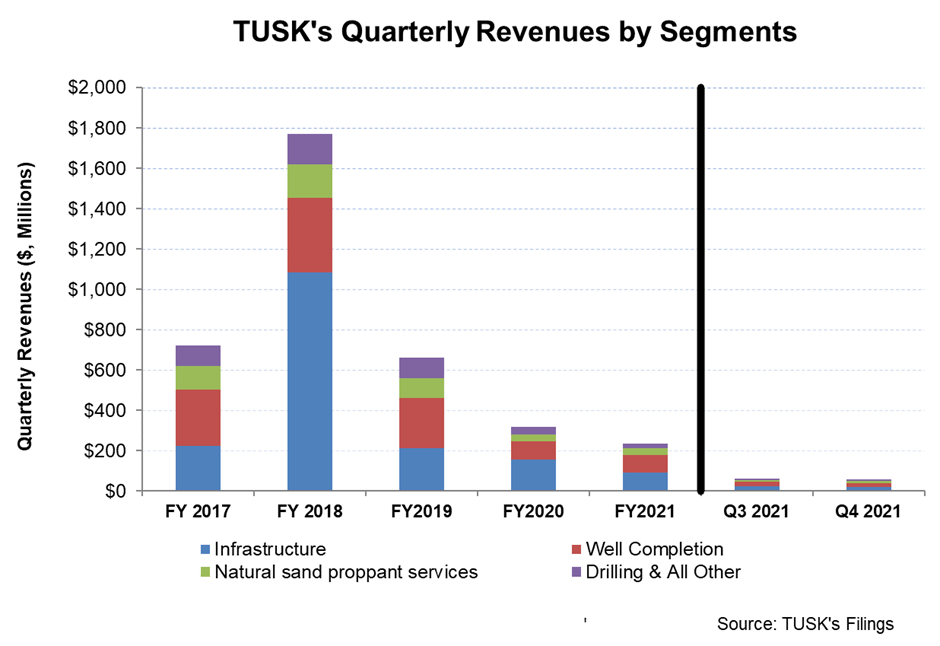

Strategically, Mammoth Energy Services (TUSK) focuses on providing its offerings through engineering, procurement, and construction through a vertically integrated model. The company sees tremendous growth opportunities in repairs, hardening, modernizing the electric grid and a shift towards renewables. Despite a setback in Q4 2021, it will continue to earn a significant share of the revenue from the infrastructure business. It may be noted that the Infrastructure segment accounted for 34% of its Q4 2021 revenues and was peeped by the Well Completion segment (37% of revenues).

In 2022, the core area of concentration for TUSK will be the fiber maintenance and installation contracts. In Q4, it implemented a master service agreement (or MSA). Its integrated business model and manufacturing equipment refurbishment facility provide differentiated offerings in the infrastructure segment. The model has the advantage of rapidly scaling operations and controlling costs. In Q4 2021, the US real GDP growth rate was 6.9%, much higher than the past five-year average. However, the geopolitical tension in Ukraine can shave off the growth expected in 2022.

The other key trend has been the company’s balancing between Infrastructure and the legacy oilfield services-centric business model, which is slightly shifted from its previous approach, as I discussed in my earlier article. As the demand for energy rises, it plans to add another frac fleet, raise pricing, and have better visibility throughout 2022. By the end of 2022, the management may add a fourth fleet, although it is not inevitable. The current trend will take its topline and margin higher for the rest of 2022. On the cost side, the company implemented a cost management structure, which, based on higher revenues, will lower the SG&A costs structure. However, input cost inflation can reduce the margin level.

PREPA Payment Update

In the latest development regarding the company’s past engagement related to the electricity transmission & distribution services in Puerto Rico, PREPA received a request for information from FEMA. The matter, subject to a time-limited decision from FEMA, can get into arbitration. Since August 2021, PREPA and Cobra have been trying to reconcile $159.5 million in invoices under a second contract. Until now, PREPA has submitted approximately $90 million in invoices to FEMA. Although it remains a matter of debate whether TUSK will be able to receive its entire receivable from PREPA, the Puerto Rican body’s recent approval of a settlement agreement with Whitefish Energy Holdings is seen to be a positive development by the company.

Investors may note that PREPAcontinued to decline payments to Cobra (a TUSK subsidiary) because of Cobra’s former president’s indictment and two FEMA officials. Earlier in 2021, however, a determination memorandum by the Federal Emergency Management Agency (or FEMA) suggested that Cobra successfully performed for PREPA in Puerto Rico. This came as a surprise to the company’s management because FEMA, the grantor, did not raise the issue of the indictments in its recent report. Investors may note that PREPA owes Cobra $69 million for services performed under the first contract.

Recent Drivers: Industry And Q4 2021

From Q4 2021 through Q1 2022, the crude oil price has shot up steeply as the geopolitical crisis worsens over the Russian oil supply. On the other hand, demand has continued to recover following the COVID-19 receding. From December 2021 to February 2022, the drilled and completed well count in the Permian were higher (5% and 6% up, respectively), while the drilled but uncompleted (or DUC) wells declined by 11%. Year-to-date, the active frac spread count went up by 14%, according to Primary Vision’s estimates. The Permian underperformed the trend with an 8% higher frac spread count by the third week of March versus December 2021. Many shales saw higher frac spread count addition during this period. The recovery in the count is an encouraging sign for the frackers.

This helped TUSK’s oilfield businesses, where equipment utilization improved with the addition of a hydraulic fracturing fleet. It operated 1.6 fleets on average in Q4 compared to Q3 2021. The company operated two hydraulic fracturing fleets in Q4 and planned to add another in Q1. Pricing, too, is improving with higher visibility for 2022.

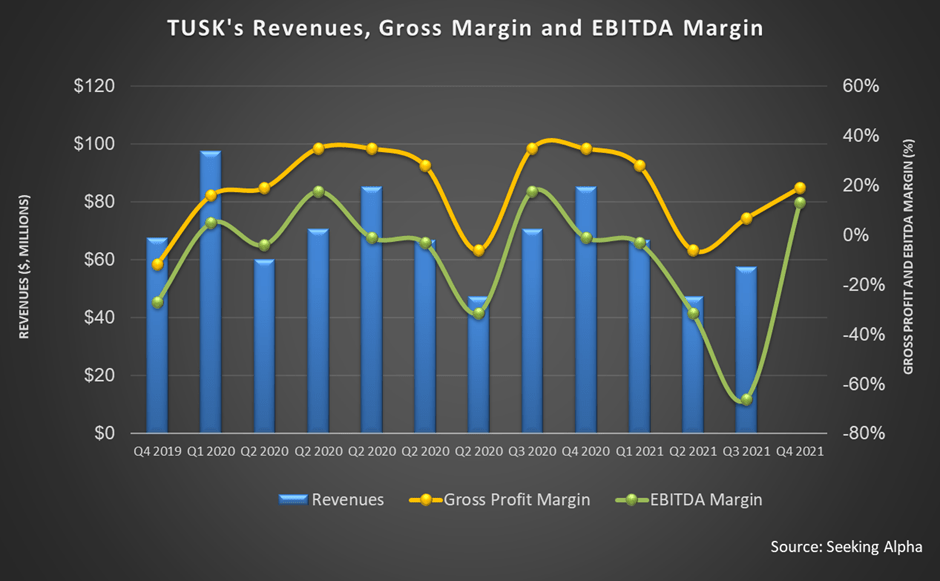

Revenues in the company’s Infrastructure and the Well Completion segments contracted in Q4 2021. A decline in storm activity resulted in lower storm restoration revenue. Although sand prices went up by 7.6% quarter-over-quarter, the sand volume decreased by 14% in Q4. Adjusted EBITDA, however, improved during this period. The Well Completion segment’s EBITDA loss turned into a profit as frac fleet count, and utilization improved. The Natural and proppant services segment, in comparison, had a steady run in Q4 (revenues up by 29% sequentially).

Low Leverage But FCF Deteriorated

In the case of non-receipt, the balance sheet will carry some liquidity risks. As of December 31, 2021, TUSK’s liquidity (excluding working capital but including revolving credit facility available) was $95 million. Because its allowance for doubtful accounts is much less ($18 million as of December 31, 2021) than accounts receivable owed to PREPA ($227 million), investors might also want to consider not realizing a part of the whole of its accounts receivable. Such a possibility is remote because PREPA’s ability to pay the dues depends on funding from a federal agency (Federal Emergency Management Agency or FEMA). It’s our call that the matter will be resolved amicably, and the risks will not surface.

TUSK’s cash flow from operations (or CFO) turned negative in FY2021 versus a mildly positive CFO a year ago, led by lower year-over-year revenues and adverse timing of cash inflows for accounts receivable. As a result, free cash flow was also negative. The company’s leverage (debt-to-equity) is low (0.19x). The management has increased the FY2022 capex budget to $6 million.

Learn about TUSK’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.